GEN COMBO LL ACCOUNTING FOR GOVERNMENTAL & NONPROFIT ENTITIES; CONNECT AC

18th Edition

ISBN: 9781260259261

Author: Jacqueline L. Reck James E. Rooks Distinguished Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 16EP

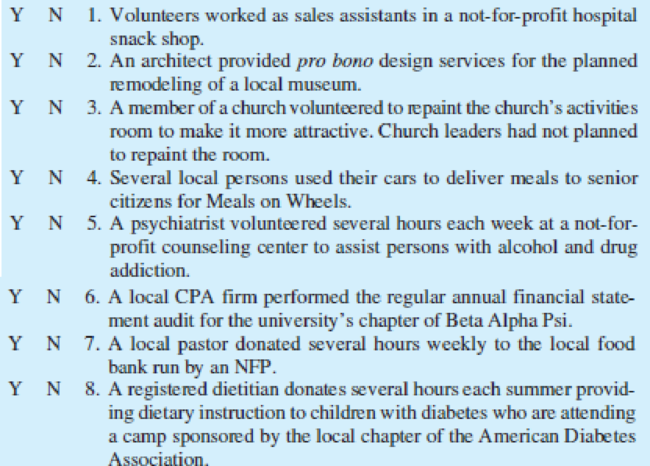

Donated Services. (LO14-3) Indicate whether each of the following donated services situations would require a

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

(2, 7) Helping tags: Accounting, Intermediate Accounting

.

.

.

WILL UPVOTE, just pls help me answer the question and show complete solutions. Thank you!

1. The information on the defined benefit plan is provided in the picture.

a) How much is the remeasurement on asset ceiling to be reported in OCI?

b) What is the interest on asset ceiling?

Which of the following is not a procedure in accounting for defined contribution plans?

Remeasurements are recorded in other comprehensive income.

Contributions shall be recognized as expense in the period it is payable.

Any unpaid contribution at the end of the period shall be recognized as accrued expense.

Any excess contribution shall be recognized as prepaid expense.

Under PFRS 15, what is the measurement basis of revenue from contracts with customers? Select the correct letter:

A. Revocable amount of the consideration received or receivable

B. Book value of the consideration received or receivable

C. Fair value of the consideration received or receivable

D. Historical cost of the consideration received or receivable

Chapter 14 Solutions

GEN COMBO LL ACCOUNTING FOR GOVERNMENTAL & NONPROFIT ENTITIES; CONNECT AC

Ch. 14 - Prob. 1QCh. 14 - Prob. 2QCh. 14 - Prob. 3QCh. 14 - What is the value of reporting expenses by...Ch. 14 - Prob. 5QCh. 14 - Prob. 6QCh. 14 - What criteria must be met before an NFP...Ch. 14 - Prob. 8QCh. 14 - What are joint costs, and how are joint costs...Ch. 14 - Prob. 10Q

Ch. 14 - Prob. 11CCh. 14 - Prob. 13CCh. 14 - Prob. 14.1EPCh. 14 - According to GAAP, all not-for-profit...Ch. 14 - Prob. 14.3EPCh. 14 - In a local NFP elementary schools statement of...Ch. 14 - Prob. 14.5EPCh. 14 - Prob. 14.6EPCh. 14 - The Maryville Cultural Center recently conducted a...Ch. 14 - Prob. 14.8EPCh. 14 - Prob. 14.9EPCh. 14 - Prob. 14.10EPCh. 14 - Prob. 14.11EPCh. 14 - Prob. 14.12EPCh. 14 - Prob. 14.13EPCh. 14 - Prob. 15EPCh. 14 - Donated Services. (LO14-3) Indicate whether each...Ch. 14 - Prob. 17EPCh. 14 - Prob. 18EPCh. 14 - Prob. 19EPCh. 14 - Statement of Activities. (LO14-3) The Atkins...Ch. 14 - Prob. 21EPCh. 14 - Prob. 22EPCh. 14 - Prob. 23EPCh. 14 - Prob. 24EPCh. 14 - Prob. 25EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following will a Notice of Donation is needed?arrow_forward(3, 5, 8 ) Helping tags: Accounting, Intermediate Accounting . . . WILL UPVOTE, just pls help me answer the question and show complete solutions. Thank you! 1. The information on the defined benefit plan is provided in the picture. a) What is the net defined asset or liability on the beginning of the period? b) How much is the defined benefit cost reported in profit or loss? c) What is the net defined asset or liability at the end of the period?arrow_forward19. If an individual renders services to a creditor who in consideration thereof cancels the debt, the cancellation of indebtedness may,amount to a: a. Gift С. Donation inter vivos b. Capital contribution d. Payment of income CS Scanned with CamScannerarrow_forward

- I need some assistance with Requirement 1 of this question using the information on the document provided by preparing a contribution approach income statement.arrow_forwardIdentify each of the following items as a capital expenditure (C), an immediate expense (E), or neither (N). question 42 attached in ss thanks for help appreicated riwjgoihjwoi wtiohwarrow_forwardI need some assistance with question 3 of this paper using the information on the document provided to prepare a contribution approach income statement.arrow_forward

- Briefly describe the differences between the FASB and GASB approaches to recognition of contribution revenue.arrow_forwardThe expense matching principle states that: Multiple Choice Expenses are recognized when paid. All expenses are recognized when the corresponding revenue is recorded. Some expenses are recognized when the corresponding revenue is recognized and some are spread over time. Expenses are recognized when the invoice is received.arrow_forwardAmounts that come from accounts of unvested employees that can be directed/contributed to the accounts of other employees who participate and remain in the plan are known as what? Select one: a. Matching contributions b. Excess contributions c. Forfeitures d. Rollover contributionsarrow_forward

- fill in the blanks Revenues are monies an organization received in exchange for ________ and _____________ it provides.arrow_forwardWhich of the following best represents the matching principle criteria? A. Expenses are reported in the period in which they were incurred. B. Expenses may be reported in a different period than the matching revenues. C. Revenue and expenses are matched based on when expenses are paid. D. Revenue is recognized when an order occurs and not when the actual sale is initiated.arrow_forwardwhere do all of the nonseparately stated items go on the form 1065?where is the net of all those items reported on form 1065?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Revenue recognition explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=816Q6pOaGv4;License: Standard Youtube License