1.

Prepare a flexible-

1.

Explanation of Solution

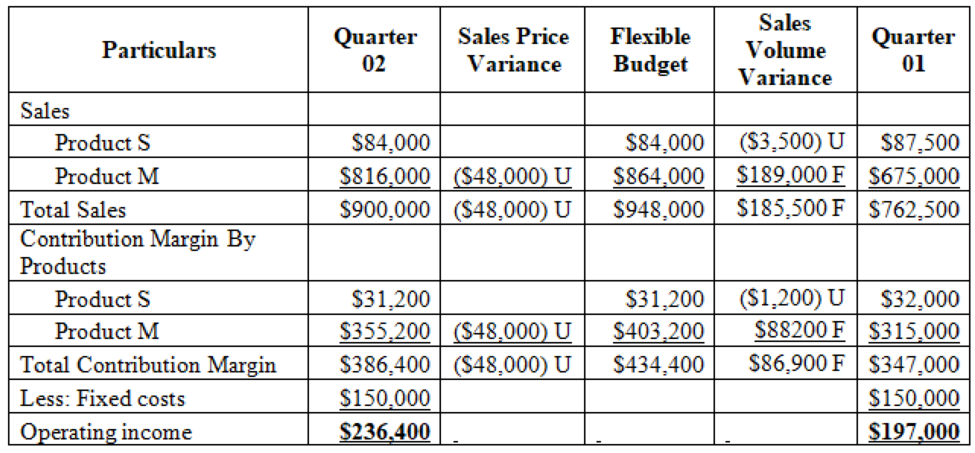

Prepare a flexible-budget contribution income statement for Qtr. 2, showing the Qtr. 2 results, the Qtr. 1 results, and the flexible budget:

Table (1)

2.

Calculate the sales volume variance for each product based both on sales dollars and contribution margin.

2.

Explanation of Solution

Calculate the sales volume variance for each product based both on sales dollars and contribution margin:

In sales Dollars:

Product S:

Product M:

In Contribution Margin:

Product S:

Product M:

3.

Compute the sales mix variance, and the sales quantity variance for each product, based on contribution margin.

3.

Explanation of Solution

Compute the sales mix variance, and the sales quantity variance for each product, based on contribution margin:

Sales Mix Variance:

Product S:

Product M:

Sales Quantity Variance:

Product S:

Product M:

Want to see more full solutions like this?

Chapter 16 Solutions

COST MGT:STRAT.EMP(LL)W/CONNECT ACCESS

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education