Concept explainers

1. Introduction:

Cash Flow Statements:

- Cash flow statements are an integral part of the financial statements of a company. They reflect the direction and movement of the

cash inflows and outflows during a reporting period. The cash inflows and outflows are segregated into the following activities:

- Cash flows from Operating activities − The cash inflows refer to sales and income from operating activities and

cash outflows include both cash and non-cash outflows from the operating activities i.e. the day to day activities of the business.

- Cash flows from Investing activities − The cash inflows refer to sales and income from investing activities and cash outflows include cash outflows from the investing activities in the form of purchase of fixed assets and investments.

- Cash flows from Financing activities − The cash inflows refer to income from financing activities such as raising share capital and debt and cash outflows include cash outflows from the financing activities in the form of dividends and interest paid.

There are two methods of preparing cash flow statements:

- Direct Method − It measures the actual cash inflows and cash outflows that are affected during a particular reporting period. The actual cash flows do not include non-cash items and items that are recorded owing to the accrual principle.

- Indirect Method −It measures the cash inflows and cash outflows that are affected during a particular reporting period including the non-cash items and items that are recorded owing to the accrual principle.

The reporting objectives of the cash flow statements.

Explanation of Solution

- The Cash flow statements measure the cash inflows and cash outflows that are affected during a particular reporting period including the non-cash items and items that are recorded owing to the accrual principle.

- Cash inflows and outflows from both balance sheet accounts such as

accounts receivable , accounts payable, inventory etc as well as Income statement accounts such as Sales,Depreciation Expense etc. and the changes in the values from the preceding period and the effect of the same on the net income is detailed in the cash flow statement of the current year.

- Non-cash items include depreciation, amortization expenses, prepaid expenses etc. and the accrual principle requires items of the financial statements to reflect data of the current reporting period.

- Investing activities are related to acquisition of assets and disposal of assets during the reporting period. They are concerned with the changes in non-current assets of the business.

- Examples of Non-current assets include fixed assets such as Plant and Machinery, Buildings, Land etc. and Investments such as Investment in Shares of other companies etc.

- Financing activities are concerned with the acquisition and disposal of funds in the forms of equity and debt during a reporting period. They are concerned with the changes in non-current liabilities of the business.

- Preparation of cash flow statements is essential as comparative balance sheets only list the figures of assets and liabilities on a reporting date but do not highlight the reason for the change in the assets and liabilities. Cash flow Statements seek to establish reasons for change in assets and liabilities.

- The overall combination of cash flows from operating activities, investing activities and financing activities is essential for a thorough analysis of the business and its activities. It also aids in understanding the biggest components of cash inflows and cash outflows of the business.

Hence the reporting objectives of cash flow statements are highlighted.

2. Introduction:

Cash Flow Statements:

- Cash flow statements are an integral part of the financial statements of a company. They reflect the direction and movement of the cash inflows and outflows during a reporting period. The cash inflows and outflows are segregated into the following activities:

- Cash flows from Operating activities − The cash inflows refer to sales and income from operating activities and cash outflows include both cash and non-cash outflows from the operating activities i.e. the day to day activities of the business.

- Cash flows from Investing activities − The cash inflows refer to sales and income from investing activities and cash outflows include cash outflows from the investing activities in the form of purchase of fixed assets and investments.

- Cash flows from Financing activities − The cash inflows refer to income from financing activities such as raising share capital and debt and cash outflows include cash outflows from the financing activities in the form of dividends and interest paid.

Method of reconciling net income to cash flows from operating activities for non-cash items.

Answer to Problem 4BTN

Solution:

The non-cash items are given an opposite effect to their nature and relation to the net income in order to arrive at the cash flows from operating activities i.e. the Non-Cash expenses are added to the Net Income in order to derive the cash flows from operations.

Explanation of Solution

- The Cash flow statements measure the cash inflows and cash outflows that are affected during a particular reporting period including the non-cash items and items that are recorded owing to the accrual principle.

- Cash inflows and outflows from both balance sheet accounts such as accounts receivable, accounts payable, inventory etc as well as Income statement accounts such as Sales, Depreciation Expense etc. and the changes in the values from the preceding period and the effect of the same on the net income is detailed in the cash flow statement of the current year.

- Non-cash items include depreciation, amortization expenses, prepaid expenses etc. and the accrual principle requires items of the financial statements to reflect data of the current reporting period.

- In order to arrive at the cash flow from operations, opposite effect is given to the non-cash items i.e. Non-Cash expenses are added back to the net income as they are originally deducted from the net income.

- The purpose of this reversal is to arrive at the actual cash flow position and the net income reported on the income statement is actually arrived at after giving effect to non-cash items

Hence the Method of reconciling net income to cash flows from operating activities for non-cash items is explained.

3. Introduction:

Cash Flow Statements:

- Cash flow statements are an integral part of the financial statements of a company. They reflect the direction and movement of the cash inflows and outflows during a reporting period. The cash inflows and outflows are segregated into the following activities:

- Cash flows from Operating activities − The cash inflows refer to sales and income from operating activities and cash outflows include both cash and non-cash outflows from the operating activities i.e. the day to day activities of the business.

- Cash flows from Investing activities − The cash inflows refer to sales and income from investing activities and cash outflows include cash outflows from the investing activities in the form of purchase of fixed assets and investments.

- Cash flows from Financing activities − The cash inflows refer to income from financing activities such as raising share capital and debt and cash outflows include cash outflows from the financing activities in the form of dividends and interest paid.

There are two methods of preparing cash flow statements:

- Direct Method − It measures the actual cash inflows and cash outflows that are affected during a particular reporting period. The actual cash flows do not include non-cash items and items that are recorded owing to the accrual principle.

- Indirect Method −It measures the cash inflows and cash outflows that are affected during a particular reporting period including the non-cash items and items that are recorded owing to the accrual principle.

Formula for computing Cash receipts from Sale to Customers under the direct method.

Answer to Problem 4BTN

Solution:

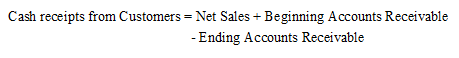

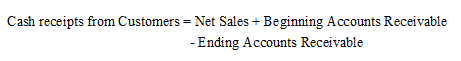

Cash receipts from Sale to Customers is given by the formula

Explanation of Solution

- Under the direct method the cash flows from operations are segregated into several specific categories. These categories include Cash collected from customers, Interest and dividends received, Cash paid to employees, Cash paid to suppliers, Interest paid and Income taxes paid.

- The formula for calculating the cash receipts from sales to customers is given by the following formula:

- Net sales include receipts from sale of goods and services to customers.

- Beginning accounts receivable is added as the sale proceeds from previous periods will be received in the current period and represent cash inflows.

- Ending accounts receivable is deducted as the sale proceeds from this period will be received in the next period and represent cash inflows receivable in future periods.

Hence the formula for computing Cash receipts from Sale to Customers under the direct method is explained.

Want to see more full solutions like this?

Chapter 16 Solutions

FUND. ACCOUNTING PRINCIPLES >CUSTOM<

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education