SURVEY OF ACCOUNTING 360DAY CONNECT CAR

5th Edition

ISBN: 9781260591811

Author: Edmonds

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 13E

Exercise 10-13A Determining the payback period with uneven

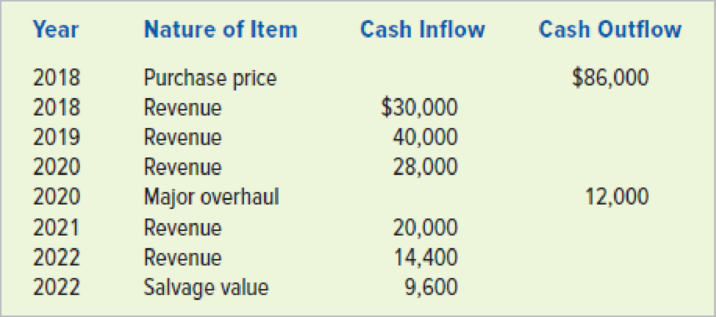

Currie Company has an opportunity to purchase a forklift to use in its heavy equipment rental business. The forklift would be leased on an annual basis during its first two years of operation. Thereafter, it would be leased to the general public on demand. Currie would sell it at the end of the fifth year of its useful life. The expected

Required

- a. Determine the payback period using the accumulated cash flows approach.

- b. Determine the payback period using the average cash flows approach. Round your computation to one decimal point.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Exercise 9-16

The Blue Spruce Company is planning to purchase $496,800 of equipment with an estimated seven-year life and no estimated salvage value. The company has projected the following annual cash flows for the investment.

Year

Projected Cash Flows

1

$202,000

2

152,000

3

105,000

4

50,400

5

50,400

6

42,500

7

42,500

Total

$644,800

(a) Calculate the payback period for the proposed equipment purchase. Assume that all cash flows occur evenly throughout the year.

Payback period

years and

months.

(b) If Blue Spruce requires a payback period of three years or less, should the company make this investment?

The company

shouldshould not

make this investment.

Problem 9-2 Relevant Cash Flows [LO 1]

Winnebagel Corporation currently sells 29,900 motor homes per year at $82,500 each and 8,900 luxury motor coaches per year at $124,500 each. The company wants to introduce a new portable camper to fill out its product line; it hopes to sell 24,900 of these campers per year at $28,500 each. An independent consultant has determined that if the company introduces the new campers, it should boost the sales of its existing motor homes by 4,500 units per year and reduce the sales of its motor coaches by 1,040 units per year. What is the amount to use as the annual sales figure when evaluating this project?

11. Uneven cash flows

A series of cash flows may not always necessarily be an annuity. Cash flows can also be uneven and variable in amount, but the concept of the time value of money will continue to apply.

Consider the following case:

The Purple Lion Beverage Company expects the following cash flows from its manufacturing plant in Palau over the next six years:

Annual Cash Flows

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

$400,000

$20,000

$180,000

$300,000

$350,000

$725,000

A. The CFO of the company believes that an appropriate annual interest rate on this investment is 9%. What is the present value of this uneven cash flow stream, rounded to the nearest whole dollar?

$1,975,000

$1,395,097

$1,775,000

$600,000

B. Identify whether the situations described in the following table are examples of uneven cash flows or annuity payments:

Description

Uneven Cash Flows

Annuity Payments

Debbie has…

Chapter 16 Solutions

SURVEY OF ACCOUNTING 360DAY CONNECT CAR

Ch. 16 - Prob. 1QCh. 16 - Prob. 2QCh. 16 - Prob. 3QCh. 16 - 4. Define the term return on investment. How is...Ch. 16 - Prob. 5QCh. 16 - Prob. 6QCh. 16 - Prob. 7QCh. 16 - Prob. 8QCh. 16 - Prob. 9QCh. 16 - Prob. 10Q

Ch. 16 - 11. Maria Espinosa borrowed 15,000 from the bank...Ch. 16 - Prob. 12QCh. 16 - 13. What criteria determine whether a project is...Ch. 16 - Prob. 14QCh. 16 - Prob. 15QCh. 16 - Prob. 16QCh. 16 - 17. What is the relationship between desired rate...Ch. 16 - Prob. 18QCh. 16 - Prob. 19QCh. 16 - Prob. 20QCh. 16 - Prob. 21QCh. 16 - Prob. 22QCh. 16 - Prob. 23QCh. 16 - Exercise 10-1A Identifying cash inflows and...Ch. 16 - Exercise 10-2A Determining the present value of a...Ch. 16 - Prob. 3ECh. 16 - Prob. 4ECh. 16 - Exercise 10-5A Determining net present value...Ch. 16 - Exercise 10-6A Determining net present value Aaron...Ch. 16 - Exercise 10-7A Using the present value index Rolla...Ch. 16 - Exercise 10-8A Determining the cash flow annuity...Ch. 16 - Prob. 9ECh. 16 - Exercise 10-10A Using the internal rate of return...Ch. 16 - Prob. 11ECh. 16 - Prob. 12ECh. 16 - Exercise 10-13A Determining the payback period...Ch. 16 - Prob. 14ECh. 16 - Prob. 15ECh. 16 - Prob. 16PCh. 16 - Prob. 17PCh. 16 - Problem 10-18A Postaudit evaluation Brett Collins...Ch. 16 - Problem 10-19A Using net present value and...Ch. 16 - Problem 10-20A Using the payback period and...Ch. 16 - Problem 10-21A Using net present value and payback...Ch. 16 - Problem 10-22A Effects of straight-line versus...Ch. 16 - Problem 10-23A Comparing internal rate of return...Ch. 16 - Prob. 1ATCCh. 16 - ATC 10-4 Writing Assignment Limitations of capital...Ch. 16 - Prob. 5ATC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 2 - UNIT 2: CAPITAL BUDGETTING PROCESS UNIT 3: CASH FLOW ESTIMATION Adler is replacing its old packing line with a more efficient line. The old line was being depreciated on a straight-line basis at a rate of $20,000 per year. The old machine has a current book value of $100,000. The new line, which costs $910,000, will be depreciated on a 10-year MACRS schedule. The more efficient operation is expected to increase revenues by $50,000 per year and reduce annual operating costs by $80,000. a) Compute the net cash flows for Adler in year Assume Adler has a marginal tax rate of 40%. Use the rounded MACRS schedule listed below: (10-Year Depreciation Schedule: 10%, 18%, 14%, 12%, 9%, 7%, 7%, 7%, 7%, 6%, 3%) Kaneb is evaluating two alternative pipeline welders. Welder A costs $310,000, has a 7-year life, and is expected to generate net cash inflows of $78,000 in each of the 7 years. Welder B costs $320,000, has a 5-year life, and is expected to generate annual net…arrow_forwardProblem 6-26 Project Analysis and Inflation Shinoda Manufacturing, Incorporated, has been considering the purchase of a new manufacturing facility for $630,000. The facility is to be fully depreciated on a straightline basis over seven years. It is expected to have no resale value at that time. Operating revenues from the facility are expected to be $455,000, in nominal terms, at the end of the first year. The revenues are expected to increase at the inflation rate of 3 percent. Production costs at the end of the first year will be $300,000, in nominal terms, and they are expected to increase at 4 percent per year. The real discount rate is 6 percent. The corporate tax rate is 24 percent. Calculate the NPV of the project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPVarrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License