a) Calculate the required rate of return for SmilWhite using the information given from the table.

To Determine:

The return rate required for SmileWhite using the data from the given information is calculated.

Introduction:

To value the stocks that is required by theJanetLudlow's firm, is analyzed using a two date DDM and the CAPM which are the two methods providing the value for the company's investment. DDM is the

a) Calculate the required rate of return for SmilWhite using the information given from the table.

Explanation of Solution

Given Information:

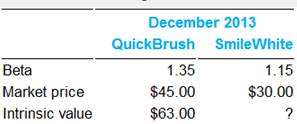

The given tabular column is as follows

The formula is given as,

By substituting we have,

b) Ludlow estimates the following EPS and growth rate of dividend for SmileWhite

To Determine:

To estimate the stock intrinsic value for SmileWhite using the given table and DDM of two-stage

Introduction:

To value the stocks that is required by the Janet Ludlow's firm, is analyzed using a two date DDM and the CAPM which are the two methods providing the value for the company's investment. DDM is the dividend discount model that uses the present stock share values having the dividend value for the future. The organization dividends with the financial projections measures the value of dividend for the future years. CAPM is the capital asset pricing model that depends on various factors like return rate with free of risk, expected return rate, market return rate and the investment risk according to the market situations.

b) Ludlow estimates the following EPS and growth rate of dividend for SmileWhite

Explanation of Solution

Given Information:

The table is given as follows,

First three years: 12% per year

Years thereafter: 9% per year

In the year2007, dividend is given as $1.72 per share

With the dividend given for the year 2007, the following year's dividend are calculated as follows:

In the year,

2008

2009

2010

2011

From the year 2008to 2010 the dividends paid are,

2008

2009

2010

Total=$4.82

Market price per share in the 2010 is,

PV for the year 2007 of

Stock intrinsic value=

c) Recommend Quickbrush or SmileWhite stock for purchase by comparing the intrinsic value of the company with the current market price.

To Determine:

To recommend Quickbrush or SmileWhite stock for purchase by comparing the intrinsic value of the company with the current market price

Introduction:

To value the stocks that is required by the Janet Ludlow's firm, is analyzed using a two date DDM and the CAPM which are the two methods providing the value for the company's investment. DDM is the dividend discount model that uses the present stock share values having the dividend value for the future. The organization dividends with the financial projections measures the value of dividend for the future years. CAPM is the capital asset pricing model that depends on various factors like return rate with free of risk, expected return rate, market return rate and the investment risk according to the market situations.

c) Recommend Quickbrush or SmileWhite stock for purchase by comparing the intrinsic value of the company with the current market price.

Explanation of Solution

Given Information:

Recommend Quickbrush or SmileWhite stock for purchase by comparing the intrinsic value of the company with the current market price.

From the given table it is stated that the QuickBrush is selling less than the intrinsic value. The SmileWhite sells above the intrinsic value. So therefore the potentials for the abnormal returns that is considerable is offered by the QuickBrush and little below the market risk adjusted returns offered by the SmileWhite.

d) Describe one strength of the two-stage DDM in comparison with the DDM CONTSNT GROWTH and one weakness that inherent in all DDMs

To Determine:

To determine one strength of the two-stage DDM in comparison with the DDM CONTSNT GROWTH and one weakness that inherent in all DDMs.

Introduction:

To value the stocks that is required by the Janet Ludlow's firm, is analyzed using a two date DDM and the CAPM which are the two methods providing the value for the company's investment. DDM is the dividend discount model that uses the present stock share values having the dividend value for the future. The organization dividends with the financial projections measures the value of dividend for the future years. CAPM is the capital asset pricing model that depends on various factors like return rate with free of risk, expected return rate, market return rate and the investment risk according to the market situations.

d) Describe one strength of the two-stage DDM in comparison with the DDM CONTSNT GROWTH and one weakness that inherent in all DDMs

Explanation of Solution

Given Information:

Strength of the two-stage DDM in comparison with the DDM CONTSNT GROWTH and one weakness that inherent in all DDMs

Two-stage DDM strength

- As it gives the separate valuation for two different periods for the future, it helps it accommodating the effects of life cycle. It eliminates the difficult situation that arises when the growth rate is more than the rate of discount. Weakness of DDM

- They are very sensitive to values of input. Even small changes in the g value or k value can give many changes in the estimated intrinsic value and they are difficult to measure.

Want to see more full solutions like this?

Chapter 13 Solutions

ESSENTIALS OF INVEST.-W/ACCESS >CUSTOM<

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education