a)

Prepare a report for the chair of the allocation committee indicating the extent to which BRC’s financial situation has improved or worsened.

a)

Explanation of Solution

Not-for-profit (NFP) entities: It is an individual or group of people who work together to attain the goals and mission that is something other than making profit for its shareholders or owners. Not-for-profit entities’ success is measured by how much the entity serves to the well-being of public or poor people with the available resource of the entity.

Prepare a report for the chair of the allocation committee indicating the extent to which BRC’s financial situation has improved or worsened:

Report

To: Chair of allocation committee

UW allocation panel

From: Person X,

Financial advisor

Subject: Analysis of the rehabilitative camp funding for fiscal year 2018

It is recalled to the panel members that it is quite concerned about the financial reserves. It is because the financial are precariously low during the evaluation of the organization for fiscal year 2017. At that time, the financial advisor Person X raised the issue about ability of the organization to continue to sustain its function/program within the budgeted level. Further, he recommended the request of budget from UW might be cut by 50% until the improvement of financial position.

It is also noted from the statement of activities of fiscal year 2016; only 57% of the total expenses were spent for the program/function. The entire panel further decided to send a message about concerns of the organization and request the budget amount from $5,000 to $25,000 to the board. Based on this request the UW board has approved the fund.

During the meeting conducted in the last year, the Chairman and Director of the board promised to take immediate steps to improve the financial condition of the camp. It including more fund-raising activities and if required for reducing the cost, cutting the camp’s support staff.

It is very surprised and pleased by the proof that shows the improvement made in the organizations financial situation. After the inspection of statements and budgets of 2017, it is noted that there is a doubtful reduction of $31,934 in the investments amount. The camp has been carrying this amount (that is restricted for building expansion) for few years. However, in the temporarily restricted net assets, the exact amount has been decreased.

It is to be noted that there was no increase in the building account balance. In building account, the only change is decrease in balance due to

After identifying the apparent fund transfer, person X contacted director of the camp who provides the details about the donor. For the future building expansion, the donor has contributed $100,000 several years ago. The donor was no longer living and not able to locate the written agreement about this contribution.

Further, these facts have been reported to the board of directors. Directors passed resolution to authorize the use of investment of $37,500 for unrestricted purposes in the fiscal year 2017. Here, it is stated that the additional fund will be transferred in the future years if requirement arises.

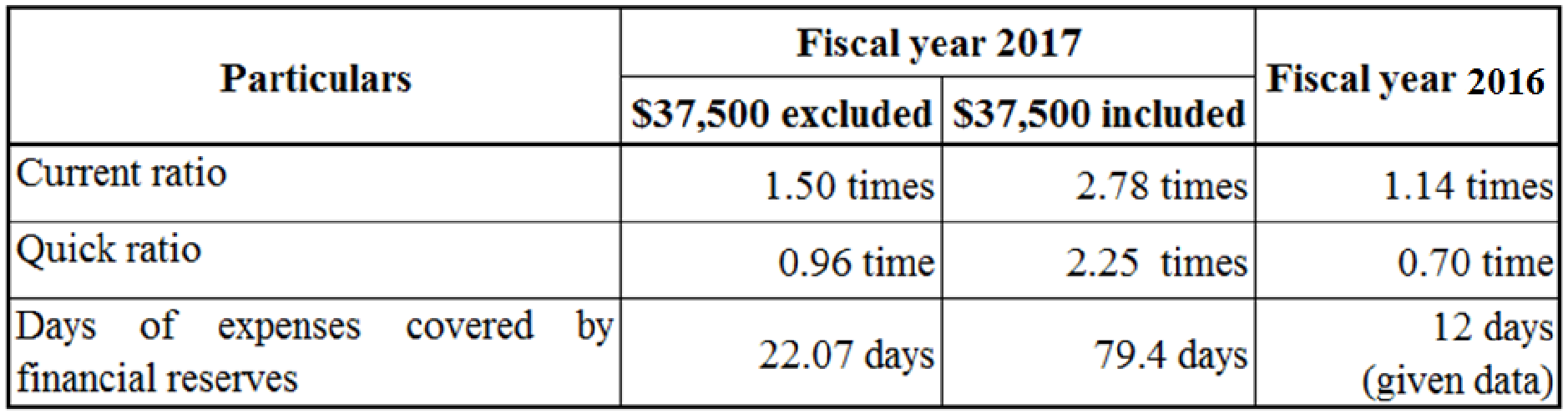

Hence, the panel members would like to see the impact of the transfer of $37,500 in the financial position of the camp. The following are the key calculations including and excluding the amount of $37,500.

Table (1)

This comparison clearly shows the difference between inclusion and exclusion of $37,500 in the assets. Based on this fact, the following recommendation is provided. UW’s attorney should look into the matter why the restricted resources used as unrestricted operation purpose of the camp.

Regards,

Person X,

Financial advisor

Notes for the above table:

a. Calculate current ratio:

It is given that the current asset is $43,589 and current liability is $29,141 for the fiscal year 2017. The current ratio is calculated by dividing the current assets by the current liabilities.

Hence, the current ratio excluding $37,500 is 1.50 times.

If add the amount of $37,500, the ratio will be:

Hence, the current ratio including $37,500 is 2.78 times.

Now, calculate current ratio for the fiscal year 2016:

It is given that the current asset is $46,368 and current liability is $40,786 for the fiscal year 2016.

Hence, current ratio for the year 2016 is 1.14 times.

b. Calculate quick ratio:

It is calculated by dividing the difference between the current assets and prepaid expenses by the current liabilities. It is given the prepaid expenses of 2017 is 15,559 and 2016 is $17,748.

Hence, the quick ratio excluding $37,500 is 0.96 times.

If add the amount of $37,500, the ratio will be:

Hence, the quick ratio including $37,500 is 2.25 times.

Now, calculate quick ratio for the fiscal year 2016:

It is given that the current asset is $46,368 and current liability is $40,786 for the fiscal year 2016.

Hence, the quick ratio for 2016 is 0.70 times.

c. Calculate days of expenses covered by financial reserves:

It is calculated by dividing the difference between the current assets and current liability by the total expenses. It is given that the total expenses are $238,932.

Hence, the quick ratio (exclusion of $37,500) is 22.07 days.

Now, calculated quick ratio for inclusion of $37,500:

Hence, the quick ratio (inclusion of $37,500) is 79.4 days.

b)

Explain the reaction of financial advisor to the board of director’s decision to use, for operating purposes, the $100,000 temporarily restricted net assets provided by a donor for building expansion.

b)

Explanation of Solution

Using the restricted fund of the donor contributed for the future building expansion as an unrestricted fund for the operation is not an ethical activity.

There is a transfer of funds from one account to another without any approvals. This is a questionable activity.

If it is identified that the Chairman and the board of directors had illegally transferred the restricted fund to operation activities, legal charges should filed against them.

c)

Identify the amount of UW funds would the financial advisor recommend be allocated to the BRC for the fiscal year 2018.

c)

Explanation of Solution

The donor’s restricted fund contributed for the future building expansion should be allocated if there is any requirement for the expansion of the building. Otherwise, this fund should be restricted further and must not be allocated for operating purposes. It is illegal to use restricted funds for operation purposes.

The restricted fund balance should be audited every year-end. If the fund is spent for particular purpose it should be verified whether fund is used for donor’s mentioned contributed purpose. Otherwise, the fund should be recovered and it must be added to the restricted fund balance.

Want to see more full solutions like this?

Chapter 13 Solutions

ACCOUNTING F/GOVERNMENTAL &NONPROFIT

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education