Foundations of Financial Management

16th Edition

ISBN: 9781259277160

Author: Stanley B. Block, Geoffrey A. Hirt, Bartley Danielsen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 1P

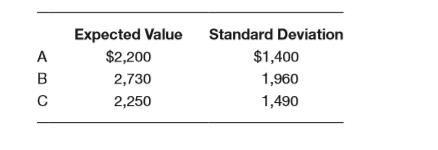

Assume you are risk-averse and have the following three choices. Which project will you select? Compute the coefficient of variation for each.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Suppose the net present values of projects A and B show a distribution as follows. a) Compare the projects by expected value criteria?b) Compare the projects by standard deviation criteria?c) Evaluate A and B projects according to the coefficient of variation criterion?Calculate on paper.

When you assign the highest anticipated sales and price and the lowest anticipated costs to a project, you are analyzing the project under the condition known as: base-case scenario analysis best-case sensitivity analysis worst-case sensitivity analysis best-case scenario analysis worst-case scenario analysis

(a) If you apply the payback decision rule, which investment will you choose? Why?

(b) If you apply the NPV decision rule, which investment will you choose? Why?

(c) If you apply the IRR decision rule, which investment will you choose? Why?

(d) Based on your answers of (a) to (c), which project will you (eventually) choose? Why?

Chapter 13 Solutions

Foundations of Financial Management

Ch. 13 - Prob. 1DQCh. 13 - Discuss the concept of risk and how it might be...Ch. 13 - When is the coefficient of variation a better...Ch. 13 - Explain how the concept of risk can be...Ch. 13 - If risk is to be analyzed in a qualitative way,...Ch. 13 - Assume a company, correlated with the economy, is...Ch. 13 - Assume a firm has several hundred possible...Ch. 13 - Explain the effect of the risk-return trade-off on...Ch. 13 - What is the purpose of using simulation analysis?...Ch. 13 - Assume you are risk-averse and have the following...

Ch. 13 - Myers Business Systems is evaluating the...Ch. 13 - Prob. 3PCh. 13 - Prob. 4PCh. 13 - Prob. 5PCh. 13 - Possible outcomes for three investment...Ch. 13 - Prob. 7PCh. 13 - Prob. 8PCh. 13 - Prob. 9PCh. 13 - Prob. 10PCh. 13 - Prob. 12PCh. 13 - Waste Industries is evaluating a 70,000 project...Ch. 13 - Prob. 14PCh. 13 - Debby’s Dance Studios is considering the...Ch. 13 - Prob. 17PCh. 13 - Prob. 18PCh. 13 - Allison’s Dresswear Manufacturers is preparing a...Ch. 13 - Prob. 20PCh. 13 - Prob. 21PCh. 13 - Prob. 22PCh. 13 - Ms. Sharp is looking at a number of different...Ch. 13 - Prob. 25P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A.) Which project is least risky, judging on the basis of range? (Project A, B, C, or D)B.) Which project has the lowest standard deviation? (Project A, B, C, or D)C.) Which project do you think Frederic’s owners should choose? (Project A, B, C, or D)arrow_forwardWhat are the shortcomings of the internal rate of return criterion? How do you make an investment decision based on the IRR? How would the NPV of the same project look?arrow_forwardBriefly explain the three risks of a project? How to measure each risk?arrow_forward

- Assume that Allied’s average project has a coefficient of variation (CV) in the range of 1.25 to 1.75.Would the lemon juice project be classified as high risk, average risk, or low risk? What type of risk isbeing measured here?arrow_forwardWhen faced with a set of independent projects, one should select (choose the best answer) O all projects with a positive NPV or an IRR greater than the hurdle rate. O all projects with an IRR greater than the hurdle rate O all projects with a positive NPV O all projects with a positive NPV or an IRR greater than the hurdle rate or a PI greater than one. O all projects with a positive NPV or a PI greater than the one. O all projects with a Pl greater than one. O all projects with an IRR greater than the hurdle rate or a Pl greater than one.arrow_forwardWhen faced with a set of independent projects, one should select (choose the best answer) A. all projects with a positive NPV or an IRR greater than the hurdle rate or a PI greater than one. B. all projects with a PI greater than one. C. all projects with an IRR greater than the hurdle rate D. all projects with a positive NPV or an IRR greater than the hurdle rate. E. all projects with a positive NPV or a PI greater than the one. F. all projects with a positive NPV G. all projects with an IRR greater than the hurdle rate or a Pl greater than one.arrow_forward

- Which of the following statements is CORRECT? a. An NPV profile graph shows how a project's payback varies as the cost of capital changes. b. The NPV profile graph for a normal project will generally have a positive (upward) slope as the life of the project increases. c. An NPV profile graph is designed to give decision makers an idea about how a project's risk varies with its life. d. An NPV profile graph is designed to give decision makers an idea about how a project's contribution to the firm's value varies with the cost of capital. e. We cannot draw a project's NPV profile unless we know the appropriate WACC for use in evaluating the project's NPV. Provide explanation for the choicearrow_forwardWhen choosing between two projects of different scales, which of the following methodologies is best employed? a. Probability index to rank projects b. Equivalent annuities method c. Replacement chain method d. IRR methodarrow_forwardIf the decision is made by choosing the project with the higher IRR, how much value will be forgone?arrow_forward

- Indicate whether its True or False. Then write the explanation! The twin advantages with using the IRR method as opposed to the NPV method for project evaluation is that you don’t need to worry about what an appropriate risk- adjusted discount rate might be for the project and you will always get the correct answer to the investment decision.arrow_forwardWhat does the beta of the project represent and how will higher project betas affect your decision?arrow_forwardTwo investment projects are under analysis and, due to budget constraints, only one of them can be selected. The investor should select the project: a. Based on absolute metric of value b. With higher internal rate of returnc. With lower discounted payback periodarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY