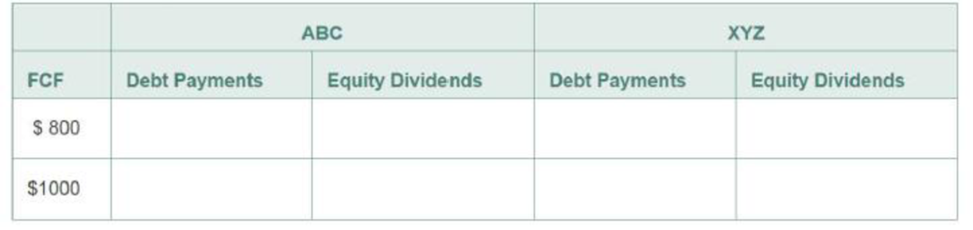

Suppose there are no taxes. Firm ABC has no debt, and firm XYZ has debt of $5000 on which it pays interest of 10% each year. Both companies have identical projects that generate

a. Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows.

b. Suppose you hold 10% of the equity of ABC. What is another portfolio you could hold that would provide the same cash flows?

c. Suppose you hold 10% of the equity of XYZ. If you can borrow at 10%, what is an alternative strategy that would provide the same cash flows?

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Corporate Finance: The Core, Student Value Edition Plus Mylab Finance With Pearson Etext -- Access Card Package (4th Edition)

- The Berndt Corporation expects to have sales of 12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be 1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndts federal-plus-state tax rate is 40%. Berndt has no debt. a. Set up an income statement. What is Berndts expected net income? Its expected net cash flow? b. Suppose Congress changed the tax laws so that Berndts depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow? c. Now suppose that Congress changed the tax laws such that, instead of doubling Berndts depreciation, it was reduced by 50%. How would profit and net cash flow be affected? d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why?arrow_forwardHasting Corporation is interested in acquiring Vandell Corporation. Vandell has 1 million shares outstanding and a target capital structure consisting of 30% debt; its beta is 1.4 (given its target capital structure). Vandell has $10.82 million in debt that trades at par and pays an 8% interest rate. Vandell’s free cash flow (FCFJ is $2 million per year and is expected to grow at a constant rate of 5% a year. Vandell pays a 40% combined federal and state tax rate. The risk-free rate of interest is 5%, and the market risk premium is 6%. Hasting’s First step is to estimate the current intrinsic value of Vandell. What are Vandell’s cost of equity and weighted average cost of capital? What is Vandell’s intrinsic value of operations? [Hint: Use the free cash flow corporate valuation model from Chapter 8.) What is the current intrinsic value of Vandell’s stock?arrow_forwardOgier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning