A Preparation of Ratios

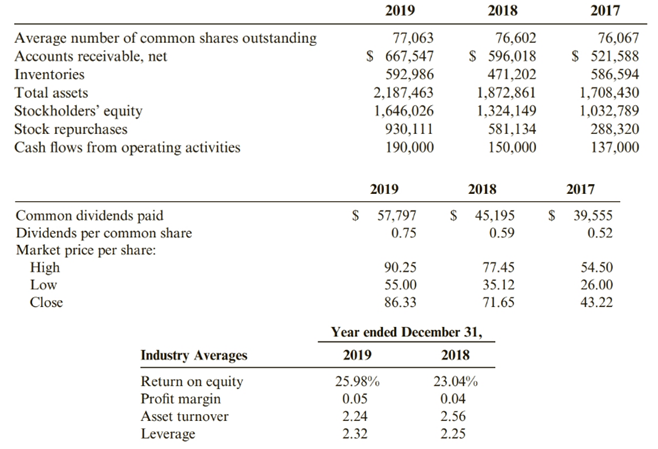

Refer to the financial statements for Burch Industries in Problem 12-89A and the following data.

Required:

1. Prepare all the financial ratios for Burch for 2019 and 2018 (using percentage terms where appropriate and rounding all answers to two decimal places).

2. CONCEPTUAL CONNECTION Explain whether Burch’s short-term liquidity is adequate.

3. CONCEPTUAL CONNECTION Discuss whether Burch uses its assets efficiently.

4. CONCEPTUAL CONNECTION Determine whether Burch is profitable.

5. CONCEPTUAL CONNECTION Discuss whether long-term creditors should regard Burch as a high-risk or a low-risk firm.

6. Perform a Dupont analysis (rounding to two decimal places) for 2018 and 2019.

(a)

An organization’s liquidity is its capacity to meet its short-term financial commitments. Liquidity proportions endeavor to quantify an organization’s capacity to satisfy its short-term obligation commitments. This is finished by contrasting an organization’s most fluid resources, those that can be effectively changed over to money, with its short-term liabilities.

To discuss:

Calculate all financial ratio.

Answer to Problem 92PSA

| Ratio | 2019 | 2018 |

| Current ratio | 3.58 | 3.30 |

| Quick ratio | 2.18 | 2.10 |

| Cash ratio | 0.64 | 0.62 |

| Operating cash flow ratio | 0.42 | 0.35 |

| Long-term debt to equity ratio | 0.01 | 0.058 |

| Debt to equity ratio | 0.35 | 0.414 |

| Long-term debt to total assets ratio | 0.007 | 0.041 |

| Debt to Total assets ratio | 0.25 | 0.30 |

| Accounts receivable turnover ratio | 6.22 | 6.09 |

| Inventory turnover ratio | 4.48 | 3.95 |

| Assets turnover ratio | 1.93 | 1.90 |

| Gross profit percentage | 0.40 | 0.386 |

| Return on assets | 0.19 | 0.19 |

| Return on equity | 0.25 | 0.279 |

| Earnings per share ratio | 4.73 | 4.30 |

| Return on common equity | 4.73 | 4.30 |

| Dividend yield ratio | 0.009 | 0.016 |

| Stock repurchase payout ratio | 2.54 | 1.765 |

Explanation of Solution

For 2019

Short-term liquidity ratios

Assets Efficiency ratios

Profitability ratio

Stockholder Ratios

For 2018

Short-term liquidity ratios

Assets Efficiency ratios

Profitability ratio

Stockholder Ratios

(b)

A company’s liquidity is its capacity to meet its short-term money related obligations. Liquidity ratios endeavor to measure a company’s capacity to satisfy its short-term obligation obligations. This is finished by looking at a company’s most fluid assets, those that can be easily changed over to cash, with its short-term liabilities.

To discuss:

Discuss the Short term liquidity.

Answer to Problem 92PSA

As per the company ratio, the company has more cash and company need to investment the extra cash in the market or any other place so company earn more benefit.

Explanation of Solution

Short-term liquidity always be better if the ratio is near about 2:1, 1:1 and like this.

In this company both the year ratio is high which better but not effective for the company its company have more cash so company need to investment the extra cash in the market.

(c)

The benefit turnover ratio is an efficiency ratio that estimates an organization’s capacity to create deals from its advantages by contrasting net deals and normal all out resources. At the end of the day, this ratio demonstrates how productively an organization can utilize its resources for create deals.

To discuss:

Discuss the assets efficiently ratio.

Answer to Problem 92PSA

Company cannot use the assets properly so the ratio is low. The company real need to improve the efficiency of assets for increase the production.

The Company have sufficient assets but company not uses the assets for production.

Explanation of Solution

Higher stock turnover ratios are viewed as a positive pointer of powerful stock administration. Nonetheless, a higher stock turnover ratio improves execution. It in some cases may show lacking stock dimension, which may result in decline in deals.

(d)

Profitability ratios are a class of money related measurements that are utilized to survey a business' capacity to produce income with respect to its income, working costs, accounting report resources, and shareholders' value after some time, utilizing information from a particular point in time.

To discuss:

Discuss the profitability of the company.

Answer to Problem 92PSA

Company have good profitability according to all profitability ratio but the company have more resource to earn income like extra utilization of assets for more production.

Explanation of Solution

The company have sufficient earning from the main business. The company have more benefit which can be use for the production. The company has to more resource of the assets for increase the production.

Right now profitability goods for the company.

(a)

Long Term Debt to Total Asset Ratio is the proportion that speaks to the money related position of the organization and the organization’s capacity to meet all its monetary prerequisites. It demonstrates the level of an organization’s assets that are financed with credits and other monetary commitments that last over a year.

To discuss:

Discuss the long-term creditor as a high risk or low risk.

Answer to Problem 92PSA

Long-term debt ratio is normal in the question because in 2019 the ratio is good but in 2018 the ratio more than 0.40. so the ratio in the 2018 is higher than normal.

Explanation of Solution

It is determined by separating total liabilities by total assets, with higher debt proportions demonstrating higher degrees of debt financing. Regardless of whether a debt proportion is great relies upon the setting inside which it is being broke down. From an unadulterated hazard point of view, lower proportions (0.4 or lower) are viewed as better debt proportions.

(e)

The Dupont analysis sometime called the Dupont display is a monetary proportion dependent on the arrival on value proportion that is utilized to investigate an organization’s capacity to build its arrival on value. As it were, this model separates the arrival on value proportion to clarify how organizations can expand their arrival for speculators.

To calculate:

Calculate the Dupont analysis for 2019 and 2018.

Answer to Problem 92PSA

According to Dupont analysis

| Particular | 2019 | 2018 |

| Return on equity | 0.245 | 0.28 |

Explanation of Solution

For 2019

For 2018

Want to see more full solutions like this?

Chapter 12 Solutions

Bundle: Cornerstones Of Financial Accounting, Loose-leaf Version, 4th + Lms Integrated Cengagenowv2, 1 Term Printed Access Card

- Using the following select financial statement information from Black Water Industries, compute the accounts receivable turnover ratios for 2018 and 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Black Water Industries?arrow_forwardDebt Management Ratios Glow Corporation provides annual and quarterly financial data to the public. For the years of 2018 and 2019. Glows financial data included the following account balances: Required: Determine whether the debt to equity ratio is increasing or decreasing and whether Glow should be concerned.arrow_forwardDebt Management and Short-Term Liquidity Ratios The following items appear on the balance sheet of Figgins Company at the end of 2018 and 2019: Required: Between 2018 and 2019, indicate whether Figgins debt to equity ratio increased or decreased. Also, indicate whether Figgins current ratio increased or decreased. Interpret these ratios.arrow_forward

- Profitability Ratios Tinker Corporation operates in the highly competitive consulting industry. Tinkers balance sheet indicates the following balances as of December 31, 2019. Required: Calculate Tinkers return on equity if Tinkers 2019 net income is $90,000.arrow_forwardGrammatico Company has just completed its third year of operations. The income statement is as follows: Selected information from the balance sheet is as follows: Required: Note: Round answers to two decimal places. 1. Compute the times-interest-earned ratio. 2. Compute the debt ratio. 3. CONCEPTUAL CONNECTION Assume that the lower quartile, median, and upper quartile values for debt and times-interest-earned ratios in Grammaticos industry are as follows: How does Grammatico compare with the industrial norms? Does it have too much debt?arrow_forwardShort-Term Liquidity Ratios Three ratios calculated for Puckerman, Cohen, and Chang companies for 2018 and 2019 follow. Required: Explain which company appears to be the most liquid.arrow_forward

- Ratio Analysis Consider the following information taken from the stockholders equity section: How do you interpret the companys payout and profitability performance? Required: 1. Calculate the following for 2020. (Note. Round answers to two decimal places.) 2. CONCEPTUAL CONNECTION Assume 2019 ratios were: and the current year industry averages are: How do you interpret the companys payout and profitability performance?arrow_forwardReview the select information for Bean Superstore and Legumes Plus (industry competitors), and then complete the following. A. Compute the accounts receivable turnover ratios for each company for 2018 and 2019. B. Compute the number of days sales in receivables ratios for each company for 2018 and 2019. C. Determine which company is the better investment and why. Round answers to two decimal places.arrow_forwardThe average liabilities, average stockholders' equity, and average total assets are as follows: 1. Determine the following ratios for both companies, rounding ratios and percentagesto one decimal place: a. Return on total assets b. Return on stockholders' equity c. Times interest earned d. Ratio of total liabilities to stockholders' equity 2. Based on the information in (1), analyze and compare the two companies'solvency and profitability. Comprehensive profitability and solvency analysis Marriott International, Inc., and Hyatt Hotels Corporation are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions): Balance sheet information is as follows:arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College