Intermediate Accounting

9th Edition

ISBN: 9781259722660

Author: J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 16.8E

Calculate income tax amounts under various circumstances

• LO16–1, LO16–2

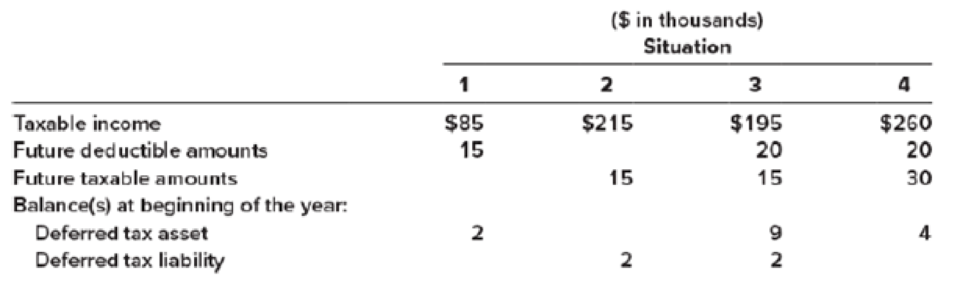

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:

The enacted tax rate is 40%.

Required:

For each situation, determine the:

a. Income tax payable currently

b.

c. Deferred tax asset—change (dr) cr

d.

e. Deferred tax liability—change (dr) cr

f. Income tax expense

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Question No.4

a) The U.S. currently has seven federal income tax brackets, with rates of 10%, 12%, 22%, 24%, 32%, 35% and 37%. If you fall into the 37% bracket, that doesn’t mean that the entirety of your taxable income will be subject to a 37% tax. Instead, 37% is your top marginal tax rate.

FEDERAL TAX BRACKETS 2018 – 2019

Tax rate (%)

$0 – $9,525

10

$9,526 – $38,700

12

$38,701 – $82,500

22

$82,501 – $157,500

24

$157,501 – $200,000

32

$200,001 – $500,000

35

$500,001+

37

i) Create a Mathematical Model that represents the aforementioned information to calculate the annual income tax.

ii) How much annual income tax you will have to pay if your monthly taxable income is $ 40,000

Rubrics

Uses information appropriately:

Applies appropriate procedures:

Answers the problem:

Rr.12.

1.) Calculate taxable income for 20X2

answer: 139,000

2.) Calculate taxes payable for 20X2

answer: 20,850

3.) Determine the current deferred tax liability at 12/31/X2

answer: 37200

4.) calculate total income tax expense for 20X2

answer: 58,050

5.) Compute net income after taxes for 20X2

answer: 328,950

6.) Calculate taxable income for 20X3

answer: 213,027

7.) The entry required at the end of 20X3 requires

answer: debit DTL for 26,040

8.) Compute net income after taxes for 20X3

answer: ???

9.) Calculate taxable income for 20X4

answer: 196,800

10.) Compute net income after taxes for 20X4

answer: ???

Using the information above, solve for parts 8 and 10

Ma3.

All final answers, unless otherwise indicated, have been rounded to the nearest $10. Also, assume that each question is independent of any other question. please answer questions using tax rules in effect for the year 2021, but ignoring temporary Covid-10 related changes.

8. During the year, Dan Davis, a single taxpayer, pays $2,200 of interest on a qualified student loan. Assume that Dan has adjusted gross income of $65,000. What student loan interest deduction may Dan claim on his Form 1040 for the year?

A. $2,500

B. 2,200

C. 1,100

D. 0

E. None of the above

9. A contribution made to which of the listed entities is not deductible?

A. Boy Scouts of America

B. Oxford University, England

C. Virginia Commonwealth University

D. Society for the Prevention of Cruelty to Animals

E. All of the above are deductible

Chapter 16 Solutions

Intermediate Accounting

Ch. 16 - Prob. 16.1QCh. 16 - A deferred tax liability (or asset) is described...Ch. 16 - Prob. 16.3QCh. 16 - Prob. 16.4QCh. 16 - Temporary differences result in future taxable or...Ch. 16 - Identify three examples of differences with no...Ch. 16 - The income tax rate for Hudson Refinery has been...Ch. 16 - Suppose a tax reform bill is enacted that causes...Ch. 16 - A net operating loss occurs when tax-deductible...Ch. 16 - Prob. 16.10Q

Ch. 16 - Additional disclosures are required pertaining to...Ch. 16 - Additional disclosures are required pertaining to...Ch. 16 - Prob. 16.13QCh. 16 - Prob. 16.14QCh. 16 - IFRS and U.S. GAAP follow similar approaches to...Ch. 16 - Temporary difference LO161 A company reports...Ch. 16 - Prob. 16.2BECh. 16 - Temporary difference LO162 A company reports...Ch. 16 - Prob. 16.4BECh. 16 - Temporary difference; income tax payable given ...Ch. 16 - Valuation allowance LO162, LO163 At the end of...Ch. 16 - Valuation allowance LO162, LO163 VeriFone Systems...Ch. 16 - Temporary and permanent differences; determine...Ch. 16 - Calculate taxable income LO161, LO164 Shannon...Ch. 16 - Multiple tax rates LO165 J-Matt, Inc., had pretax...Ch. 16 - Change in tax rate LO165 Superior Developers...Ch. 16 - Net operating loss carryforward LO167 During its...Ch. 16 - Net operating loss carryback LO167 AirParts...Ch. 16 - Tax uncertainty LO169 First Bank has some...Ch. 16 - Intraperiod tax allocation LO1610 Southeast...Ch. 16 - Temporary difference; taxable income given LO161...Ch. 16 - Prob. 16.2ECh. 16 - Prob. 16.3ECh. 16 - Prob. 16.4ECh. 16 - Prob. 16.5ECh. 16 - Prob. 16.6ECh. 16 - Identify future taxable amounts and future...Ch. 16 - Calculate income tax amounts under various...Ch. 16 - Determine taxable income LO161, LO162 Eight...Ch. 16 - Prob. 16.10ECh. 16 - Deferred tax asset; income tax payable given;...Ch. 16 - Prob. 16.12ECh. 16 - Prob. 16.13ECh. 16 - Multiple differences LO164, LO166 For the year...Ch. 16 - Multiple t ax rates LO162, LO165 Allmond...Ch. 16 - Prob. 16.16ECh. 16 - Deferred taxes; change in tax rates LO161, LO165...Ch. 16 - Multiple temporary differences; record income...Ch. 16 - Multiple temporary differences; record income...Ch. 16 - Net operating loss carryforward LO167 During...Ch. 16 - Net operating loss carryback LO167 Wynn Sheet...Ch. 16 - Net operating loss carryback and carryforward ...Ch. 16 - Identifying income tax deferrals LO161, LO162,...Ch. 16 - Multiple temporary differences; balance sheet...Ch. 16 - Multiple tax rates LO161, LO164, LO165 Case...Ch. 16 - Prob. 16.26ECh. 16 - Balance sheet classification LO168 As of December...Ch. 16 - Concepts; terminology LO161 through LO168 Listed...Ch. 16 - Tax credit; uncertainty regarding sustainability ...Ch. 16 - Intraperiod tax allocation LO1610 The following...Ch. 16 - FASB codification research LO165, LO168, LO1610...Ch. 16 - Prob. 16.1PCh. 16 - Prob. 16.2PCh. 16 - Prob. 16.3PCh. 16 - Prob. 16.4PCh. 16 - Change in tax rate; record taxes for four years ...Ch. 16 - Multiple differences; temporary difference yet to...Ch. 16 - Multiple differences; calculate taxable income;...Ch. 16 - Multiple differences; taxable income given; two...Ch. 16 - Determine deferred tax assets and liabilities ...Ch. 16 - Prob. 16.10PCh. 16 - Prob. 16.11PCh. 16 - Prob. 16.12PCh. 16 - Prob. 16.13PCh. 16 - Prob. 16.1BYPCh. 16 - Prob. 16.2BYPCh. 16 - Integrating Case 163 Tax effects of accounting...Ch. 16 - Communication Case 164 Deferred taxes; changing...Ch. 16 - Prob. 16.5BYPCh. 16 - Research Case 166 Researching the way tax...Ch. 16 - Analysis Case 167 Reporting deferred taxes; Ford...Ch. 16 - Prob. 16.8BYPCh. 16 - Judgment Case 169 Analyzing the effect of deferred...Ch. 16 - Prob. 16.12BYPCh. 16 - Target Case LO16-1, LO16-2, LO16-4, LO16-8,...Ch. 16 - Prob. 1CCIFRS

Additional Business Textbook Solutions

Find more solutions based on key concepts

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (4th Edition)

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

The managers of an organization are responsible for performing several broad functions. They are ______________...

Principles of Accounting Volume 2

How is activity-based costing useful for pricing decisions?

Cost Accounting (15th Edition)

What are assets limited as to use and how do they differ from restricted assets?

Accounting for Governmental & Nonprofit Entities

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (4th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- H6. 13 A claim for refund is a request for reimbursement of the overpayment of taxes paid in previous years. To be valid, a claim for refund must include which of the following features? Select one: a. The claim for refund can be made by telephone or in writing. b. The claim for refund must be signed only by the taxpayer c. The claim for refund must be filed within the set statute of limitations d. All of the above are correct Please explain also wrong options and explain with detailsarrow_forward54. In relation to transaction #1, How much is the capital gains tax due, if any? A. PO C. P300,000 B. P360,000. D. P450,000arrow_forwardQuestion 2a) Income tax is calculated as follows;Taxable Salary Rate of Tax (GH¢)First 1000 0. 05Next 1,000 0.10Next 3,000 0.25Next 4,000 0.40Remainder 0.60Calculate the tax on a taxable salary of;i. GH¢ 2,450ii. GH¢ 10,500 with GH¢ 450 as none taxable allowance. b) A card is picked at random from cards numbered from 1 to 20. Find the probability that the number on the card isi. divisible by 5ii. a prime number c) Find the following probabilities; P(0 < z < 2.32)arrow_forward

- Question1.gif” alt=”Question 1 unsaved”>The Federal estate and gift taxes areexamples of progressive taxes.Question 1 options: True False SaveQuestion 2.gif” alt=”Question 2 unsaved”>The FICA tax (Medicare component) onwages is progressive since the tax due increases as wagesincrease.Question 2 options: True False SaveQuestion 3.gif” alt=”Question 3 unsaved”>Some states use their state incometax return as a means of collecting unpaid sales and use taxes.Question 3 options: True False SaveQuestion 4.gif” alt=”Question 4 unsaved”>No state has offered an income taxamnesty program more than once.Question 4 options: True False SaveQuestion 5.gif” alt=”Question 5 unsaved”>The ad valorem taxon personal use personalty is more often avoided by taxpayers than the advalorem tax on business use personalty.Question 5 options: True False Save Question 6.gif” alt=”Question 6 unsaved”>A VAT (value added tax):Question 6 options: Is regressivein its effect. Has not proved popular…arrow_forward16. Use the graduated tax table below if applicable: GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 A taxpayer made available the following financial information: Gross receipts - Php 10,000,000 Cost of service – Php 6,000,000 Expenses: Depreciation expense – Php 200,000 Miscellaneous expenses – Php 10,000 Office supplies…arrow_forwardRequired information Problem 8-50 (LO 8-1) (Static) [The following information applies to the questions displayed below.] Lacy is a single taxpayer. In 2021, her taxable income is $42,000. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. Her $42,000 of taxable income includes $5,000 of qualified dividends.arrow_forward

- Ma3. Outline the differences between IRC Section 311 and 336/337 for non-liquidating and liquidating distributions. In your answers, include the consequences for the tax attributes (E&P, recapture, installment sales)arrow_forward13. Instructions Use the graduated tax table below if applicable: GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 A taxpayer registered in 2020 made available the following financial information for TY2021: Balance Sheet: Asset - Php 500,000 Liability - Php 100,000 Stockholders' Equity - Php 400,000 Income Statement: Gross sales - Php 10,000,000 Cost of sales – Php 8,000,000 Operating Expenses - Php 5,000,000 How much is the income tax due under CREATE Law if the taxpayer is a domestic corporation? Group of answer choices Php 300,000 Php 600,000 Php 200,000…arrow_forward5. What amount should be reported as current tax expense for the current year? ₱ 1,050,000 ₱ 1,950,000 ₱ 1,350,000 ₱ 2,250,000arrow_forward

- 14. Instructions Use the graduated tax table below if applicable: GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor was employed by ABC Corp. from April 1, 2020. He receives basic pay of Php 20,000 per month as compensation. During annualization of compensation in November, it was determined that he will also receive the following: Additional compensation allowance – Php 5,000 Cash gift – Php 5,000 Christmas bonus – Php 5,000 Loyalty award – Php 5,000 Performance bonus/productivity incentive – Php 10,000 How much is the 13th month pay? Group of answer…arrow_forwardV4. 5. For each the Regressive, Proportional, and Progressive Income Tax Systems, write a paragraph documenting the advantages another paragraph documenting the disadvantages of each system. Provide 3 reasons or arguments for each "pro" and "con" paragrapharrow_forwardReview Examples 50 and 52 (Section 1231 Computations) in the text. In both examples, the taxpayer's AGI is $129,400 even though in Example 52 there is $700 of nonrecaptured § 1231 loss from 2018. As part of the § 1231 lookback provision any net gain is______(either added to or offset against) any ______(either, nonrecaptured net § 1231 losses or recaptured net § 1231 losses) from the______ (either two three or five) prior tax years. Therefore, the $700 from 2018 results in part of the 2019 net § 1231 gain to be treated as_______(either a capital gain a nontaxable gain or ordinary income) Please fill in the blanks?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Chapter 19 Accounting for Income Taxes Part 1; Author: Vicki Stewart;https://www.youtube.com/watch?v=FMjwcdZhLoE;License: Standard Youtube License