Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 13E

Ratio of liabilities to stockholders’ equity and times interest earned

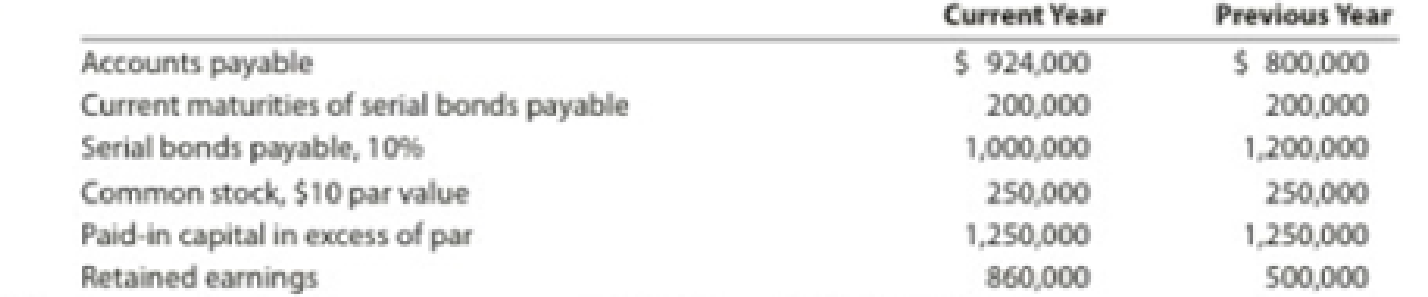

The following data were taken from the financial statements of Hunter Inc. for December 31 of two recent years:

The income before income tax expense was $480,000 and $420,000 for the current and previous years, respectively.

- A. Determine the ratio of liabilities to stockholders’ equity at the end of each year. Round to one decimal place.

- B. Determine the times interest earned ratio for both years. Round to one decimal place.

- C. What conclusions can be drawn from these data as to the company’s ability to meet its currently maturing debts?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Financial And Managerial Accounting

Ch. 14 - Prob. 1DQCh. 14 - Prob. 2DQCh. 14 - Prob. 3DQCh. 14 - How would the current and quick ratios of a...Ch. 14 - Prob. 5DQCh. 14 - What do the following data, taken from a...Ch. 14 - A. How does the return on total assets differ from...Ch. 14 - The Kroger Company (KR), a grocery store chain,...Ch. 14 - The dividend yield of Suburban Propane Partners,...Ch. 14 - Prob. 10DQ

Ch. 14 - Prob. 1BECh. 14 - Income statement information for Einsworth...Ch. 14 - Prob. 3BECh. 14 - A company reports the following: Determine (a) the...Ch. 14 - Prob. 5BECh. 14 - Prob. 6BECh. 14 - A company reports the following: Determine the...Ch. 14 - A company reports the following: Determine the...Ch. 14 - Prob. 9BECh. 14 - A company reports the following: Determine (a) the...Ch. 14 - Prob. 11BECh. 14 - Vertical analysis of income statement Revenue and...Ch. 14 - The following comparative income statement (in...Ch. 14 - Common-sized income statement Revenue and expense...Ch. 14 - Prob. 4ECh. 14 - Prob. 5ECh. 14 - The following data were taken from the balance...Ch. 14 - PepsiCo, Inc. (PEP), the parent company of...Ch. 14 - Current position analysis The bond indenture for...Ch. 14 - Accounts receivable analysis The following data...Ch. 14 - Prob. 10ECh. 14 - Inventory analysis The following data were...Ch. 14 - Inventory analysis QT, Inc. and Elppa Computers,...Ch. 14 - Ratio of liabilities to stockholders equity and...Ch. 14 - Hasbro, Inc. (HAS), and Mattel, Inc. (MAT), are...Ch. 14 - Recent balance sheet information for two companies...Ch. 14 - Prob. 16ECh. 14 - The following selected data were taken from the...Ch. 14 - Ralph Lauren Corporation (RL) sells apparel...Ch. 14 - Six measures of solvency or profitability Obj. 4,...Ch. 14 - Five measures of solvency or profitability The...Ch. 14 - Prob. 21ECh. 14 - The table that follows shows the stock price,...Ch. 14 - Earnings per share, discontinued operations The...Ch. 14 - Income statement and earnings per share for...Ch. 14 - Unusual items Explain whether Colston Company...Ch. 14 - Comprehensive income Anson Industries, Inc.,...Ch. 14 - Prob. 1PACh. 14 - Prob. 2PACh. 14 - Effect of transactions on current position...Ch. 14 - Measures of liquidity, solvency, and profitability...Ch. 14 - Solvency and profitability trend analysis Addai...Ch. 14 - Horizontal analysis of income statement For 20Y2,...Ch. 14 - Prob. 2PBCh. 14 - Effect of transactions on current position...Ch. 14 - Prob. 4PBCh. 14 - Solvency and profitability trend analysis Crosby...Ch. 14 - Prob. 1MADCh. 14 - Prob. 2MADCh. 14 - Deere Company (DE) manufactures and distributes...Ch. 14 - Marriott International, Inc. (MAR), and Hyatt...Ch. 14 - Prob. 1TIFCh. 14 - Real-world annual report The financial statements...Ch. 14 - Prob. 3TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ratio of liabilities to stockholders equity and times interest earned The following data were taken from the financial statements of Hunter Inc. for December 31 of two recent years: The income before income tax expense was 480,000 and 420,000 for the current and previous years, respectively. A. Determine the ratio of liabilities to stockholders equity at the end of each year. Round to one decimal place. B. Determine the times interest earned ratio for both years. Round to one decimal place. C. What conclusions can be drawn from these data as to the companys ability to meet its currently maturing debts?arrow_forwardJuroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forwardFive measures of solvency or profitability The balance sheet for Garcon Inc. at the end of the current fiscal year indicated the following: Income before income tax was 3,000,000, and income taxes were 1,200,000 for the current year. Cash dividends paid on common stock during the current year totaled 1,200,000. The common stock was selling for 32 per share at the end of the year. Determine each of the following: (a) times interest earned ratio, (b) earnings per share on common stock, (c) price-earnings ratio, (d) dividends per share of common stock, and (e) dividend yield. Round ratios and percentages to one decimal place, except for per-share amounts.arrow_forward

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forwardNet income and dividends The income statement of a corporation for the month of November indicates a net income of $90,000. During the same period, $100,000 in cash dividends were paid. Would it be correct to say that the business incurred a net loss of $10,000 during the month? Discuss.arrow_forwardThe following data (in millions) were taken from the financial statements of Costco Wholesale Corporation: a. For Costco, determine the amount of change in millions and the percent of change (round to one decimal place) from the prior year to the recent year for: 1. Revenue 2. Operating expenses 3. Operating income b. Comment on the results of your horizontal analysis in part (a). c. Based upon Exercise 2-23, compare and comment on the operating results of Target and Costco for the recent year.arrow_forward

- The following data (in millions) are taken from the financial statements of Target Corporation: a. For Target Corporation, determine the amount of change in millions and the percent of change (round to one decimal place) from the prior year to the recent year for: 1. Revenue 2. Operating expenses 3. Operating income b. What conclusions can you draw from your analysis of the revenue and the total operating expenses?arrow_forwardThe income statement, statement of retained earnings, and balance sheet for Somerville Company are as follows: Includes both state and federal taxes. Brief Exercise 15-20 Calculating the Average Common Stockholders Equity and the Return on Stockholders Equity Refer to the information for Somerville Company on the previous pages. Required: Note: Round answers to four decimal places. 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardReturn on assets The following data (in millions) were adapted from recent financial statements of Tootsie Roll Industries Inc. (TR): What is Tootsie Roll’s percent of the cost of sales to sales? Round to one decimal place.arrow_forward

- Net income and dividends The income statement for the month of February indicates a net income of 17,500. During the same period, 25,500 in cash dividends were paid. Would it be correct to say that the business incurred a net loss of 8,000 during the month? Discuss.arrow_forwardReal-world annual report The financial statements for Nike, Inc. (NKE), are presented in Appendix E at the end of the text. The following additional information is available (in thousands): Instructions 1. Determine the following measures for the fiscal years ended May 31, 2017, and May 31, 2016. Round ratios and percentages to one decimal place. a. Working capital b. Current ratio c. Quick ratio d. Accounts receivable turnover e. Number of days sales in receivables f. Inventory turnover g. Number of days sales in inventory' h. Ratio of liabilities to stockholders equity i. Asset turnover j. Return on total assets, assuming interest expense is 82 million for the year ending May 31. 2017, and 33 million for the year ending May 31, 2016. k. k. Return on common stockholders equity l. Price-eamings ratio, assuming that the market price was 52.81 per share on May 31, 2017, and 54.35 per share on May 31, 2016. m. m. Percentage relationship of net income to sales 2. What conclusions can be drawn from these analyses?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License