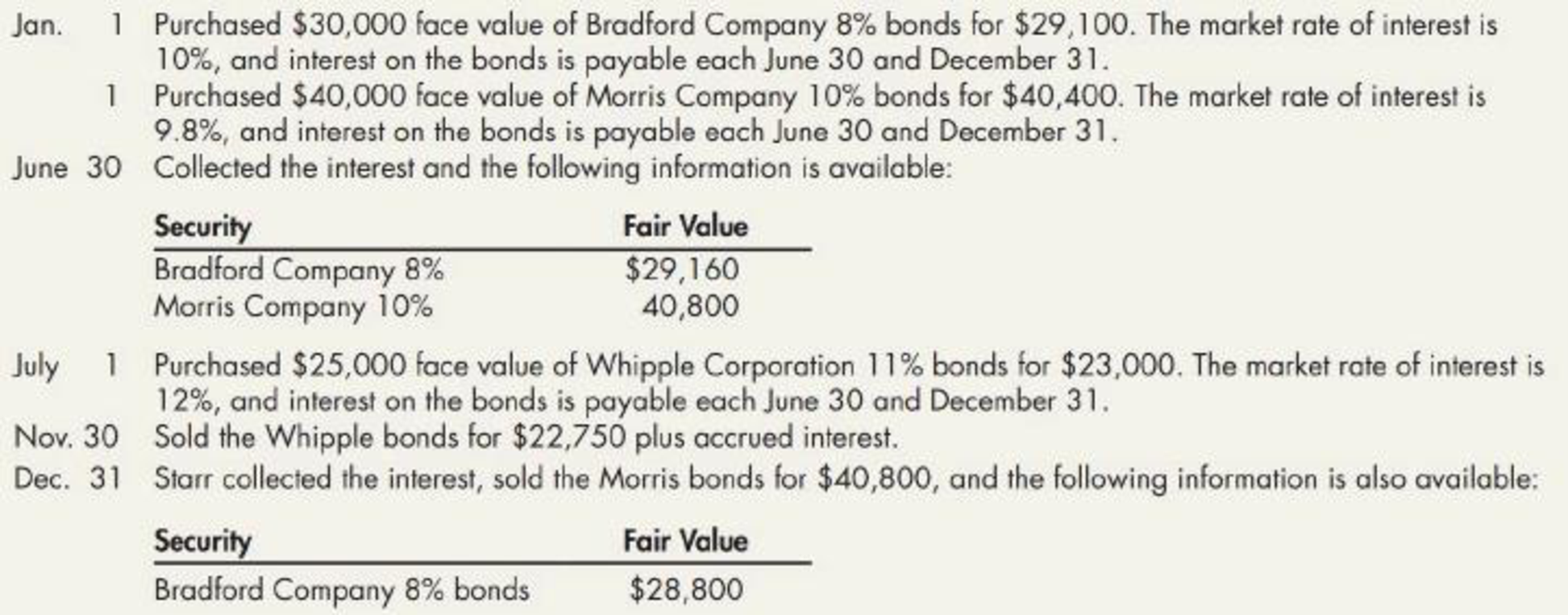

Investment in Available-for-Sale Bonds The following information relates to Starr Company’s investment in available-for-sale bonds for 2019:

Required:

- 1. Prepare

journal entries to record the previous information for 2019. Use the effective interest method and round all amounts to the nearest dollar. Assume that Starr prepares semiannual financial statements. - 2. Show the items of income or loss from investment transactions that Starr reports for each 2019 semiannual income statement.

- 3. Show how the investment items are reported on each of the 2019 semiannual balance sheets, assuming that management expects to dispose of all investments with in one year of purchase.

1.

Record the journal entries in the books of Company S for the year 2019.

Explanation of Solution

Investment: It refers to the process of using the currently held excess cash to earn profitable returns in future. The investments can be made in equity securities such as shares or debt securities such as bonds.

Record the journal entries in the books of Company S for the year 2019.

| Date | Account Title and Explanation |

Debit ($) | Credit ($) |

| January 1, 2019 | Investment in Available-for-sale Securities | 29,100 | |

| Cash | 29,100 | ||

| (To record the purchase of Available-for-sale securities at discount) | |||

| January 1, 2019 | Investment in Available-for-sale Securities | 40,400 | |

| Cash | 40,400 | ||

| (To record the purchase of Available-for-sale securities at premium) | |||

| June 30, 2019 | Cash | 1,200 | |

| Investment in Available-for- sale Securities | 255 | ||

| Interest income | 1,455 | ||

| (To record the earned interest and amortization of discount) | |||

| June 30, 2019 | Cash | 2,000 | |

| Investment in Available-for- sale Securities | 20 | ||

| Interest income | 1,980 | ||

| (To record the earned interest and amortization of premium) | |||

| June 30, 2019 | Allowance for change in fair value of investment (1) | 225 | |

| Unrealized holding gain/loss: Available-for-sale securities | 225 | ||

| (To adjust the allowance and the unrealized gain on holding the Securities) | |||

| July 1, 2019 | Investment in Available-for-sale Securities | 23,000 | |

| Cash | 23,000 | ||

| (To record the purchase of Available-for-sale securities at discount) | |||

| November 30, 2019 | Interest receivable | 1,146 | |

| Investment in Available-for- sale Securities | 4 | ||

| Interest income | 1,150 | ||

| (To record the interest earned for 5 months) | |||

| November 30, 2019 | Cash | 23,896 | |

| Loss on sale of Available-for-sale Securities | 254 | ||

| Investment in Available-for-sale Securities | 23,004 | ||

| Interest receivable | 1,146 | ||

| (To record the sale of Corporation W's bond on loss) | |||

| December 31, 2019 | Cash | 1,200 | |

| Investment in Available-for-sale Securities | 268 | ||

| Interest income ` | 1,468 | ||

| (To record the earned interest and amortization of discount) | |||

| December 31, 2019 | Cash | 2,000 | |

| Investment in Available-for-sale Securities | 21 | ||

| Interest income | 1,979 | ||

| (To record the earned interest and amortization of premium) | |||

| December 31, 2019 | Cash | 40,800 | |

| Gain on sale of Available-for-sale Securities | 441 | ||

| Investment in Available-for-sale Securities | 40,359 | ||

| (To record the sale of Company M's bond at gain) | |||

| December 31, 2019 | Unrealized holding gain/loss: Available-for-sale securities | 420 | |

| Allowance for change in fair value of investment | 420 | ||

| (To reverse the allowance and the unrealized gain, that has been allowed earlier on June 30, 2019) | |||

| December 31, 2019 | Unrealized holding gain/loss: Available-for-sale securities | 628 | |

| Allowance for change in fair value of investment | 628 | ||

| (To adjust the allowance and the unrealized loss on holding the Securities) |

Table (1)

Working note (1):

Calculate the allowance for change in fair value of investment:

| Security | Book value | Fair value | Change in fair value |

| Corporation B’s bond of $30,000 | $29,355 (2) | $29,160 | $(195) |

| Corporation M’s bond of $40,000 | $40,380 (3) | $40,800 | $420 |

| Total | $69,735 | $69,960 | $225 |

Table (2)

Working note (2):

Calculate the book value of Corporation B:

Working note (3):

Calculate the book value of Corporation M:

2.

Show the items that would be reported as income or loss from the investment in the income statement.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

| Income statement | ||

| For semi-annual period ended | ||

| Particulars | 06/30/2019 | 12/31/2019 |

| Interest income | $3,435(4) | $4,597(5) |

| Loss on sale of securities | - | ($254) |

| Gain on sale of securities | - | $441 |

Table (3)

Working note (4):

Calculate the amount of interest income for 06/30/2019:

Working note (5):

Calculate the amount of interest income for 12/31/2019:

3.

Show the way in which the investments items are reported in the 2019 semi-annual balance sheets.

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Show the way in which the investments items are reported in the 2019 semi-annual balance sheets.

| Balance sheet (Partial) | ||

| Particulars | 06/30/2019 | 12/31/2019 |

| Current assets: | ||

| Investment in available-for-sale securities | $69,735 | $29,623 |

| Add(Less): Allowance for change in fair value of investment | $225 | $(823) |

| Investment in available-for-sale securities | $69,960 | $28,800 |

| Shareholders’ equity: | ||

| Accumulated other comprehensive income: | ||

| Unrealized holding gain/loss: | ||

| Available for sale securities | $225 | ($823) |

Table (4)

Want to see more full solutions like this?

Chapter 13 Solutions

INTERM.ACCT.:REPORTING...-CENGAGENOWV2

- Refer to the information in RE13-5. Assume that on December 31, 2019, the investment in Smith Corporation bonds has a market value of 12,500. Prepare the year-end journal entry to record the unrealized gain or loss.arrow_forwardRefer to the information in RE 13-3. Assume that on December 31, 2019, Wolfpack received interest on the Todd Corporation bonds. Wolfpack uses the straight-line method to amortize premiums and discounts. Prepare the December 31 journal entry to record the receipt of the interest. On July 1, 2019, Wolfpack Corporation purchases securities which it intends to buy and sell frequently. These securities consisted of todd Corporation 10%, 5-year bonds with a face value of 20,000 which were purchased for 18,500. Prepare the july 1 journal entry to record the purchase of these trading securities.arrow_forwardInvestments in Equity Securities Manson Incorporated reported investments in equity securities of 60,495 as a current asset on its December 31, 2018, balance sheet. An analysis of Mansons investments on December 31, 2018, reveals the following: During 2019, the following transactions related to Mansons investments occurred: Required: 1. Assuming Manson prepares quarterly financial statements, prepare journal entries to record the preceding information. 2. Show the items of income or loss from investment transactions that Manson reports for each quarter of 2019. 3. Show how Mansons investments are reported on the balance sheet on March 31, 2019; June 30, 2019; September 30, 2019; and December 31, 2019.arrow_forward

- Investments in Equity Securities Noonan Corporation prepares quarterly financial statements and invests its excess funds in marketable securities. At the end of 2018, Noonans portfolio of investments consisted of the following equity securities: Dunne the first half of 2019, Noonan engaged in the following investment transactions: Required: 1. Record Noonans investment transactions for January 6 through June 30, 2019. 2. Show the items of income or loss from investment transactions that Noonan reports for each of the first and second quarters of 2019. 3. Show how the preceding items are reported on the first and second quarter 2019 ending balance sheets, assuming that management expects to dispose of the Keene and Sachs securities within the next year.arrow_forwardRefer to the information in RE13-5. Assume that on June 30, Aggie received interest on the Smith Corporation bonds. Prepare the June 30 journal entries to record the receipt of the interest. On April 30, 2019, Aggie Corporation purchased Smith Corporation 10%, 5-years bonds with a face value of 12,000 at par plus four months of accrued interest. Prepare the April 30 journal entry to record the purchase of these available-for-sale securities.arrow_forwardHeld-to-Maturity Securities and Amortization of a Discount On January 1, 2019, Kelly Corporation acquired bonds with a face value of 500,000 for 483,841.79, a price that yields a 10% effective annual interest rate. The bonds carry a 9% stated rate of interest, pay interest semiannually on June 30 and December 31, are due December 31, 2022, and are being held to maturity Required: Prepare journal entries to record the purchase of the bonds and the first two interest receipts using the: 1. straight-line method of amortization 2. effective interest method of amortizationarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning