EBK HORNGREN'S ACCOUNTING

12th Edition

ISBN: 9780134491523

Author: Matsumura

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem P12.36BPGB

Accounting for the liquidation of a

Learning Objective 6

2. Loss on Disposal $55,000

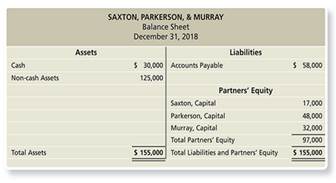

The partnership of Saxton, Parkerson, & Murray has experienced operating losses for three consecutive years. The partners—who have shared profits and losses in the ratio of Saxton, 10%; Parkerson, 65%; and Murray, 25%—are liquidating the business. They ask you to analyze the effects of liquidation. They present the following condensed partnership balance sheet at December 31, 2018:

Requirements

1. Assume the non-cash assets are sold for $170,000. Journalize the liquidation transactions.

2. Assume the non-cash assets are sold for $70,000. Journalize the liquidation transactions.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Part AThe partnership of Butler, Osman, and Ward was formed several years as a local tax preparation firm. Two partners have reached retirement age and the partners have decided to terminate operations and liquidate the business. Liquidation expenses of $34,000 are expected. The partnership balance sheet at the start of liquidation is as follows: Cash . . . . . . . . . . . . . . . . . . . $ 30,000 Liabilities . . . . . . . . . . . . . . . $170,000Accounts receivable . . . . . 60,000 Butler, loan . . . . . . . . . . . .. . . . 30,000Office equipment (net) . . . . 50,000 Butler, capital (25%) . . . . . . . . . 50,000Building (net) . . . . . . . . . . . . 110,000 Osman, capital (25%) . . . . . . . . 30,000Land . . . . . . . . . . . . . . . . . . . 100,000 Ward, capital (50%) . . . . .. . . . . 70,000

Prepare a predistribution plan for this partnership.Part BThe following transactions transpire in chronological order during the liquidation of the partnership:1. Collected 90 percent of…

Chapter 3 – Partnership Operation (Division of Profit or Loss) Bruce and Rachel agree to form a partnership on July 1, 2020. Bruce, who has been trading as a sole proprietor, will invest certain business assets at agreed valuations, transfer his business liabilities and contribute sufficient cash to bring his total contribution to a 60% interest over the new business. Details of Bruce’s assets and liabilities are given below. Book value Agreed value Accounts receivable P 32,000 P 30,000 Inventory 240,000 138,000 Equipment 322,000 240,000 Accounts payable 200,000 200,000 Notes payable 14,000 14,000 Rachel agrees to bring in inventory with a value of P146,500 and P93,500 in cash for a 40% interest in the partnership. The partners have agreed on the following: 1. Capital accounts will remain fixed 2. 12% interest profit computed on capital 3. Salaries of P30,000 each for 2020 but will be twice this amount next year and thereafter; 4. 10% interest charge on partners’ drawings made beyond…

Chapter 3 – Partnership Operation (Division of Profit or Loss) Bruce and Rachel agree to form a partnership on July 1, 2020. Bruce, who has been trading as a sole proprietor, will invest certain business assets at agreed valuations, transfer his business liabilities and contribute sufficient cash to bring his total contribution to a 60% interest over the new business. Details of Bruce’s assets and liabilities are given below. Book value Agreed value Accounts receivable P 32,000 P 30,000 Inventory 240,000 138,000 Equipment 322,000 240,000 Accounts payable 200,000 200,000 Notes payable 14,000 14,000 Rachel agrees to bring in inventory with a value of P146,500 and P93,500 in cash for a 40% interest in the partnership. The partners have agreed on the following: 1. Capital accounts will remain fixed 2. 12% interest profit computed on capital 3. Salaries of P30,000 each for 2020 but will be twice this amount next year and thereafter; 4. 10% interest charge on partners’ drawings made beyond…

Chapter 12 Solutions

EBK HORNGREN'S ACCOUNTING

Ch. 12 - Prob. 1QCCh. 12 - Prob. 2QCCh. 12 - Prob. 3QCCh. 12 - Which financial statement shows the changes in...Ch. 12 - Prob. 5QCCh. 12 - Prob. 6QCCh. 12 - Prob. 7QCCh. 12 - Peter and Steve admit Meredith to their...Ch. 12 - Prob. 9QCCh. 12 - Prob. 10QC

Ch. 12 - Prob. 1RQCh. 12 - Prob. 2RQCh. 12 - Prob. 3RQCh. 12 - Prob. 4RQCh. 12 - Prob. 5RQCh. 12 - Prob. 6RQCh. 12 - Prob. 7RQCh. 12 - Prob. 8RQCh. 12 - Prob. 9RQCh. 12 - Prob. 10RQCh. 12 - Prob. 11RQCh. 12 - Prob. 12RQCh. 12 - Prob. 13RQCh. 12 - Prob. 14RQCh. 12 - Prob. 15RQCh. 12 - What are the three steps involved in liquidation...Ch. 12 - Prob. 17RQCh. 12 - Prob. S12.1SECh. 12 - Prob. S12.2SECh. 12 - Prob. S12.3SECh. 12 - Prob. S12.4SECh. 12 - Prob. S12.5SECh. 12 - S12-6 Accounting for the admission of a new...Ch. 12 - Accounting for the admission of a new partner...Ch. 12 - Prob. S12.8SECh. 12 - Prob. S12.9SECh. 12 - Prob. S12.10SECh. 12 - Prob. S12.11SECh. 12 - Prob. S12.12SECh. 12 - Prob. E12.13ECh. 12 - Prob. E12.14ECh. 12 - Prob. E12.15ECh. 12 - Prob. E12.16ECh. 12 - Prob. E12.17ECh. 12 - Prob. E12.18ECh. 12 - Prob. E12.19ECh. 12 - Prob. E12.20ECh. 12 - Prob. E12.21ECh. 12 - Prob. E12.22ECh. 12 - Determining characteristics of a partnership and...Ch. 12 - Prob. P12.24APGACh. 12 - Prob. P12.25APGACh. 12 - Prob. P12.26APGACh. 12 - Prob. P12.27APGACh. 12 - Prob. P12.28APGACh. 12 - Prob. P12.29APGACh. 12 - Prob. P12.30APGACh. 12 - Prob. P12.31BPGBCh. 12 - Prob. P12.32BPGBCh. 12 - Prob. P12.33BPGBCh. 12 - Prob. P12.34BPGBCh. 12 - Prob. P12.35BPGBCh. 12 - Accounting for the liquidation of a partnership...Ch. 12 - Prob. P12.37BPGBCh. 12 - Prob. P12.38BPGBCh. 12 - Prob. P12.39CTCh. 12 - P12-40 Accounting for partner contributions,...Ch. 12 - Prob. 12.1TIATCCh. 12 - Prob. 12.1DCCh. 12 - Prob. 12.2DCCh. 12 - Prob. 12.1EICh. 12 - Prob. 12.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Instructions: Please answer it with complete solution. Thank you so much!! Rachelle, Patrick, and Lorreyn formed the RPL Professional Partnership on April 1, 20X2, by contributing capital. They agreed that Lorreyn would receive P20,000 as manager of the firm, and the remainder will be divided according to the profit ratio of 34%, 44%, 22%, respectively. At the end of the month, the company had a net loss of P900,000. Discuss how the loss shall be distributed in no more than five (5) sentences.arrow_forwardTom and Julie formed a management consulting partnership on January 1, 2016. The fair value of the net assets invested by each partner follows: Tom Julie Cash $12,600 $11,200 Accounts receivable 7,400 5,700 Office supplies 2,100 900 Office equipment 32,600 — Land — 32,200 Accounts payable 2,200 5,500 Mortgage payable — 19,100 During the year, Tom withdrew $16,000 and Julie withdrew $12,800 in anticipation of operating profits. Net profit for 2016 was $46,200, which is to be allocated based on the original net capital investment. (a) Your answer is correct. Prepare journal entries to: 1. Record the initial investment in the partnership. 2. Record the withdrawals 3. Close the Income Summary and Drawing accounts. (Round intermediate calculations to 6 decimal places, e.g. 1.576843 answers to 0 decimal places, e.g. 5,125. Credit account titles are…arrow_forwardCan I please get help with practice 6.4 Required information Skip to question [The following information applies to the questions displayed below.] Ries, Bax, and Thomas invested $48,000, $64,000, and $72,000, respectively, in a partnership. During its first calendar year, the firm earned $416,100. Required: Prepare the entry to close the firm’s Income Summary account as of its December 31 year-end and to allocate the $416,100 net income under each of the following separate assumptions. Appropriation of profits General Journal Allocate $416,100 net income in the ratio of their beginning capital investments.Note: Do not round intermediate calculations. Round final answers to the nearest whole dollar. Supporting Computations Percentage of Total Equity × Income Summary Allocated Income to Capital Ries × Bax × Thomas × Record the entry to close the income summary account assuming the partners have…arrow_forward

- The partnership of Donald, Healey & Jaguar has experienced operating losses. The partners—who have shared profits and losses in the ratio of Donald, 10%; Healey, 30%; and Jaguar, 60%—are liquidating the business. They ask you to analyze the effects of liquidation and present the following partnership balance sheet at December 31, end of the current year: Requirements 1. Prepare a summary of liquidation transactions (as illustrated in Exhibit 12-5). The noncash assets are sold for $192,000. 2. Journalize the liquidation transactions.arrow_forwardAdmission of a New Partner: David Breck has a capital balance of $20,000 and he sells one half of his partnership interest to Cris Davis for $18,000 on January 4th, 2003. Breck is selling a $10,000 recorded interest in the partnership. Write the journal entry for this transaction. Admission of a new partner : David Breck decides that he would like to remain in the business, and instead Cris Davis invests $18,000 cash in the business. Record the journal entry for this transaction.arrow_forwardRequired: 3. Prepare journal entry to record Pedro’s admission. 4. During the first year of operations, the partnership earned P650,000. After Pedro’s admission, the profitand loss sharing ratio is 40:40:20 for Juan, Pablo, and Pedro, respectively, based on capital credits.Drawings were made in these amounts: Juan, P100,000; Pablo, P130,000; Pedro – P56,000. What isthe capital balance of Pedro after the first year?arrow_forward

- Assume the following assets, liabilities, and partners’ equity in the Chang and Lee partnership on December 31, 2014: Assets = Liabilities + Chang, Capital + Lee, Capital$160,000 = $10,000 + $90,000 + $60,000The partnership has no cash. When the partners agree to liquidate the business, theassets are sold for $120,000, and the liabilities are paid. Chang and Lee share incomeand losses in a ratio of 3:1. 1. Prepare a statement of liquidation.2. Prepare journal entries for the sale of assets, payment of liabilities, distribution ofloss from realization, and final distribution of cash to Chang and Lee.arrow_forwardThe partnership of Benedict, Joshua and Constantine have asked you to assist it in winding up the affairs of the business. You compile the following information: a) The trial balance of the partnership on June 30, 2020 is: Debit Credit Cash 6,000 Accounts Receivable (net) 22,000 Inventory 14,000 Plant and Equipment (net) 99,000 Loan to Benedict 12,000 Loan to Constantine 7,500 Accounts Payable 17,000 Benedict, Capital 67,000 Joshua, Capital 45,000 Constatine, Capital 31,500 Total…arrow_forwardCan I please get help with this practice question? 6.1 Ries, Bax, and Thomas invested $48,000, $64,000, and $72,000, respectively, in a partnership. During its first calendar year, the firm earned $416,100. Required: Prepare the entry to close the firm’s Income Summary account as of its December 31 year-end and to allocate the $416,100 net income under each of the following separate assumptions. 1. The partners did not agree on a plan, and therefore share income equally. Record the entry to close the income summary account assuming the partners did not agree on a plan, and therefore share income equally. Note: Enter debits before credits. Date General Journal Debit Credit December 31arrow_forward

- The partnership of Butler, Osman, and Ward was formed several years ago as a local tax preparation firm. Two partners have reached retirement age, and the partners have decided to terminate operations and liquidate the business. Liquidation expenses of $50,000 are expected. The partnership balance sheet at the start of liquidation is as follows: Cash $ 46,000 Liabilities $ 186,000 Accounts receivable 76,000 Butler, loan 46,000 Office equipment (net) 66,000 Butler, capital (25%) 130,000 Building (net) 190,000 Osman, capital (25%) 46,000 Land 180,000 Ward, capital (50%) 150,000 Total assets $ 558,000 Total liabilities and capital $ 558,000 Prepare a predistribution plan for this partnership.arrow_forwardThe partnership of Butler, Osman, and Ward was formed several years ago as a local tax preparation firm. Two partners have reached retirement age, and the partners have decided to terminate operations and liquidate the business. Liquidation expenses of $50,000 are expected. The partnership balance sheet at the start of liquidation is as follows: Cash $ 46,000 Liabilities $ 186,000 Accounts receivable 76,000 Butler, loan 46,000 Office equipment (net) 66,000 Butler, capital (25%) 130,000 Building (net) 190,000 Osman, capital (25%) 46,000 Land 180,000 Ward, capital (50%) 150,000 Total assets $ 558,000 Total liabilities and capital $ 558,000 The following transactions transpire in chronological order during the liquidation of the partnership: Collected 90 percent of the accounts receivable and wrote the remainder off as uncollectible. Sold the office equipment for $28,000, the building for…arrow_forward4. A balance sheet for the partnership of A, B, and C, who share profits 2:1:1, shows the following balances just before liquidation: Cash: P48,000 Other assets: 238,000 Liabilities: 80,000 A, Capital: 88,000 B, Capital: 62,000 C, Capital: 56,000 On the first month of liquidation, certain non-cash assets were sold resulting to a loss of P23,000. Liquidation expenses of P4,000 were paid, and additional liquidation expenses of P3,200 are withheld to anticipate payment before liquidation is completed. After creditors were paid, partner B received P13,000 on the initial installment. Determine the total book value of the non-cash assets on the first month. Determine total payment to partners on the initial installment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License