NEW MyLab Accounting with Pearson eText -- Access Card -- for Managerial Accounting

4th Edition

ISBN: 9780133451481

Author: Karen W. Braun, Wendy M. Tietz

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 13.37BP

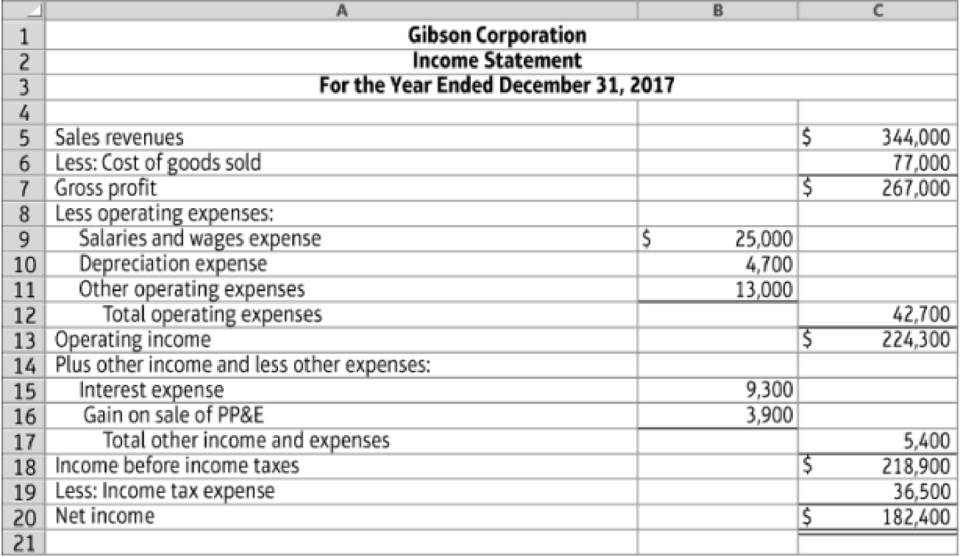

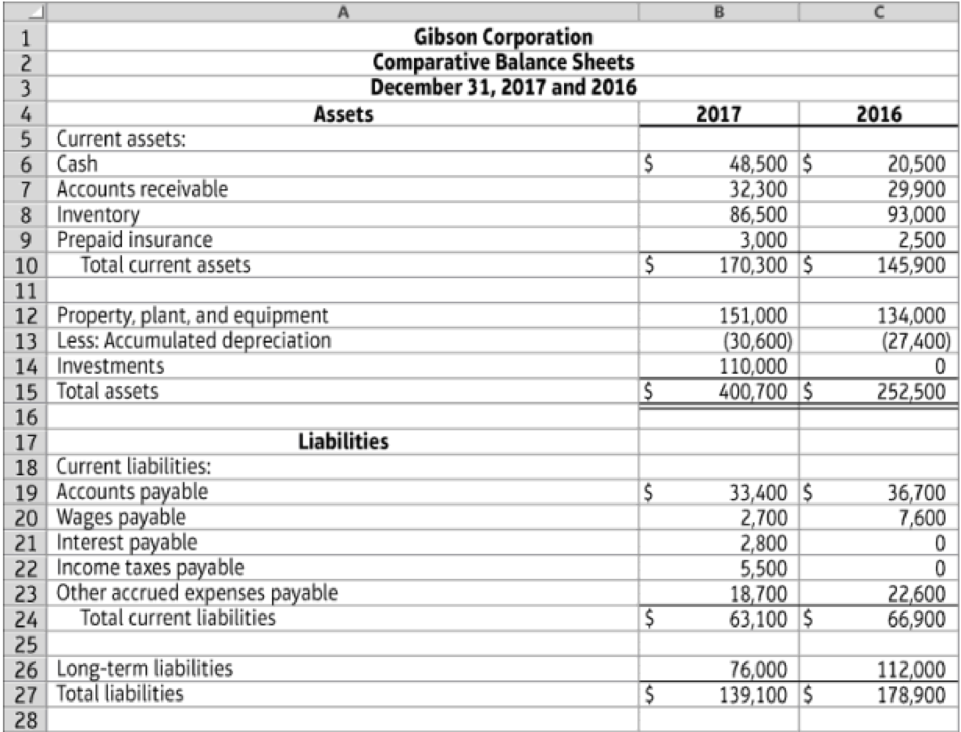

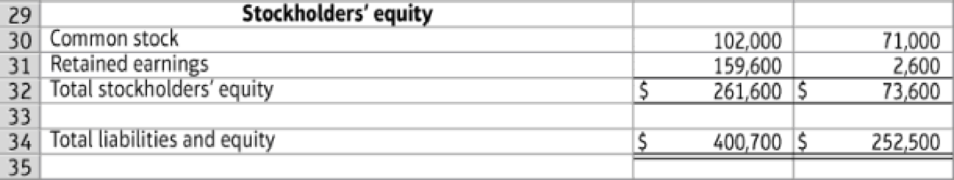

Prepare statement of cash flows (indirect method) (Learning Objectives 1 & 2)

The 2017 and 2016 balance sheets of Gibson Corporation follow. The 2017 income statement is also provided. Gibson had no noncash investing and financing transactions during 2017. During the year, the company sold equipment for $15,200, which had originally cost $12,800 and had a book value of $11,300. The company did not issue any notes payable during the year but did issue common stock for $31,000. The company purchased plant assets and long-term investments with cash.

13.5-45 Full Alternative Text

13.5-46 Full Alternative Text

Requirements

- 1. Prepare the statement of cash flows for Gibson Corporation for 2017 using the indirect method.

- 2. Evaluate the company’s cash flows for the year. Discuss each of the categories of cash flows in your response.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Selected information from Large Corporation's accounting records and financial statements for 2018 is as follows ($ in millions): Cash paid to acquire a patent $54 Treasury stock purchased for cash Proceeds from sale of land and buildings Gain from the sale of land and buildings 51 84 52 Investment revenue received 18 Cash paid to acquire office equipment 79 Large prepares its financial statements in accordance with IFRS. In its statement of cash flows, Large most likely reports net cash outflows from investing activities of: Multiple Choice $54 million $133 million. $64 million $31 million.

2.

Monty Corporation had the following activities in 2020.

1.

Sale of land $194,000

4.

Purchase of equipment $386,000

2.

Purchase of inventory $913,000

5.

Issuance of common stock $326,000

3.

Purchase of treasury stock $74,000

6.

Purchase of available-for-sale debt securities $54,000

Compute the amount Monty should report as net cash provided (used) by investing activities in its 2020 statement of cash flows. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)

Net cash select an option by investing activities

$enter a dollar amount

P11-77. (Learning Objectives 2, 3: Prepare a balance sheet from a statement of cash flows)The December 31, 2017, balance sheet and the 2018 statement of cash flows for McFarlandCorporation follow:

Requirement1. Prepare the December 31, 2018, balance sheet for McFarland.

Chapter 13 Solutions

NEW MyLab Accounting with Pearson eText -- Access Card -- for Managerial Accounting

Ch. 13 - (Learning Objective 1) Which of the following is...Ch. 13 - Prob. 2QCCh. 13 - Prob. 3QCCh. 13 - Prob. 4QCCh. 13 - Prob. 5QCCh. 13 - Prob. 6QCCh. 13 - Prob. 7QCCh. 13 - Prob. 8QCCh. 13 - Prob. 9QCCh. 13 - (Learning Objective 3) Which one of the following...

Ch. 13 - Prob. 13.1SECh. 13 - Prob. 13.2SECh. 13 - Prob. 13.3SECh. 13 - Prob. 13.4SECh. 13 - Prob. 13.5SECh. 13 - Calculate financing cash flows (Learning...Ch. 13 - Prob. 13.7SECh. 13 - Prob. 13.8SECh. 13 - Prob. 13.9SECh. 13 - Prob. 13.10SECh. 13 - Prob. 13.11SECh. 13 - Prob. 13.12AECh. 13 - Prob. 13.13AECh. 13 - Prob. 13.14AECh. 13 - Calculate operating cash flows (indirect method)...Ch. 13 - Prob. 13.16AECh. 13 - Prob. 13.17AECh. 13 - Prob. 13.18AECh. 13 - Prob. 13.19AECh. 13 - Prob. 13.20AECh. 13 - Classify sustainable activities effect on cash...Ch. 13 - Prob. 13.22BECh. 13 - Prob. 13.23BECh. 13 - Prob. 13.24BECh. 13 - Calculate operating cash flows (indirect method)...Ch. 13 - Prob. 13.26BECh. 13 - Prob. 13.27BECh. 13 - Prob. 13.28BECh. 13 - Prob. 13.29BECh. 13 - Prob. 13.30BECh. 13 - Classify sustainable activities effect on cash...Ch. 13 - Prob. 13.32APCh. 13 - Prepare statement of cash flows (indirect method)...Ch. 13 - Prob. 13.34APCh. 13 - Prob. 13.35APCh. 13 - Prob. 13.36BPCh. 13 - Prepare statement of cash flows (indirect method)...Ch. 13 - Prob. 13.38BPCh. 13 - Prob. 13.39BPCh. 13 - Prob. 13.40SCCh. 13 - Discussion Analysis A13-41 Discussion Questions...Ch. 13 - Prob. 13.42ACTCh. 13 - Ethics involved with statement of cash flows...Ch. 13 - Prob. 13.44ACTCh. 13 - Prob. 13.45ACT

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Direction: Study the given data below and compute for (1) the cash generated/used in financing activities, (2) the net change in cash for the year, and (3) prepare the CFS for the year. Learning is Fun Company has presented the following in order to aid the account in preparing CFS during the month. Net income: P200, 000 Depreciation expense: P25, 000 Gain on sale on property and equipment: P100. 000 Decrease in trade and other receivables: P 70, 000 Purchase of property and equipment: P200, 000 Payment of loan from bank: P150, 000 Compute for the cash generated/used in financing activities. Based on the given above, compute for the net change in cash for the year.arrow_forwardWainwright Corporation had the following activities in 2017.1. Sale of land $180,000. 2. Purchase of inventory $845,000. 3. Purchase of treasury stock $72,000. 4. Purchase of equipment $415,000. 5. Issuance of common stock $320,000. 6. Purchase of available-for-sale debt securities $59,000. Compute the amount Wainwright should report as net cash provided (used) by investing activities in its 2017 statement of cash flows.arrow_forwardThe company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the owners. The owners have asked each student from your accounting course to assist with the needed clarification and have put forward the following financial information Maple Group Ltd Comparative Balance Sheet December 31, 2020 and 2019 2020 2019 Increase/(Decrease) Assets Cash and cash equivalent ? ? ? Accounts Receivable 87,550 ? 1,550 Inventories 93,900 98,540 ? Fixed Assets, net 160,400 ? 49,900 Total Assets 373,350 316,890 56,460 Liabilities Accounts payable ? ? 950 Accrued liabilities 22,850 24,940 ?…arrow_forward

- The company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the owners. The owners have asked each student from your accounting course to assist with the needed clarification and have put forward the following financial information Maple Group Ltd Comparative Balance Sheet December 31, 2020 and 2019 2020 2019 Increase/(Decrease) Assets Cash and cash equivalent ? ? ? Accounts Receivable 87,550 ? 1,550 Inventories 93,900 98,540 ? Fixed Assets, net 160,400 ? 49,900 Total Assets 373,350 316,890 56,460 Liabilities Accounts payable ? ? 950 Accrued liabilities 22,850 24,940 ?…arrow_forwardThe company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the owners. The owners have asked each student from your accounting course to assist with the needed clarification and have put forward the following financial information Maple Group Ltd Comparative Balance Sheet December 31, 2020 and 2019 2020 2019 Increase/(Decrease) Assets Cash and cash equivalent ? ? ? Accounts Receivable 87,550 ? 1,550 Inventories 93,900 98,540 ? Fixed Assets, net 160,400 ? 49,900 Total Assets 373,350 316,890 56,460 Liabilities Accounts payable ? ? 950 Accrued liabilities 22,850 24,940 ?…arrow_forwardanswer these 4 questions please: Slater Company prepares its statement of cash flows using the indirect method and provided the following information for the year 2018. • Net cash flows from operating activities: $32,000 positive • Net cash flows used for investing activities: $38,000 negative • Net cash flows used for financing activities: $9,000 negative How much was the net change in cash during the year based on the information given? Question 17Answer a. $79,000 positive. b. $3,000 negative. c. $15,000 negative. d. $3,000 positive. Supper Company Ltd., reported the following stockholders’ equity on its balance sheet at June 30, 2021: Supper Company Ltd. Stockholders’ Equity June 30,2021 Paid-in Capital Preferred stock, 10%,? par, 650,000 shares authorized, 280,000 shares issued $ 1,400,000 Common stock, par value $? per share, 5,000,000…arrow_forward

- Your friend is in business and wants your advice on preparing and interpreting the statement of cash flows for 2016. Information regarding the business is as follows: Cash received from customers $ 175,000 Cash paid to vendors 75,000 Cash paid to employees 140,000 Cash paid for interest 35,000 Depreciation expense 40,000 Cash paid in acquiring equipment 375,000 Cash received from issuing bonds 250,000 Cash received from issued common stock 400,000 Beginning cash balance 95,000 Required: a. Based upon the above information, prepare the statement of cash flows using the direct method. b. Explain what has happened during the year.arrow_forwardYour goal is to prepare a Statement of Cash Flows within the problem noted below. In the Excel Template provided, you will find the Balance Sheet of Marina Comp for December 31, 2013. In addition to the information on the Balance Sheet, we are presented with the following additional data related to current year operations: 1. Net income for the year 2013, $66,000. 2. Depreciation on plant assets for the year, $12,700. 3. Sold the long-term investments for $28,000 (assume gain or loss is ordinary). 4. Paid dividends of $25,000. 1 / 2 5. Purchased machinery costing $21,500, paid cash. 6. Purchased machinery and gave a $60,000 long-term note payable. 7. Paid a $40,000 long-term note payable by issuing common stock.arrow_forwardThe Garfield Ltd company uses the indirect method for preparing its statement of cash flows. It reported a net income of $100,000 for the year 2016.During the year 2016, the working capital accounts were changed as follows:Increase in accounts receivable: $22,000Increase in accounts payable: $18,600Increase in inventory: $14,800Decrease in non-trade notes payable: $30,000Increase in available for sale securities: $32,000The depreciation expense was $34,000 for the year 2016.Required: Compute net cash provided (used) by operating activities using the indirect method.arrow_forward

- Slater Company prepares its statement of cash flows using the indirect method and provided the following information for the year 2018. • Net cash flows from operating activities: $32,000 positive • Net cash flows used for investing activities: $38,000 negative • Net cash flows used for financing activities: $9,000 negative How much was the net change in cash during the year based on the information given? a. $79,000 positive. b. $3,000 positive. c. $3,000 negative. d. $15,000 negative.arrow_forwardUsing the information below, complete the operating cash flow section of the Statement of Cash Flows for Peter Ltd using direct method. Your presentation must be consistent with the requirements of AASB107. Ignore tax. Reporting date is 30 June. The balances of selected accounts of Peter Ltd at 30 June 2021 and 30 June 2022 were ($000): 2021 2022 Cash 3850 1200 Inventory 3750 4250 Accounts receivable 2800 3500 Allowance for doubtful debts 320 260 Land 5000 5000 Plant 2750 2800 Accumulated depreciation 490 450 Accounts payable 3200 3500 Rent payable 100 130 Salaries payable 120 190 Share capital 1000 1000 Sales (on credit) 7750 6550 Cost of goods sold 1250 1100 Doubtful debts expense 280 300 Rent expense 540 450 Salaries expense 800 750 Depreciation expense 260 180 Required: Peter Ltd’s operating cash flow section extracted from the Statement of Cash Flows for year ended 30 June 2022 (Direct Method)arrow_forwardSelected information from Peridot Corporation's accounting records and financial statements for 2011 is as follows ($ in millions). Cash paid to acquire machinery = $32 Retired common stock = $51 Proceeds from sale of land = $95 Gain from the sale of land = $50 Investment revenue received = $72 Cash paid to acquire office equipment = $85 In its statement of cash flows, Peridot should report net cash outflows from investing activities of: a. $22 million b. $95 million c. $18 million d. $42 millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License