Concept explainers

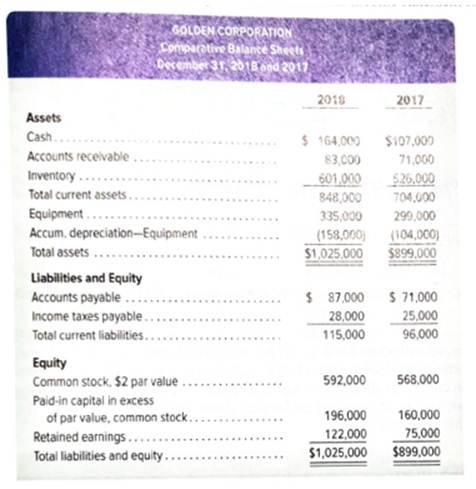

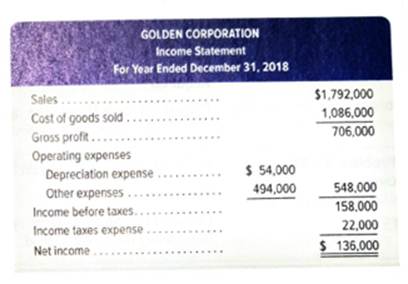

Golden Corp., a merchandiser, recently completed its 2018 operations. For the year. (1) all sales arc credit sales. (2) all credits to Accounts Receivable reflect cash receipts from customers. (3) all purchases of inventory are on credit. (4) ail debits to Accounts Payable reflect cash payments for inventory. (5) Other Expenses are all cash expenses. any change in Income Taxes Payable reflects the accrual and cash payment of taxes. The company’s balance sheets and income statement follow.

Additional Information on Year 2018 Transactions

Additional Information on Year 2018 Transactions

- Purchased equipment for $36,000 cash.

- Issued 12,000 shares of common stock for $5 cash per share.

- Declared and paid $89,000 in cash dividends.

Required

Prepare a complete statement of cash flows; report its

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Gen Combo Ll Financial Accounting: Information For Decisions; Connect Ac

- The accounts receivable balance on the records of of P38,000 were written off during the year as uncollectible. eud was P283,000. In going over the records, you found accounts reccivable REQUIRED: How much cash was received from the sale of the machine? during the year ended December 31, 2020. The accounts receivable at year- REQUIRED: How much cash was collected on credit sales during the year. Luneta Company of January 1, 2020. Credit sales were recorded at P1,060.000 P245,000 on durine p283.000. In going over the records, you found accounts reccivable PEOUIRED: How much cash was collected on credit sales during the year 2020 ? The manager of the Pansol Company is planning for the qaurter ending Narch 31, 2020, and wants to know how much cash must be paid for merchandise purchases. The inventory of merechandise is to be deereased by P46,000 during the quarter. Sales have been estimated at P360,000. The cost of saies is equal to 30% of sales. Accounts payable is expected to inerease…arrow_forwardRequirements: 1. How much from the total collections were not able to avail of any of the cash discounts? 2. What is the net sales of the entity for 2016? 3. What is the adjusted balance of the Accounts Receivable account as of December 31, 2016?arrow_forwardThe following information relates to a company’s accounts receivable: gross accounts receivable balance at the beginning of the year, $350,000; allowance for uncollectible accounts at the beginning of the year, $24,000 (credit balance); credit sales during the year, $1,200,000; accounts receivable written off during the year, $15,000; cash collections from customers, $1,100,000. Assuming the company estimates that future bad debts will equal 12% of the year-end balance in accounts receivable.1. Calculate bad debt expense for the year.2. Calculate the year-end balance in the allowance for uncollectible accounts.arrow_forward

- if the company paid the salaries payable in the next period, the transaction will be as bellow cash debit, salaries payable credit. cash debit , salaries credit. salaries expense debit, cash credit. salaries payable debit, cash credit. Note collection in the bank reconciliation will be Add to the balance per bank. Deduct from balance per bank. O Add to the balance per book. Deduct from balance per book. cost of goods sold equal to O Goods available for sale mince beginning inventory. O Net sale mince goods available for sale Net purchase mince beginning inventory. beginning inventory blues net purchase mince ending inventoryarrow_forwardRosalie Co. uses the gross method to record sales made on credit. On June 10,2018, it made sales of P100,000 with terms 2/10, n/30 to Finley Farms, Inc. On June 19, 2018, Rosalie received payment for % the amount due from Finley Farms. Rosalie's fiscal year end is on June 30,2018. What amount will be reported in the statement of financial position for the accounts receivable due from Finley Farms, Inc. ?arrow_forwardABC Corporation began 2019 with an accounts receivable balance of $56,921. During 2019, ABC had sales revenue of $207,500: $35,000 of that was cash sales and $172,500 of that was credit sales. ABC wrote off $10,000 of uncollectible accounts and had payments on account of $180,000 Create a T-account for Accounts Receivable. Post the relevant information from above and calculate ABC Corporation’s Accounts Receivable balance at 12/31/19.arrow_forward

- The following information relates to Maharlika Corporation for the year ended June 30, 2021. Sales revenue 450000 Opening balance of trade receivables (net of allowance) 100000 Closing balance of trade receivable (net of allowance) 132500 Doubtful debt expense 5000 Increase in allowance for doubtful debts 2000 Bad debts are written off against the allowance for doubtful debts. What is the amount of cash collected from the customers during the year ended June 30, 2021? 487,500 481,500 418,500 412,500arrow_forwardThe following information relates to a company’s accounts receivable: gross accounts receivable balance at the beginning of the year, $300,000; allowance for uncollectible accounts at the beginning of the year, $25,000 (credit balance); credit sales during the year, $1,500,000; accounts receivable written off during the year, $16,000; cash collections from customers, $1,450,000. Assuming the company estimates that future bad debts will equal 10% of the year-end balance in accounts receivable. 1. Calculate bad debt expense for the year.2. Calculate the year-end balance in the allowance for uncollectible accounts.arrow_forwardUse the following information for the Problems below. Skip to question [The following information applies to the questions displayed below.]Forten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. FORTEN COMPANYComparative Balance SheetsDecember 31 Current Year Prior Year Assets Cash $ 58,900 $ 79,500 Accounts receivable 74,830 56,625 Inventory 284,656 257,800 Prepaid expenses 1,270 2,015 Total current assets 419,656 395,940 Equipment 151,500 114,000 Accum.…arrow_forward

- Use the following information for the Problems below. Skip to question [The following information applies to the questions displayed below.]Forten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. FORTEN COMPANYComparative Balance SheetsDecember 31 Current Year Prior Year Assets Cash $ 58,900 $ 79,500 Accounts receivable 74,830 56,625 Inventory 284,656 257,800 Prepaid expenses 1,270 2,015 Total current assets 419,656 395,940 Equipment 151,500 114,000 Accum.…arrow_forwardCompany A's net credit sales in 2020 and 2021 are 21115 and 35118 respectively. Cost of sales in 2020 is 15432, and in 2021 is 17088. Company A'a account receivable in 2020 and 2021 are 500 and 1000 respectively and its inventory in 2020 and 2021 are 2839 and 3489 respectively. Company A's cash collections from customers in 2021 are:arrow_forwardVKS Company had the following information relating to its accounts receivable: · Accounts receivable, 12/31/2020- P780,000· Credit sales during 2021- P3,290,000· Collections from customers during 2021 (excluding recovery of P20,000)- P3,640,000· Accounts written off during 2021- P85,000· Collection of accounts written off in prior years- P20,000· Estimated uncollectible accounts per aging at 12/31/2021- P63,000 At December 31, 2021, VKS Company's accounts receivable before allowance for uncollectible accounts should bearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education