ADVANCED FINANCIAL ACCOUNTING IA

12th Edition

ISBN: 9781260545081

Author: Christensen

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 15.10E

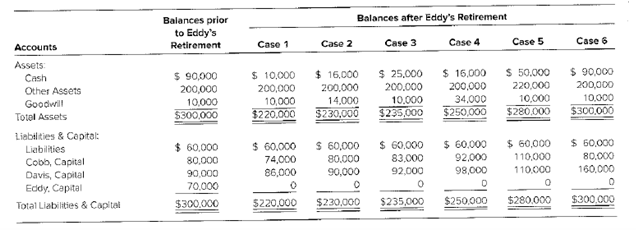

Retirement of a Partner

On January 1, 20X1, Eddy decides to retire from the

Required

Prepare the necessary

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Pike, Quinn, and Reed are forming a partnership

On March 31 of the current year, the capital accounts of the three existing partners and theirshares of profits and losses are as follows:

Pike, Quinn, and Reed are considering adding Shipp as a new partner on April 31 Shipp in$200,000 in the partnership, acquiring a one-fourth interest in the business. Journalizeadmission of Shipp as a partner on March 31

Admitting New Partners

1. Prepare general journal entries showing the transactions admitting Bridges and Terrell to the partnership. If an amount box does not require an entry, leave it blank.

2. Calculate the ending capital balances of all four partners after the transactions.

Jeff Bowman and Kristi Emery, who have ending capital balances of $100,900 and $53,500, respectively, agree to admit two new partners to their business on August 18, 20--. Dan Bridges will buy one-fifth of Bowman’s capital interest for $28,580 and one-fourth of Emery’s capital interest for $30,325. Payments will be made directly to the partners. Anna Terrell will invest $58,905 in the business, for which she will receive a $58,905 capital interest

Withdrawal of a Partner

Gregorio is retiring from the partnership of Guerra, Guillermo, and Gregorio. The profit and loss ratio is 2:2:1, respectively. After the accountant has posted the revaluation and closing entries, the credit balances in the Capital accounts are: Guerra, P530,000; Guillermo, P430,000; and Gregorio, P210,000.

Required: Journalize the journal entries to record the retirement of Gregorio under each of the following unrelated assumptions:

Gregorio retires, talking P210,000 of partnership cash for her equity.

Gregorio retires, talking P270,000 of partnership cash for her equity.

Chapter 15 Solutions

ADVANCED FINANCIAL ACCOUNTING IA

Ch. 15 - Prob. 15.1QCh. 15 - Prob. 15.2QCh. 15 - Prob. 15.3QCh. 15 - Prob. 15.4QCh. 15 - Under what circumstances would a partner’s capital...Ch. 15 - Prob. 15.6QCh. 15 - Prob. 15.7QCh. 15 - Prob. 15.8QCh. 15 - Prob. 15.9QCh. 15 - Prob. 15.10Q

Ch. 15 - Prob. 15.11QCh. 15 - Prob. 15.12QCh. 15 - Prob. 15.13QCh. 15 - Prob. 15.14QCh. 15 - Prob. 15.15AQCh. 15 - Prob. 15.16BQCh. 15 - Prob. 15.1CCh. 15 - Prob. 15.2CCh. 15 - Prob. 15.3CCh. 15 - Prob. 15.1.1ECh. 15 - Prob. 15.1.2ECh. 15 - Prob. 15.1.3ECh. 15 - Prob. 15.1.4ECh. 15 - Multiple-Choice on Initial Investment [AICPA...Ch. 15 - Prob. 15.2ECh. 15 - Prob. 15.3ECh. 15 - Prob. 15.4ECh. 15 - Prob. 15.5ECh. 15 - Prob. 15.6ECh. 15 - Prob. 15.7ECh. 15 - Prob. 15.8.1ECh. 15 - Prob. 15.8.2ECh. 15 - Prob. 15.8.3ECh. 15 - Prob. 15.8.4ECh. 15 - Prob. 15.8.5ECh. 15 - Prob. 15.8.6ECh. 15 - Prob. 15.8.7ECh. 15 - Prob. 15.8.8ECh. 15 - Prob. 15.9ECh. 15 - Retirement of a Partner On January 1, 20X1, Eddy...Ch. 15 - Prob. 15.11PCh. 15 - Prob. 15.12PCh. 15 - Prob. 15.13PCh. 15 - Prob. 15.14PCh. 15 - Withdrawal of a Partner under Various Alternatives...Ch. 15 - Prob. 15.16.1PCh. 15 - Prob. 15.16.2PCh. 15 - Prob. 15.16.3PCh. 15 - Prob. 15.16.4PCh. 15 - Prob. 15.16.5PCh. 15 - Prob. 15.16.6PCh. 15 - Prob. 15.16.7PCh. 15 - Prob. 15.16.8PCh. 15 - Prob. 15.16.9PCh. 15 - Prob. 15.17PCh. 15 - Prob. 15.18PCh. 15 - Initial investments and Tax Bases [AICPA Adapted]...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The partnership of Magda and Sue shares profits and losses in a 50:50 ratio after Mary receives a $7,000 salary and Sue receives a $6,500 salary. Prepare a schedule showing how the profit and loss should be divided, assuming the profit or loss for the year is: A. $10,000 B. $5,000 C. ($12,000) In addition, show the resulting entries to each partners capital account.arrow_forwardENTRIES FOR DISSOLUTION OF PARTNERSHIP Cummings and Stickel Construction Company, a partnership, is operating a general contracting business. Ownership of the company is divided among the partners, Katie Cummings, Julie Stickel, Roy Hewson, and Patricia Weber. Profits and losses are shared equally. The books are kept on the calendar-year basis. On August 10, after the business had been in operation for several years, Patricia Weber passed away. Mr. Weber wished to sell his wifes interest for 30,000. After the books were closed, the partners capital accounts had credit balances as follows: REQUIRED 1. Prepare the general journal entry required to enter the check issued to Mr. Weber in payment of his deceased wifes interest in the partnership. According to the partnership agreement, the difference between the amount paid to Mr. Weber and the book value of Patricia Webers capital account is allocated to the remaining partners based on their ending capital account balances. 2. Assume instead that Mr. Weber is paid 60,000 for the book value of Patricia Webers capital account. Prepare the necessary journal entry. 3. Assume instead that Julie Stickel (with the consent of the remaining partners) purchased Webers interest for 70,000 and gave Mr. Weber a personal check for that amount. Prepare the general journal entry for the partnership only.arrow_forwardAfter the tangible assets have been adjusted to current market prices, the capital accounts of Grayson Jackson and Harry Barge have balances of $64,900 and $86,500, respectively. Lewan Gorman is to be admitted to the partnership, contributing $43,300 cash to the partnership, for which he is to receive an ownership equity of $50,500. All partners share equally in income. Required: a. On December 31, journalize the entry to record the admission of Gorman, who is to receive a bonus of $7,200. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. b. What are the capital balances of each partner after the admission of the new partner? c. Why are tangible assets adjusted to current market prices, prior to admitting a new partner?arrow_forward

- Preparing Partial Financial Statements and Closing Entries The partnership of Robo and Swing, CPAS, reported revenues of $215,000 and expenses of $80,000 on their year-end work sheet. Their capital balances as of January 1, 20--, were $55,000 for I. Robo and $45,000 for B. Swing. No additional investments were made during the year. As stated in their partnership agreement, after withdrawing salary allowances of $65,000 for Robo and $35,000 for Swing, the partners each withdrew their full 10% interest allowances on their January 1 capital balances. No additional withdrawals were made. Any remaining net income is to be divided on a 45-55 basis. Required: 1. Prepare the lower portion of the income statement of the partnership for the year ended December 31, 20--, showing the division of the partnership net income for the year.arrow_forwardStatement of Partnership Liquidation After the accounts are closed on February 3, prior to liquidating the partnership, the capital accounts of William Gerloff, Joshua Chu, and Courtney Jewett are $19,680, $4,960, and $21,840, respectively. Cash and noncash assets total $5,100 and $56,140, respectively. Amounts owed to creditors total $14,760. The partners share income and losses in the ratio of 2:1:1. Between February 3 and February 28, the noncash assets are sold for $32,700, the partner with the capital deficiency pays the deficiency to the partnership, and the liabilities are paid. CHART OF ACCOUNTS Gerloff, Chu, and Jewett General Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 113 Allowance for Doubtful Accounts 114 Interest Receivable 115 Notes Receivable 116 Inventory 117 Supplies 118 Office Supplies 119 Prepaid Insurance 120 Land 123 Building 124 Accumulated Depreciation-Building 125 Equipment 126 Accumulated…arrow_forwardAfter the tangible assets have been adjusted to current market prices, the capital accounts of Grayson Jackson and Harry Barge have balances of $44,920 and $60,890, respectively. Lewan Gorman is to be admitted to the partnership, contributing $32,080 cash to the partnership, for which he is to receive an ownership equity of $36,650. All partners share equally in income. Required: a. On December 31, journalize the entry to record the admission of Gorman, who is to receive a bonus of $4,570. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. b. What are the capital balances of each partner after the admission of the new partner? c. Why are tangible assets adjusted to current market prices, prior to admitting a new partner? Chart of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning - Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

What is liquidity?; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XtjS7CfUSsA;License: Standard Youtube License