EBK CORPORATE FINANCE

11th Edition

ISBN: 8220102798878

Author: Ross

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 7QP

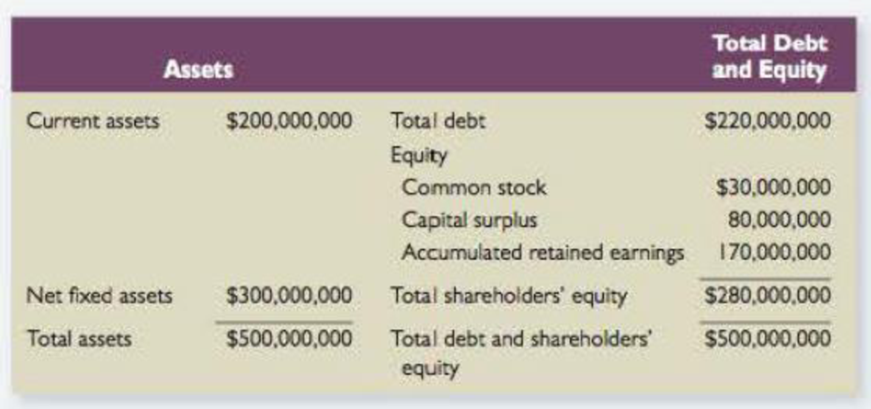

Financial Leverage Harrison, Inc., has the following book value balance sheet:

a. What is the debt-equity ratio based on book values?

b. Suppose the market value of the company’s debt is $225 million and the market value of equity is $670 million. What is the debt-equity ratio based on market values?

c. Which is more relevant, the debt-equity ratio based on book values or market values? Why?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Give typing answer with explanation and conclusion

If the company were to borrow more (or less), how would that impact the cost of debt and the WACC? Provide a specific assumed example.

Weight of Equity 76.10%

Weight of Debt 23.90%

Cost of Equity 6.98%

Cost of Debt 2.55%

Tax Rate

WACC 5.92%

A firm has a debt -to -equity of 0.69 and a market -to- book ratio of 3.0. What is the ratio of the book value of debt to the market value of equity

Queen, Inc., has a total debt ratio of .22.

a.

What is its debt-equity ratio?

b.

What is its equity multiplier?

Chapter 15 Solutions

EBK CORPORATE FINANCE

Ch. 15 - Bond Features What are the main features of a...Ch. 15 - Prob. 2CQCh. 15 - Preferred Stock Preferred stock doesnt offer a...Ch. 15 - Preferred Stock and Bond Yields The yields on...Ch. 15 - Prob. 5CQCh. 15 - Call Provisions A company is contemplating a...Ch. 15 - Prob. 7CQCh. 15 - Preferred Stock Do you think preferred stock is...Ch. 15 - Long-Term Financing As was mentioned in the...Ch. 15 - Internal versus External Financing What is the...

Ch. 15 - Prob. 11CQCh. 15 - Classes of Stock Several publicly traded companies...Ch. 15 - Callable Bonds Do you agree or disagree with the...Ch. 15 - Bond Prices If interest rates fall, will the price...Ch. 15 - Sinking Funds Sinking funds have both positive and...Ch. 15 - Prob. 1QPCh. 15 - Prob. 2QPCh. 15 - Prob. 3QPCh. 15 - Prob. 4QPCh. 15 - Financial Leverage Kiedis, Corp., has...Ch. 15 - Financial Leverage Frusciante, Inc., has 290,000...Ch. 15 - Financial Leverage Harrison, Inc., has the...Ch. 15 - Valuing Callable Bonds KJC, Inc., plans to issue 5...Ch. 15 - Valuing Callable Bonds New Business Ventures,...Ch. 15 - Valuing Callable Bonds Bowdeen Manufacturing...Ch. 15 - Prob. 11QPCh. 15 - Prob. 12QP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are analyzing the leverage of two firms and you note the following (all values in millions of dollars): a. What is the market debt-to-equity ratio of each firm? b. What is the book debt-to-equity ratio of each firm? c. What is the interest coverage ratio of each firm? d. Which firm will have more difficulty meeting its debt obligations? a. What is the market debt-to-equity ratio of each firm? The market debt-to-equity ratio for Firm A is enter your response here . (Round to two decimal places.) Part 2 The market debt-to-equity ratio for Firm B is enter your response here . (Round to two decimal places.) Part 3 b. What is the book debt-to-equity ratio of each firm? The book debt-to-equity ratio for Firm A is enter your response here . (Round to two decimal places.) The book debt-to-equity ratio for Firm B is enter your response here . (Round to two decimal places.) Part 5 c. What is the interest coverage ratio of each firm? The interest coverage ratio for Firm A is enter…arrow_forwardWhich of the following is true of a leverage ratio? It is a measure of the extent to which a company uses debt compared to equity. O It is a measure of whether the company will have sufficient cash to pay its bills over the following year. O It is a comparison of the company's net income to its stockholder's equity. O It is a measure of the company's ability to be profitable over the coming year. O It is a measure of the rate at which the company "turns over" its inventory.arrow_forwardAssume you are given the following relationships for the Haslam Corporation: Calculate Haslam’s profit margin and liabilities-to-assets ratio. Suppose half its liabilities are in the form of debt. Calculate the debt-to-assets ratio.arrow_forward

- When analyzing a companys debt to equity ratio, lithe ratio has a value that is greater than one, then the company has: a. equal amounts of debt and equity. c. less debt than equity. b. more debt than equity. d. none of these.arrow_forwardThe following is selected financial data from Block Industries: How much does Block Industries have in current liabilities? A. $19,800 B. $18,300 C. $12,300 D. $25,800arrow_forwardThe cost of equity is _______. A. the interest associated with debt B. the rate of return required by investors to incentivize them to invest in a company C. the weighted average cost of capital D. equal to the amount of asset turnoverarrow_forward

- discuss the meaning of liquidity and solvency as it applies to a company's liquidity and credit-risk. It is often thought that the higher the company's current ratio and/or the lower the debt-to-asset ratio, the better the company's financial condition. Do you agree with these statements? Select from industry examples noted below to support/explain your point of view Industry Company Current Ratio Debt-Asset Ratio Oil & Gas Industry Average 2020 1.08 .52 Exxon .80 .51 Marathon Oil 1.32 .41 BP America 11.01 .66arrow_forwardYou have the following information on a company on which to base your calculations and discussion: Cost of equity capital (rE) = 18.55% Cost of debt (rD) = 7.85% Expected market premium (rM –rF) = 8.35% Risk-free rate (rF) = 5.95% Inflation = 0% Corporate tax rate (TC) = 35% Current long-term and target debt-equity ratio (D:E) = 2:5 a. What are the equity beta (bE) and debt beta (bD) of the firm described above?[Hint: Assume that the above costs of capital have been generated by an appropriate equilibrium model.] b. What is the weighted-average cost of capital (WACC) for this firm at the current debt-equity ratio? c. What would the company’s cost of equity capital become if you unlevered the capital structure (i.e. reduced gearing until there is no debt)arrow_forwardYou calculate that a firm has a total asset turnover of 0.12 and a profit margin of 0.92. If the firm reports that its ROE for the same time period is equal to 0.26, what must be the firms debt-to-equity ratio? Answer as a decimal (not percentage) to two decimal places.arrow_forward

- Assume Lavender Corporation has a market value of $4 billion of equity and a market value of $19.8 billion of debt. What are the weights in equity and debt that are used for calculating the WACC?arrow_forwardCalculate the Weighted Average Cost of Capital (WACC) for McCormick and Company using the formula WACC = (WD x RD x (1-T)) + (WS x Rs) Note that -- Rs = the cost of equity Rd = the cost of debt T = the tax rate WD = Value of debt / (Value of debt plus value of equity) WS = Value of equity / (Value of debt plus value of equity) **Note that the weight of debt plus the weight of equity must total to 100%, as there are only two components in the capital structure.** In order to estimate the weights of debt and equity in the total capital structure, the CFO suggests using the book value of debt and the market value of equity. To determine the book value of debt, use data from the year end November 2019 McCormick 10-K. Look on the Balance sheet and add the following -- Short term borrowings, Current portion of long term debt, and Long term debt. To determine the market value of equity, use the following data: On March 17, 2020 the market value of equity (or "Market Cap")…arrow_forwardAssume Bismuth Electronics has a book value of $6 billion of equity and a face value of $19.7 billion of debt. The market values of equity and debt are $2.5 billion and $18.5 billion. A Wall Street financial analyst determines values of equity and debt as $3 billion and $20 billion. Which of the following values should be used for calculating the firm's WACC? A) $6 billion of equity and $19.7 billion of debt B) $2.5 billion of equity and $20 billion of debt C) $3 billion of equity and $19.9 billion of debt D) $2.5 billion of equity and $18.5 billion of debtarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License