Concept explainers

Capital Structure of any company is the mix of different levels of debt and equity. An optimal capital structure is the appropriate mix of debt and equity, striking a balance between risk and return to achieve the goal of maximizing the price of the firm’s stock. Therefore, a target proportion of capital structure and cost of each financing can be used to determine the WACC of the company.

Weighted Average Cost of Capital (WACC) is the required

Here,

Proportion of debt in the target capital structure “

Proportion of preferred stock in the target capital structure “

Proportion of equity in the target capital structure “

After tax cost of debt, preferred stock,

EPS analysis at a given level of EBIT helps in determining the optimal capital structure of the firm, that is the structure at which the EPS will be the highest.

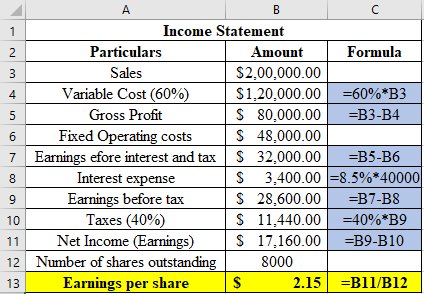

At a sale of $200,000 and debt to total asset ratio of 20%, the company has total assets $200,000, cost of debt 8.5% and number of shares outstanding 8,000.

Explanation of Solution

Income statement of the company is prepared with a debt of $40,000 (20%*$200,000) and interest rate on the debt of 8.5%.

Therefore, when D/TA is 20% and sales is $200,000, the company’s EPS would be

Want to see more full solutions like this?

Chapter 12 Solutions

CFIN -STUDENT EDITION-W/ACCESS >CUSTOM<

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education