Loose Leaf For Introduction To Managerial Accounting

8th Edition

ISBN: 9781260190175

Author: Brewer Professor, Peter C.; Garrison, Ray H; Noreen, Eric

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 1F15

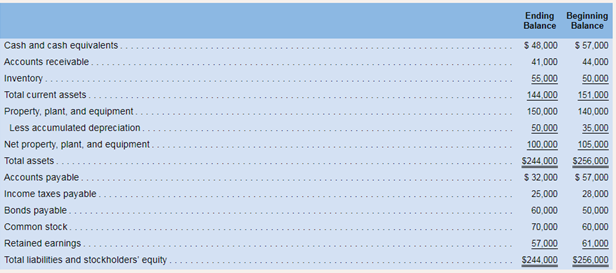

Ravenna Company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of

During the year, Ravenna paid a $6,000 cash dividend and it sold a piece of equipment for $3,000 that had

Required:

- What is the amount of the net increase or decrease in cash and cash equivalents that would be shown on the company’s statement of cash flows?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Prepare a Statement of Cash Flows

Comparative financial statements for Weaver Company follow:

During this year, Weaver sold some equipment for $20 that had cost $40 and on which there was accumulated depreciation of $16. In addition, the company sold long-term investments for $10 that had cost $3 when purchased several years ago. Weaver paid a cash dividend this year and the company repurchased $40 of its own stock. This year Weaver did not retire any bonds.

Required:

1. Using the indirect method, determine the net cash provided by operating activities for this year.

2. Using the information in (1) above, along with an analysis of the remaining balance sheet accounts, prepare a statement of cash flows for this year.

The company did not dispose of any property, plant, and equipment during the year. Its net income for the year was $6,000 and its cash dividends were $6,000. The company did not issue any bonds payable or purchase any of its own common stock during the year. Its net cash provided by (used in) operating activities and net cash provided by (used in) financing activities are:

Norbury Corporation's net income last year was $36,000. The company did not sell or retire any property, plant,

and equipment last year. Changes in selected balance sheet accounts for the year appear below:

Asset and Contra-Asset Accounts:

Accounts receivable

Inventory

Prepaid expenses

Accumulated depreciation

Liability Accounts:

Accounts payable

Accrued liabilities

Income taxes payable

Multiple Choice

$53,600

Based solely on this information, the net cash provided by (used in) operating activities under the indirect

method on the statement of cash flows would be:

$47,500

$24,500

Increases

(Decreases)

$81,700

$ 12,500

$ (3,400)

$ 8,000

$ 22,000

$ 12,000

$ (7,900)

$ 2,500

Chapter 13 Solutions

Loose Leaf For Introduction To Managerial Accounting

Ch. 13.A - Prob. 1ECh. 13.A - Prob. 2ECh. 13.A - Prob. 3ECh. 13.A - Prob. 4ECh. 13.A - Prob. 5PCh. 13.A - Prob. 6PCh. 13.A - Prob. 7PCh. 13 - Prob. 1QCh. 13 - Prob. 2QCh. 13 - Prob. 3Q

Ch. 13 - What general guidelines can you provide for...Ch. 13 - Prob. 5QCh. 13 - Prob. 6QCh. 13 - Prob. 7QCh. 13 - Prob. 8QCh. 13 - A business executive once stated, “Depreciation is...Ch. 13 - If the Accounts Receivable balance increases...Ch. 13 - Would a sale of equipment for cash be considered a...Ch. 13 - Prob. 12QCh. 13 - Ravenna Company is a merchandiser that uses the...Ch. 13 - Prob. 2F15Ch. 13 - Prob. 3F15Ch. 13 - Ravenna Company is a merchandiser that uses the...Ch. 13 - Prob. 5F15Ch. 13 - Ravenna Company is a merchandiser that uses the...Ch. 13 - Ravenna Company is a merchandiser that uses the...Ch. 13 - Prob. 8F15Ch. 13 - Prob. 9F15Ch. 13 - Prob. 10F15Ch. 13 - Prob. 11F15Ch. 13 - Ravenna Company is a merchandiser that uses the...Ch. 13 - Ravenna Company is a merchandiser that uses the...Ch. 13 - Prob. 14F15Ch. 13 - Prob. 15F15Ch. 13 - Prob. 1ECh. 13 - Net Cash Provided by Operating Activities For the...Ch. 13 - Prob. 3ECh. 13 - Prob. 4ECh. 13 - Net Cash Provided by Operating Activities Changes...Ch. 13 - Prepare a Statement of Cash Flows; Free Cash Flow...Ch. 13 - Prob. 7PCh. 13 - Prob. 8PCh. 13 - Prob. 9PCh. 13 - Prepare a Statement of Cash Flows; Free Cash...Ch. 13 - Prob. 11PCh. 13 - Prepare a Statement of Cash Flows A comparative...Ch. 13 - Prob. 13PCh. 13 - Prob. 14P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Net Profit of LSLS Corporation for the year is $ 2,515,250. Using the following information in the table and find out the Net Cash Flows from Operating Activities by Indirect Method SI. No : Particulars Amount ($) 1 Depreciation Expense 25,565.00 Decrease in Current Liabilities 57,677.00 3 Increase in Prepaid Insurance 67,076.00 4 Loss on Sale of Machinery 322,387.00 Gain on sale of Non Current Asset 377,553.00 6 Increase in Salaries Payable 64,704.00 7 Provision for Taxation 123,321.00 $ 2,584,921 O $ 2,548,921 O $ 2,544,921 O $ 2,458,921arrow_forwardComparative financial statements for Weaver Company follow: During this year, Weaver sold some equipment for $10 that had cost $49 and on which there wasaccumulated depreciation of $30. In addition, the company sold long-term investments for $50 thathad cost $38 when purchased several years ago. Weaver paid a cash dividend this year and thecompany repurchased $109 of its own stock. This year Weaver did not retire any bonds. Required:1. Using the direct method, adjust the company’s income statement for this year to a cash basis.2. Using the information obtained in (1) above, along with an analysis of the remaining balance sheetaccounts, prepare a statement of cash flows for this year.arrow_forwardZenith Corporation sells some of its used store fixtures. The acquisition cost of the fixtures is $13,732, and the accumulated depreciation on these fixtures is $8,504 at the time of sale. The fixtures are sold for $4,206. The value of this transaction in the investing section of the statement of cash flows isarrow_forward

- Macrosoft Company reports net income of $62,000. The accounting records reveal depreciation expense of $77,000 as well as increases in prepaid rent, accounts payable, and income tax payable of $57,000, $10,000, and $16,500, respectively. Prepare the operating activities section of Macrosoft's statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.) Cash flows from operating activities MACROSOFT COMPANY Statement of Cash Flows (partial) Adjustments to reconcile net income to net cash flows from operating activities: Net cash flows from operating activitiesarrow_forwardWildhorse Company reported a loss of $1586 for the sale of equipment for cash. The equipment had a cost of $39040 and accumulated depreciation of $35990. How much will Wildhorse report in the cash flows from investing activities section of its statement of cash flows?arrow_forwardRavenna Company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash $ 113,600 $ 136,600 Accounts receivable 89,800 96,800 Inventory 120,600 110,000 Total current assets 324,000 343,400 Property, plant, and equipment 318,000 308,000 Less accumulated depreciation 106,000 77,000 Net property, plant, and equipment 212,000 231,000 Total assets $ 536,000 $ 574,400 Accounts payable $ 70,400 $ 125,000 Income taxes payable 54,600 74,400 Bonds payable 132,000 110,000 Common stock 154,000 132,000 Retained earnings 125,000 133,000 Total liabilities and stockholders’ equity $ 536,000 $ 574,400 During the year, Ravenna paid a $13,200 cash dividend and it sold a piece of equipment for $6,600 that had originally cost…arrow_forward

- In the current year, Harrisburg Corporation had net income of 35,000, a 9,000 decrease in accounts receivable, a 7,000 increase in inventory, an 8,000 increase in salaries payable, a 13,000 decrease in accounts payable, and 10,000 in depreciation expense. Using the indirect method, prepare the operating activities section of its statement of cash flows based on this information.arrow_forwardThompson Company sold a piece of equipment that had an original cost of 22,000 and a carrying value of 10,000 for 13,000 in cash. How would this information be reported on a statement of cash flows prepared using the indirect method?arrow_forwardRavenna Company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 102,000 $ 122,400 Accounts receivable 81,700 88,000 Inventory 109,700 100,000 Total current assets 293,400 310,400 Property, plant, and equipment 291,000 280,000 Less accumulated depreciation 97,000 70,000 Net property, plant, and equipment 194,000 210,000 Total assets $ 487,400 $ 520,400 Accounts payable $ 64,000 $ 113,700 Income taxes payable 49,700 65,700 Bonds payable 120,000 100,000 Common stock 140,000 120,000 Retained earnings 113,700 121,000 Total liabilities and stockholders’ equity $ 487,400 $ 520,400 During the year, Ravenna paid a $12,000 cash dividend and it sold a piece of equipment for $6,000 that had…arrow_forward

- Ravenna Company is a merchandiser using the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 89,000 $ 106,750 Accounts receivable 71,500 77,000 Inventory 96,000 87,500 Total current assets 256,500 271,250 Property, plant, and equipment 255,000 245,000 Less accumulated depreciation 85,000 61,250 Net property, plant, and equipment 170,000 183,750 Total assets $ 426,500 $ 455,000 Accounts payable $ 56,000 $ 99,500 Income taxes payable 43,500 57,000 Bonds payable 105,000 87,500 Common stock 122,500 105,000 Retained earnings 99,500 106,000 Total liabilities and stockholders’ equity $ 426,500 $ 455,000 During the year, Ravenna paid a $10,500 cash dividend and sold a piece of equipment for $5,250 that originally cost $12,000 and had accumulated depreciation of $8,000. The company did not retire any bonds or…arrow_forwardRavenna Company is a merchandiser using the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 89,000 $ 106,750 Accounts receivable 71,500 77,000 Inventory 96,000 87,500 Total current assets 256,500 271,250 Property, plant, and equipment 255,000 245,000 Less accumulated depreciation 85,000 61,250 Net property, plant, and equipment 170,000 183,750 Total assets $ 426,500 $ 455,000 Accounts payable $ 56,000 $ 99,500 Income taxes payable 43,500 57,000 Bonds payable 105,000 87,500 Common stock 122,500 105,000 Retained earnings 99,500 106,000 Total liabilities and stockholders’ equity $ 426,500 $ 455,000 During the year, Ravenna paid a $10,500 cash dividend and sold a piece of equipment for $5,250 that originally cost $12,000 and had accumulated depreciation of $8,000. The company did not retire any bonds or…arrow_forwardRavenna Company is a merchandiser using the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 89,000 $ 106,750 Accounts receivable 71,500 77,000 Inventory 96,000 87,500 Total current assets 256,500 271,250 Property, plant, and equipment 255,000 245,000 Less accumulated depreciation 85,000 61,250 Net property, plant, and equipment 170,000 183,750 Total assets $ 426,500 $ 455,000 Accounts payable $ 56,000 $ 99,500 Income taxes payable 43,500 57,000 Bonds payable 105,000 87,500 Common stock 122,500 105,000 Retained earnings 99,500 106,000 Total liabilities and stockholders’ equity $ 426,500 $ 455,000 During the year, Ravenna paid a $10,500 cash dividend and sold a piece of equipment for $5,250 that originally cost $12,000 and had accumulated depreciation of $8,000. The company did not retire any bonds or…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License