Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 5TP

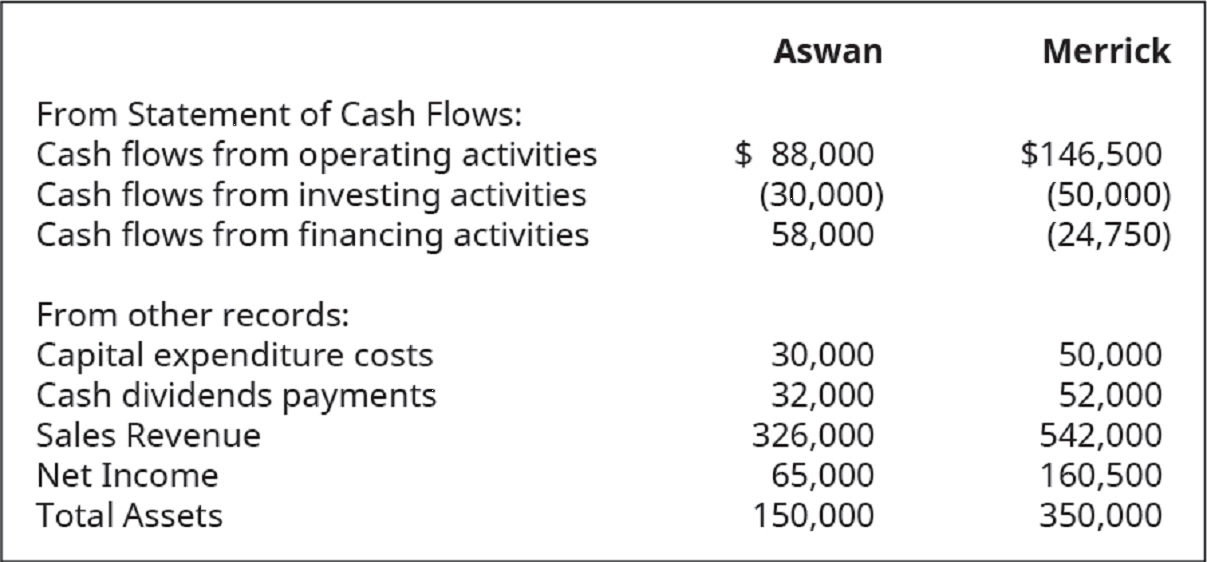

If you had $100,000 available for investing, which of these companies would you choose to invest with? Support your answer with analysis of

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Which of the following is a section of a cash flow statement?

Select one:

a.Fixed costs outflows

b.Cash basis accounting systems

c.Wage taxes

d.EIN

Question 22

Question text

If you invest $1,525,000 in a business and earn a return of $775,000, what is your ROI?

Select one:

a.42%

b.45%

c.51%

d.1.96%

Question 23

Question text

If Jacques invests $20,000 at 10% interest for 3 years, what will the future value of the money be?

Select one:

a.$26,620.00

b.$6620.00

c.$20,606.02

d.$26,000.00

Question 24

Question text

Two common risks to cash flow stability are ________ and ________.

Select one:

a.credit squeeze; burn rate

b.surplus inventory; pilferage

c.burn rate; pilferage

d.surplus inventory; credit squeeze

Question 25

Question text

A suggested allowance for contingencies and emergencies at start-up is _____ of estimated start-up costs.

Select one:

a.5 percent

b.10 percent

c.25 percent

d.40 percent

In the provided scenario, you address the time value of money also known as discounted cash flow analysis. This type of analysis is crucial to being able to viably analyze financial statements. The start - up firm you founded is trying to save $10, 000 in order to buy a parcel of land for a proposed small warehouse expansion. In order to do so, your finance manager is authorized to make deposits of S 1250 per year into the company account that is paying 12% annual interest. The last deposit will be less than $1250 if less is needed to reach $10,000. How many years will it take to reach the $10,000 goal and how large will the last deposit be? Show your work

Answer the following question with a clear explanation, showing any steps or processes used to reach the answer. Explain your process as though you are teaching the concept to a student who is a beginner at finance.A corporation makes an investment of $20,000 that will provide the following cash flows after the corresponding amounts of time:Year 1 - $10,000Year 2 - $10,000Year 3 - $2,000Should the company make this investment?*

What is the net present value at a 7 percent discount rate? Round your answer to two decimal points.

Provide a step-by-step explanation for how you arrived at your solution as though you were teaching a student to solve this type of problem.*

Chapter 16 Solutions

Principles of Accounting Volume 1

Ch. 16 - Which of the following statements is false? A....Ch. 16 - Which of these transactions would not be part of...Ch. 16 - Which is the proper order of the sections of the...Ch. 16 - Which of these transactions would be part of the...Ch. 16 - Which of these transactions would be part of the...Ch. 16 - Which of these transactions would be part of the...Ch. 16 - What is the effect on cash when current noncash...Ch. 16 - What is the effect on cash when current...Ch. 16 - What is the effect on cash when current noncash...Ch. 16 - What is the effect on cash when current...

Ch. 16 - Which of the following would trigger a subtraction...Ch. 16 - Which of the following represents a source of cash...Ch. 16 - Which of the following would be included in the...Ch. 16 - If beginning cash equaled $10,000 and ending cash...Ch. 16 - Which of the following is a stronger indicator of...Ch. 16 - What function does the statement of cash flows...Ch. 16 - Is it possible for a company to have significant...Ch. 16 - What categories of activities are reported on the...Ch. 16 - Describe three examples of operating activities,...Ch. 16 - Describe three examples of investing activities,...Ch. 16 - Describe three examples of financing activities,...Ch. 16 - Explain the difference between the two methods...Ch. 16 - Why is depreciation an addition in the operating...Ch. 16 - When preparing the operating section of the...Ch. 16 - If a company reports a gain/(loss) from the sale...Ch. 16 - Note payments reduce cash and are related to...Ch. 16 - Is there any significance that can be attributed...Ch. 16 - Would there ever be activities that relate to...Ch. 16 - What insight does the calculation of free cash...Ch. 16 - Why is using the direct method to prepare the...Ch. 16 - Provide journal entries to record each of the...Ch. 16 - In which section of the statement of cash flows...Ch. 16 - In which section of the statement of cash flows...Ch. 16 - Use the following information from Albuquerque...Ch. 16 - What adjustment(s) should be made to reconcile net...Ch. 16 - Use the following information from Birch Companys...Ch. 16 - Use the following information from Chocolate...Ch. 16 - Use the following information from Denmark...Ch. 16 - Use the following excerpts from Eagle Companys...Ch. 16 - Use the following excerpts from Fruitcake Companys...Ch. 16 - Use the following excerpts from Grenada Companys...Ch. 16 - Provide the missing piece of information for the...Ch. 16 - Provide the missing piece of information for the...Ch. 16 - Use the following excerpts from Kirsten Companys...Ch. 16 - Use the following excerpts from Franklin Companys...Ch. 16 - The following are excerpts from Hamburg Companys...Ch. 16 - Use the following excerpts from Algona Companys...Ch. 16 - Use the following excerpts from Huckleberry...Ch. 16 - Provide journal entries to record each of the...Ch. 16 - In which section of the statement of cash flows...Ch. 16 - In which section of the statement of cash flows...Ch. 16 - Use the following information from Hamlin Companys...Ch. 16 - What adjustment(s) should be made to reconcile net...Ch. 16 - Use the following excerpts from Indigo Companys...Ch. 16 - Use the following information from Jumper Companys...Ch. 16 - Use the following information from Kentucky...Ch. 16 - Use the following excerpts from Leopard Companys...Ch. 16 - Use the following information from Manuscript...Ch. 16 - Use the following excerpts from Nutmeg Companys...Ch. 16 - Provide the missing piece of information for the...Ch. 16 - Provide the missing piece of information for the...Ch. 16 - Use the following excerpts from Indira Companys...Ch. 16 - Use the following excerpts from Bolognese Companys...Ch. 16 - The following shows excerpts from Camole Companys...Ch. 16 - Use the following excerpts from Brownstone...Ch. 16 - Use the following excerpts from Jasper Companys...Ch. 16 - Provide journal entries to record each of the...Ch. 16 - Use the following information from Acorn Companys...Ch. 16 - Use the following information from Berlin Companys...Ch. 16 - Use the following information from Coconut...Ch. 16 - Use the following information from Dubuque...Ch. 16 - Use the following information from Eiffel Companys...Ch. 16 - Analysis of Forest Companys accounts revealed the...Ch. 16 - Use the following excerpts from Zowleski Companys...Ch. 16 - Use the following excerpts from Yardley Companys...Ch. 16 - Use the following excerpts from Wickham Companys...Ch. 16 - Use the following excerpts from Tungsten Companys...Ch. 16 - The following shows excerpts from financial...Ch. 16 - Use the following excerpts from Fromera Companys...Ch. 16 - Use the following excerpts from Victrolia Companys...Ch. 16 - Use the following cash transactions relating to...Ch. 16 - Provide journal entries to record each of the...Ch. 16 - Use the following information from Grenada...Ch. 16 - Use the following information from Honolulu...Ch. 16 - Use the following information from Isthmus...Ch. 16 - Use the following information from Juniper...Ch. 16 - Use the following excerpts from Kayak Companys...Ch. 16 - Analysis of Longmind Companys accounts revealed...Ch. 16 - Use the following excerpts from Stern Companys...Ch. 16 - Use the following excerpts from Unigen Companys...Ch. 16 - Use the following excerpts from Mountain Companys...Ch. 16 - Use the following excerpts from OpenAir Companys...Ch. 16 - The following shows excerpts from financial...Ch. 16 - Use the following excerpts from Swansea Companys...Ch. 16 - Use the following excerpts from Swahilia Companys...Ch. 16 - Use the following cash transactions relating to...Ch. 16 - Use a spreadsheet and the following financial...Ch. 16 - Consider the dilemma you might someday face if you...Ch. 16 - If you had $100,000 available for investing, which...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Describe the various individual communication roles in organizations.

Principles of Management

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (11th Edition)

Define cost pool, cost tracing, cost allocation, and cost-allocation base.

Cost Accounting (15th Edition)

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (4th Edition)

What is an internai change order and how is it used?

Construction Accounting And Financial Management (4th Edition)

Prepare a production cost report and journal entries (Learning Objectives 4 5) Vintage Accessories manufacture...

Managerial Accounting (5th Edition)

Knowledge Booster

Similar questions

- You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Investment End of Year A B C 1 $ 3,000 $ 1,000 $ 5,000 2 4,000 1,000 5,000 3 5,000 1,000 (5,000) 4 (6,000) 1,000 (5,000) 5 6,000 5,000 15,000 (Click on the icon in order to copy its contents into a spreadsheet.) What is the present value of each of these three investments if the appropriate discount rate is 14 percent? Question content area bottom Part 1 a. What is the present value of investment A at an annual discount rate of 14 percent? $ enter your response here (Round to the nearest cent.)arrow_forwardNu Things, Inc., is considering an investment in a business venture with the following anticipated cash flow results: Assume MARR is 20% per year. Based on an internal rate of return analysis (1) determine the investment’s worth; (2) state whether or not your results indicate the investment should be undertaken; and (3) state the decision rule you used to arrive at this conclusion.arrow_forwardMake sure you provide complete answers, and show your work with calculation problems Given the following information, calculate the Net Free Cash Flow. Net income = $25,000; Capital expenditures = $4,000; Cash dividends paid to shareholders = $2,500; Repayment of Long-term debt = $1,500; Depreciation, Depletion & Amortization = $5,000; Increase in current assets = $250; Increase in current liabilities = $750;arrow_forward

- Nu Things, Inc., is considering an investment in a business venture with the following anticipated cash flow results: Assume MARR is 20% per year. Based on an external rate of return analysis (1) determine the investment’s worth; (2) state whether or not your results indicate the investment should be under taken; and (3) state the decision rule you used to arrive at this conclusion.arrow_forwardYour employer, Rubio LLC, is considering an investment in an office building that has the following cash flows: Purchase in Year 0…………… $ -2,750,000 Year 1………………. 220,000 Year 2……………….. 226,000 Year 3……………….. 250,000 Year 4………………… 255,000 Year 5 ………………… 230,000, and a sale @ $3,290,000 takes place EOY 5 The company’s weighted average cost of capital that they use as their discount rate for such calculations is 12% What would be the total cash flows in Year 5, taking into consideration the cash flows, annual debt service, sale price and the balance on the loan at the EOY 5? $1,662,985 $1,937,607 $1,802,986 $1,343,455 What is the leveraged IRR of the project ? 64% 58% 48% 55% In the above problem, you might expect The Yield to be higher than the discount rate because you sold the property at a profit. The NPV to be positive because the IRR is higher than the discount rate The NPV to be negative because the IRR is lower than the discount rate All of the…arrow_forwardUsing the financial statements and additional information below, construct an indirect cash flow statement in Excel for year 4. As long as you are following general cash flow formatting rules (e.g. operating section, investing section, financing section), you can format it as you see fit. Remember that these reports should be clean, easy to read and understand, and useful for decision-making purposes.arrow_forward

- True or false, suppose Auga Company Ltd just started business and was looking for additional capital in order to purchase a property to build their headquarters. If they found an investor who was willing to sell them land worth $500,000 in exchange for stock in the company, would this transaction be shown in the investing activities section of the statement of cash flows? True or false, buying property, plant and equipment would be considered a cash outflow from financing? True or false, the financing section of the statement of cash flows reflects transactions in the equity accounts and the long-term liability accounts?arrow_forwardPlease answer all of the following questions and kindly type it out if possible so I can easily understand. I have attached two pictures with the information to complete the questions. Thank You :) As part of your analysis, you are required to investigate WITCO’s cash flows. (a)Using the financial statements and additional notes provided, calculate the following for 2020: i. Operating Cash Flow ii. Net Capital Spending iii. Change in Net Working Capital iv. Cash Flow from assets v. Cash Flow to creditors vi. Cash Flow to stockholders (b) Prepare WITCO’s Statement of Cash Flow for the year ended December 31, 2020. (c)What is the purpose and importanceof the Cash Flow Statement?arrow_forwardIs it more advantageous for a recent start-up, with revenues close to $23 Million over the last five years to operate on a cash basis or accrual basis? What are the major distinctions between cash and accrual method?arrow_forward

- Assume a company is going to make an investment in a machine of $825,000 and the following are the cash flows that two different products would bring. Which of the two options would you choose based on the payback method?arrow_forwardAssume a company is going to make an investment of $450,000 in a machine and the following are the cash flows that two different products would bring in years one through four. Which of the two options would you choose based on the payback method?arrow_forwardYour company is planning to purchase a new log splitter for is lawn and garden business. The new splitter has an initial investment of $180,000. It is expected to generate $25,000 of annual cash flows, provide incremental cash revenues of $150,000, and incur incremental cash expenses of $100,000 annually. What is the payback period and accounting rate of return (ARR)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,