Horngren's Financial & Managerial Accounting

5th Edition

ISBN: 9780133851281

Author: Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 15.6SE

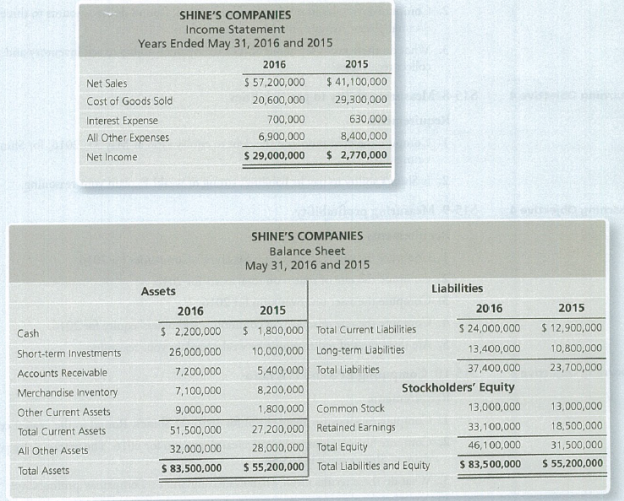

Shine's Companies, a home improvement store chain, reported the following summarized figures:

Shine's has 100,000 common shares outstanding during 2016.

Evaluating

Requirements

- 1. Compute Shine’s Companies’ current ratio at May 31, 2016 and 2015.

- 2. Did Shine’s Companies’ current ratio improve, deteriorate, or hold steady during 2016?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Use the following information for Short Exercises S15-6 through S15-10.

Accel’s Companies, a home improvement store chain, reported the following summarized figures:

Accel’s has 10,000 common shares outstanding during 2018.

Evaluating current ratio

Requirements

Compute Accel’s Companies’ current ratio at May 31, 2018 and 2017.

Did Accel’s Companies’ current ratio improve, deteriorate, or hold steady during 2018?

As of December 31, 2015, Lincolnshire Company had assets of $1,850,000 and liabilities of $570,000. During 2016, the stockholders invested an additional $100,000 and paid dividends of $60,000 from the business.

What is the net income for the company during 2016, assuming that as of December 31, 2016, assets were $1,960,000, and liabilities were $510,000?

Group of answer choices

A) $170,000

B) $130,000

C) $210,000

D) $40.000

Towson Company’s Assets and Liabilities on January 1, 2016 were $85,600 and $62,400 respectively. During the year 2016, the stockholders invested an additional $5,500, while the company generated $14,300 of revenues, and incurred $7,900 of expenses. If the company’s assets and liabilities on December 31, 2016 were $101,300 and $67,500 respectively, determine the dividends paid by the company during 2016.

Chapter 15 Solutions

Horngren's Financial & Managerial Accounting

Ch. 15 - What part of the Libertys annual report is written...Ch. 15 - Horizontal analysis of Liberty's balance sheet for...Ch. 15 - Vertical analysis of Liberty's balance sheet for...Ch. 15 - Which statement best describes Liberty's acid-test...Ch. 15 - Liberty's inventory turnover during 2017 was...Ch. 15 - Prob. 6QCCh. 15 - Prob. 7QCCh. 15 - Liberty's rate of return on common stockholders'...Ch. 15 - The company has 2,500 shares of common stock...Ch. 15 - Prob. 10AQC

Ch. 15 - What ate the three main ways to analyze financial...Ch. 15 - What is an annual report? Briefly describe the key...Ch. 15 - Prob. 3RQCh. 15 - What is trend analysis, and how does it differ...Ch. 15 - Prob. 5RQCh. 15 - Prob. 6RQCh. 15 - Prob. 7RQCh. 15 - Briefly describe the ratios that can be used to...Ch. 15 - Prob. 9RQCh. 15 - Briefly describe the ratios that can be used to...Ch. 15 - Briefly describe the ratios that can be used to...Ch. 15 - Prob. 12RQCh. 15 - Prob. 13RQCh. 15 - Prob. 14RQCh. 15 - Prob. 15RQCh. 15 - Prob. 15.1SECh. 15 - Performing horizontal analysis McDonald Corp....Ch. 15 - Calculating trend analysis Variline Corp. reported...Ch. 15 - Performing vertical analysis Hoosier Optical...Ch. 15 - Preparing common-size income statement Data for...Ch. 15 - Shine's Companies, a home improvement store chain,...Ch. 15 - Shine's Companies, a home improvement store chain,...Ch. 15 - Shine's Companies, a home improvement store chain,...Ch. 15 - Prob. 15.9SECh. 15 - Prob. 15.10SECh. 15 - Prob. 15.11SECh. 15 - Using ratios to reconstruct a balance sheet...Ch. 15 - Prob. 15.13SECh. 15 - Prob. 15.14SECh. 15 - Prob. 15.15ECh. 15 - Computing trend analysis Grand Oaks Realty's net...Ch. 15 - Prob. 15.17ECh. 15 - Prob. 15.18ECh. 15 - Prob. 15.19ECh. 15 - Prob. 15.20ECh. 15 - Analyzing the ability to pay liabilities Big Bend...Ch. 15 - Analyzing profitability Varsity, Inc.s comparative...Ch. 15 - Prob. 15.23ECh. 15 - Using ratios to reconstruct a balance sheet The...Ch. 15 - Prob. 15.25ECh. 15 - Computing earnings per share Falconi Academy...Ch. 15 - Prob. 15.27APCh. 15 - Prob. 15.28APCh. 15 - Prob. 15.29APCh. 15 - Prob. 15.30APCh. 15 - Using ratios to evaluate a stock investment...Ch. 15 - Prob. 15.32APCh. 15 - Preparing an income statement The following...Ch. 15 - Computing trend analysis and return on common...Ch. 15 - Prob. 15.35BPCh. 15 - Prob. 15.36BPCh. 15 - Determining the effects of business transactions...Ch. 15 - Prob. 15.38BPCh. 15 - Prob. 15.39BPCh. 15 - Prob. 15.40BPCh. 15 - Prob. 15.41CPCh. 15 - Lance Berkman is the controller of Saturn, a dance...Ch. 15 - Prob. 15.1CTEI

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lowes Companies Inc., a major competitor of The Home Depot in the home improvement business, operates over 1,700 stores. Lowes recently reported the following balance sheet data (in millions): a. Determine the total stockholders equity at the end of Years 2 and 1. b. Determine the ratio of liabilities to stockholders equity for Year 2 and Year 1. Round to two decimal places. c. What conclusions regarding the risk to the creditors can you draw from (b)? d. Using the balance sheet data for The Home Depot in Exercise 1-26, how does the ratio of liabilities to stockholders equity of Lowes compare to that of The Home Depot?arrow_forwardOn December 31, 2016, Cantor Company reported Total Assets of $20,000 and Total equity of $15,000. In 2017, the company’s Total Assets went up $5,000 and liabilties went up $3000. Revenue was 80,000 and expenses were 70,000. Dividends paid were 6,000. Determine the company’s balance of owners equity for 2017.arrow_forwardThe balance sheet for the company at December 31, 2015, indicated that total assets were $173,000, total liabilities were $61,000, and Common Stock had a balance of $72,000. At December 31, 2016, assets had increased by $40,000 and there had been no change in the amount of Common Stock. Additional information for 2016 included the following: Revenues $143,000 Expenses 88,000 Dividends 9,000 What were the total liabilities on December 31, 2016? Answer pleaserarrow_forward

- Toth Company had the following assets and liabilities on the dates indicated December 31 Total Assests total Liabilities 2016 400,000 260,000 2017 480,000 300,000 2018 590,000 400,000 Thot began business on January, 2016, with an investment of 100,000 from stockholders. Toth paid 15,000 in dividends for the year 2016. Instructions: From an analysis of the change in stockholders' equity during the year, compute the Net Income or Loss for: 1.- 2017, asuming stockholders made an additional investment of 50,000 and Toth paid no dividends in 2017. 2.- 2018, assuming stockholders made an aditional investment of 15,000 and Toth paid dividends of 30,000 in 2018.arrow_forwardBlossom Construction Company earned $474,000 during the year ended June 30, 2017. After paying out $225,794 in dividends, the balance went into retained earnings. If the firm's total retained earnings were $846,060 at the end of fiscal year 2017, what were the retained earnings on its balance sheet on July 1, 2016? Balance of retained earnings, July 1, 2016 $enter balance of retained earnings on July 1, 2016arrow_forwardThe financial statements for Nike, Inc. (NKE), are presented in Appendix E at the end of the text. The following additional information is available (in thousands): Accounts receivable at May 31, 2015 $3,358 Inventories at May 31, 2015 4,337 Total assets at May 31, 2015 21,597 Stockholder’s equity at May 31, 2015 12,707 Determine the following measures for the fiscal year ended May 31, 2017 and May 31, 2016. Round ratios and percentages to one decimal place. Working capital. Current ratio. Quick ratio. Accounts receivable turnover. Number of days sales in receivables. Inventory turnover. Number of days sales in inventory. Ratio of liabilities to stockholder’s equity. Asset turnover. Return on total assets, assuming interest expense is $82 million for the year ending May 31, 2017 and $33 million for the year ending May 31, 2016. Return on common…arrow_forward

- Additional information: • Weighted-average ordinary shares in 2017 were $60,000 QUESTIONS Based on the financial data above, do the following: a. Calculate the financial ratio of VENUS TRADING COMPANY in 2017 below: • Current ratio • Account receivable turnover • Inventory turnover • Asset turnover • Return on assets • Return on ordinary shareholders equity • Earnings per share • Debts to total assets ratio Provide an interpretation for each of the financial ratio calculations above. b. Based on the calculation results in point a, provide an analysis of performance finance VENUS TRADING COMPANY in 2017.arrow_forwardSunlight, Inc. had the following assets and liabilities as of September 30, 2016 Assets $60,600 Liabilities $27,500If assets increased by $4,350 and equity increased by $2,900 during October, what is the increase or decrease in liabilities of Sunlight as of October 31, 2016arrow_forwardThe Carla Vista Market, Inc., balance sheet for the fiscal year ending September 25, 2016 included the following: total current assets of $2,220 million, total assets of $6,299 million, total current liabilities of $1,249 million, and total liabilities of $2,030 million. What was the company's net working capital on September 25, 2015? (Enter answer in thousands.)arrow_forward

- During 2014, Canton Company's assets increased $97,500 and their liabilities decreased $37,300. Canton Company's stockholders' equity on December 31, 2014 was $231,500. What amount was stockholders' equity at January 1, 2014?arrow_forwardOriole Paper Mill, Inc., had, at the beginning of the current fiscal year, April 1, 2016, retained earnings of $ 322,525. During the year ended March 31, 2017, the company produced net income after taxes of $ 713,175 and paid out 41 percent of its net income as dividends. Construct a statement of retained earnings and compute the year-end balance of retained earnings. (Round answers to 2 decimal places, e.g. 15.25. List items that increase retained earnings first.) Oriole Paper Mill, Inc.Retained Earnings for 2017arrow_forwardFlynn Plastics Company reports the following data in its September 30, 2015, financial statements: Gross sales $225 000 Current assets $50 000 Long-term assets $130 000 Current liabilities $33 000 Long-term liabilities $52 000 Net income $11 250 (a) Compute the owners’ equity. (b) Compute the current ratio. (c) Compute the debt-to-equity ratio.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License