Concept explainers

Lease concepts; sales-type leases; guaranteed and unguaranteed residual value

• LO15–2, LO15–6

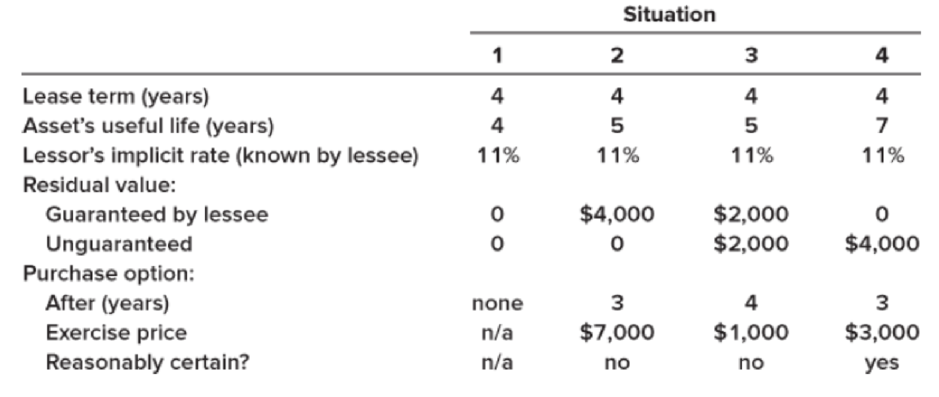

Each of the four independent situations below describes a sales-type lease in which annual lease payments of $10,000 are payable at the beginning of each year. Each is a finance lease for the lessee. Determine the following amounts at the beginning of the lease.

- A. The lessor’s:

- 1. Lease payments

- 2. Gross investment in the lease

- 3. Net investment in the lease

- B. The lessee’s:

- 4. Lease payments

- 5. Right-of-use asset

- 6. Lease liability

(A)

Lessee guaranteed residual value

The lessee guaranteed residual value of leased asset is an estimation of the commercial value of the asset at the end of lease term. The present value is considered when determining the lease classification criteria (Criteria 4). Lessee guaranteed residual value is added to lease receivable and also added to sales revenue.

To Determine: the amounts at the beginning of lease for the lessor at each independent situation.

Explanation of Solution

| Situation | ||||

| 1 | 2 | 3 | 4 | |

| Lessor | ||||

| Lease payments | (1) 40,000 | (2) 40,000 | (3) 40,000 | (4)33,000 |

| Gross investment in the lease |

(5)40,000 | (6)44,000 | (7)44,000 | (8)33,000 |

| Net investment in the lease |

(9)34,437 | (10)37,072 | (11)37,072 | (12)29,319 |

Table (1)

Working note:

The lease payment is calculated as follows:

The gross investment in lease is calculated as follows:

The net investment in the lease is calculated as follows:

(B)

Explanation of Solution

| Situation | ||||

| 1 | 2 | 3 | 4 | |

| Lessee | ||||

| Lease payments | (13) 40,000 | (14) 40,000 | (15) 40,000 | (16)33,000 |

| Right-of-use asset | (17)34,437 | (18) 34,437 | (19) 34,437 | (20)29,319 |

| Lease payable | (17) 34,437 | (18) 34,437 | (19) 34,437 | (20) 29,319 |

Table (2)

The lease payment is calculated as follows:

The amount to be recorded as right-of-use asset and lease liability is calculated as follows:

Want to see more full solutions like this?

Chapter 15 Solutions

INTERMEDIATE ACCOUNTING V2 8/17 >C<

- MN.17. On 1 July 2020 Jane Ltd (lessor) leased equipment to Austin Ltd (Lessee). The equipment had a fair value of $369,824. This was also the present value of the lease payments .The lease agreement contained the following details: Lease term 5 years Economic life 6 years Annual rental payment in arrears commencing 30June 2021 $90,000 Residual Value at end of lease term $80,000 Residual Value guaranteed by lessee 80,ooo Interest rate implicit in lease 12% Lease is cancellable with permission of lessor, Jane Ltd .Lease is classified as a finance Lease by the Lessor . Required: (a)Prepare the Lease payment schedule for Austin Ltd, Lessee, for the first two years, for the year ended 30 June 2021 and for the year ended 30 June 2022.arrow_forwardCH 21 POST-CLASS - SU21 Question 1 Ivanhoe Corporation enters into a 5-year lease of equipment on December 31, 2019, which requires 5 annual payments of $37,800 each, beginning December 31, 2019. In addition, Ivanhoe guarantees the lessor a residual value of $20,500 at the end of the lease. However, Ivanhoe believes it is probable that the expected residual value at the end of the lease term will be $10,250. The equipment has a useful life of 5 years.Prepare Ivanhoes' December 31, 2019, journal entries assuming the implicit rate of the lease is 10% and this is known to Ivanhoe. (Credit account titles are automatically indented when amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to 0 decimal places e.g. 5,275.)Click here to view factor tables. Date Account Titles and Explanation Debit Credit December 31, 2019 (To…arrow_forwardWITH SOLUTION/COMPUTATION 55. On January 1, 2019, Babson, Inc., leased two automobiles for executive use. The lease requires Babson to make five annual payments of P13,000 beginning January 1, 2019. At the end of the lease term, Babson guarantees the residual value of the automobiles will total P10,000. The interest rate implicit in the lease is 9%. Babson’s recorded lease liability on initial recognition isa. 48, 620 b. 44,070 ` c. 35,620 d. 31,070arrow_forward

- PROBLEM 10: LEASE MODIFICATION WITH EXTENSION of lease term Laze Company entered into a lease agreement for a stall space for its products on January 1, 2020. Some of the agreement in the lease contract are as follows: Annual rental payable at end of each year starting December 31, 2020 P350,000 Lease term 6 years Implicit interest rate in the lease 10% Laze Company proposed an amendment on the original lease contract on January 1, 2023, and was approved by the lessor. The amendment is to extend the lease term for another 2 years with the following additional features: Annual rental payable at end of each year starting December 31, 2023 P350,000 Implicit interest rate in the lease 11% REQUIRED:: Prepare table of amortization and journal entries for the entire lease term.arrow_forwardXI. Direct Finance Lease – Lessee (PFRS 16)Problem 13. SMC Inc. leased a machine on January 1,2011 to SM Inc. with the following pertinentinformation:Annual rental payable at the beginning of each year P500,000Lease term 5 yearsUseful life of machine 6 yearsFair value of machine on January 1,2011 2,400,000Incremental borrowing rate of lessee 14%Implicit interest rate of lessor known to lessee 12%Bargain purchase option at the end of lease term 100,000Residual value of the machine 200,000Initial direct cost incurred by lessee 300,000Prepaid bonus paid by lessee 400,000Estimated restoration cost in which lessee has contractual obligation 1,000,000Required: Based on your audit, determine the following: ____________1. Initial amount recognized as right of use asset ____________2. Initial amount recognized as leased liability ____________3. Depreciation Expense in 2011 assuming cost model ____________4. Book value of right of use asset on December 31, 2012 ____________5. Current Lease…arrow_forwardt34 Initial direct costs incurred by the lessor in an operating lease should beA. expensed in the year of incurrence by including them in the cost of goods sold or by treating them as a sellingexpense.B. deferred and recognized as reduction in the interest rate implicit in the lease.C. capitalized as part of asset cost and depreciated over the lease term.D. deferred and carried on the statement of financial position until the end of the lease term.arrow_forward

- H 22 A finance lease for 6 years has an annual payment in arrears of R24,000. The fair value of the lease at inception was R106,000. Using the sum of digits method, the liability for the lease at the end of year 2 is: Select one: a. R3 221 b. R3 700 c. R3 551 d. R3 461arrow_forwardEP#5 On January 1, 2021, Yancey, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement.(a) The agreement requires equal rental payments at the beginning each year.(b) The fair value of the building on January 1, 2021 is $6,000,000; however, the book value to Holt is $4,950,000.(c) The building has an estimated economic life of 10 years, with no residual value. Yancey depreciates similar buildings using the straight-line method.(d) At the termination of the lease, the title to the building will be transferred to the lessee.(e) Yancey’s incremental borrowing rate is 11% per year. Holt Warehouse Co. set the annual rental to insure a 10% rate of return. The implicit rate of the lessor is known by Yancey, Inc.(f) The yearly…arrow_forwardWITH SOLUTION/COMPUTATION 53. Neal Corp. entered into a nine-year lease on a warehouse on December 31, 2019. Lease payments of P52,000, which includes payments for non-lease component of P2,000 (at stand-alone selling price), are due annually, beginning on December 31, 2019, and every December 31 thereafter. Neal does not know the interest rate implicit in the lease; Neal’s incremental borrowing rate is 9%. What amount should Neal report as lease liability at December 31, 2019?a. 280,000 b. 291,200 c. 450,000 d. 468,000arrow_forward

- 9. At what amount should the lease receivable be initially recognized? ₱ 1,617,000 ₱ 278,900 ₱ 375,000 ₱ 323,400arrow_forwardWITH SOLUTION/COMPUTATION 54.Robbins, Inc., leased a machine from Ready Leasing Co. The lase requires 10 annual payments of P10,000 beginning immediately. The lease specifies an interest rate of 12% and a purchase option of P10,000 at the end of the tenth year, even though the machine’s estimated value on that date is P20,000. It is reasonably certain that Robbins will exercise the purchase option. Robbins’ incremental borrowing rate is 14%. What amount should Robbins record the right-of-use asset at the beginning of the lease term? 62,160 64,860 66,500 69,720arrow_forward23. One of the four general criteria for a capital lease is that the present value at the beginning of the lease term of the minimum lease payments equals or exceeds a. the property's fair market value. b. 90 percent of the property's fair market value. c. 75 percent of the property's fair market value. d. 50 percent of the property's fair market value.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education