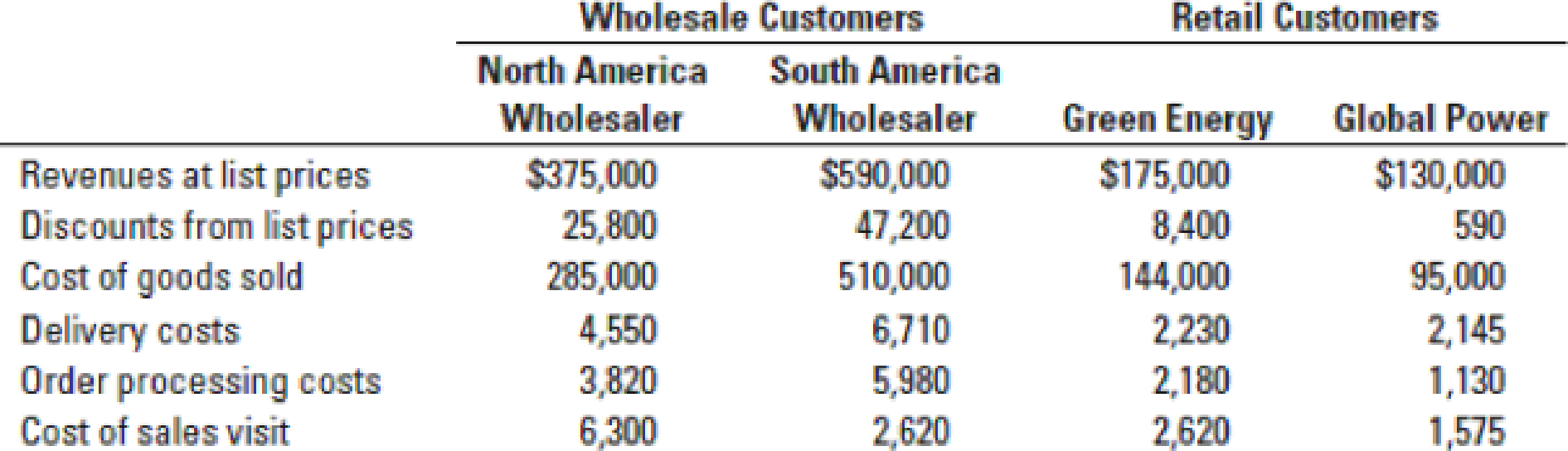

Customer profitability, customer-cost hierarchy. Enviro-Tech has only two retail and two wholesale customers. Information relating to each customer for 2017 follows (in thousands):

Enviro-Tech’s annual distribution-channel costs are $33 million for wholesale customers and $12 million for retail customers. The company’s annual corporate-sustaining costs, such as salary for top management and general-administration costs are $48 million. There is no cause-and-effect or benefits-received relationship between any cost-allocation base and corporate-sustaining costs. That is, Enviro-Tech could save corporate-sustaining costs only if the company completely shuts down.

- 1. Calculate customer-level operating income using the format in Figure 14-3.

Required

- 2. Prepare a customer-cost hierarchy report, using the format in Figure 14-6.

- 3. Enviro-Tech’s management decides to allocate all corporate-sustaining costs to distribution channels: $38 million to the wholesale channel and $10 million to the retail channel. As a result, distribution channel costs are now $71 million ($33 million + $38 million) for the wholesale channel and $22 million ($12 million + $10 million) for the retail channel. Calculate the distribution-channel-level operating income. On the basis of these calculations, what actions, if any, should Enviro-Tech’s managers take? Explain.

- 4. How might Enviro-Tech use the new cost information from its activity-based costing system to better manage its business?

Learn your wayIncludes step-by-step video

Chapter 14 Solutions

Horngren's Cost Accounting, Student Value Edition (16th Edition)

Additional Business Textbook Solutions

Intermediate Accounting

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Financial Accounting (11th Edition)

Managerial Accounting (5th Edition)

Financial Accounting, Student Value Edition (4th Edition)

- 14-19 Customer profitability, customer-cost hierarchy. Enviro-Tech has only two retail and two wholesale customers. Information relating to each customer for 2017 follows (in thousands): Enviro-Tech’s annual distribution-channel costs are $33 million for wholesale customers and $12 million for retail customers. The company’s annual corporate-sustaining costs, such as salary for top management and general-administration costs are $48 million. There is no cause-and-effect or benefits-received relationship between any cost-allocation base and corporate-sustaining costs. That is, Enviro-Tech could save corporate-sustaining costs only if the company completely shuts down. 1. Calculate customer-level operating income using the format 2. Enviro-Tech’s management decides to allocate all corporate-sustaining costs to distribution channels: $38 million to the wholesale channel and $10 million to the retail channel. As a result, distribution channel costs are now $ 71 million ( $ 33 million…arrow_forwardBovine Company, a wholesale distributor of umbrellas, has been experiencing losses for some time, as shown by its most recent monthly contribution format Income statement: In an effort to isolate the problem, the president has asked for an income statement segmented by geographic market. Accordingly, the Accounting Department has developed the following: Required: Prepare a contribution format Income statement segmented by geographic market, as requested by the president. 2-a. The company's sales manager believes that sales in the Central geographic market could be increased by 15% If monthly advertising is increased by $42, 000. Calculate the incremental net operating income. 2- b. Would you recommend the increased advertising?arrow_forward(Management Accounting) The following information is available for Kismer Corporation: Total fixed costs $313,500 Variable costs per unit $90 Selling price per unit $150 If management has a targeted net income of $59,400, then sales revenue should be ________. A) $239,721 B) $580,067 C) $671,220 D) $932,250arrow_forward

- Bed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,180,000 1,248,000 2,932,000 2,180,000 $ 752,000 Answer is complete but not entirely correct. $ (52,100) Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage) Department Hardware $ 3,100,000 830,000 2,270,000 1,380,000 $ 890,000 A study indicates that $378,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 12% decrease in the sales of the Hardware Department. Linens $ 1,080,000 418,000 662,000 800,000 $ (138,000)arrow_forwardTanek Corp.’s sales slumped badly in 2017. For the first time in its history, it operated at a loss. The company’s income statement showed the following results from selling 590,500 units of product: sales $2,952,500, total costs and expenses $3,050,875, and net loss $98,375. Costs and expenses consisted of the amounts shown below. Total Variable Fixed Cost of goods sold $2,507,615 $2,025,415 $482,200 Selling expenses 295,250 108,652 186,598 Administrative expenses 248,010 80,308 167,702 $3,050,875 $2,214,375 $836,500 Management is considering the following independent alternatives for 2018. 1. Increase unit selling price 25% with no change in costs, expenses, and sales volume. 2. Change the compensation of salespersons from fixed annual salaries totaling $177,150 to total salaries of $70,860 plus a 5% commission on sales. (a) Compute the break-even point in dollars for 2017. (Round final answer to 0 decimal places,…arrow_forwardThe Deluxe Division, a profit center of Riley Manufacturing Company, reported the following data for the first quarter of 2016:Sales $9,000,000Variable costs 6,300,000Controllable direct fixed costs 1,200,000Noncontrollable direct fixed costs 530,000Indirect fixed costs 300,000Instructions(a) Prepare a performance report for the manager of the Deluxe Division.(b) What is the best measure of the manager’s performance? Why?(c) How would the responsibility report differ if the division was an investment center?arrow_forward

- Check m Bovine Company, a wholesale distributor of umbrellas, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement: Sales Variable expenses Contribution margin Fixed expenses $2,050,000 876,050 1,173,950 1,315,000 $ (141,050) Operating loss In an effort to isolate the problem, the president has asked for an income statement segmented by geographic market. Accordingly, the Accounting Department has developed the following: Geographic Market Central South North Sales Variable expenses as a percentage of sales Traceable fixed expenses $605,000 $804,000 $641,000 34% $315,000 $500,000 $305,000 53% 44% Required: 1. Prepare a contribution format income statement segmented by geographic market, as requested by the president Geographic Market Total South Central North Companyarrow_forwardBovine Company, a wholesale distributor of umbrellas, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement: Sales $ 2,070,000 Variable expenses 895,880 Contribution margin 1,174,120 Fixed expenses 1,319,000 Operating loss $ (144,880 ) In an effort to isolate the problem, the president has asked for an income statement segmented by geographic market. Accordingly, the Accounting Department has developed the following: Geographic Market South Central North Sales $ 607,000 $ 806,000 $ 657,000 Variable expenses as a percentage of sales 50 % 36 % 46 % Traceable fixed expenses $ 320,000 $ 480,000 $ 307,000 Required:1. Prepare a contribution format income statement segmented by geographic market, as requested by the president. 2-a. The company’s sales manager believes that sales in the Central…arrow_forwardWhitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows: Whitman Company Income Statement Sales (39,000 units x $41.60 per unit) Cost of goods sold (39,000 units x $22 per unit) Gross margin Selling and administrative expenses Net operating income. The company's selling and administrative expenses consist of $292,500 per year in fixed expenses and $4 per unit sold in variable expenses. The $22 unit product cost given above is computed as follows: Direct materials. Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($235,000 47,000 units) Absorption costing unit product cost $ 1,622,400 858,000 764,400 448,500 $ 315,900 Required 1 Required 2 $9 5 3 5 $ 22 Required: 1. Redo the company's income statement in the contribution format using variable costing. 2. Reconcile any difference between the net operating income on your variable costing income statement and the net operating income on…arrow_forward

- Saunders Corporation manufactures consumer electronics products. Selected income statement data for 2009 and 2010 are provided in Table 5. P.S. The company is not operating at full capacity and therefore, fixed costs are not changing: Table 5 Selected Income Statement Items for Saunders Co. in million USD Saunders Corporation (amounts in millions of dollars) 2009 2010 Sales 8,296 8,871 Cost of Goods Sold (5,890) (6,290) Selling and Administrative Expenses (1,788) (1,714) Operating Income before Income Taxes 618 867 Calculate the variable-cost percentage of the cost of goods sold by dividing the change in cost of goods sold to change in sales between 2009 and 2010 and use it to determine the fixed and variable components of the cost of goods sold. Repeat the process in part (a) above to calculate the fixed and variable components of the selling and administrative expenses c. Saunders Corporation discloses that it expects sales to…arrow_forwardPatterson Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. PATTERSON COMPANY Income Statements for the Year 2014 Segment Sales Cost of goods sold А В C $164,000 $250,000 $245,000 (84,000) (29,000) |(130,000) (18,000) (80,000) (22,000) Sales commissions Contribution margin 143,000 16,000 137,000 General fixed oper. exp. (allocation of president's salary) Advertising expense (specific to individual divisions) (37,000) (32,000) (34,000) (5,000) (11,000) 0 (26,000) $ 94,000 $ 109,000 Net income Required: a. Prepare a schedule of relevant sales and costs for Segment A. Relevant Rev. and Cost items for Segment A Effect on income b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. PATTERSON COMPANY Comparative Income Statements for the Year 2014 Eliminate Seg. A Decision Keep Seg. A Sales Cost…arrow_forwardAnalyzing profitability Camden Company has divided its business into segments based on sales territories: East Coast, Midland, and West Coast. Following are financial data for 2018: Prepare an income statement for Camden Company for 2018 using the contribution margin format assuming total fixed costs for the company Were $435,000. Include columns for each business segment and a column for the total company.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education