a)

Prepare a report for the chair of the allocation committee indicating the extent to which BRC’s financial situation has improved or worsened.

a)

Explanation of Solution

Not-for-profit (NFP) entities: It is an individual or group of people who work together to attain the goals and mission that is something other than making profit for its shareholders or owners. Not-for-profit entities’ success is measured by how much the entity serves to the well-being of public or poor people with the available resource of the entity.

Prepare a report for the chair of the allocation committee indicating the extent to which BRC’s financial situation has improved or worsened:

Report

To: Chair of allocation committee

UW allocation panel

From: Person X,

Financial advisor

Subject: Analysis of the rehabilitative camp funding for fiscal year 2021.

It is recalled to the panel members that it is quite concerned about the financial reserves. It is because the financial reserves are precariously low during the evaluation of the organization for fiscal year 2020. At that time, the financial advisor Person X raised the issue about ability of the organization to continue to sustain its function/program within the budgeted level. Further, he recommended the request of budget from UW might be cut by 50% until the improvement of financial position.

It is also noted from the statement of activities of fiscal year 2019; only 57% of the total expenses were spent for the program/function. The entire panel further decided to send a message about concerns of the organization and request the budget amount from $5,000 to $25,000 to the board. Based on this request the UW board has approved the fund.

During the meeting conducted in the last year, the Chairman and Director of the board promised to take immediate steps to improve the financial condition of the camp. It including more fund-raising activities and if required for reducing the cost, cutting the camp’s support staff.

It is very surprised and pleased by the proof that shows the improvement made in the organizations financial situation. After the inspection of statements and budgets of 2020, it is noted that there is a doubtful reduction of $31,934 in the investments amount. The camp has been carrying this amount (that is restricted for building expansion) for few years. However, in the temporarily restricted net assets, the exact amount has been decreased.

It is to be noted that there was no increase in the building account balance. In building account, the only change is decrease in balance due to

After identifying the apparent fund transfer, person X contacted director of the camp who provides the details about the donor. For the future building expansion, the donor has contributed $100,000 several years ago. The donor was no longer living and not able to locate the written agreement about this contribution.

Further, these facts have been reported to the board of directors. Directors passed resolution to authorize the use of investment of $37,500 for unrestricted purposes in the fiscal year 2020. Here, it is stated that the additional fund will be transferred in the future years if requirement arises.

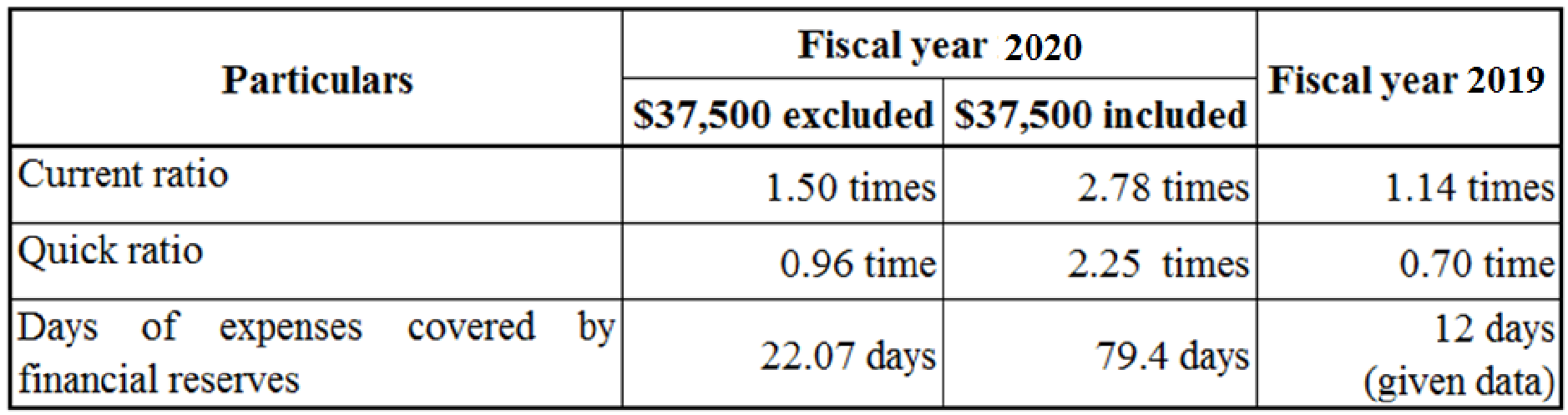

Hence, the panel members would like to see the impact of the transfer of $37,500 in the financial position of the camp. The following are the key calculations including and excluding the amount of $37,500.

Table (1)

This comparison clearly shows the difference between inclusion and exclusion of $37,500 in the assets. Based on this fact, the following recommendation is provided. UW’s attorney should look into the matter why the restricted resources used as unrestricted operation purpose of the camp.

Regards,

Person X,

Financial advisor

Notes for the above table:

a. Calculate current ratio:

It is given that the current asset is $43,589 and current liability is $29,141 for the fiscal year 2020. The current ratio is calculated by dividing the current assets by the current liabilities.

Hence, the current ratio exclusion of $37,500 is 1.50 times.

If add the amount of $37,500, the ratio will be:

Hence, the current ratio inclusion of $37,500 is 2.78 times.

Now, calculate current ratio for the fiscal year 2019:

It is given that the current asset is $46,368 and current liability is $40,786 for the fiscal year 2019.

Hence, current ratio for the year 2019 is 1.14 times.

b. Calculate quick ratio:

It is calculated by dividing the difference between the current assets and prepaid expenses by the current liabilities. It is given the prepaid expenses of 2020 is 15,559 and 2019 is $17,748.

Hence, the quick ratio exclusion of $37,500 is 0.96 times.

If add the amount of $37,500, the ratio will be:

Hence, the quick ratio inclusion of $37,500 is 2.25 times.

Now, calculate quick ratio for the fiscal year 2019:

It is given that the current asset is $46,368 and current liability is $40,786 for the fiscal year 2019.

Hence, the quick ratio for 2019 is 0.70 times.

c. Calculate days of expenses covered by financial reserves:

It is calculated by dividing the difference between the current assets and current liability by the total expenses. It is given that the total expenses are $238,932.

Hence, the quick ratio (exclusion of $37,500) is 22.07 days.

Now, calculated quick ratio for inclusion of $37,500:

Hence, the quick ratio (inclusion of $37,500) is 79.4 days.

b)

Explain the reaction of financial advisor to the board of director’s decision to use, for operating purposes, the $100,000 temporarily restricted net assets provided by a donor for building expansion.

b)

Explanation of Solution

Using the restricted fund of the donor contributed for the future building expansion as an unrestricted fund for the operation is not an ethical activity. There is a transfer of funds from one account to another without any approvals. This is a questionable activity. If it is identified that the Chairman and the board of directors had illegally transferred the restricted fund to operation activities, legal charges should have filed against them.

c)

Identify the amount of UW funds would the financial advisor recommend be allocated to the BRC for the fiscal year 2021.

c)

Explanation of Solution

The donor’s restricted fund contributed for the future building expansion should be allocated if there is any requirement for the expansion of the building. Otherwise, this fund should be restricted further and must not be allocated for operating purposes. It is illegal to use restricted funds for operation purposes.

The restricted fund balance should be audited every year-end. If the fund is spent for particular purpose it should be verified whether fund is used for donor’s mentioned contributed purpose. Otherwise, the fund should be recovered and it must be added to the restricted fund balance.

Want to see more full solutions like this?

Chapter 14 Solutions

GOVERNMENTAL ACCOUNTING 18E

- Fund A transfers $20,000 to Fund B. For each of the following, indicate whether the statement is true or false and, if false, explain why. If Fund A is the general fund and Fund B is an enterprise fund, nothing will be shown for this transfer on the statement of activities within the government-wide financial statements. If Fund A is the general fund and Fund B is a debt service fund, nothing will be shown for this transfer on the statement of activities within the government-wide financial statements. If Fund A is the general fund and Fund B is an enterprise fund, a $20,000 reduction will be reported on the statement of revenues, expenditures, and other changes in fund balance for the governmental funds within the fund financial statements. If Fund A is the general fund and Fund B is a special revenue fund (which is not considered a major fund), no changes will be shown on the statement of revenues, expenditures, and other changes in fund balance within the fund financial statements.…arrow_forwardE7-7 (Statement of Revenues, Expenditures, and Changes in Fund Balance) Prepare a statement of revenues, expenditures, and changes in fund balance for the Ahmed Village Park Improvement Capital Projects Fund for 20X7, given the following information: Fund balance, January 1, 20X7 .......................... $2,000,000 Intergovernmental grant revenue ........................ 850,000 Interest revenue ...................................... 30,000 Increase in fair value of investments ..................... 3,000 Construction costs incurred under contract with Builtwell Co. ................................... 2,400,000 Architect fees ........................................ 32,000 Engineering fees ...................................... 17,000 Bond proceeds (face amount was $1,000,000) ............. 1,008,000 Bond issuance costs ................................... 5,000 Purchase of land ...................................... 92,000 Repayment of bond anticipation notes treated as long-term…arrow_forwardFund A transfers $20,000 to Fund B. For each of the following, indicate whether the statement is true or false and, if false, explain why.a. If Fund A is the general fund and Fund B is an enterprise fund, nothing will be shown for this transfer on the statement of activities within the government-wide financial statements.b. If Fund A is the general fund and Fund B is a debt service fund, nothing will be shown for this transfer on the statement of activities within the government-wide financial statements.c. If Fund A is the general fund and Fund B is an enterprise fund, a $20,000 reduction will be reported on the statement of revenues, expenditures, and other changes in fund balance for the governmental funds within the fund financial statements.d. If Fund A is the general fund and Fund B is a special revenue fund (which is not considered a major fund), no changes will be shown on the statement of revenues, expenditures, and other changes in fund balance within the fund financial…arrow_forward

- The County of Maxnell decides to create a waste management department and offer its services to the public for a fee. As a result, county officials plan to account for this activity as an enterprise fund. Assume the information is gathered so that the county can prepare fund financial statements. Only entries for the waste management department are required here: January 1 Receive unrestricted funds of $248,000 from the general fund as permanent financing. Febrauary 1 Borrow an additional $224,000 from a local bank at a 12 percent annual interest rate. March 1 Order a truck at an expected cost of $140,000. April 1 Receive the truck and make full payment. The actual cost including transportation was $143,000. The truck has a 10-year life and no residual value. The county uses straight-line depreciation. May 1 Receive a $23,600 cash grant from the state to help supplement the pay of the department workers. According to the grant, the money must be used for that…arrow_forwardNizwa city was awarded two state grants during the fiscal year 2019 RO 4 million and RO 2 million respectively. These grants used only for restricted purposes. The expenditure related to the restricted activity is RO 2 million and bond issued and collected RO 5 million for special restricted activity. The other financing sources in the special revenue fund is a. RO 10 million b. RO 8 million c. RO 5 million d. None of the optionsarrow_forwardAt the beginning of the year, the Baker Fund,a nongovernmental not-for-profit corporation,received a $125,000 contribution restrictedto youth activity programs. During the year,youth activities generated revenues of$89,000 and had program expenses of$95,000. What amount should Baker reportas net assets released from restrictions forthe current year?arrow_forward

- The Watson Foundation, a private not-for-profit entity, starts 2020 with cash of $100,000, contributions receivable (net) of $200,000, investments of $300,000, and land, buildings, and equipment (net) of $200,000. Net assets without donor restrictions were reported as $400,000, the same figure as the net assets with donor restrictions. Of the restricted net assets, $300,000 was purpose restricted whereas the other $100,000 had to be held permanently, although the subsequently earned income is without restriction. Fifty percent of the purpose restricted net assets had to be used to help pay for a new building. The remainder was restricted to the payment of officer salaries. Donors made no stipulations about the eventual reporting of buildings and other long-lived assets when acquired. Watson has one program service (health care) and two supporting services (fundraising and administrative). During the current year, Watson Foundation has the following transactions. Computed interest of…arrow_forwardThe governing board of a private not-for-profit entity votes to set $400,000 in cash aside in an investment fund so that this money and future interest will be available in five years, when a new building is scheduled for construction. Which of the following is not true? Multiple Choice The investments are reported on the statement of financial position as net assets without donor restrictions. The acquisition of the investments is not reported on the statement of activities. Board-designated funds will appear in the net asset section of the statement of financial position as net assets with donor restrictions. Income earned by these investments appears on the statement of activities under net assets without donor restrictions.arrow_forwardHi, I am in advanced accounting and doing a balance sheet for state and local government. Can you help me create a balance sheet for the capital projects fund? The following unadjusted trial balances are for the governmental funds of the city of Copeland prepared from the current accounting records: Capital projects fund debit credit cash $70,000 special assessments receivable 90,000 contracts payable $50,000 unavailable revenues 90,000 encumbrances outstanding 16,000 fund balance-unassigned 0 other financing sources 150,000 expenditures…arrow_forward

- For each of the following, indicate whether the statement is true or false and include a brief explanation for your answer.a. A pension trust fund appears in the government-wide financial statements but not in the fund financial statements.b. Permanent funds are included as one of the governmental funds.c. A fire department placed orders of $20,000 for equipment. The equipment is received but at a cost of $20,800. In compliance with requirements for fund financial statements, an encumbrance of $20,000 was recorded when the order was placed, and an expenditure of $20,800 was recorded when the order was received.d. The government reported a landfill as an enterprise fund. At the end of Year 1, the government estimated that the landfill will cost $800,000 to clean up when it is eventually full. Currently, it is 12 percent filled. At the end of Year 2, the estimation was changed to $860,000 when it was 20 percent filled. No payments are due for several years. Fund financial statements for…arrow_forwardThe Watson Foundation, a private not-for-profit entity, starts 2024 with cash of $100,000; contributions receivable (net) of $200,000; investments of $300,000; and land, buildings, and equipment (net) of $200,000. Net assets without donor restrictions were reported as $400,000, the same figure as the net assets with donor restrictions. Of the restricted net assets, $300,000 was purpose restricted, whereas the other $100,000 had to be held permanently, although the subsequently earned income is without restriction. Fifty percent of the purpose-restricted net assets had to be used to help pay for a new building. The remainder was restricted to the payment of officer salaries. Donors made no stipulations about the eventual reporting of buildings and other long-lived assets when acquired. Watson has one program service (health care) and two supporting services (fundraising and administrative). During the current year, Watson Foundation has the following transactions: Computes interest of…arrow_forwardTHIS IS ALL THAT WAS GIVEN IN THE QUESTION: Pass-through Custodial Funds. (LO8-2) Evergreen County acts as the disbursing agent for a state grant for the performing arts. The state is responsible for determining which local governments are eligible for the grant money and for following up to ensure that the recipients comply with the requirements of the grant. The county receives the grant funds and disburses them according to the schedule provided by the state. When the county was asked to participate, the county’s attorney was concerned that the county might be held responsible for any disallowed costs. The state agreed to accept responsibility for any disallowed costs, so the county decided to act as the custodian for the state for this grant. The schedule for the grant funds to be awarded in the current fiscal year is shown below: CITY OF BOULDER $2,100,000 ASPEN TOWNSHIP $1,400,000 SNOWTON $900,000 FIRTREE VILLAGE…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education