Fundamentals of Corporate Finance, Student Value Edition Plus MyLab Finance with Pearson eText -- Access Card Package (4th Edition)

4th Edition

ISBN: 9780134641928

Author: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

Chapter 12, Problem 8P

(a)

Summary Introduction

To determine: The expected return of two stocks.

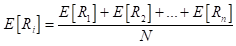

Required Formula:

Where,

is the expected return of stock

is the expected return of stock  is the expected return of investment or stock.

is the expected return of investment or stock.

(b)

Summary Introduction

To determine: The standard deviations of the returns of two stocks.

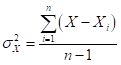

Required Formula:

Where,

is the average stock returns.

is the average stock returns.  expected returns

expected returns - n is number of observations.

(c)

Summary Introduction

To determine: The expected return and standard deviation of a portfolio of 70% stock A and 30% stock B.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Fundamentals of Corporate Finance, Student Value Edition Plus MyLab Finance with Pearson eText -- Access Card Package (4th Edition)

Ch. 12 - Prob. 1CCCh. 12 - How is the expected return of a portfolio related...Ch. 12 - What determines how much risk will be eliminated...Ch. 12 - When do stocks have more or less correlation?Ch. 12 - What is the market portfolio?Ch. 12 - Prob. 6CCCh. 12 - Prob. 7CCCh. 12 - Prob. 8CCCh. 12 - Prob. 1CTCh. 12 - What does correlation tell us?

Ch. 12 - Prob. 3CTCh. 12 - What does beta measure? How do we use beta?Ch. 12 - Prob. 5CTCh. 12 - Prob. 6CTCh. 12 - You buy 100 shares of Tidepool Co. for $40 each...Ch. 12 - You buy 100 shares of Tidepool Co. for $40 each...Ch. 12 - 3. HNL has an expected return of 18% and...Ch. 12 - Prob. 4PCh. 12 - You have $70,000. You put 20% of your money in a...Ch. 12 - 6. There are two ways to calculate the expected...Ch. 12 - Prob. 7PCh. 12 - 8. Stocks A and B have the following returns (see...Ch. 12 - 9. Using the data in the following table, estimate...Ch. 12 - Using your estimates from Problem 9 and the fact...Ch. 12 - Prob. 11PCh. 12 - Using the spreadsheet from Problem Il and the fact...Ch. 12 - 13. Using the data in Table 12.2,

Compute the...Ch. 12 - Prob. 14PCh. 12 - Prob. 15PCh. 12 - Prob. 16PCh. 12 - Prob. 17PCh. 12 - Prob. 18PCh. 12 - Prob. 19PCh. 12 - Prob. 20PCh. 12 - Prob. 21PCh. 12 - Prob. 22PCh. 12 - Prob. 23PCh. 12 - Prob. 24PCh. 12 - Prob. 25PCh. 12 - Prob. 26PCh. 12 - Prob. 27PCh. 12 - Prob. 28PCh. 12 - Prob. 29PCh. 12 - Prob. 30PCh. 12 - Prob. 31PCh. 12 - Prob. 32PCh. 12 - Prob. 33PCh. 12 - Prob. 34PCh. 12 - Prob. 35PCh. 12 - Prob. 36PCh. 12 - Prob. 37P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Investing For Beginners (Stock Market); Author: Daniel Pronk;https://www.youtube.com/watch?v=6Jkdpgc407M;License: Standard Youtube License