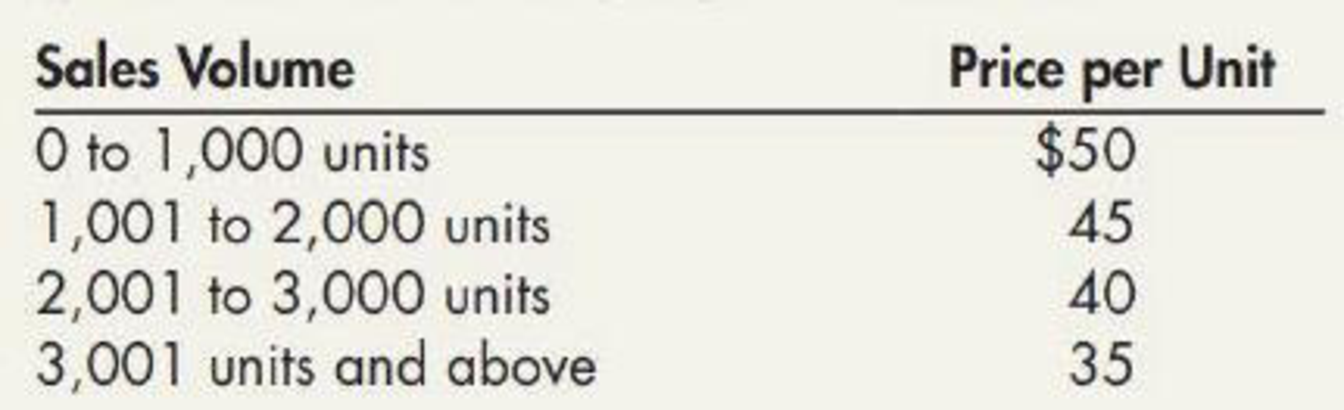

On January 1, 2019, Piper Company entered into an agreement with Save-Mart to sell its most popular product, the gadget. The contract stipulates that the price per unit will decrease as Save-Mart purchases higher volumes of the gadget, as follows:

The contract states that Save-Mart pays Piper the unit price based on the current sales volume. Once a volume threshold is reached, the price is retroactively reduced to the applicable price per unit. Based on its past experience with similar contracts, Piper believes that the total sales volume for the year will be 1,800 units and uses the most likely amount approach to estimate variable consideration. In addition, Piper concludes it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur once the uncertainty surrounding the variable consideration is resolved.

Required:

1. Determine the transaction price per unit that Piper should use to record revenue.

2. Assume that Save-Mart purchases 800 units in the first quarter of 2019 and 900 units in the second quarter of 2019. Prepare Piper’s journal entries to record the sales in the first and second quarters.

3. Given the higher than expected sales volume in the first half of the year, Piper increases its estimate of the sales volume to 2,800 units. Prepare the

1.

Ascertain the transaction price per unit that is used to record the revenue.

Explanation of Solution

Transaction price:

Transaction price is the amount of consideration that is estimated by the company to be authorized in exchange, for delivering the promised goods and services to the customer. Transaction price is examined by the seller by analyzing the terms of the contract and the normally conducts of the business.

$45 is the transaction price per unit since, sales of 1,800 units is expected and the price per unit with sales volume of 1,001-2,000 units is $45.

2.

Journalize entries to record the sakes made in the first and second quarters.

Explanation of Solution

Contract:

Contract is an agreement among two parties or more parties which includes enforceable obligations and rights. A contract can be written, oral or implied by ordinary business practices.

Journal entry:

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Accounting rules for Journal entries:

- To record increase balance of account: Debit assets, expenses, losses and credit liabilities, capital, revenue and gains.

- To record decrease balance of account: Credit assets, expenses, losses and debit liabilities, capital, revenue and gains.

Prepare journal entry for the first quarter:

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Cash (1) | 40,000 | ||

| Sales revenue (2) | 36,000 | ||

| Return liability (3) | 4,000 | ||

| (To record the recognition of liability) |

Table (1)

- Cash is an asset and it is increased. Therefore, debit cash account by $40,000.

- Sales revenue is a component of stockholders’ equity and it is increased. Therefore, credit sales revenue account by $36,000.

- Return liability is increased. Therefore, credit returns liability account by $4,000.

Prepare journal entry for the second quarter:

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Cash (Balancing figure) | 36,500 | ||

| Refund liability (3) | 4,000 | ||

| Sales revenue (4) | 40,500 | ||

| (To record the payment of refund) |

Table (2)

- Cash is an asset and it is increased. Therefore, debit cash account by $36,500.

- Refund liability is decreased. Therefore, debit returns liability account by $4,000.

- Sales revenue is a component of stockholders’ equity and it is increased. Therefore, credit sales revenue account by $40,500.

Working notes:

(1)Calculate the amount of cash during the first quarter:

Note: $50 is the price per unit for the sales of 0 to 1,000 units.

(2)Calculate the amount of sales revenue:

Note: $45 is the price per unit for the sales of 1,001 to 2,000 units.

(3)Calculate the amount of refund liability:

Note: $5 is the difference between

(4)Calculate the amount of sales revenue:

3.

Journalize entries to record the change in estimate.

Explanation of Solution

Prepare journal entry:

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Sales revenue (5) | 8,500 | ||

| Refund liability | 8,500 | ||

| ( To record the refund liability) |

Table (3)

- Sales revenue is a component of stockholders’ equity and it is decreased. Therefore, debit sales revenue account by $8,500.

- Refund liability is increased. Therefore, credit returns liability account by $8,500.

Working note:

(5)Calculate the amount of sales revenue:

Note: $5 is the difference between

Want to see more full solutions like this?

Chapter 17 Solutions

Interm.acct.:reporting.(ll)-w/access

- On March 1, 2019, Elkhart enters into a new contract to build a specialized warehouse for 7 million. The promise to transfer the warehouse is determined to be a performance obligation. The contract states that if the warehouse is usable by November 30, 2019, Elkhart will receive a bonus of 600,000. For every week after November 30 that the warehouse is not usable, the bonus will decrease by 150,000. Elkhart provides the following completion schedule: Required: 1. Assume that Elkhart uses the expected value approach. What amount should Elkhart use for the transaction price? 2. Assume that Elkhart uses the most likely amount approach. What amount should Elkhart use for the transaction price? 3. Next Level What is the purpose of assessing whether a constraint on the variable consideration exists?arrow_forwardOn January 1, 2019, Mopps Corp. agrees to provide Conklin Company 3 years of cleaning and janitorial services. The contract sets the price at 12,000 per year, which is the normal standalone price that Mopps charges. On December 31, 2020, Mopps and Conklin agree to modify the contract. Mopps reduces the fee for the third year to 10,000, and Conklin agrees to a 4-year extension that will extend services through December 31, 2024, at a price of 15,000 per year. At the time that the contract is modified, Mopps is charging other customers 13,500 for the cleaning and janitorial service. Required: Should Mopps and Conklin treat the modification as a separate contract? If so how should Mopps account for the contract modification on December 31, 2020? Support your opinion by discussing the application to this case of the factors that need to be considered for determining the accounting for contract modifications.arrow_forwardOn October 1, 2019, Grahams WeedFeed Inc. signs a contract to maintain the grounds for BigData Corp. The contract ends on March 31, 2020, and has a monthly payment of 3,200. The contract does not include any stipulations for additional periods. On June 1, Grahams WeedFeed and BigData sign a new 12-month contract that is retroactive to April 1, 2020. The monthly fee for the new contract is 4,000 per month and is also retroactive to April 1, 2020. During April and May of 2020, while the new contract was being negotiated, Grahams Weed Feed continued to maintain the grounds, and BigData continued to pay 3,200 per month. BigData was satisfied with Grahams WeedFeeds performance, and the only issue during negotiations was the monthly fee. Required: Determine if a valid contract exists between Grahams WeedFeed and BigData during April and May 2020.arrow_forward

- During 2020, BIOT Company signed a non-cancelable contract with BTS Company to purchase 5,000 units of goods at P 1,500 per unit with delivery to be made in 2021. On December 31,2020, the price had fallen to P 1,450 per unit. On March 1,2021, the price per unit further decreased to P 1,350. What is the amount of loss on purchase commitments recognized upon delivery of the 1,000 sacks on March 1,2021?arrow_forwardDuring 2020, ABC Company signed a non-cancelable contract with XYZ Company to purchase 5,000 units of goods at P 1,500 per unit with delivery to be made in 2021. On December 31,2020, the price had fallen to P 1,450 per unit. On March 1,2021, the price per unit further decreased to P 1,350. What is the amount of loss on purchase commitments recognized upon delivery of the 1,000 sacks on March 1,2021?Required to answer. Single choice.arrow_forwardOn 1 July 2019, Entity A entered into the Contract X with a customer, Entity B, to sell Product A for $300 per unit. If Entity B purchases more than 1,000 units of Product A in a 12-month period, Contract X specifies that the price will be reduced to $250 per unit. Entity B agreed to settle all outstanding amount of Contract X in July 2020 when both Entities agreed with the total units of sales on 30 June 2020. For the quarter ended 30 September 2019, Entity A sold 70 units of Product A to Entity B. At that date, Entity A concluded that Entity B's purchases would not exceed the 1,000 unit threshold required for the volume discount. In October 2019, Entity B acquired another production unit which increased the demand for Product A from Entity A. On 30 November 2019, Entity B ordered an additional 900 units of Product A from Entity A. In light of this, Entity A concluded that the customer's purchases are now highly likely to exceed the 1,000 unit threshold in the 12 months to 30…arrow_forward

- On August 1, 2019, Aiken Corp. enters into a contract with Benton Corp. to sell it $25,000 of goods. Aiken will deliver the goods on August 30, 2019, and Benton will pay the full amount upon acceptance. The goods were manufactured by Aiken at a cost of $18,000. Both Aiken and Benton consider the acceptance of the goods on August 30 a formality given that Benton has purchased the same goods from Aiken numerous times without incident. On August 30, 2019, Aiken delivers the goods and Benton transfers cash to Aiken. required: 1.Prepare the journal entries in August 2019 necessary to account for this transaction. Assume Aiken uses a perpetual inventory systemarrow_forwardWildhorse Manufacturing Inc. is a local manufacturing company. Rather than sell its product directly, Wildhorse ships its finished goods inventory to CMR Retailing Ltd., who sells the product for Wildhorse on consignment. During 2020, Wildhorse ships $119,500 in merchandise to CMR. At the end of 2020, CMR has sold 65% of the merchandise for $72,000. CMR notifies Wildhorse of the sales, retains a 20% commission, and remits the cash due to Wildhorse. Prepare all the necessary journal entries on the books of Wildhorse Manufacturing to record the consignment transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation Debit Credit 1. (To record shipped merchandise) 2. (To record year end sales entry)…arrow_forwardIn August 2021, Commonlo Corp. commits to selling 100 of its merchandise to M&H Co. for P30,000 (P300 per product). The merchandise is to be delivered to M&H over the next 6 months. After 60 merchandises were delivered, the contract is modified and Commonio promises to deliver 80 more products for an additional P21,600 (P270 per station) At year-end, Commonlo delivered an additional 90 products. All sales are cash on delivery Assume that the additional term is a prospective modification to the original contract How much revenue will be recognized on the contract for the year?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning