MANAGERIAL ACCOUNTING FUND. W/CONNECT

5th Edition

ISBN: 9781259688713

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 5QS

The following information is necessary to answer QS 12-5 and QS 12-6.

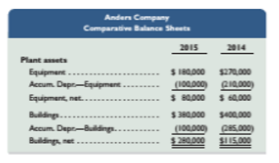

The plant assets section of the comparative balance sheets of Anders Company is reported below.

Refer to the balance sheet data above from Anders Company. During 2015, equipment with a book value of $40,000 and an original cost of $210,000 was sold at a loss of $3,000.

- How much cash did Anders receive from the sale of equipment?

- How much

depreciation expense was recorded on equipment during 2015? - What was the cost of new equipment purchased by Anders during 2015?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The net income for Fallon Company for 2017 was $320,000.During 2017, depreciation on plant assets was $124,000,amortization of patent was $40,000, and the companyincurred a loss on sale of plant assets of $21,000. Computenet cash flow from operating activities.

Use the following information for the Quick Study below. (Algo)

[The following information applies to the questions displayed below)

The plant assets section of the comparative balance sheets of Anders Company is reported below.

ANDERS COMPANY

Comparative Year-End Balance Sheets

Plant assets

Equipment

Accumulated depreciation-Equipment

Equipment, net

Buildings

Accumulated depreciation-Buildings

Buildings, net

2020

$ 220,000

(116,000)

$ 104,000

$ 420,000

(124,000)

$ 296,000

QS 12-11 (Algo) Computing investing cash flows LO P3

1. Cash received from the sale of building.

2 Depreciation expense

3 Purchase of building

2019

$ 310,000

(226,000)

$ 84,000

$ 440,000

(309,000)

$ 131,000

During 2020, a building with a book value of $78,000 and an original cost of $340,000 was sold at a gain of $68,000.

1. How much cash did Anders receive from the sale of the building?

2. How much depreciation expense was recorded on buildings during 2020?

3. What was the cost of buildings purchased by Anders…

The plant assets section of the comparative balance sheets of Anders Company is reported below.

1.

2.

3.

ANDERS COMPANY

Comparative Balance Sheets

Plant assets

Equipment

Accumulated depreciation-Equipment

Equipment, net

Buildings

Accumulated depreciation-Buildings

Buildings, net

2018

Cash received from the sale of building

Depreciation expense

Purchase of building

$ 295,000

(146,000)

$ 149,000

$ 495,000

2017

$ 385,000

(256,000)

$ 129,000

$ 515,000

(354,000)

(169,000)

$ 326,000 $ 161,000

During 2018, a building with a book value of $93,000 and an original cost of $415,000 was sold at a gain of $83,000.

1. How much cash did Anders receive from the sale of the building?

2. How much depreciation expense was recorded on buildings during 2018?

3. What was the cost of buildings purchased by Anders during 2018?

Chapter 12 Solutions

MANAGERIAL ACCOUNTING FUND. W/CONNECT

Ch. 12 - Prob. 1MCQCh. 12 - Prob. 2MCQCh. 12 - Prob. 3MCQCh. 12 - Prob. 4MCQCh. 12 - Prob. 5MCQCh. 12 - Prob. 1DQCh. 12 - Prob. 2DQCh. 12 - Prob. 3DQCh. 12 - Prob. 4DQCh. 12 - Prob. 5DQ

Ch. 12 - Prob. 6DQCh. 12 - Prob. 7DQCh. 12 - Prob. 8DQCh. 12 - Prob. 9DQCh. 12 - Prob. 10DQCh. 12 - Prob. 11DQCh. 12 - Prob. 12DQCh. 12 - Prob. 13DQCh. 12 - Prob. 14DQCh. 12 - Prob. 15DQCh. 12 - Prob. 1QSCh. 12 - Prob. 2QSCh. 12 - Prob. 3QSCh. 12 - Prob. 4QSCh. 12 - The following information is necessary to answer...Ch. 12 - Refer to the balance sheet data above from Anders...Ch. 12 - Prob. 7QSCh. 12 - Prob. 8QSCh. 12 - Prob. 9QSCh. 12 - Prob. 10QSCh. 12 - Use the following balance sheet and income...Ch. 12 - Prob. 12QSCh. 12 - Prob. 13QSCh. 12 - Prob. 14QSCh. 12 - Prob. 15QSCh. 12 - Prob. 16QSCh. 12 - Prob. 17QSCh. 12 - Prob. 18QSCh. 12 - Prob. 19QSCh. 12 - Prob. 20QSCh. 12 - Prob. 1ECh. 12 - Prob. 2ECh. 12 - Prob. 3ECh. 12 - Prob. 4ECh. 12 - Prob. 5ECh. 12 - Prob. 6ECh. 12 - Prob. 7ECh. 12 - Prob. 8ECh. 12 - Prob. 9ECh. 12 - Prob. 10ECh. 12 - The following financial statements and additional...Ch. 12 - Prob. 12ECh. 12 - Complete the following spreadsheet in preparation...Ch. 12 - Prob. 14ECh. 12 - Prob. 15ECh. 12 - Prob. 16ECh. 12 - Prob. 17ECh. 12 - The following summarized Cash T-account reflects...Ch. 12 - Prob. 1PSACh. 12 - Refer to the information in problem 12-1A....Ch. 12 - Forten Company, a merchandiser, recently completed...Ch. 12 - Prob. 4PSACh. 12 - Refer to Forten Companys financial statements and...Ch. 12 - Golden Corp., a merchandiser, recently completed...Ch. 12 - Prob. 7PSACh. 12 - Prob. 8PSACh. 12 - Prob. 1PSBCh. 12 - Prob. 2PSBCh. 12 - Prob. 3PSBCh. 12 - Prob. 4PSBCh. 12 - Prob. 5PSBCh. 12 - Prob. 6PSBCh. 12 - Prob. 7PSBCh. 12 - Prob. 8PSBCh. 12 - Prob. 12SPCh. 12 - Prob. 1GLPCh. 12 - Prob. 3GLPCh. 12 - Prob. 1BTNCh. 12 - Prob. 2BTNCh. 12 - Prob. 3BTNCh. 12 - Prob. 4BTNCh. 12 - Prob. 5BTNCh. 12 - Prob. 6BTNCh. 12 - Prob. 7BTNCh. 12 - Prob. 8BTNCh. 12 - Prob. 10BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- help mearrow_forwardIn its 2017 annual report, Crane Manufacturing Company reports beginning-of-the-year total assets of $2,322,000, end-of-the-year total assets of $2,803,000, total sales of $4,886,000, and net income of $805,000. (a) Your answer is incorrect. Compute Crane's asset turnover. (Round answer to 3 decimal places, e.g. 4.870.) Asset turnover ratio timesarrow_forward2. Prepare a schedule showing the gain or loss from each asset disposal that would be recognized in Pell's income statement for the year ended December 31, 2016. PELL CORPORATION Gain or Loss from Plant Asset Disposals For the Year Ended December 31, 2016 Sale of machine on 3/31/16: Trade-in of automobile on 12/31/16:arrow_forward

- Equipment and Accumulated Depreciation-Equipment. The following information pertains to Luo Company at the end of 2014 for the following accounts: Equipment Accum Deprec Beginning balance Acquisitions Disposals Ending Balance Beginning Balance Depreciation Expense Disposals Ending Balance $ 100,000 65,000 21,000 144,000 $45,000 15,000 7,000 53,000 In addition Luo Company's Income Statement reported a gain on disposal of Equipment of $9,000. What amount was reported on Statement of Cash Flows as "cash flow from sale of equipment? Show the calculation.arrow_forward(Entries for Disposition of Assets) On December 31, 2017, Travis Tritt Inc. has a machine with a book value of $940,000. The original cost and related accumulated depreciation at this date are as follows. Machine $1,300,000 Less: Accumulated depreciation 360,000 Book value $ 940,000 Depreciation is computed at $60,000 per year on a straight-line basis.InstructionsPresented below is a set of independent situations. For each independent situation, indicate the journal entry to be made to record the transaction. Make sure that depreciation entries are made to update the book value of the machine prior to its disposal. (a) A fire completely destroys the machine on August 31, 2018. An insurance settlement of $430,000 was received for this casualty. Assume the settlement was received immediately.(b) On April 1, 2018, Tritt sold the machine for $1,040,000 to Dwight Yoakam Company.(c) On July 31, 2018, the company donated this machine to the Mountain King City Council. The fair value…arrow_forwardPlease answer all the parts of the below question: At December 31, 2017, Sheffield Corporation reported the following plant assets. Land $ 3,798,000 Buildings $26,660,000 Less: Accumulated depreciation—buildings 15,097,050 11,562,950 Equipment 50,640,000 Less: Accumulated depreciation—equipment 6,330,000 44,310,000 Total plant assets $59,670,950 During 2018, the following selected cash transactions occurred. Apr. 1 Purchased land for $2,785,200. May 1 Sold equipment that cost $759,600 when purchased on January 1, 2011. The equipment was sold for $215,220. June 1 Sold land for $2,025,600. The land cost $1,266,000. July 1 Purchased equipment for $1,392,600. Dec. 31 Retired equipment that cost $886,200 when purchased on December 31, 2008. No salvage value was received. Prepare a tabular summary that includes the plant asset accounts and…arrow_forward

- At September 1, 2013, the following existed in the records of Lauren Company: Fixed assets P8,600,000 Accumulated depreciation P3,970,000 During the year ended September 30, 2014, fixed assets with a written down value of P370,000 was sold P490,000. The plant had originally cost P800,000. Fixed assets purchased during the year cost P1,800,000. It is the company’s policy to charge a full year’s depreciation in the year of acquisition of an asset and none in the year of sale, using the a rate of 10% on the straight-line basis. What net amount (book value) should appear in Lauren’s statement of financial position at September 30, 2014 for fixed assetarrow_forwardAt December 31, 2022, Culver Corporation reported the following plant assets. Land Buildings Less: Accumulated depreciation-buildings June Equipment Less: Accumulated depreciation-equipment During 2023, the following selected cash transactions occurred. (a) Total plant assets Apr. 1 Purchased land for $2,785,200. May 1 1 1 Sold equipment that cost $759,600 when purchased on January 1, 2016. The equipment was sold for $215,220. Sold land for $2.025,600. The land cost $1,266,000. July Purchased equipment for $1,392,600. Dec. 31 Retired equipment that cost $886,200 when purchased on December 31, 2013. No salvage value was received. Bal. $ $26,690,000 Cash 15,097,050 Land 50,640,000 6,330,000 $3,798,000 Prepare a tabular summary that includes the plant asset accounts and balances shown on the December 31, 2022, balance sheet. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the…arrow_forwardThe following data were included in a recent Mango, Incorporated annual report ($ in millions): Net sales In millions Net property, plant, and equipment Required: 2017 $ 189,234 34,783 2018 2019 $ 225,595 $ 220,174 47,304 34,378 2020 $ 284,515 35,766 Compute Mango's fixed asset turnover ratio for 2018, 2019, and 2020. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. 2018 2019 Fixed asset turnover ratio 2020arrow_forward

- An analysis of changes in selected balance sheet accounts of Johnson Corporation shows the following for the current year: Plant and Equipment accounts: Debit entries to asset accounts Credit entries to asset accounts Debit entries to accumulated depreciation accounts (resulting from sale of plant assets) Credit entries to accumulated depreciation accounts (representing depreciation for the current year) $ 154,000 $ 115,000 $ 88,000 Johnson's income statement for the current year includes a $11,000 loss on disposal of plant assets. All payments and proceeds relating to purchase or sale of plant assets were in cash. Select one: $ 104,000 Total cash proceeds received by Johnson from sales of plant assets during the current year amounted to: a. $104,000. b. $208,000. c. $219,000. d. $16,000.arrow_forwardRequired information [The following information applies to the questions displayed below.] The plant assets section of the comparative balance sheets of Anders Company is reported below. ANDERS COMPANY Comparative Balance Sheets 2019 2018 Plant assets Equipment Accumulated depreciation-Equipment $ 180,000 (100,e00) $ 80,000 $ 380,000 (100,000) $ 280,000 $ 270,000 (210,000) $ 60,000 $ 400,000 (285,000) $ 115,000 Equipment, net Buildings Accumulated depreciation-Buildings Buildings, net During 2019, a building with a book lue of $70,000 and an original cost of $300,000 was sold at a gain of $60,000. 1. How much cash did Anders receive from the sale of the building? 2 How much denreciation evnense was recorded on buildinas during 20192 ... Chatarrow_forwardFranco Company uses IFRS and owns property, plant, and equipment with a historical cost of $5,000,000. At December 31, 2016, the company reported a valuation reserve of $690,000. At December 31, 2017, the property, plant, and equipment was appraised at $5,325,000. The valuation reserve will show what balance at December 31, 2017?(a) $365,000.(b) $325,000.(c) $690,000.(d) $0.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

7.2 Ch 7: Notes Payable and Interest, Revenue recognition explained; Author: Accounting Prof - making it easy, The finance storyteller;https://www.youtube.com/watch?v=wMC3wCdPnRg;License: Standard YouTube License, CC-BY