EBK HORNGREN'S COST ACCOUNTING

16th Edition

ISBN: 8220103631723

Author: Rajan

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 13.33P

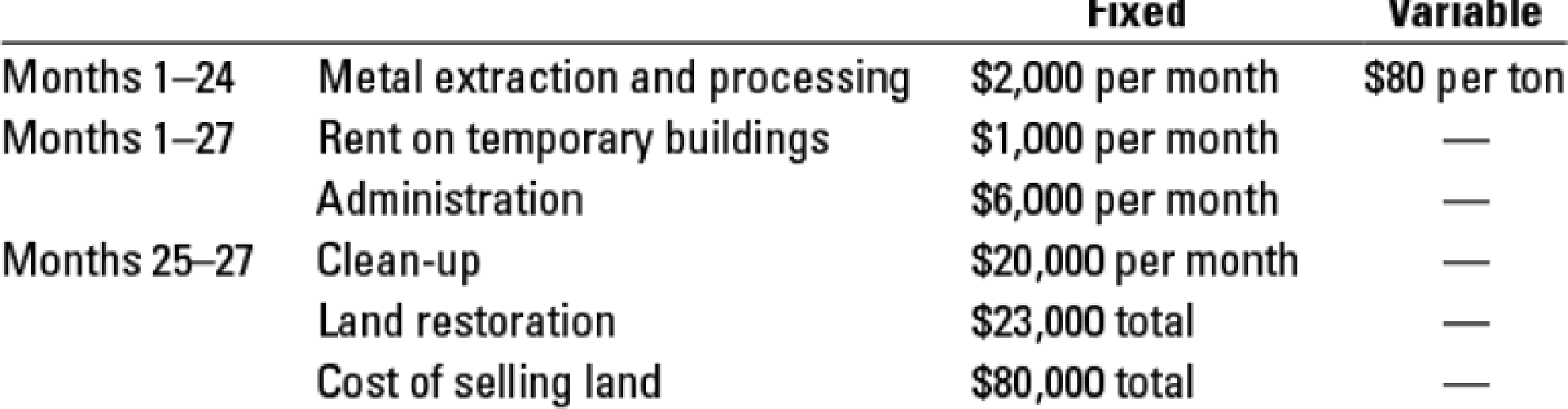

Life-cycle costing. Maximum Metal Recycling and Salvage receives the opportunity to salvage scrap metal and other materials from an old industrial site. The current owners of the site will sign over the site to Maximum at no cost. Maximum intends to extract scrap metal at the site for 24 months and then will clean up the site, return the land to useable condition, and sell it to a developer. Projected costs associated with the project follow:

Ignore the time value of money.

- 1. Assuming that Maximum expects to salvage 70.000 tons of metal from the site, what is the total project life-cycle cost?

- 2. Suppose Maximum can sell the metal for $110 per ton and wants to earn a profit (before taxes) of $30 per ton. At what price must Maximum sell the land at the end of the project to achieve its target profit per ton?

- 3. Now suppose Maximum can only sell the metal for $100 per ton and the land at $110,000 less than what you calculated in requirement 2. If Maximum wanted to maintain the same markup percentage on total project life-cycle cost as in requirement 2, by how much would the company have to reduce its total project life-cycle cost?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Life-cycle costing. Maximum Metal Recycling and Salvage receives the opportunity to salvage scrap metal and other materials from an old industrial site. The current owners of the site will sign over the site to Maximum at no cost. Maximum intends to extract scrap metal at the site for 24 months and then will clean up the site, return the land to useable condition, and sell it to a developer. Projected costs associated with the project follow:

Ignore time value of money.

Assuming that Maximum expects to salvage 70,000 tons of metal from the site, what is the total project life cycle cost?

Suppose Maximum can sell the metal for $110 per ton and wants to earn a profit (before taxes) of $30 per ton. At what price must Maximum sell the land at the end of the project to achieve its target profit per ton?

Now suppose Maximum can only sell the metal for $100 per ton and the land at $110,000 less than what you calculated in requirement 2. If Maximum wanted to maintain the same markup…

Metal Recycling and Salvage receives the opportunity to salvage scrap metal and other materials from an old industrial site. The current owners of the site will sign over the site to Enviro at no cost. Enviro intends to extract scrap metal at the site for 24 months and then will clean up the site, return the land to useable condition, and sell it to a developer. Projected costs associated with the project follow:

Read the requirements2.

Requirement 1. Assuming that Enviro expects to salvage 70,000tons of metal from the site, what is the total project life cycle cost?

Total Life-Cycle Costs

Variable costs:

Metal extraction and processing

Fixed costs:

Metal extraction and processing

Rent on temporary buildings

Administration

Clean-up

Land restoration

Selling land

Total life-cycle cost

Requirement 2. Suppose Enviro can sell the metal for $110 per ton and wants to earn a…

:You are evaluating two different silicon wafer milling machines. The Techron I costs $265,000, has a 3-year life, and has pretax operating costs of $74,000 per year. The Techron II costs $445,000, has a 5-year life, and has pretax operating costs of $47,000 per year. For both milling machines, we use straight line depreciation to zero over the project’s life and assume a salvage value of $35,000. If your tax rate is 22 percent and your discount rate is 10 percent, compute the EAC for both machines. Which machine do you prefer? Why?

Chapter 13 Solutions

EBK HORNGREN'S COST ACCOUNTING

Ch. 13 - What are the three major influences on pricing...Ch. 13 - Relevant costs for pricing decisions are full...Ch. 13 - Describe four purposes of cost allocation.Ch. 13 - How is activity-based costing useful for pricing...Ch. 13 - Describe two alternative approaches to long-run...Ch. 13 - What is a target cost per unit?Ch. 13 - Describe value engineering and its role in target...Ch. 13 - Give two examples of a value-added cost and two...Ch. 13 - It is not important for a company to distinguish...Ch. 13 - Prob. 13.10Q

Ch. 13 - Describe three alternative cost-plus pricing...Ch. 13 - Give two examples in which the difference in the...Ch. 13 - What is life-cycle budgeting?Ch. 13 - What are three benefits of using a product...Ch. 13 - Prob. 13.15QCh. 13 - Which of the following statements regarding price...Ch. 13 - Value-added, non-value-added costs. The Magill...Ch. 13 - Target operating income, value-added costs,...Ch. 13 - Target prices, target costs, activity-based...Ch. 13 - Target costs, effect of product-design changes on...Ch. 13 - Target costs, effect of process-design changes on...Ch. 13 - Cost-plus target return on investment pricing....Ch. 13 - Cost-plus, target pricing, working backward....Ch. 13 - Life-cycle budgeting and costing. Arnold...Ch. 13 - Considerations other than cost in pricing...Ch. 13 - Cost-plus, target pricing, working backward. The...Ch. 13 - Value engineering, target pricing, and target...Ch. 13 - Target service costs, value engineering,...Ch. 13 - Cost-plus, target return on investment pricing....Ch. 13 - Cost-plus, time and materials, ethics. C S...Ch. 13 - Cost-plus and market-based pricing. Georgia Temps,...Ch. 13 - Cost-plus and market-based pricing. (CMA, adapted)...Ch. 13 - Life-cycle costing. Maximum Metal Recycling and...Ch. 13 - Airline pricing, considerations other than cost in...Ch. 13 - Prob. 13.35PCh. 13 - Ethics and pricing. Instyle Interior Designs has...Ch. 13 - Value engineering, target pricing, and locked-in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You are evaluating two different silicon wafer milling machines. The Techron I costs $255,000, has a three-year life, and has pretax operating costs of $68,000 per year. The Techron II costs $445,000, has a five-year life, and has pretax operating costs of $41,000 per year. For both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $45,000. If your tax rate is 25 percent and your discount rate is 8 percent, compute the EAC for both machines. (Your answer should be a negative value and indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $300,000, has a 3-year life, and has pretax operating costs of $83,000 per year. The Techron II costs $520,000, has a 5-year life, and has pretax operating costs of $49,000 per year. For both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $60,000. If your tax rate is 24 percent and your discount rate is 12 percent, compute the EAC for both machines. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $195,000, has a three-year life, and has pretax operating costs of $32,000 per year. The Techron II costs $295,000, has a five-year life, and has pretax operating costs of $19,000 per year. For both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $20,000. If your tax rate is 35 percent and your discount rate is 14 percent, compute the EAC for both machines. Which do you prefer? Why?arrow_forward

- You are evaluating two different silicon wafer milling machines. The Techron I costs $267,000, has a three-year life, and has pretax operating costs of $72,000 per year. The Techron II costs $465,000, has a five-year life, and has pretax operating costs of $45,000 per year. For both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $49,000. If your tax rate is 24 percent and your discount rate is 9 percent, compute the EAC for both machines.arrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $288,000, has a three-year life, and has pretax operating costs of $79,000 per year. The Techron II costs $500,000, has a five-year life, and has pretax operating costs of $46,000 per year. For both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $56,000. If your tax rate is 25 percent and your discount rate is 12 percent, compute the EAC for both machines. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Which machine do you prefer? Techron II Techron Iarrow_forwardAnalysis of a replacement project At times firms will need to decide if they want to continue to use their current equipment or replace the equipment with newer equipment. In this case, the company will need to perform a replacement analysis to determine which alternative is the best financial decision for the company. Consider the case of LoRusso Company: The managers of LoRusso Company are considering replacing an existing piece of equipment, and have collected the following information: • The new piece of equipment will have a cost of $600,000, and it will be depreciated on a straight-line basis over a period of five years (years 1–5). • The old machine is also being depreciated on a straight-line basis. It has a book value of $200,000 (at year 0) and three more years of depreciation left ($50,000 per year). • The new equipment will have a salvage value of $0 at the end of the project's life (year 5). The old machine has a current salvage value (at year 0) of…arrow_forward

- You are evaluating two different silicon wafer milling machines. The Techron I costs $216,000, has a three-year life, and has pretax operating costs of $55,000 per year. The Techron II costs $380,000, has a five-year life, and has pretax operating costs of $28,000 per year. For both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $32,000. If your tax rate is 23 percent and your discount rate is 10 percent, compute the EAC for both machines Which machine should you choose? Techron II or Techron Iarrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $216,000, has a three - year life, and has pretax operating costs of $55, 000 per year. The Techron II costs $380,000, has a five-year life, and has pretax operating costs of $28, 000 per year. For both milling machines, use straight - line depreciation to zero over the project's life and assume a salvage value of $32, 000. If your tax rate is 23 percent and your discount rate is 10 percent, compute the EAC for both machines. Note: Your answer should be a negative value and indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.arrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $265,000, has a 3-year life, and has pretax operating costs of $41,000 per year. The Techron II costs $330,000, has a 5-year life, and has pretax operating costs of $52,000 per year. For both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $25,000. If your tax rate is 21 percent and your discount rate is 9 percent, compute the EAC for both machines.arrow_forward

- You are evaluating two different silicon wafer milling machines. The Techron I costs $258,000, has a three-year life, and has pretax operating costs of $69,000 per year. The Techron II costs $450,000, has a five-year life, and has pretax operating costs of $42,000 per year. For both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $46,000. If your tax rate is 25 percent and your discount rate is 10 percent, compute the EAC for both machines. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardABC Manufacturing Company is planning to reduce its labor costs by automating a critical task that is currently performed manually. The automation requires the installation of a new machine. The cost to purchase and install a new machine is 15,000. The installation of machine can reduce annual labor cost by 4,200. The life of the machine is 15 years. The salvage value of the machine after fifteen years will be zero. The required rate of return of Smart Manufacturing Company is 25%. Should Smart Manufacturing Company purchase the machine?arrow_forwardLang Industrial Systems Company (LISC) is trying to decide between two different conveyor belt systems. System A costs $216,000, has a four-year life, and requires $69,000 in pretax annual operating costs. System B costs $306,000, has a six-year life, and requires $63,000 in pretax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value. Whichever project is chosen, it will not be replaced when it wears out. The tax rate is 35 percent and the discount rate is 10 percent. Calculate the NPV for both conveyor belt systems. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) NPV System A $ System B $ Which conveyor belt system should the firm choose? System B System Aarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License