a)

Prepare all necessary journal entries to record the given transactions.

a)

Explanation of Solution

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and

stockholders’ equities . - Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Prepare all necessary journal entries to record the given transactions:

| Date | Accounts title and Explanation | Debit ($) | Credit ($) |

| 1 | Rent expense | $35,000 | |

| Contributions - Unrestricted | $35,000 | ||

| (To record the rent expenses paid ny the net assets) | |||

| 2 | Cash | $335,000 | |

| Contributions receivable | $100,000 | ||

| Contributions - Unrestricted | $185,000 | ||

| Contributions - Temporarily restricted | $250,000 | ||

| (To record the cash receipt and contribution receivables) | |||

| 3. | Salaries & benefits expense | $224,560 | |

| Cash | $208,560 | ||

| Salaries & benefits payable | |||

| (To record the salaries and benefits expenses) | |||

| 4 | Contributions receivable | $100,000 | |

| Contributions - Temporarily restricted | $94,260 | ||

| Discount on contributions receivable | $5,740 | ||

| (To record the contribution receivable) | |||

| 5. | Equipment & furniture | $21,600 | |

| Cash | $12,000 | ||

| Contributions - Unrestricted | $9,600 | ||

| (To record the purchase of furniture and equipment) | |||

| 6 | Telephone expense | $5,200 | |

| Printing & postage expense | $12,000 | ||

| Utilities expense | $8,300 | ||

| Supplies expense | $4,300 | ||

| Cash | $26,200 | ||

| Accounts payable | $3,600 | ||

| (To record the expenses partly paid and partly payable) | |||

| 7 | For this transaction no | ||

| 8 | Provision for uncollectible pledges | $10,000 | |

| Allowance for uncollectible pledges -Unrestricted | $10,000 | ||

| (To record the provision for uncollectible pledges) | |||

| $3,360 | |||

| Allowance for depreciation - equipment & furniture | $3,360 | ||

| (To record the depreciation expense) | |||

| 9 | Public health education program | $105,952 | |

| Community service program | $90,816 | ||

| Management & general | $60,544 | ||

| Fund-raising | $45,408 | ||

| Salaries & benefits expense | $224,560 | ||

| Rent expense | $35,000 | ||

| Telephone expense | $5,200 | ||

| Printing & postage expense | $12,000 | ||

| Utilities | $8,300 | ||

| Supplies expense | $4,300 | ||

| Provision for uncollectible accounts | $10,000 | ||

| Depreciation expense | $3,360 | ||

| (To record the | |||

| 10 | Net assets released satisfaction of purpose restriction - Unrestricted | $105,952 | |

| Net assets released-satisfaction of purpose restriction- Unrestricted | $105,952 | ||

| (To record the release of net assets) | |||

| 11 | Contributions— Temporarily restricted (transactions 1, 2 and 5) | $229,600 | |

| Net assets-Unrestricted | $73,120 | ||

| Public health education | $105,952 | ||

| Community service | $90,816 | ||

| Management & general | $60,544 | ||

| Fund-raising | $45,408 | ||

| (To record the closing entry for contributions- Unrestricted) | |||

| Contributions - Temporarily restricted (transactions 2 & 4) | $344,260 | ||

| Net assets-Temporarily restricted | $344,260 | ||

| (To record the closing entry for the contributions – Temporarily restricted) | |||

| Net assets - Temporarily restricted | $105,952 | ||

| Net assets released—satisfaction of purpose restriction - Temporarily restricted | $105,952 | ||

| (To record the closing entry for the net assets Temporarily restricted) | |||

| Net assets released—satisfaction of purpose restriction - Unrestricted | $105,952 | ||

| Net assets - Unrestricted | $105,952 | ||

| (To record the closing entry for the net assets-Unrestricted) | |||

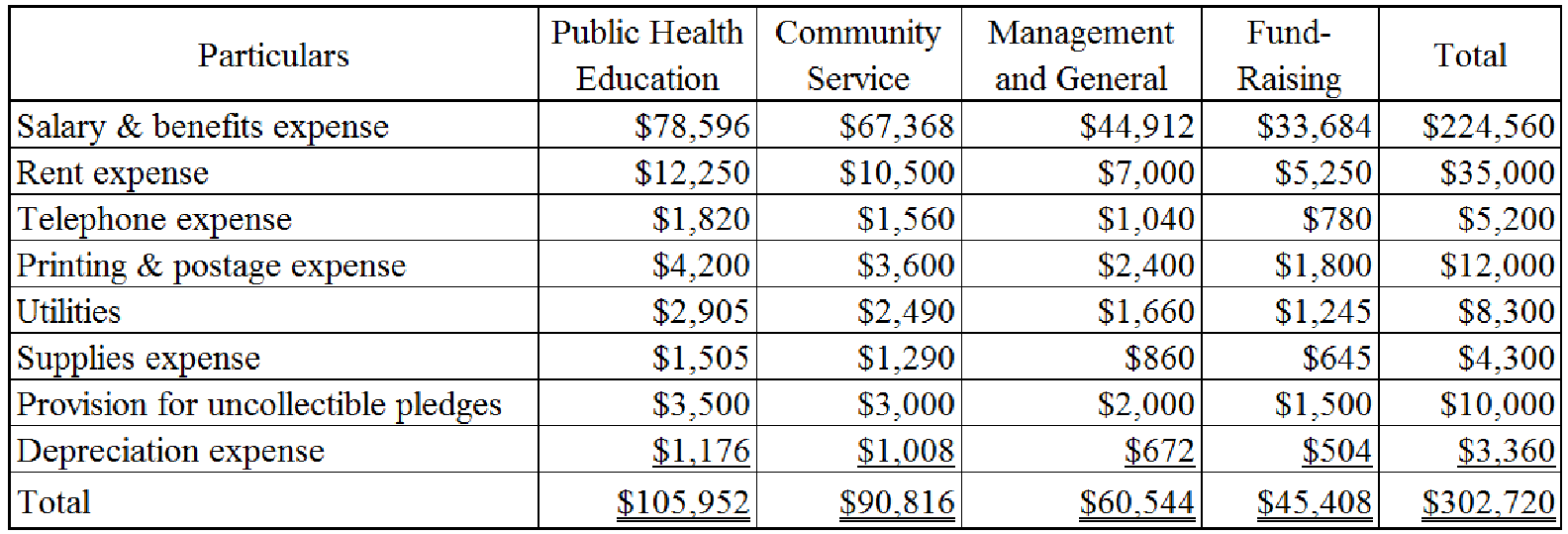

Table (1)

Notes to the above table:

- Compute the resource allocation based on the available information (transaction 9):

Table (2)

b.

Prepare the statement of activity for the year ended December 31, 2017.

b.

Explanation of Solution

Prepare the statement of activity for the year ended December 31, 2017:

| Entity I | |||

| Statement of activities | |||

| For the year ended December 31, 2017 | |||

| Particulars | Unrestricted | Temporarily restricted | total |

| Revenue and other Support: | |||

| Contributions-net assets released from restriction | $ 229,600 | $ 344,260 | $ 573,860 |

| Satisfaction of purpose | $105,952 | ($105,952) | |

| Total revenue & other support (A) | $335,552 | $238,308 | $573,860 |

| Expenses: | |||

| Public health education | $105,952 | 105,952 | |

| Community services | $90,816 | 90,816 | |

| Management & general | $60,544 | 60,544 | |

| Fund-raising | $45,408 | 45,408 | |

| Total expenses (B) | $302,720 | 302,720 | |

| Increase in net assets (A) – (B) | $32,832 | $238,308 | $271,140 |

| Beginning net assets | 0 | 0 | 0 |

| Ending net assets | $ 32,832 | $ 238,308 | $ 271,140 |

Table (3)

Therefore, the total ending net assets are $271,140.

c)

Prepare a

c)

Explanation of Solution

Statement of financial position: It is an itemized list of total assets and “liabilities and net assets.” The assets are classified into current and noncurrent assets. The liabilities are also classified into current and noncurrent liabilities. The assets should be equal to the liabilities and net assets.

Prepare a statement of financial position for the year ended December 31, 2017:

| Entity I | |

| Statement of Financial Positions | |

| For the year ended December 31, 2017 | |

| Assets | Amount ($) |

| Cash | $88,240 |

| Contributions receivable (less allowance for uncollectible accounts of $10,000 and discount on contributions receivable of $5,740) | $184,260 |

| Equipment and furniture (less allowance for |

$18,240 |

| Total Assets | $290,740 |

| Liabilities: | |

| Accounts payable | $3,600 |

| Salaries & benefits payable | $16,000 |

| Total liabilities | $19,600 |

| Net Assets: | |

| Unrestricted | $32,832 |

| Temporarily restricted | $238,308 |

| Total net assets | $271,140 |

| Total liabilities and net assets | $290,740 |

Table (4)

d)

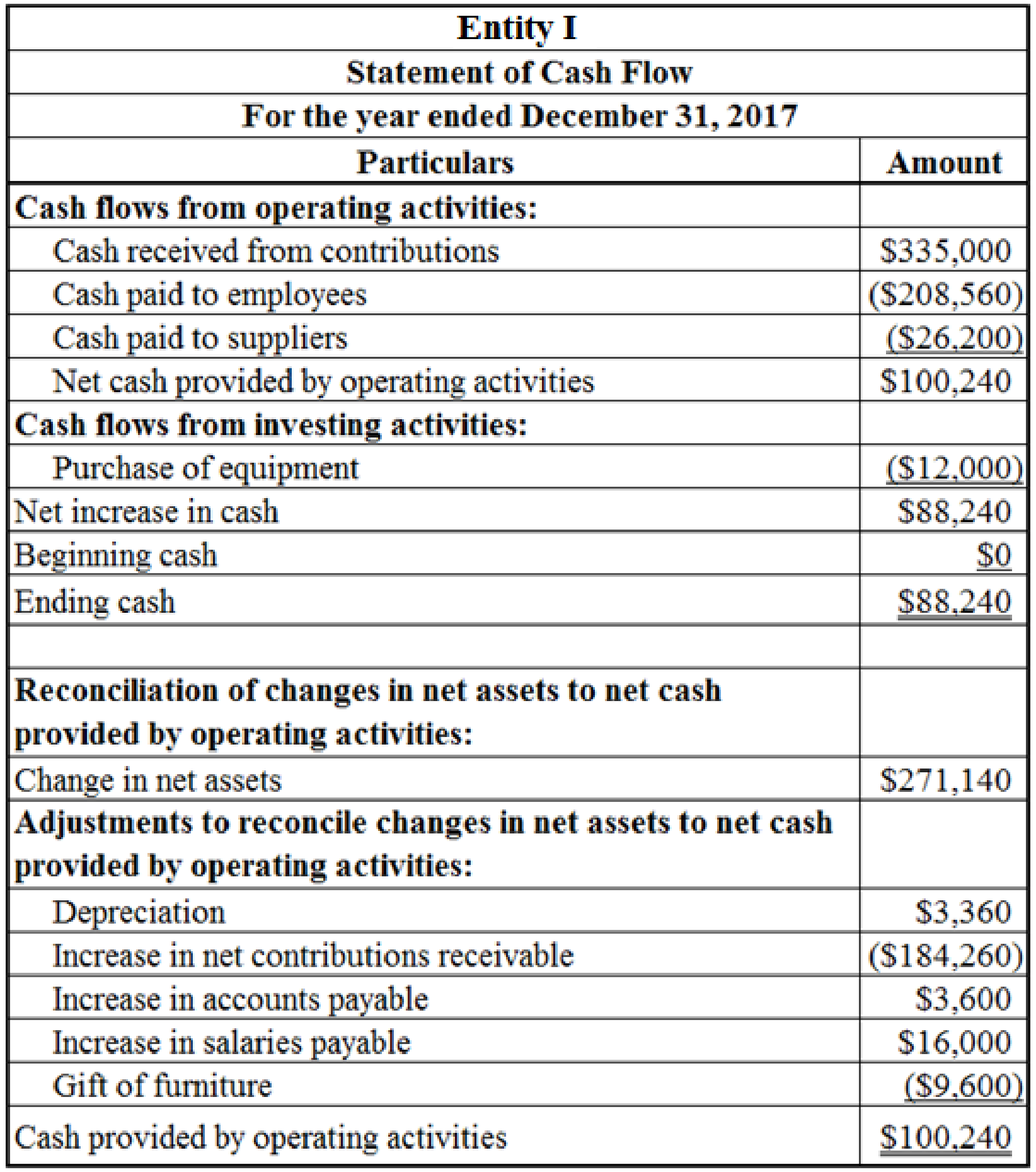

Prepare a statement of cash flow for the year ended December 31, 2017.

d)

Explanation of Solution

Prepare a statement of cash flow for the year ended December 31, 2017:

Table (5)

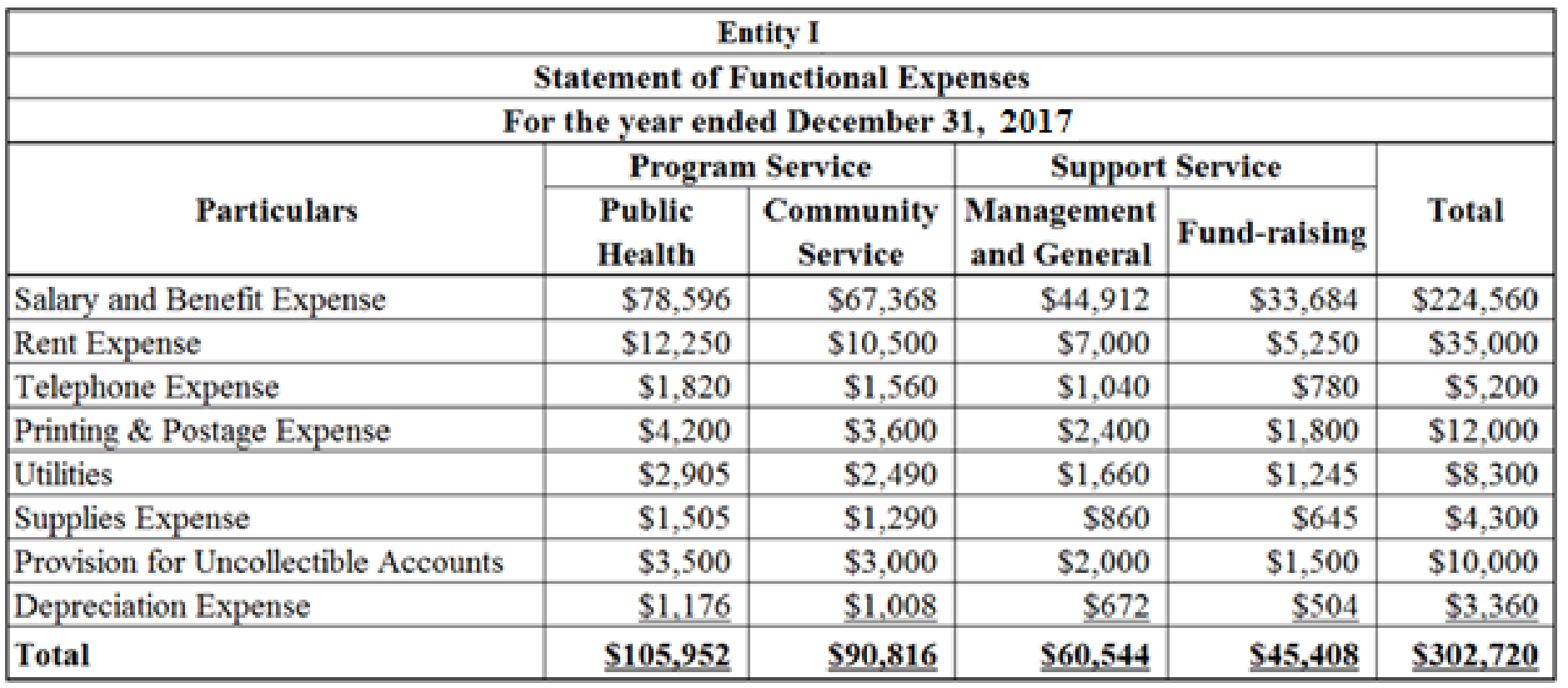

e)

Prepare the schedule of expenses by nature and function for the year ended December 31, 2017.

e)

Explanation of Solution

Prepare the schedule of expenses by nature and function for the year ended December 31, 2017:

Table (6)

Want to see more full solutions like this?

Chapter 13 Solutions

Accounting For Governmental And Not For Profit Entities

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education