Concept explainers

Estimate Cash Receipts

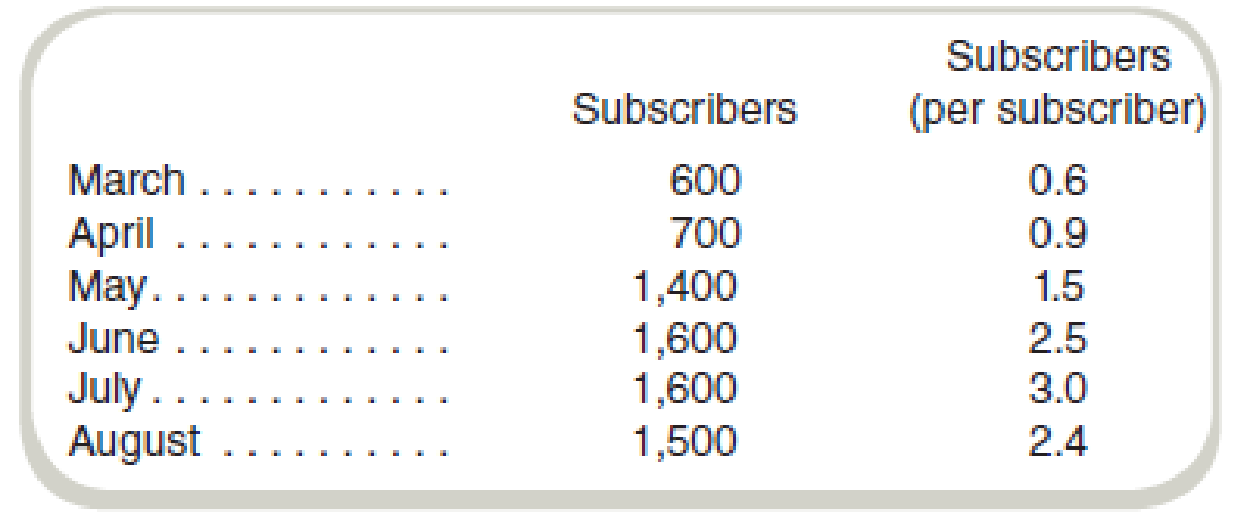

Varmit-B-Gone is a pest control service that operates in a suburban neighborhood. The company attempts to make service calls at least once a month to all homes that subscribe to its service. It makes more frequent calls during the summer. The number of subscribers also varies with the season. The number of subscribers and the average number of calls to each subscriber for the months of interest follow:

The average price charged for a service call is $80. Of the service calls, 30 percent are paid in the month the service is rendered, 60 percent in the month after the service is rendered, and 8 percent in the second month after. The remaining 2 percent is uncollectible.

Required

What are Varmit-B-Gone’s expected cash receipts for May, June, July, and August?

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Best Breath is a retail store selling home oxygen equipment. Best Breath also services home oxygen equipment, for which the company bills customers monthly. Best Breath has budgeted for increases in service revenue of $100 each month due to a recent advertising campaign. The forecast of sales and service revenue for March-June 2018 is as follows: Almost all of the sales revenues of the oxygen equipment are credit card sales; cash sales are negligible. The credit card company deposits 97% of the revenues recorded each day into Best Breath's account overnight. For the servicing of home oxygen equipment, 75% of oxygen services billed each month is collected in the month of the service, and 25% is collected in the month following the service.arrow_forwardAlmost all of the sales revenues of the oxygen equipment are credit card sales; cash sales are negligible. The credit card company deposits 97% of the revenues recorded each day into HealthMart’s account overnight. For the servicing of home oxygen equipment, 60% of oxygen services billed each month is collected in the month of the service, and 40% is collected in the month following the service. Q. Why do HealthMart’s managers prepare a cash budget in addition to the revenue, expenses, and operating income budget? Has preparing the cash budget been helpful? Explain briefly.arrow_forwardAlmost all of the sales revenues of the oxygen equipment are credit card sales; cash sales are negligible. The credit card company deposits 97% of the revenues recorded each day into HealthMart’s account overnight. For the servicing of home oxygen equipment, 60% of oxygen services billed each month is collected in the month of the service, and 40% is collected in the month following the service. Q. HealthMart has budgeted expenditures for May of $11,000 and requires a minimum cash balance of $250 at the end of each month. It has a cash balance on May 1 of $400. a. Given your answer to requirement 1, will HealthMart need to borrow cash to cover its payments for May and maintain a minimum cash balance of $250 at the end of May? b. Assume (independently for each situation) that (1) May total revenues might be 10% lower or that (2) total costs might be 5% higher. Under each of those two scenarios, show the total net cash for May and the amount HealthMart would have to borrow to cover its…arrow_forward

- Using the following data for for Rodriguez Art Studio to prepare a cash follow forecast. - Sales revenue: $10,000 March, $10,000 April, $9,000 May, $11,000 June. - Payment from customers is 50% paid in cash, 50% paid on one months credit - Direct Costs $5,500 April, $4,950 May, $6,060 June. - Opening Cash Balance in April $1,200 - Indirect Costs are $5,100 per month. What is the Total Cash inflow in May? Options -$4,500 -$11,200 -$10,000 -$9,500 What is the Net Cash flow in April? Options -$-600 -$660 -$-610 $600arrow_forwardCash collections The treasurer of Homeyra Corp. needs to estimate cash collections from accounts receivable for September, October, and November. Forty percent of the company’s customers pay in cash and the rest are credit customers. The collection pattern for the credit customers is 20 percent in the month of sale and 80 percent in the following month. Because of Homeyra’s established client base, the company experiences almost zero uncollectible accounts. Estimated total sales for August, September, October, and November follow. Month Sales August $78,000 September 80,000 October 95,000 November 91,000 Determine Homeyra Corp.’s cash collections for September, October, and November. Cash Collections: September Answer 0 October Answer 0 November Answer 0arrow_forwardLane Products manufactures a popular kitchen utensil. The company recently expanded, and the controller believes that it will need to borrow cash to continue operations. It opened negotiations with the local bank for a one-month loan of $40,000 starting March 1. The bank would charge interest at the rate of 0.5 percent per month and require the company to repay interest and principal on March 31. In considering the loan, the bank requested a projected income statement and cash budget for March. The following information is available: The company budgeted sales at 12,000 units per month in February, April, and May and at 9,000 units in March. The selling price is $60 per unit. The company offers a 2 percent discount for cash sales. The company's experience is that bad debts average 1 percent of credit sales. The inventory of finished goods on February 1 was 2,400 units. The desired finished goods inventory at the end of each month equals 25 percent of sales anticipated for the…arrow_forward

- from the following data of nature’s herbs company, prepare a sales forecast and schedule of cash receipts for the company covering the last quarter of the year. based on past experience, 20% of sales are collected in the month of sales, 70% in the following month, and 10% are never collected. nature’s herbs company has forecast credit sales for the fourth quarter of the year: september (actual) p 100,000 fourth quarter: october 80,000 november 70,000 december 120,000arrow_forwardFrom past experience, the company has learned that 20% of a month’s sales are collected in the month of sale, another 75% are collected in the month following sale, and the remaining 5% are collected in the second month following sale. Bad debts are negligible and can be ignored. February sales totaled $270,000, and March sales totaled $300,000. Required: 1. Prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter. 2. What is the accounts receivable balance on June 30th?arrow_forwardSchedule of Cash Receipts Del Spencer is the owner and founder of Del Spencer's Men's Clothing Store. Del Spencer's has its own house charge accounts and has found from past experience that 10 percent of its sales are for cash. The remaining 90 percent are on credit. An aging schedule for accounts receivable reveals the following pattern: 15 percent of credit sales are paid in the month of sale.65 percent of credit sales are paid in the first month following the sale.14 percent of credit sales are paid in the second month following the sale.6 percent of credit sales are never collected. Credit sales that have not been paid until the second month following the sale are considered overdue and are subject to a 3 percent late charge. Del Spencer's has developed the following sales forecast: May $60,000 June 53,000 July 46,000 August 57,000 September 83,000 Required: Prepare a schedule of cash receipts for August and September. Round all amounts to the nearest dollar. Del…arrow_forward

- Lipton Auto Parts, a family-owned auto parts store, began January with $10,300 cash . Management forecasts.Management forecasts that collections from credit customers will be $11,000 in January and $15,200 in February.The store is scheduled to receive $5,500 cash on a business note receivable in January. Projected cash payments include inventory purchases ($13,200 in January and $13,200 in February) and selling and administrative expenses ($3,100 each month). Requirement 1. Prepare Lipton Auto Parts's cash budget for January and February Requirement 2. How much cash will Lipton Auto Parts borrow in February if collections from customers that month total $14,200 instead of $15,200?arrow_forwardA CARDBOARD BOX FACTORY pays its suppliers 40 days after making the purchase and receiving the goods. The average collection period is 45 days, i.e. its customers settle their debt with the company in that time; and the average inventory age is based on the inventory turnover which is 10 times a year. The company spends about $1.23 million in operating cycle investments. With this data we need to calculate: The operating cycle.The cash conversion cycle.The cash turnover.The minimum cash balance.You plan to make modifications to your policies so that you can decrease your PPC by 10 days, and decrease your EPI by 2 times (before converting it to days). Negotiations with your supplier have been unsuccessful and the payment term has been reduced by 10 days. With these data you have to calculate: Re-calculate the Operating Cycle, the SCC, RC and SMC introducing the proposed changes.Calculate the opportunity cost that the changes will cause, if the company's interest rate is 8%.arrow_forwardPreparing Cash Receipts and Cash Payments Budgets E33-18 Martin Clothing Company is a retail company that sells hiking and other outdoor gear specially made for the desert heat. It sells to individuals as well as local companies that coordinate adventure Page 1282getaways in the desert for tourists. The following information is available for several months of the current year: Month Sales Purchases Cash Expenses Paid May $120,000 $90,000 $24,000 June 115,000 95,000 31,000 July 160,000 150,000 38,250 August 145,000 80,000 34,700 The majority of Martin’s sales (70 percent) are cash, but a few of the excursion companies purchase on credit. Of the credit sales, 40 percent are collected in the month of sale and 60 percent are collected in the following month. All of Martin’s purchases are on account with 55 percent paid in the month of purchase and 45 percent paid the following month. Required: 1. Prepare a…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning