You are reviewing the property, plant, and equipment working papers of Mandville Corporation, a company that publishes travel guides. The lead schedule for the account is included in the chapter as Figure 13.1. The following are among the findings relating to changes in the account:

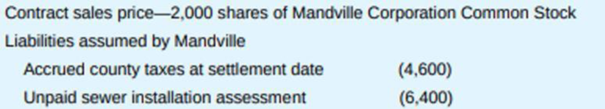

1. Land: The addition represents the purchase of land adjacent to the company’s existing plant and is financed as follows:

On June 17, the date on which the buyer and seller discussed the transaction, shares of Mandville Corporation stock were selling for $77.50. On June 30, the settlement date (day of the sale), Mandville stock was selling for $70.00 per share. The

Examination of publicly available records has indicated that prices of comparable land in the area have been relatively constant, selling in a range from $140,000 to $160,000 during the past 18 months.

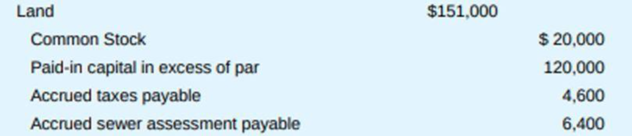

2. Land improvements: This account was increased by three journal entries (each recorded with a debit to land improvements and a credit to cash) during the year. Each of these improvements relates to the new land that was purchased in point (1) above.

3. Building: The building was constructed by an independent contractor; the contract was for $473,000. Progress payments were made during construction through use of proceeds of a bank loan, for which the building serves as collateral. The interest during construction was capitalized ($22,000), while the interest subsequent to construction but prior to year-end ($20,000) was expensed.

4. Equipment: The change in the equipment was a trade of old book “update printing equipment” for two new computer servers and associated software that will maintain electronic updates. Until recently, updates of outdated portions of guidebooks were printed and “shrinkwrapped” with the guidebook. Now the updates will be available on Mandville’s website. The old equipment had a cost of $60,000 and

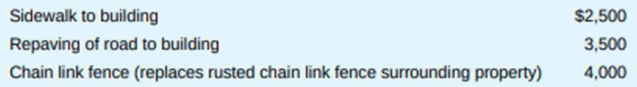

5. Depreciation provisions: Mandville uses software to calculate depreciation to the exact day.

Required:

- a. For additions (1) through (4) above, prepare any necessary

adjusting entries . If in any case your adjusting entry relies upon an assumption, provide that assumption. - b. For item (5), prepare a calculation of the depreciation provisions and determine whether they appear reasonable. For this calculation, assume that acquisitions, on average, occur at mid-year. If the provision does not appear reasonable, discuss follow-up procedures related to the provisions. Use the following table for your calculation:

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Principles Of Auditing & Other Assurance Services

- During the current year, Alanna Co. had the following transactions pertaining to its new office building. A. What should Alanna Co. record on its books for the land? The total cost of land includes all costs of preparing the land for use. The demolition cost of the old building is added to the land costs, and the sale of the old building scrap is subtracted from the land cost. B. What should Alanna Co. record on its books for the building?arrow_forwardHallergan Company produces car and truck batteries that it sells primarily to auto manufacturers. Dorothy Hawkins, the company’s controller, is preparing the financial statements for the year ended December 31, 2024. Hawkins asks for your advice concerning the following information that has not yet been included in the statements. The statements will be issued on February 28, 2025. Hallergan leases its facilities from the brother of the chief executive officer. On January 8, 2025, Hallergan entered into an agreement to sell a tract of land that it had been holding as an investment. The sale, which resulted in a material gain, was completed on February 2, 2025. Hallergan uses the straight-line method to determine depreciation on all of the company’s depreciable assets. On February 8, 2025, Hallergan completed negotiations with its bank for a $10,000,000 line of credit. Hallergan uses the first-in, first-out (FIFO) method to value inventory. Required: For each of the above items, discuss…arrow_forwardDonner Company is selling a piece of land adjacent to its business premises. An appraisal reported the market value of the land to be $220,000. The Focus Company initially offered to buy the land for $177,000. The companies settled on a purchase price of $212,000. On the same day, another piece of land on the same block sold for $232,000. Under the cost concept, at what amount should the land be recorded in the accounting records of Focus Company?arrow_forward

- For each of the following situations write the principle, assumption, or concept that justifies or explains what occurred. A) Land is purchased for $205,000 cash; the land is reported on the balance sheet of the purchaser at $205,000.B)A company records the expenses incurred to generate the revenues reported. C)When preparing financials for a company, the owner makes sure that the expense transactions are kept separate from expenses of the other company that he owns. *arrow_forwardDuring the current year, Alanna Co. had the following transactions pertaining to its new office building. A. What should Alanna Co. record on its books for the land? The total cost of land includes all costs of preparing the land for use. The demolition cost of the old building is added to the land costs, and the sale of the old building scrap is subtracted from the land cost. B. What should Alanna Co. record on its books for the building?arrow_forwardFor each of the following situations write the principle, assumption, or concept that justifies or explains what occurred. A. A landscaper received a customers order and cash prepayment to install sod at a house that would not be ready for installation until March of next year. The owner should record the revenue from the customer order in March of next year, not in December of this year. B. A company divides its income statements into four quarters for the year. C. Land is purchased for $205,000 cash; the land is reported on the balance sheet of the purchaser at $205,000. D. Brandys Flower Shop is forecasting its balance sheet for the next five years. E. When preparing financials for a company, the owner makes sure that the expense transactions are kept separate from expenses of the other company that he owns. F. A company records the expenses incurred to generate the revenues reported.arrow_forward

- The Thompson Corporation, a manufacturer of steel products, began operations on October 1, 2019. The accounting department of Thompson has started the fixed-asset and depreciation schedule presented below. You have been asked to assist in completing this schedule. In addition to ascertaining that the data already on the schedule are correct, you have obtained the following information from the company's records and personnel: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Depreciation is computed from the first of the month of acquisition to the first of the month of disposition. Land A and Building A were acquired from a predecessor corporation. Thompson paid $792,500 for the land and building together. At the time of acquisition, the land had a fair value of $70,400 and the building had a fair value of $809,600. Land B was acquired on October 2, 2019, in exchange for 2,800 newly issued shares of…arrow_forwardTristar Production Company began operations on September 1, 2021. Listed below are a number of transactions that occurred during its first four months of operations. On September 1, the company acquired five acres of land with a building that will be used as a warehouse. Tristar paid $220,000 in cash for the property. According to appraisals, the land had a fair value of $151,200 and the building had a fair value of $88,800. On September 1, Tristar signed a $52,000 noninterest-bearing note to purchase equipment. The $52,000 payment is due on September 1, 2022. Assume that 10% is a reasonable interest rate. On September 15, a truck was donated to the corporation. Similar trucks were selling for $3,700. On September 18, the company paid its lawyer $3,500 for organizing the corporation. On October 10, Tristar purchased maintenance equipment for cash. The purchase price was $27,000 and $1,100 in freight charges also were paid. On December 2, Tristar acquired various items of office…arrow_forwardThe Thompson Corporation, a manufacturer of steel products, began operations on October 1, 2016. The accounting department of Thompson has started the fixed-asset and depreciation schedule presented below. You have been asked to assist in completing this schedule. In addition to ascertaining that the data already on the schedule are correct, you have obtained the following information from the company's records and personnel (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.): Depreciation is computed from the first of the month of acquisition to the first of the month of disposition. Land A and Building A were acquired from a predecessor corporation. Thompson paid $712,500 for the land and building together. At the time of acquisition, the land had a fair value of $96,000 and the building had a fair value of $704,000. Land B was acquired on October 2, 2016, in exchange for 2,000 newly issued shares of…arrow_forward

- Tristar Production Company began operations on September 1, 2024. Listed below are a number of transactions that occurred during its first four months of operations. On September 1, the company acquired five acres of land with a building that will be used as a warehouse. Tristar paid $200,000 in cash for the property. According to appraisals, the land had a fair value of $134,200 and the building had a fair value of $85,800. On September 1, Tristar signed a $50,000 noninterest-bearing note to purchase equipment. The $50,000 payment is due on September 1, 2025. Assume that 8% is a reasonable interest rate. On September 15, a truck was donated to the corporation. Similar trucks were selling for $3,500. On September 18, the company paid its lawyer $8,000 for organizing the corporation. On October 10, Tristar purchased equipment for cash. The purchase price was $25,000 and $1,000 in freight charges also were paid. On December 2, Tristar acquired equipment. The company was short of cash…arrow_forwardThe following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. (a) Money borrowed to pay building contractor (signed a note) $(294,600 ) (b) Payment for construction from note proceeds 294,600 (c) Cost of land fill and clearing 10,250 (d) Delinquent real estate taxes on property assumed by purchaser 7,170 (e) Premium on 6-month insurance policy during construction 11,100 (f) Refund of 1-month insurance premium because construction completed early (1,850 ) (g) Architect’s fee on building 26,350 (h) Cost of real estate purchased as a plant site (land $208,600 and building $51,900) 260,500 (i) Commission fee paid to real estate agency 9,500 (j) Installation of fences around property 4,120 (k) Cost of razing and removing building 10,230 (l) Proceeds from salvage of…arrow_forwardThe following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. (a) Money borrowed to pay building contractor (signed a note) $(294,600 ) (b) Payment for construction from note proceeds 294,600 (c) Cost of land fill and clearing 10,250 (d) Delinquent real estate taxes on property assumed by purchaser 7,170 (e) Premium on 6-month insurance policy during construction 11,100 (f) Refund of 1-month insurance premium because construction completed early (1,850 ) (g) Architect’s fee on building 26,350 (h) Cost of real estate purchased as a plant site (land $208,600 and building $51,900) 260,500 (i) Commission fee paid to real estate agency 9,500 (j) Installation of fences around property 4,120 (k) Cost of razing and removing building 10,230 (l) Proceeds from salvage of…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning