Concept explainers

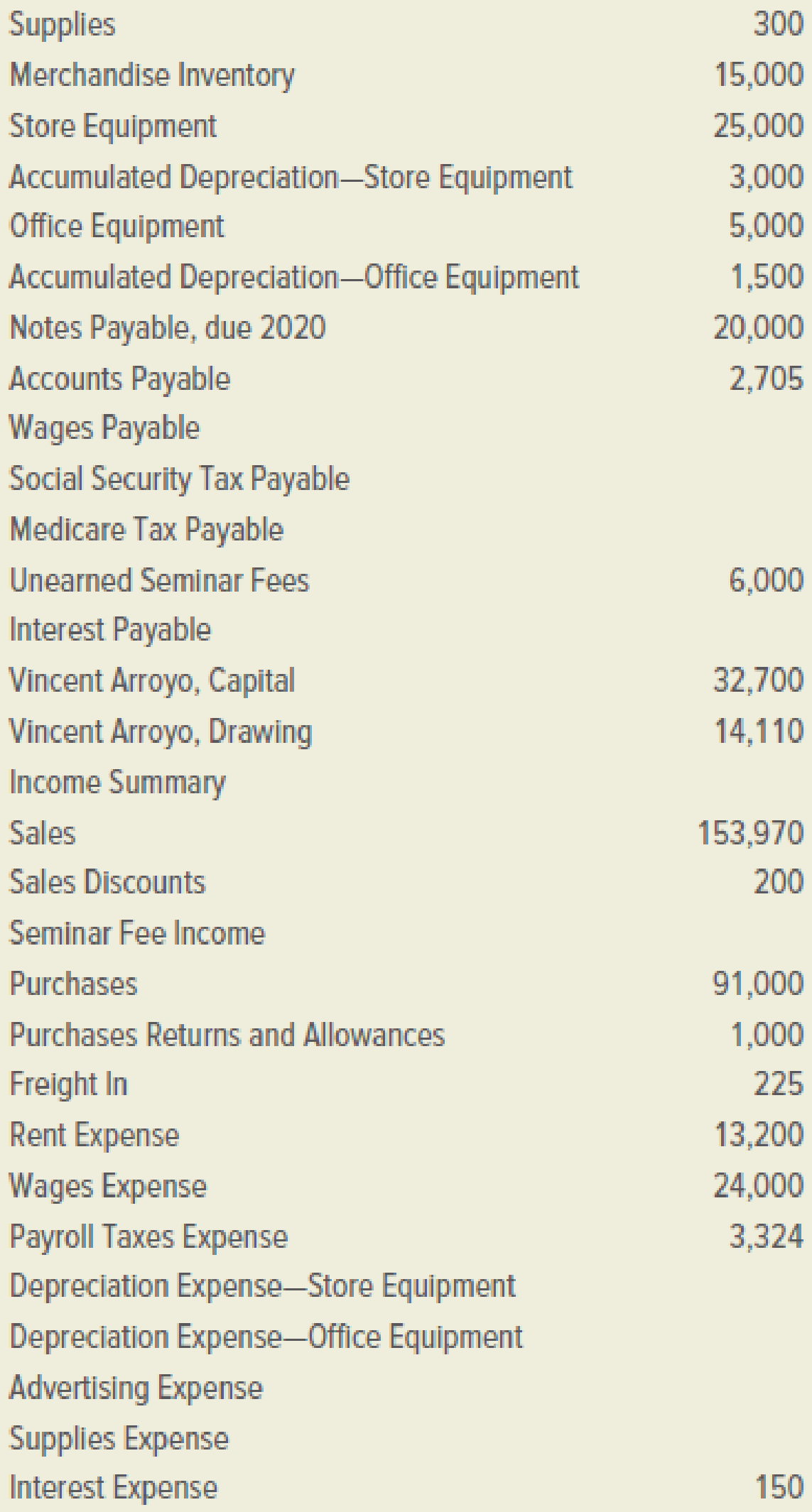

The Artisan Wines is a retail store selling vintage wines. On December 31, 2019, the firm’s general ledger contained the accounts and balances below. All account balances are normal.

INSTRUCTIONS:

- 1. Prepare the

Trial Balance section of a 10-column worksheet. The worksheet covers the year ended December 31, 2019. - 2. Enter the adjustments below in the Adjustments section of the worksheet. Identify each adjustment with the appropriate letter.

- 3. Complete the worksheet.

ADJUSTMENTS:

a.–b. Merchandise inventory at December 31, 2019, was counted and determined to be $13,000.

c. The amount recorded as prepaid advertising represents $480 paid on September 1, 2019, for 12 months of advertising.

d. The amount of supplies on hand at December 31 was $160.

e. Depreciation on store equipment was $3,000 for 2019.

f. Depreciation on office equipment was $1,125 for 2019.

g. Unearned seminar fees represent $6,000 received on November 1, 2019, for six seminars. At December 31, four of these seminars had been conducted.

h. Wages owed but not paid at December 31 were $500.

i. On December 31, 2019, the firm owed the employer’s social security tax ($31.00) and Medicare tax ($7.25).

j. The note payable bears interest at 6 percent per annum. One month’s interest is owed at December 31, 2019.

Analyze: What was the amount of revenue earned by conducting seminars during the year ended December 31, 2019?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

LooseLeaf for College Accounting: A Contemporary Approach

- Complex Company prepares monthly financial statements. Below are listed some selected accounts and their balances in the September 30 trial balance before any adjustments have been made for the month of September. Instruction: Using the information given, prepare the adjusting entries that should be made by Complex Company on September 30. Complex COMPANY Trial Balance (Selected Accounts) September 30, 2010 Debit Credit Office Supplies....................................................................................$ 2,700 Prepaid Insurance..............................................................................$4,200 Office Equipment............................................................................. $16,200 Accumulated Depreciation—Office…arrow_forwardIn quickbooks I need: Record the appropriate adjusting journal entries on 1/31/2021 based on the following: A bill for $675 was received and recorded in the next month from FixIt, Inc. for advertising placed in the current month. Create a new liability account like you did earlier in the chapter.arrow_forwardComprehensive On November 30, 2019. Davis Company had the following account balance. During the month of December, Davis entered into the following transactions: Required: a.Prepare generaljournal entries to record the preceding transactions. b.Post to general ledger T accoun c.Prepare a year-end trial balance on a worksheet and complete theworksheet using the following information: (a) accrued salaries at year-end total s1,200; (b) for simplicity, the building and equipment are being depreciated using the straight-line method over an estimated life of 20 yean with no residual value;(c) supplies on hand at the end of the year total $630; (d) bad debts expense for the year totals $830; and (e)the income tax rate is 30%; income taxes are payable in the first quarter of d.Prepare the companis financial statements for 2019. e.Prepare the 2019 (a) adjusting and (b) closing entries in the general journal.arrow_forward

- Cielo Bonita is engaged in buying and selling of novelty items. The following transactions have transpired for the month of Sept. 2020. Prepare: Journal entry Trial balancearrow_forwardYou must complete the following tasks below for the month of April in the Excel workbook provided. Required: Part 1. Prepare a journal entry to record each transaction. You must provide a short explanation for each transaction. Part 2. Setup appropriate T-accounts. All accounts begin with 0 balances. Part 3. Record in the T-accounts the effects of each transaction for Sydney Stables in April, referencing each transaction in the accounts with the transaction letter. Show the ending balances in the T-accounts. Part 4. Prepare a trial balance. Part 5. Prepare a statement of earnings, a statement of shareholders’ equity and a statement of financial position for the month ended April 30, 2020.arrow_forwardVictoria Company has following account balances on December 31, 2019, prior to any adjustments: 1. Trarnsfer account balances to a 10-column worksheet and prepare a trial balance.2. Prepare adjusting entries in the general journal and complete the worksheet. 3. Prepare company's income statement, retained earnings statement,and balance sheet. 4. Prepare closing entries in the general journal.arrow_forward

- Required: Prepare an income statement for the month of June and a balance sheet in account format for Safety Hire as at 30 June 2019. (10 marks)arrow_forwardYou will find the transactions within the spreadsheet. This additional information may be of use, as well. Additional Info (this mainly relates to adjustments - ie. Thinking) Because of the loan, you have to provide the bank with your financial statements at the end of the month - Feb 28, 2021. (we have to make proper FS including adjustments) You do a quick count of your inventory and find there are 19 pairs of shoes in inventory. On March 2nd, you receive a report from Shopify that states your credit card processing fees for the last month totalled $250. Shopify will remove the amount due from your future sales transactions. The March 2nd report also includes notice that your next $400 monthly fee will also simply reduce the amount received from future sales transactions. You think that your office furniture etc. will last for about 3 years. You do a quick check and find there's still about $370 worth of office and packing supplies left. In your wallet…arrow_forwardUse the May 31 fiscal year-end information from the following ledger accounts (assume that all accounts have normal balances) to prepare closing journal entries and then post those entries to ledger accounts.arrow_forward

- Assuming a year-end in March 31,it is now April 4.A staff member asks you to process an unpaid invoice with details as follows: The invoice is for bus transportation in the amount of P800 and is dated April. The invoice indicates the charges relate to transportation on March 20.A transfer is processed to pay the invoice on April 7. Hiw would you proceed? You may describe how you would record the transaction in the general ledger, including a description of journal entries and the dates each item will be recordedarrow_forwardOn June 30 of the current year, Rosemount Copy Center has completed the Trial Balance columns of the work sheet. Analyze the adjustment information given here into debit and credit parts. Record the adjustments on the work sheet. Total the Adjustments columns. Adjustment Information June 30 Supplies on hand $188.00 Value of prepaid insurance 540.00 WORK SHEET For Month Ended June 30, 20-- ACCOUNT TITLE TRIAL BALANCE ADJUSTMENTS INCOME STATEMENT BALANCE SHEET DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT 1 Cash 8,715.00 1 2 Petty Cash 75.00 2 3 Accounts Receivable-Raymond O’Neil 642.00 3 4 Supplies 518.00 4 5 Prepaid Insurance 675.00 5 6 Accounts Payable-Western Supply 268.00 6 7 Akbar…arrow_forwardOn December 31, 2019, Mason Company made following proper year-end adjusting entries: 1. Prepare journal entries to record whatever reversing entries you think appropriate. 2. Explain your reasoning for each reversing entry.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage