Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 15E

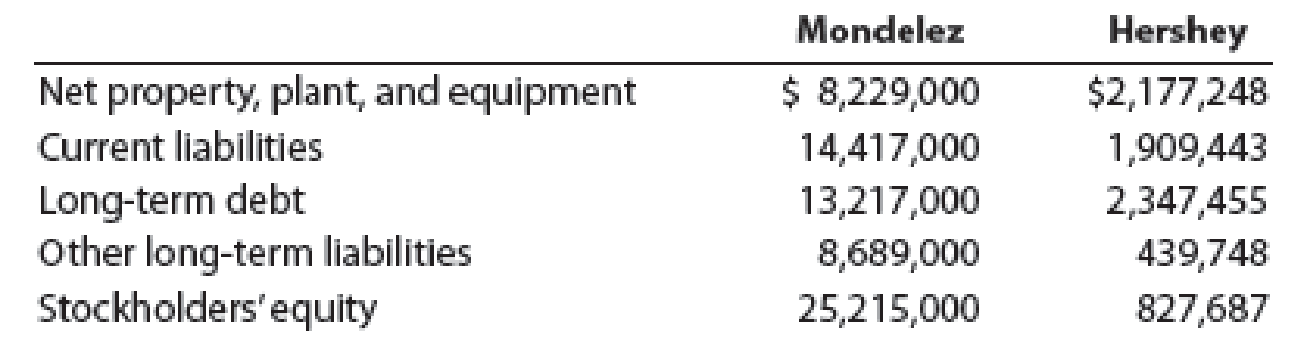

Recent balance sheet information for two companies in the food industry, Mondelez International, Inc. (MDLZ), and The Hershey Company (HSY), is as follows (in thousands):

- a. Determine the ratio of liabilities to stockholders’ equity for both companies. Round to one decimal place.

- b. Determine the ratio of fixed assets to long-term liabilities for both companies. Round to one decimal place.

- C. Interpret the ratio differences between the two companies.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Recent balance sheet information for two companies in the food industry, Santa Fe Company and Madrid Company, is as follows (in thousands):

Santa Fe

Madrid

Net property, plant, and equipment

$625,380

$573,480

Current liabilities

289,737

492,570

Long-term debt

661,116

458,784

Other long-term liabilities

232,284

178,416

Stockholders' equity

288,570

251,060

a. Determine the ratio of liabilities to stockholders' equity for both companies. Round to one decimal place.

Santa Fe

Madrid

b. Determine the ratio of fixed assets to long-term liabilities for both companies. Round to one decimal place.

Santa Fe

Madrid

Recent balance sheet information for two companies in the food industry, Santa Fe Company and Madrid Company, is as follows (in thousands):

Santa Fe

Madrid

Net property, plant, and equipment

$565,680

$773,920

Current liabilities

305,732

747,820

Long-term debt

697,672

696,528

Other long-term liabilities

245,128

270,872

Stockholders' equity

304,520

381,160

a. Determine the ratio of liabilities to stockholders' equity for both companies. Round your answers to one decimal place.

Santa Fe

fill in the blank 1

Madrid

fill in the blank 2

b. Determine the ratio of fixed assets to long-term liabilities for both companies. Round your answers to one decimal place.

Santa Fe

fill in the blank 3

Madrid

fill in the blank 4

The following financial information is taken from the balance sheets of the Peter Company and the Paul Company:

Peter

Paul

Current assets

$200,000

$50,000

Current liabilities

40,000

20,000

Calculate the current ratio for each company.Round answers to two decimal places, when appropriate.Peter Company AnswerPaul Company Answer

Which firm has a higher level of liquidity?

Chapter 16 Solutions

Managerial Accounting

Ch. 16 - Prob. 1DQCh. 16 - What is the advantage of using comparative...Ch. 16 - Prob. 3DQCh. 16 - Prob. 4DQCh. 16 - Prob. 5DQCh. 16 - What do the following data, taken from a...Ch. 16 - Prob. 7DQCh. 16 - Prob. 8DQCh. 16 - The dividend yield of Suburban Propane Partners,...Ch. 16 - Prob. 10DQ

Ch. 16 - Prob. 1BECh. 16 - Prob. 2BECh. 16 - The following items are reported on a companys...Ch. 16 - Prob. 4BECh. 16 - Prob. 5BECh. 16 - Prob. 6BECh. 16 - Prob. 7BECh. 16 - Prob. 8BECh. 16 - Prob. 9BECh. 16 - Prob. 10BECh. 16 - Prob. 11BECh. 16 - Prob. 1ECh. 16 - The following comparative income statement (in...Ch. 16 - Prob. 3ECh. 16 - Prob. 4ECh. 16 - Prob. 5ECh. 16 - The following data were taken from the balance...Ch. 16 - PepsiCo, Inc. (PEP), the parent company of...Ch. 16 - Current position analysis The bond indenture for...Ch. 16 - Prob. 9ECh. 16 - Accounts receivable analysis Xavier Stores Company...Ch. 16 - Prob. 11ECh. 16 - Prob. 12ECh. 16 - Ratio of liabilities to stockholders equity and...Ch. 16 - Hasbro, Inc. (HAS), and Mattel, Inc. (MAT), are...Ch. 16 - Recent balance sheet information for two companies...Ch. 16 - Prob. 16ECh. 16 - Prob. 17ECh. 16 - Prob. 18ECh. 16 - Prob. 19ECh. 16 - Prob. 20ECh. 16 - Prob. 21ECh. 16 - Prob. 22ECh. 16 - Prob. 23ECh. 16 - Prob. 24ECh. 16 - Prob. 25ECh. 16 - Comprehensive income Anson Industries, Inc.,...Ch. 16 - Prob. 1PACh. 16 - Prob. 2PACh. 16 - Prob. 3PACh. 16 - Measures of liquidity, solvency, and profitability...Ch. 16 - Prob. 5PACh. 16 - Prob. 1PBCh. 16 - Prob. 2PBCh. 16 - Prob. 3PBCh. 16 - Prob. 4PBCh. 16 - Prob. 5PBCh. 16 - Prob. 1MADCh. 16 - Prob. 2MADCh. 16 - Deere Company (DE) manufactures and distributes...Ch. 16 - Marriott International, Inc. (MAR), and Hyatt...Ch. 16 - Prob. 1TIFCh. 16 - Real-world annual report The financial statements...Ch. 16 - Prob. 3TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Grammatico Company has just completed its third year of operations. The income statement is as follows: Selected information from the balance sheet is as follows: Required: Note: Round answers to two decimal places. 1. Compute the times-interest-earned ratio. 2. Compute the debt ratio. 3. CONCEPTUAL CONNECTION Assume that the lower quartile, median, and upper quartile values for debt and times-interest-earned ratios in Grammaticos industry are as follows: How does Grammatico compare with the industrial norms? Does it have too much debt?arrow_forwardLowes Companies Inc., a major competitor of The Home Depot in the home improvement business, operates over 1,700 stores. Lowes recently reported the following balance sheet data (in millions): a. Determine the total stockholders equity at the end of Years 2 and 1. b. Determine the ratio of liabilities to stockholders equity for Year 2 and Year 1. Round to two decimal places. c. What conclusions regarding the risk to the creditors can you draw from (b)? d. Using the balance sheet data for The Home Depot in Exercise 1-26, how does the ratio of liabilities to stockholders equity of Lowes compare to that of The Home Depot?arrow_forwardThe average liabilities, average stockholders' equity, and average total assets are as follows: 1. Determine the following ratios for both companies, rounding ratios and percentagesto one decimal place: a. Return on total assets b. Return on stockholders' equity c. Times interest earned d. Ratio of total liabilities to stockholders' equity 2. Based on the information in (1), analyze and compare the two companies'solvency and profitability. Comprehensive profitability and solvency analysis Marriott International, Inc., and Hyatt Hotels Corporation are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions): Balance sheet information is as follows:arrow_forward

- Comparing Two Companies in the Same Industry: Chipotle and Panera Bread Refer to the financial information for Chipotle and Panera Bread reproduced at the back of the book and answer the following questions. What was the total revenue for each company for the most recent year? By what percentage did each companys revenue increase or decrease from its total amount in the prior year? What was each companys net income for the most recent year? By what percentage did each companys net income increase or decrease from its net income for the prior year? What was the total asset balance for each company at the end of its most recent year? Among its assets, what was the largest asset each company reported on its year-end balance sheet? Did either company pay its stockholders any dividends during the most recent year? Explain how you can tell.arrow_forwardThe following data (in millions) were taken from the financial statements of Costco Wholesale Corporation: a. For Costco, determine the amount of change in millions and the percent of change (round to one decimal place) from the prior year to the recent year for: 1. Revenue 2. Operating expenses 3. Operating income b. Comment on the results of your horizontal analysis in part (a). c. Based upon Exercise 2-23, compare and comment on the operating results of Target and Costco for the recent year.arrow_forwardHasbro, Inc. and Mattel, Inc. are the two largest toy companies in North America. Condensed liabilities and stockholders’ equity from a recent balance sheet are shown for each company as follows (in thousands): Please see the attachment for details: a. Determine the ratio of liabilities to stockholders’ equity for both companies. Round toone decimal place.b. Determine the times interest earned ratio for both companies. Round to one decimalplace.c. Interpret the ratio differences between the two companies.arrow_forward

- Recent balance sheet information for two companies in the food industry, Mondelez International, Inc. (MDLZ), and The Hershey Company (HSY), is as follows (in thousands): Mondelez Hershey Net property, plant, and equipment $8,229,000 $2,177,248 Current liabilities 14,417,000 1,909,443 Long-term debt 13,217,000 2,347,455 Other long-term liabilities 8,689,000 439,748 Stockholders' equity 25,215,000 827,687 a. Determine the ratio of liabilities to stockholders' equity for both companies. Round to one decimal place. Mondelez fill in the blank 1 Hershey fill in the blank 2 b. Determine the ratio of fixed assets to long-term liabilities for both companies. Round to one decimal place. Mondelez fill in the blank 3 Hershey fill in the blank 4arrow_forwardRecent balance sheet information for two companies in the food industry, Mondelez International, Inc. and The Hershey Company, is as follows (in thousands): Mondelez HersheyNet property, plant, and equipment $10,010,000 $1,674,071Current liabilities 14,873,000 1,471,110Long-term debt 15,574,000 1,530,967Other long-term liabilities 12,816,000 716,013Stockholders’ equity 32,215,000 1,036,749a. Determine the ratio of liabilities to stockholders’ equity for both companies. Round to one decimal place.b. Determine the ratio of fixed assets to long-term liabilities for both companies. Round to one decimal place.c. Interpret the ratio differences between the two companies.arrow_forwardMarriott International, Inc., and Hyatt Hotels Corporation are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions):Please see the attachment for details:1. Determine the following ratios for both companies, rounding ratios and percentages to one decimal place:a. Return on total assetsb. Return on stockholders’ equityc. Times interest earnedd. Ratio of total liabilities to stockholders’ equity2. Based on the information in (1), analyze and compare the two companies’ solvency and profitability.arrow_forward

- Certain financial ratios for The Gap for its most recent year are given below, along with the average ratios for its industry. Based on those ratios, answer the following. 1) Does The Gap seem to prefer to finance its assets with debt or with equity? How can you tell? What percent of its assets are funded with debt? What percent of its assets are funded with equity? 2) A supplier to The Gap sells merchandise to The Gap and asks to be paid within 60 days. While any of The Gap’s financial ratios might be of interest to the supplier, which of the ratios listed below do you think would likely be the most important one to the supplier? Why? 3) Which of the ratios presented suggest that, compared to its industry, The Gap may have a problem controlling its operating expenses? How can you tell? Your answer should clearly indicate that you understand why the ratio that you chose answers this question. Here is the data for The Gap and its industry. Financial Ratios…arrow_forwardThe following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place.b. What conclusions can be drawn from these data as to the company's ability to meet its currently maturing debts?arrow_forwardthe following information was drawn from the balance sheets of the kansas and montana companies: current assets: kansas-54,000 montana- 76,000 current liabilites: kansas-27000 montana-30400 a. compute the current ration for each company. b. which company has the greater likelihood of being able to pay its bills? c. assume that both companies have the same amount of total assets. Speculate as to which company would produce the higher return on assets ratio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License