a.

To calculate:

Example of net asset value for a mutual fund.

Introduction: Net asset value is the market value of the securities contain by mutual fund deducting its liabilities and then dividing it by number of shares outstanding.

a.

Answer to Problem 2FPA

Solution:

Net asset value is $10.

Explanation of Solution

For example, ABC mutual fund has a total asset of $100 million, $10 million of liability and 9 million of outstanding shares.

Given,

Total assets are $100 million.

Total liabilities are $10 million.

Total number of shares is 9 million.

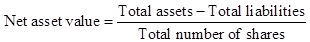

The formula to calculate net asset value is,

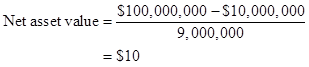

Substitute $100 million for total assets, $10 million for total liabilities and 9 million for total number of shares in the above formula.

Net asset value is $10.

b.

To calculate:

Example of a load fund.

Introduction: A load fund refers to a fund on which investor pay certain fees known as a sales charge whenever they purchase shares.

b.

Answer to Problem 2FPA

Solution:

Amount of commission or load amount is $200.

Explanation of Solution

XY is a mutual fund on which a purchaser has pays a sales commission of 2% on the purchase of mutual fund. Mutual fund is worth $10,000:

Given,

Amount investing is $10,000.

Commission rate is 2%.

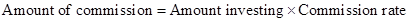

Formula to calculate amount of commission is,

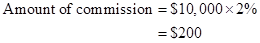

Substitute $10,000 for amount investing and 2% for commission rate in the above formula.

Amount of commission or load amount is $200.

c.

To calculate:

Example of a no load fund.

Introduction: A no load fund refers to that fund on which no sales fees are charged on purchase of fund.

c.

Answer to Problem 2FPA

Solution:

When a person does not pay anything on the purchase of mutual fund it is called no load fund.

Explanation of Solution

A person purchases a YZ fund of $20,000 on which he has not paid any sales charge or sales load.

d.

To calculate:

Example of management fee for a specific mutual fund.

Introduction: Management fee refers to the fees charged by the mutual fund company from the investors for managing their investment or portfolio. Management fees typically range in between 0.25 to 1.5%.

d.

Answer to Problem 2FPA

Solution:

Management fee is $300.

Explanation of Solution

A person invested $30,000 in ZY mutual fund who charges annual management fees of 1%.

Given,

Total asset value is $30,000.

Management fee rate is 1%.

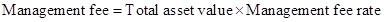

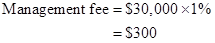

Formula to calculate management fee is,

Substitute $30,000 for total asset value and 1% for management fee rate in the above formula.

Management fee is $300.

e.

To calculate:

Example of mutual fund with contingent deferred sales load.

Introduction: Mutual fund with contingent deferred sales load refers to a fund on which sales fees is charged when the investor sales his mutual fund as except to charging in the starting of the fund.

e.

Answer to Problem 2FPA

Solution:

Amount of contingent deferred sales load that she needs to pay is $800.

Explanation of Solution

A person has $20,000 invested in QS mutual fund for four years and company charge deferred sales load if any person withdraw amount before 5 years he has to pay deferred load fees of 4%. Now, the person requires his money back.

Given,

Amount withdrawn is $20,000.

Withdrawal rate is 4%.

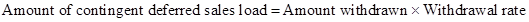

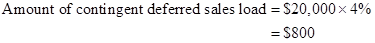

Formula to calculate amount of contingent deferred sales load is,

Substitute $20,000 for amount withdrawn and 4% for withdrawal rate in the above formula.

Amount of contingent deferred sales load that she needs to pay is $800.

f.

To calculate:

Example of mutual fund who charges 12b-1 fee.

Introduction: Expense ratio is the amount that an investor pays for all fees and operating cost. It may vary according to the different providers but for a good investment it should be less than one percent.

f.

Answer to Problem 2FPA

Solution:

12b-1 fee is $50.

Explanation of Solution

A person has invested $20,000 in a fund that charges 0.25% of 12b-1 fee annually

Given,

Total asset value is $20,000.

12b-1 fee rate is 0.25%.

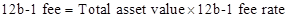

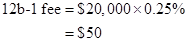

Formula to calculate 12b-1 fee is,

Substitute $20,000 for total asset value and 0.25% for 12b-1 fee rate in the above formula.

12b-1 fee is $50.

g.

To calculate:

Example of expense ratio.

Introduction: Mutual fund is a product which is made by pooling money from investors with the sole motive of investing in different kind of securities. Mutual funds give chance to small investor to invest in security with professional expertise.

g.

Answer to Problem 2FPA

Solution:

Amount that they will pay for expense is $600.

Explanation of Solution

A fund has an expense ratio of 2% annually. A person invested $30,000 in this fund.

Given,

Total asset value is $30,000.

Expense rate is 2%.

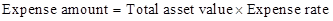

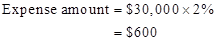

Formula to calculate expense amount is,

Substitute $30,000 for total asset value and 2% for expense rate in the above formula.

Expense amount or amount that they will pay for expense is $600.

Want to see more full solutions like this?

Chapter 16 Solutions

EBK PERSONAL FINANCE

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education