FINANCIAL ACCT-CONNECT

8th Edition

ISBN: 9781266627903

Author: Wild

Publisher: INTER MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 9QS

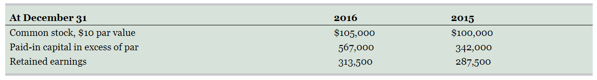

Computing financing cash flows P3

The following selected information is from Princeton Company’s comparative balance sheets.

The company’s net income for the year ended December 31, 2016, was $48,000.

- Compute the cash received from the sale of its common stock during 2016.

- Compute the cash paid for dividends during 2016.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Question Content Area

Comprehensive: Balance Sheet from Statement of Cash Flows

Mills Company prepared the following balance sheet at the beginning of 2016:

Balance SheetJanuary 1, 2016

Assets

Liabilities and Shareholders' Equity

Cash

$ 1,000

Accounts payable

$ 4,000

Accounts receivable (net)

3,900

Salaries payable

1,100

Inventory

4,700

Total Liabilities

$ 5,100

Land

9,800

Common stock, $10 par

13,500

Buildings and equipment

68,900

Additional paid-in capital

11,200

Less: Accumulated depreciation

(14,100)

Retained earnings

44,400

Total Assets

$ 74,200

Total Liabilities and Shareholders' Equity

$74,200

At the end of 2016, Mills prepared the following statement of cash flows:

Statement of Cash FlowsFor Year Ended December 31, 2016

Operating Activities:

Net income

$ 5,400

Adjustments for differences between income flowsand cash flows from operating activities:

Add: Depreciation expense

1,900

Decrease in…

Adjust the Cash BalanceWe obtain the following 2018 forecasts of selected financial statement line items for Journey Company.

$ millions

2017 Actual

2018 Est.

Net Sales

$747,442

$779,327

Marketable securities

67,096

62,096

Long-term debt

346,558

308,437

Treasury stock (deducted from equity)

51,174

51,174

Cash generated by operations

57,918

Cash used for investing

(15,130)

Cash used for financing

(54,438)

Total net change in cash

(11,650)

Cash at beginning of period

51,141

Cash at end of period

$39,491

a. Does forecasted cash deviate from the normal level for this company?Calculate the company's normal cash level as a percentage of sales.Round answer to one decimal place.Answer%

Using the rounded answer above, compute what should be the normal cash balance for FY2018.Round answer to the nearest million.

million

C. Complete the following statement of cash flows assuming long-term debt is used to adjust the forecasted cash balance.

Use…

Reading Apple Inc.’s Statement of Cash Flows

The following items appeared in the Investing Activities section of Apple Inc.’s statement of cash flows included in Form 10-K for the year ended September 26, 2015. (All amounts are in millions of dollars.)

2015

2014

2013

Purchases of marketable securities

$(166,402)

$(217,128)

$(148,489)

Proceeds from maturities of marketable securities

14,538

18,810

20,317

Proceeds from sales of marketable securities

107,447

189,301

104,130

Required:

1. What amount did Apple spend in 2015 to purchase marketable securities?$fill in the blank 1 million

How does this amount compare to the amounts spent in the two prior years?

This was $fill in the blank 2 million less than it spent in 2014.

This was $fill in the blank 4 million more than it spent in 2013.

2. What amount did Apple receive from marketable securities that matured in 2015?$fill in the blank 6 million

How does this amount compare to the amounts received in the…

Chapter 12 Solutions

FINANCIAL ACCT-CONNECT

Ch. 12 - What is the reporting purpose of the statement of...Ch. 12 - Prob. 2DQCh. 12 - Prob. 3DQCh. 12 - Describe the direct method of reporting cash flows...Ch. 12 - Prob. 5DQCh. 12 - Prob. 6DQCh. 12 - Prob. 7DQCh. 12 - Prob. 8DQCh. 12 - Prob. 9DQCh. 12 - Prob. 10DQ

Ch. 12 - Prob. 11DQCh. 12 - Prob. 12DQCh. 12 - Prob. 13DQCh. 12 - Prob. 14DQCh. 12 - Prob. 15DQCh. 12 - Prob. 1QSCh. 12 - Prob. 2QSCh. 12 - Prob. 3QSCh. 12 - Prob. 4QSCh. 12 - Prob. 5QSCh. 12 - Prob. 6QSCh. 12 - Prob. 7QSCh. 12 - Prob. 8QSCh. 12 - Computing financing cash flows P3 The following...Ch. 12 - Prob. 10QSCh. 12 - Prob. 11QSCh. 12 - Prob. 12QSCh. 12 - Prob. 13QSCh. 12 - Refer to the data in QS 12-11. How much cash is...Ch. 12 - Prob. 15QSCh. 12 - Prob. 16QSCh. 12 - Prob. 17QSCh. 12 - Prob. 18QSCh. 12 - Prob. 19QSCh. 12 - Prob. 20QSCh. 12 - The following transactions and events occurred...Ch. 12 - Prob. 2ECh. 12 - Prob. 3ECh. 12 - Prob. 4ECh. 12 - Prob. 5ECh. 12 - Prob. 6ECh. 12 - Prob. 7ECh. 12 - Prob. 8ECh. 12 - Prob. 9ECh. 12 - Prob. 10ECh. 12 - Prob. 11ECh. 12 - Prob. 12ECh. 12 - Prob. 13ECh. 12 - Prob. 14ECh. 12 - Prob. 15ECh. 12 - Prob. 16ECh. 12 - Prob. 17ECh. 12 - Prob. 18ECh. 12 - Prob. 1PSACh. 12 - Prob. 2PSACh. 12 - Prob. 3PSACh. 12 - Prob. 4PSACh. 12 - Prob. 5PSACh. 12 - Prob. 6PSACh. 12 - Prob. 7PSACh. 12 - Prob. 8PSACh. 12 - Prob. 1PSBCh. 12 - Prob. 2PSBCh. 12 - Prob. 3PSBCh. 12 - Prob. 4PSBCh. 12 - Prob. 5PSBCh. 12 - Prob. 6PSBCh. 12 - Prob. 7PSBCh. 12 - Prob. 8PSBCh. 12 - Santana Rey, owner of Business Solutions, decides...Ch. 12 - Prob. 1BTNCh. 12 - Prob. 2BTNCh. 12 - Prob. 3BTNCh. 12 - Prob. 4BTNCh. 12 - Access the March 31, 2015, filing of the 10-K...Ch. 12 - Prob. 6BTNCh. 12 - Prob. 8BTNCh. 12 - Prob. 10BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following excerpts from Bolognese Companys statement of cash flows and other financial records to determine the companys free cash flow for 2018 and 2017.arrow_forwardStatement of Cash Flows—Direct Method Lang Company has not yet prepared a formal statement of cash flows for 2016. Following are comparative balance sheets as of December 31, 2016 and 2015, and a statement of income and retained earnings for the year ended December 31, 2016: Required For purposes of a statement of cash flows, are the U.S. Treasury bills cash equivalents? If not, how should they be classified? Explain your answers. Prepare a statement of cash flows for 2016 using the direct method in the Operating Activities section.arrow_forwardUse the following excerpts from Tungsten Companys financial information to prepare a statement of cash flows (indirect method) for the year 2018.arrow_forward

- How to prepare a statement of cash flows ? To prepare a statment of cash flows for the year 2014 2014 2013 Cash 177,000 78,000 Accounts recievable 180,000. 185,000 Investments 52,000 74,000 Equipment 298,000 240,000Accoumulated depreciation-- equipment (106,000) (89,000) Current Liabalities 134,000 151,000 Common stock 160,000 160,000 Retained Earnings 307,000 177,000 Additional Infomation : Investments were sold at loss (not extraordinary) of 10,000; no…arrow_forwardThe income statement for the year ended December 31, 2016, is as follows: Paid-in capital: Excess of issue price over par-common stock. activities. of cash flows, using the low from tivities, PR 14-5A 1, 2015 Dec. 31, 2 lo $ 585,920 208,960 Dec. 31, 2016 Cash........... Assets $ 625,760 Accounts receivable (net) d Inventories 617,120 227,840 641,760 240,000 Investments Land arosTE Equipment.. 328,000 553,120 705,120 (148,000) Accumulated depreciation-equipment (166,400) $2,057,120 Total assets $2,362,080 $ 404,960 52,640 co0ro Accounts payable (merchandise creditors) Liabilities and Stockholders' Equity $ 424,480 42,240 Accrued expenses payable (operating expenses) Dividends payable. Common stock, $2 par.... 19,200 000 24,000 100,000 150,000 280,000 Retained earnings..... 417,500 1,200,320 Total liabilities and stockholders' equity. 1,303,860 $2,057,120 $2,362,080 008B 000 a2 Cost of merchandise sold 00080 Gross profit 008.800 Operating expenses: Sales $ 5,372,559 ebivid 3,306,190…arrow_forwardConsider the financial statements alongside the notes presented by Simple Things Industries and prepare the statement of cash flows for the year ended December 31, 2014. Assets Current: Cash Accounts Receivable Inventory Plant assets, net Total Assets Liabilities Current: Accounts payable Accrued liabilities Long-term notes payable Stockholders' Equity Common S tock Retained earnings Treasury stock Total liabilities and stockholders' equity Revenues and gains: Sales revenue Interest revenue Dividend revenue Gain on sale of plant assets Total revenues and gains Simple Things Industries Ltd. Comparative Balance Sheet December 31, 2014 and 2013 Expenses Cost of goods sold Salary and wages expense Depreciation expense Other operating expense Interest expense Income tax expense Total expenses Net Income/(Loss) Simple Things Industries Ltd Income Statement Year Ended December 31,2014 Notes Acquisition of plant asset during 2014 Sale proceeds from sale of plant asset Receipt for issuance of…arrow_forward

- Cash flow identity. Use the data from the following financial statements the popup window,. The company paid interest expense of $17,700 for 2017 and had an overall tax rate of 40% for 2017. Verify the cash flow identity: cash flow from assets = cash flow to creditors + cash flow to owners The cash flow from assets is $ (Round to the nearest dollar.)arrow_forwardEspinoza Air Conditioning & Heating had the following select financial data as of June 30, 2018. What is Espinoza’s cash ratio? a. 0.34 b. 0.65 c. 0.78 d. 1.54arrow_forwardcompute the cash ratios for 2018 and 2017 (Round your answers to two decimal places, X.XX.) 2018:? 2017:? here is the data table Ranfield, Inc. Comparative Balance Sheet December 31, 2018 and 2017 2018 2017 2016* Assets Current Assets: Cash $91,000 $90,000 Accounts Receivables, Net 112,000 119,000 $102,000 Merchandise Inventory 148,000 160,000 202,000 Prepaid Expenses 17,000 6,000 Total Current Assets 368,000 375,000 Property, Plant, and Equipment, Net 213,000 174,000 Total Assets $581,000 $549,000 $596,000 Liabilities Total Current Liabilities $223,000 $241,000 Long-term Liabilities 115,000 98,000 Total Liabilities 338,000 339,000 Stockholders' Equity…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License