Concept explainers

1. and 2.

Prepare a schedule to show the impact of the assumed conversion of each convertible security on diluted earnings per share and also show the manner by which the securities that are included in the diluted earnings per share are ranked.

1. and 2.

Explanation of Solution

Earnings per share (EPS): The amount of net income available to each shareholder per common share outstanding is referred to as earnings per share (EPS).

Prepare a schedule to show the impact of the assumed conversion of each convertible security on diluted earnings per share.

| Convertible security | Impact in ($) | Ranking |

| 10.2% bonds (1) | $2.55 | 5 |

| 12.0% bonds (3) | $1.71 | 3 |

| 9.0% bonds (5) | $1.51 | 2 |

| 8.3% | $2.13 | 4 |

| 7.5% preferred stock (7) | $1.25 | 1 |

(Table 1)

Working notes:

(1) Calculate the impact of the 10.2% bonds on diluted earnings per share.

(2) Calculate the Premium on amortized bond for 20 year life:

(3) Calculate the impact of the 12.0% bonds on diluted earnings per share.

(4) Calculate the discount on amortized bond for 10 year life:

(5) Calculate the impact of the 9.0% bonds on diluted earnings per share.

(6) Calculate the impact of the 8.3% preferred stock on diluted earnings per share.

(7) Calculate the impact of the 7.5% preferred stock on diluted earnings per share.

3. and 4.

Calculate the basic earnings per share and diluted earnings per share.

3. and 4.

Explanation of Solution

Calculate the basic earnings per share and diluted earnings per share.

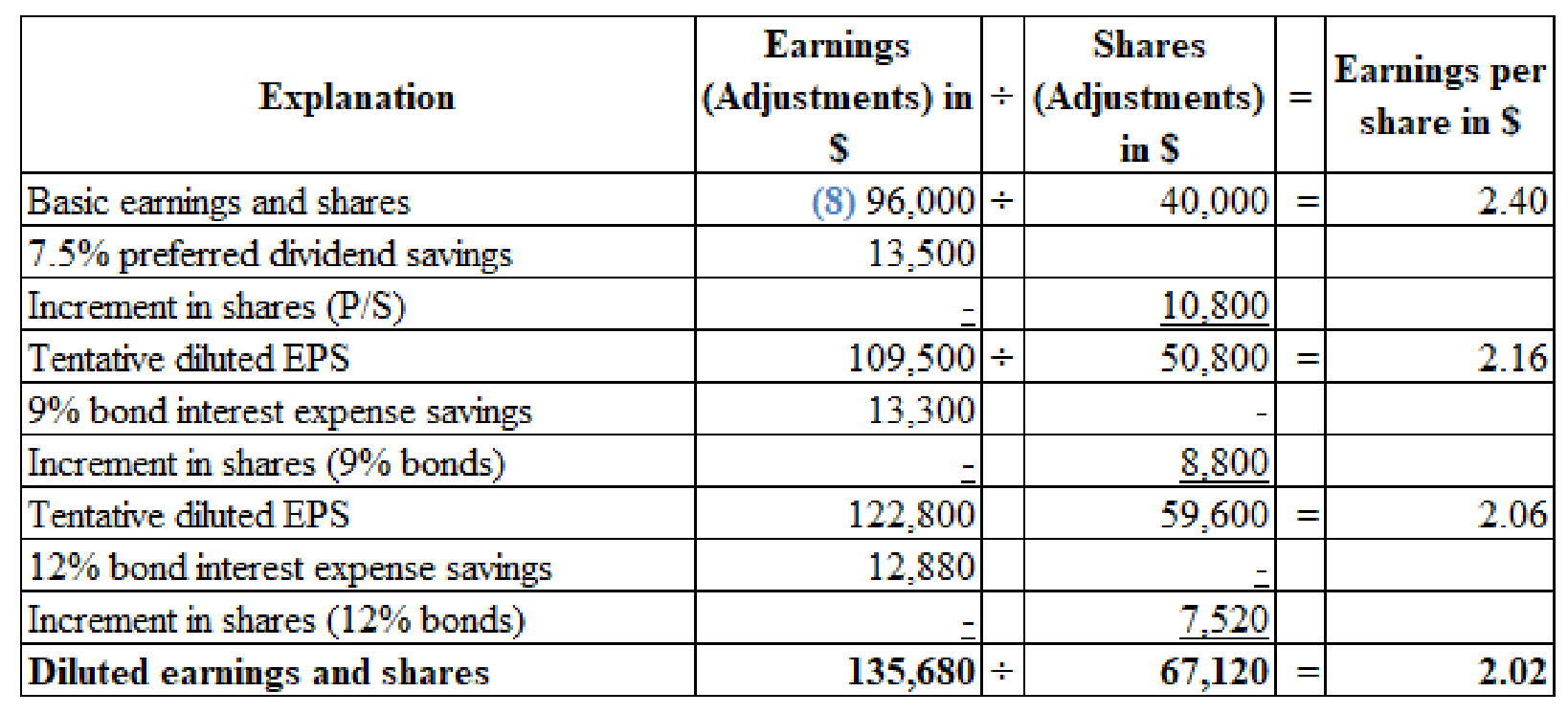

(Figure 1)

Working notes:

(8) Calculate the numerator for the basic earnings per share:

5.

Identify the amount that will be reported as basic and diluted earnings per share for the year 2016.

5.

Explanation of Solution

The Company W must report an amount of $2.40 as basic earnings per share and $2.20 as diluted earnings per share in its 2016 income statement.

Want to see more full solutions like this?

Chapter 16 Solutions

Intermediate Accounting: Reporting and Analysis

- Tama Companys capital structure consists of common stock and convertible bonds. At the beginning of 2019, Tama had 15,000 shares of common stock outstanding; an additional 4,500 shares were issued on May 4. The 7% convertible bonds have a face value of 80,000 and were issued in 2016 at par. Each 1,000 bond is convertible into 25 shares of common stock; to date, none of the bonds have been converted. During 2019, the company earned net income of 79,200 and was subject to an income tax rate of 30%. Required: Compute the 2019 diluted earnings per share.arrow_forwardFrost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.arrow_forwardWaseca Company had 5 convertible securities outstanding during all of 2019. It paid the appropriate interest (and amortized any related premium or discount using the straight line method) and dividends on each security during 2019. Each of the convertible securities is described in the following table: Additional data: Net income for 2019 totaled 119,460. The weighted average number of common shares outstanding during 2019 was 40,000 shares. No share options or warrants arc outstanding. The effective corporate income tax rate is 30%. Required: 1. Prepare a schedule that lists the impact of the assumed conversion of each convertible security on diluted earnings per share. 2. Prepare a ranking of the order in which each of the convertible securities should be included in diluted earnings per share. 3. Compute basic earnings per share. 4. Compute diluted earnings per share. 5. Indicate the amount(s) of the earnings per share that Waseca would report on its 2019 income statement.arrow_forward

- Percy Company has 15,000 shares of common stock outstanding during all of 2019. It also has 2 convertible securities outstanding at the end of 2019. These are: 1. Convertible preferred stock: 1,000 shares of 9%, 100 par, preferred stock were issued in 2015 for 140 per share. Each share of preferred stock is convertible into 3.5 shares of common stock. The current dividends have been paid. To date, no preferred stock has been converted. 2. Convertible bonds: Bonds with a face value of 100,000 and an interest rate of 10% were issued at par on July 1, 2019. Each 1,000 bond is convertible into 35 shares of common stock. To date, no bonds have been converted. Percy earned net income of 54,000 during 2019. Its income tax rate is 30%. Required: Compute the 2019 diluted earnings per share. What earnings per share amount(s) would Percy report on its 2019 income statement?arrow_forwardHanson Co. had 200,000 shares of common stock, 20,000 shares of convertible preferred stock, and $1,000,000 of 6% convertible bonds outstanding during 2015. The preferred stock is convertible into 40,000 shares of common stock. During 2015, Hanson paid dividends of $.60 per share on the common stock and $1.50 per share on the preferred stock. Each $1,000 bond is convertible into 40 shares of common stock. The net income for 2015 was $400,000 and the income tax rate was 30%. 4. Basic earnings per share for 2015 is (rounded to the nearest penny) a. $1.57. b. $1.71. c. $1.80. d. $1.85. 5. Diluted earnings per share for 2015 is (rounded to the nearest penny) a. $1.41. b. $1.49. c. $1.53. d. $1.58. Show work following example below Hanson Co. had 200,000 shares of common stock, 20,000 shares of convertible preferred stock, and $1,000,000 of 5% convertible bonds outstanding during 2015. The preferred stock is convertible into 40,000 shares of common stock. During 2015, Hanson paid dividends…arrow_forwardDuring 2016, Moore Corp. had the following two classes of stock issued and outstanding for the entire year: • 100,000 shares of common stock, $1 par. • 1,000 shares of 4% preferred stock, $100 par, convertible share for share into common stock. Moore’s 2016 net income was $900,000, and its income tax rate for the year was 30%. In the computation of diluted earnings per share for 2016, the amount to be used in the numerator is a. $896,000 b. $898,800 c. $900,000 d. $901,200arrow_forward

- InterTractor America, Inc. reported net income (amounts in thousands) of $1,239,400 for 2017. Included in net income was income tax expense of $20,800. During the year the company paid the preferred shareholders $18,000 in dividends. The weighted average of common shares outstanding during 2017 was 937,620 shares. InterTractor America, Inc. subtracted interest expense (net of tax saving) on convertible debt of $9,640. If the convertible debt had been converted into common stock, it would have increased the weighted average common shares outstanding by 41,810 shares. InterTractor America, Inc. has outstanding stock options that, if exercised, would increase the weighted average of common shares outstanding by 14,670 shares. REQUIRED: Compute both basic and diluted earnings per share (EPS) for 2017, showing supporting computations.arrow_forwardAdams Industries holds 40,000 shares of FedEx common stock. On December 31, 2015, and December 31, 2016, the market value of the stock is $95 and $100 per share, respectively. What is the appropriate reporting category for this investment and at what amount will it be reported in the 2016 balance sheet?arrow_forwardOn January 2, 2016, Lang Co. issued at par $10,000 of 4% bonds convertible in total into 1,000 shares of Lang’s common stock. No bonds were converted during 2016. Throughout 2016, Lang had 1,000 shares of common stock outstanding. Lang’s 2016 net income was $1,000. Lang’s income tax rate is 50%. No potential common shares other than the convertible bonds were outstanding during 2016. Lang’s diluted earnings per share for 2016 would be a. $ .50 b. $ .60 c. $ .70 d. $1.00arrow_forward

- Rockland Corporation earned net income of $300,000 in 2017 and had 100,000 shares of common stock outstanding throughout the year. Also outstanding all year was $800,000 of 9% bonds, which are convertible into 16,000 shares of common. Rockland’s tax rate is 40%. Compute Rockland’s 2017 diluted earnings per share.arrow_forwardIn 2019, Crane Ltd. issued $48,000 of 9% bonds at par, with each $1,000 bond being convertible into 100 common shares. The company had revenues of $77,300 and expenses of $40,200 for 2020, not including interest and taxes (assume a tax rate of 20%). Throughout 2020, 1,400 common shares were outstanding, and none of the bonds were converted or redeemed. (For simplicity, assume that the convertible bonds’ equity element is not recorded.) Calculate diluted earnings per share for the year ended December 31, 2020. (Round answer to 2 decimal places, e.g. 15.25.) Diluted earnings per sharearrow_forwardOn December 31, 2017, Alexander Company had $1,200,000 of short-term debt in the form of notes payable due February 2, 2018. On January 21, 2018, the company issued 25,000 ordinary shares for $36 per share, receiving $900,000 proceeds after brokerage fees and other costs of issuance. On February 2, 2018, the proceeds from the share sale, supplemented by an additional $300,000 cash, are used to liquidate the $1,200,000 debt. The December 31, 2017, statement of financial position isauthorized for issue on February 23, 2018.InstructionsShow how the $1,200,000 of short-term debt should be presented on the December 31, 2017, statement of financial position.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning