INTRO MGRL ACCT LL W CONNECT

8th Edition

ISBN: 9781266376771

Author: BREWER

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 1E

Common-Size Income Statement

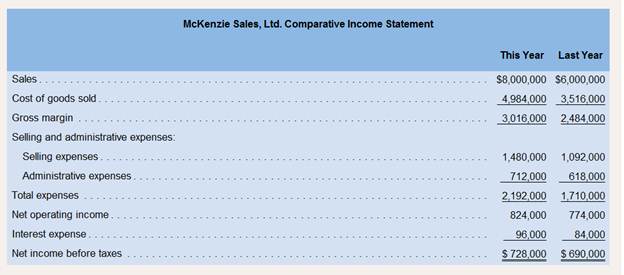

A comparative income statement is given below for McKenzie Sales. Ltd., of Toronto:

Members of the company's board of directors are surprised to see that net income increased by only $38,000 when sales increased by $2,000,000.

Required:

1. Express each year's income statement in common-size percentages. Carry computations to one decimal place.

2. Comment briefly on the changes between the two years.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Prepare a comparative common-size income statement for Jubilee Corporation. To an investor, how does the current year compare with the prior year? Explain your reasoning.

E (Click the icon to view the comparative income statement.)

Data table

Start by calculating the percentages. (Round the percentages to two decimal places, X.XX.)

Jubilee Corporation

Comparative Common-Size Income Statement

A

C

For the Years Ended December 31

1

Jubilee Corporation

Current

2

Income Statement

year

Prior year

3

For the Years Ended December 31

Sales revenues

100.00 %

100.00 %

4

(amounts in thousands)

Less: Cost of goods sold

%

%

Current

Gross profit

%

%

year

Prior year

Less: Operating expenses

%

6 Sales revenues

$

494,208 $

429,000

%

Operating income

%

7 Less: Cost of goods sold

172,640

160,000

Less: Interest expense

8 Gross profit

2$

321,568 $

269,000

0%

Income before income taxes

%

%

9 Less: Operating expenses

143,370

135,000

Less: Income tax expense

10 Operating income

2$

178,198 $

134,000

%

%

11 Less:…

Horizontal Analysis of Income Statement

For 20Y2, McDade Company reported a decline in net income. At the end of the year, T. Burrows, the president, is presented with the following

condensed comparative income statement:

McDade Company

Comparative Income Statement

For the Years Ended December 31, 20Y2 and 20Y1

20Υ2

20Υ1

Sales

$829,639

$693,000

Cost of merchandise sold

616,000

440,000

Gross profit

$213,639

$253,000

Selling expenses

$87,000

$58,000

Administrative expenses

50,320

37,000

Total operating expenses

$137,320

$95,000

Income from operations

$76,319

$158,000

Other revenue

3,634

2,900

Income before income tax expense

$79,953

$160,900

Income tax expense

22,400

48,300

Net income

$57,553

$112,600

Required:

Chapter 14 Solutions

INTRO MGRL ACCT LL W CONNECT

Ch. 14 - Prob. 1QCh. 14 - What is the basic purpose for examining trends in...Ch. 14 - Prob. 3QCh. 14 - Prob. 4QCh. 14 - What is meant by the dividend yield on a common...Ch. 14 - What is meant by the term financial leverage?Ch. 14 - Prob. 7QCh. 14 - Prob. 8QCh. 14 - Prob. 9QCh. 14 - Markus Company’s common stock sold for $2.75 per...

Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Prob. 11F15Ch. 14 - Prob. 12F15Ch. 14 - Prob. 13F15Ch. 14 - Prob. 14F15Ch. 14 - Prob. 15F15Ch. 14 - Common-Size Income Statement A comparative income...Ch. 14 - Prob. 2ECh. 14 - Prob. 3ECh. 14 - Financial Ratios for Debt Management Refer to the...Ch. 14 - Prob. 5ECh. 14 - Prob. 6ECh. 14 - Prob. 7ECh. 14 - Prob. 8ECh. 14 - Financial Ratios for Assessing Profitability and...Ch. 14 - Prob. 10ECh. 14 - Prob. 11ECh. 14 - Selected Financial Measures for Assessing...Ch. 14 - Effects of Transactions on Various Financial...Ch. 14 - Effects of Transactions on Various Ratios Denna...Ch. 14 - Prob. 15PCh. 14 - Common-Size Financial StatementsRefer to the...Ch. 14 - Interpretation of Financial Ratios Pecunious...Ch. 14 - Common-Size Statements and Financial Ratios for a...Ch. 14 - Financial Ratios for Assessing Profitability and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Revenue and expense data for Gresham Inc. for two recent years are as follows: a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. Round to one decimal place. b. Comment on the significant changes disclosed by the comparative income statement.arrow_forwardCuneo Companys income statements for the last 3 years are as follows: Refer to the information for Cuneo Company above. Required: 1. Prepare a common-size income statement for Year 1 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.) 2. Prepare a common-size income statement for Year 2 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.) 3. Prepare a common-size income statement for Year 3 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.)arrow_forwardSundahl Companys income statements for the past 2 years are as follows: Refer to the information for Sundahl Company above. Required: 1. Prepare a common-size income statement for Year 1 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.) 2. Prepare a common-size income statement for Year 2 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.)arrow_forward

- Cuneo Companys income statements for the last 3 years are as follows: Refer to the information for Cuneo Company above. Required: 1. Prepare a common-size income statement for Year 2 by expressing each line item for Year 2 as a percentage of that same line item from Year 1. (Note: Round percentages to the nearest tenth of a percent.) 2. Prepare a common-size income statement for Year 3 by expressing each line item for Year 3 as a percentage of that same line item from Year 1. (Note: Round percentages to the nearest tenth of a percent.)arrow_forwardScherer Company provided the following income statements for its first 3 years of operation: Refer to the information for Scherer Company on the previous page. Required: Prepare common-size income statements by using net sales as the base. (Note: Round answers to the nearest whole percentage.)arrow_forwardSundahl Companys income statements for the past 2 years are as follows: Refer to the information for Sundahl Company above. Required: Prepare a common-size income statement for Year 2 by expressing each line item for Year 2 as a percentage of that same line item from Year 1. (Note: Round percentages to the nearest tenth of a percent.)arrow_forward

- Jasmine Company provided the following income statements for its first 3 years of operation: Refer to the information for Jasmine Company above. Required: Prepare common-size income statements by using net sales as the base. (Note: Round answers to the nearest whole percentage.)arrow_forwardThe condensed income statements through income from operations for Dell Inc. and Apple Inc. for recent fiscal years follow (numbers in millions of dollars): Prepare comparative common-sized statements, rounding percents to one decimal place. Interpret the analyses.arrow_forwardThe following data (in millions) are taken from the financial statements of Target Corporation: a. For Target Corporation, determine the amount of change in millions and the percent of change (round to one decimal place) from the prior year to the recent year for: 1. Revenue 2. Operating expenses 3. Operating income b. What conclusions can you draw from your analysis of the revenue and the total operating expenses?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License