Concept explainers

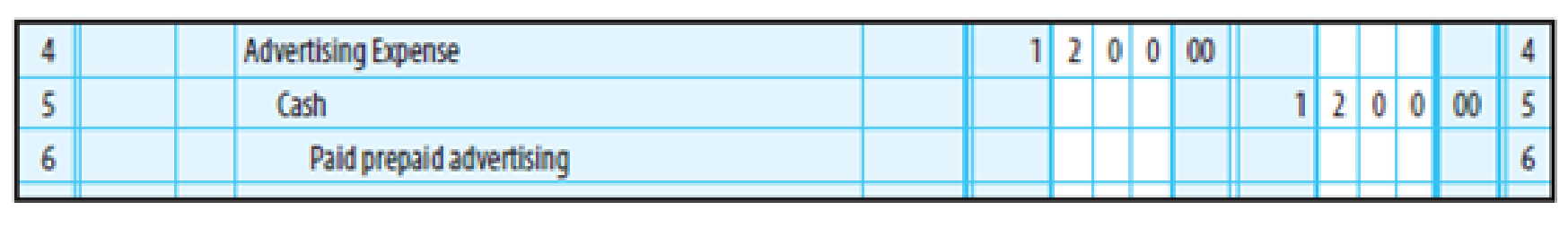

EXPENSE METHOD OF ACCOUNTING FOR PREPAID EXPENSES Davidson’s Food Mart paid $1,200 in advance to the local newspaper for advertisements that will appear monthly. The following entry was made:

At the end of the year, December 31, 20--, Davidson received notification that advertisements costing $800 had been run. Prepare the

Prepare the adjusting entry.

Explanation of Solution

The expense method of accounting for prepaid expenses:

In expense method of accounting for prepaid supplies, prepaid expenses and other prepaid items are recorded as purchases during its purchase.

Adjustment entries:

Adjusting entries are those entries which are made at the end of the year to update all the balances in the financial statements to show the true financial information and to maintain the records according to accrual basis principle.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Record the adjusting entries under prepaid expenses method:

| Date | Account titles and Explanation | Debit ($) | Credit ($) |

| December 31 | Prepaid advertising | 400 | |

| Advertising expense | 400 | ||

| (To record amount of prepaid advertising ) |

Table (1)

- Prepaid advertising is a current asset and it is increased. Therefore, debit prepaid advertising account by $400.

- Advertising expense is a component of stockholders’ equity and it is increased. Therefore, credit advertising expense account by $400.

Want to see more full solutions like this?

Chapter 14A Solutions

CENGAGENOWV2 FOR HEINTZ/PARRY'S COLLEGE

- Following are transactions for Vitalo Company. November 1 Accepted a $5,000, 180-day, 5% note from Kelly White in granting a tine extension on her past-due account receivable. December 31 Adjusted the year-end accounts for the accrued interest earned on the White note.. April 30 white honored her note when presented for payment. Complete the table to calculate the interest amounts at December 31st and April 30th and use those calculated values to prepare your Journal entries. Note: Do not round intermediate calculations. Use 360 days a year.arrow_forwardReview the following transactions and prepare any necessary journal entries for Woodworking Magazine. Woodworking Magazine provides one issue per month to subscribers for a service fee of $240 per year. Assume January 1 is the first day of operations for this company, and no new customers join during the year. A. On January 1, Woodworking Magazine receives advance cash payment from forty customers for magazine subscription services. Handyman had yet to provide subscription services as of January 1. B. On April 30, Woodworking recognizes subscription revenues earned. C. On October 31, Woodworking recognizes subscription revenues earned. D. On December 31, Woodworking recognizes subscription revenues earned.arrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forward

- Cee Co.s fiscal year begins April 1. At the beginning of its fiscal year, Cee Co. estimates that it will owe 17,400 in property taxes for the year. On June 1, its property taxes are assessed at 17,000, which it pays immediately. Prepare the related journal entries for April 1, May 1, and June 1. Then compute the monthly property tax expense that Cee Co. would record during June through March.arrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan.arrow_forwardIn the journal provided, prepare entries for the following (assume a calendar-year accounting period).Dec. 1 Received a three-month, 15 percent note receivable for $3,920 from acustomer as an extension of his past-due account.31 Made the year-end adjustment for accrued interest.Mar. 1 Received full payment on the note.arrow_forward

- Following are transactions for Vitalo Company. November 1 Accepted a $10,000, 180-day, 7% note from Kelly White in granting a time extension on her past-due account receivable. December 31 Adjusted the year-end accounts for the accrued interest earned on the White note. April 30 White honored her note when presented for payment. Complete the table to calculate the interest amounts at December 31st and April 30th and use those calculated values to prepare your journal entries. (Do not round intermediate calculations. Use 360 days a year.) Complete this question by entering your answers in the tabs below. General Journal Interest Amounts Complete the table to calculate the interest amounts at December 31st and April 30th Total Through Maturity November 1 Through December 31 January 1 Through April 30 Principal Rate (%) Time Total interest Amounts General Journal > ere to search 68°F 40 4. ort se deletearrow_forwardFollowing are transactions for Vitalo Company. November 1 Accepted a $11,000, 180-day, 7 % note from Kelly White in granting a time extension on her past-due account receivable. December 31 Adjusted the year-end accounts for the accrued interest earned on the White note. April 30 White honored her note when presented for payment. Complete the table to calculate the interest amounts at December 31st and April 30th and use those calculated values to prepare your journal entries. (Do not round intermediate calculations. Use 360 days a year.) Complete this question by entering your answers in the tabs below. General Journal Complete the table to calculate the interest amounts at December 31st and April 30th November 1 Through December 31 Interest Amounts Principal Rate (%) Time Total interest Total Through Maturity January 1 Through April 30arrow_forwardPrepare journal entries to record transactions for Vitalo Company. Nov. 1 Accepted a $6,000, 180-day, 8% note from Kelly White in granting a time extension on her past-due account receivable. Dec. 31 Adjusted the year-end accounts for the accrued interest earned on the White note. Apr. 30 White honored her note when presented for payment.arrow_forwardFollowing are transactions of Danica Company 13 Accepted a $9,500, 45-day, 81 note in granting Miranda Lee a extension on her past-due account receivable. Prepared an adjusting entry to record accrued interest the Lee note. Complete the table to calculate the Interest amounts at Dexember 31^ \st and use the calculated value to prepare your journal entries. (Do not round your intermediate calculations. Use 360 days a year.)arrow_forwardFollowing are transactions for Vitalo Company. November 1 Accepted a $7,000, 180-day, 7% note from Kelly White in granting a time extension on her past-due account receivable. December 31 Adjusted the year-end accounts for the accrued interest earned on the White note. April 30 White honored her note when presented for payment. Complete the table to calculate the interest amounts at December 31st and April 30th and use those calculated values to prepare your journal entries. (Do not round intermediate calculations. Use 365 days a year.) Complete this question by entering your answers in the tabs below. Interest Amounts General Journal Complete the table to calculate the interest amounts at December 31st and April 30th.arrow_forwardA gift shop signs a three-month note payable on May 1/2020 of OMR 36,000 with an annual interest of 10%. What is the adjusting entry to be made on December 31 for the interest expense accrued to that date? Select one: O a. Debit Interest Expense, 2,400; Credit Interest Payable, 2,400. b. Debit Prepaid Interest, 2,000; Credit Interest Expense, 2,000. c. Debit Interest Expense, 2,100; Credit Interest Payable, 2,100. d. None of the answers are correct e. Debit Interest Expense, 2,400; Credit Prepaid Interest, 2,400.arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College