a)

To determine: The total cost of producing in Country M.

Introduction:

Supplier selection is the process of evaluating the performance of each supplier and comparing it with in-house production to choose a capable supplier to support the output of the organization.

a)

Explanation of Solution

Given information:

It is given that Company D is considering outsourcing its door production to Country M. The price quoted by the company of Country M is $83 for 5,000 units of standard door per year. The transportation cost is $825, which holds 250 doors. In order to send engineers to prequalify plant costs, $5,000 is required and to negotiate the contract, $1,000. The inventory cost is a 20 percent carrying charge for an average of 6 months.

Company D is currently situated in Country U, where the production cost is $119. In addition to this, the following information is given:

| Criteria | Weight | Supplier from Country M | In-house | ||

| Rating | Score | Rating | Score | ||

| Quality and delivery | 16% | 3 | 4 | ||

| Price | 60% | 5 | 4 | ||

| Social responsibility | 7% | 2 | 5 | ||

| Currency risk | 17% | 3 | 5 | ||

| Total | 100% | ||||

Determine the total cost producing in Country M:

| Price of the door | ₹ 83.00 |

| Transportation cost | ₹ 3.30 |

| Pre-qualify supplier | ₹ 1.00 |

| Manage contract | ₹ 0.20 |

| Inventory carrying | ₹ 8.30 |

| Total | ₹ 95.80 |

Working note:

Price of the door, pre-quality supplier, and manager contract are given.

Compute transportation cost:

The transportation cost is $825 for one run, which holds 250 doors.

Compute inventory carrying cost:

The inventory cost is 20 percent carrying charge for an average of 6 months

Hence, the total cost of producing in Country M is $95.80 (refer to the table) per door, which is less than producing in Country U ($119).

b)

To determine: The total weighed scores for in-house production and Country M’s supplier.

Introduction:

Supplier selection is the process of evaluating the performance of each supplier and comparing it with in-house production to choose the capable supplier to support the output of the organization.

b)

Explanation of Solution

Given information:

It is given that Company D is considering outsourcing its door production to Country M. The price quoted by the company of Country M is $83 for 5,000 units of standard door per year. The transportation cost is $825, which holds 250 doors. In order to send engineers to prequalify plant costs, $5,000 is required and to negotiate the contract, $1,000. The inventory cost is a 20 percent carrying charge for an average of 6 months.

Company D is currently situated in Country U, where the production cost is $119. In addition to this, the following information is given:

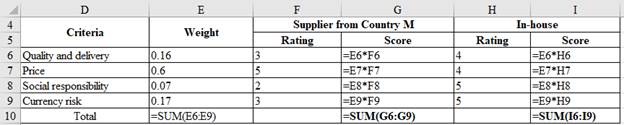

| Criteria | Weight | Supplier from Country M | In-house | ||

| Rating | Score | Rating | Score | ||

| Quality and delivery | 16% | 3 | 4 | ||

| Price | 60% | 5 | 4 | ||

| Social responsibility | 7% | 2 | 5 | ||

| Currency risk | 17% | 3 | 5 | ||

| Total | 100% | ||||

Determine the total weighted score:

| Criteria | Weight | Supplier from Country M | In-house | ||

| Rating | Score | Rating | Score | ||

| Quality and delivery | 16% | 3 | 0.48 | 4 | 0.64 |

| Price | 60% | 5 | 3 | 4 | 2.4 |

| Social responsibility | 7% | 2 | 0.14 | 5 | 0.35 |

| Currency risk | 17% | 3 | 0.51 | 5 | 0.85 |

| Total | 100% | 4.13 | 4.24 | ||

Computation of total weighted score:

Hence, the weighed score is 4.13 for the supplier from Country M and 4.24 for in-house production.

c)

To determine: Whether the firm should outsource or not.

Introduction:

Supplier selection is the process of evaluating the performance of each supplier and comparing it with in-house production to choose a capable supplier to support the output of the organization.

c)

Explanation of Solution

Given information:

It is given that Company D is considering outsourcing its door production to Country M. The rice quoted by the company of Country M is $83 for 5,000 units of standard door per year. The transportation cost is $825, which holds 250 doors. In order to send engineers to prequalify plant costs, $5,000 is required and to negotiate the contract, $1,000. The inventory cost is a 20 percent carrying charge for an average of 6 months.

Company D is currently situated in Country U, where the production cost is $119. In addition to this, the following information is given:

| Criteria | Weight | Supplier from Country M | In-house | ||

| Rating | Score | Rating | Score | ||

| Quality and delivery | 16% | 3 | 4 | ||

| Price | 60% | 5 | 4 | ||

| Social responsibility | 7% | 2 | 5 | ||

| Currency risk | 17% | 3 | 5 | ||

| Total | 100% | ||||

Determine whether the firm should outsource or not:

It is better to produce the door in-house rather than outsourcing. Even though the price is less for outsourcing, the other ratings favor in-house production. The weighted score is maximum for in-house production. Hence, there is no need to outsource the production.

Want to see more full solutions like this?

Chapter 17 Solutions

OPERATIONS MANAGEMENT IN THE SUPPLY CHAIN: DECISIONS & CASES (Mcgraw-hill Series Operations and Decision Sciences)

- Scenario 3 Ben Gibson, the purchasing manager at Coastal Products, was reviewing purchasing expenditures for packaging materials with Jeff Joyner. Ben was particularly disturbed about the amount spent on corrugated boxes purchased from Southeastern Corrugated. Ben said, I dont like the salesman from that company. He comes around here acting like he owns the place. He loves to tell us about his fancy car, house, and vacations. It seems to me he must be making too much money off of us! Jeff responded that he heard Southeastern Corrugated was going to ask for a price increase to cover the rising costs of raw material paper stock. Jeff further stated that Southeastern would probably ask for more than what was justified simply from rising paper stock costs. After the meeting, Ben decided he had heard enough. After all, he prided himself on being a results-oriented manager. There was no way he was going to allow that salesman to keep taking advantage of Coastal Products. Ben called Jeff and told him it was time to rebid the corrugated contract before Southeastern came in with a price increase request. Who did Jeff know that might be interested in the business? Jeff replied he had several companies in mind to include in the bidding process. These companies would surely come in at a lower price, partly because they used lower-grade boxes that would probably work well enough in Coastal Products process. Jeff also explained that these suppliers were not serious contenders for the business. Their purpose was to create competition with the bids. Ben told Jeff to make sure that Southeastern was well aware that these new suppliers were bidding on the contract. He also said to make sure the suppliers knew that price was going to be the determining factor in this quote, because he considered corrugated boxes to be a standard industry item. As the Marketing Manager for Southeastern Corrugated, what would you do upon receiving the request for quotation from Coastal Products?arrow_forwardThe Tavern Restaurant in State College, PA, has decided to perform a total cost analysis on its suppliers of Ultra-Pure Mount Nittany Sparkling Water. Consumption is currently 6,000 bottles per year. Demand is predicted to stay at that level for the next few years. The current source, United, charges $10.50 per bottle and can pack 335 bottles in a crate. The cost to ship the crate is $25. Another potential source of this product is National. National charges $10.25 per bottle and ships 300 bottles in a crate at $38 per crate. Assume that a partial crate may be purchased, and shipping is prorated. Which supplier is offering the better total delivered cost and what is the savings vs. the other supplier (closest answer within $10)? Group of answer choices United: $575 National: $1,325 National: $1,190 United: $1,010arrow_forwardSpecial Order; Strategy; International Williams Company, located in southern Wisconsin,manufactures a variety of industrial valves and pipe fittings that are sold to customers in nearbystates. Currently, the company is operating at about 70% capacity and is earning a satisfactory returnon investment.Glasgow Industries Ltd. of Scotland has approached management with an offer to buy 120,000units of a pressure valve. Glasgow Industries manufactures a valve that is almost identical toWilliams’s pressure valve; however, a fire in Glasgow Industries’s valve plant has shut down itsmanufacturing operations. Glasgow needs the 120,000 valves over the next 4 months to meetcommitments to its regular customers; the company is prepared to pay $21 each for the valves.Williams’s product cost for the pressure valve, based on current attainable standards, follows:[LO 11-2][LO 11-2]Direct materials $ 6Direct labor (0.5 hour per valve) 8Manufacturing overhead (1/3 variable) 9Total manufacturing cost…arrow_forward

- A local club is selling Christmas trees and deciding how many to stock for the month of December. If demand is normally distributed with a mean of 100 and standard deviation of 20, trees have a salvage value at the end of the month of $8, cost $20 to acquire, and sell for $50, how many trees should be stocked for December?arrow_forwardWhat is the impact of lead times on the implementation of the Wilson approach in supply chain management?arrow_forwardIn each of the following, name the term defined. Answersare listed at the bottom. A supply chain that must deal with high levels of both supply and demand uncertainty. In order to cope with high levels of supply uncertainty, a firm would use this strategy to reduce risk. Used to describe functions related to the flow of material in a supply chain. When a firm works with suppliers to look for opportunities to save money and benefit the environment. Refers to an estimate of the cost of an item that includes all costs related to the procurement and use of an item, including the costs of disposing of after its useful life.arrow_forward

- Refer to the slides on buy-back contracts to answer this question. A publisher sells books to Borders at $12 each. The marginal production cost for the publisher is $1 per book. Borders prices the book to its customers at $24 and expects demand over the next two months to be normally distributed, with a mean of $20,000 and a standard deviation of $5000. Borders places a single order with the publisher for delivery at the beginning of the two-month period. Currently, Borders discounts any unsold books at the end of the two months down to $3, and any books that did not sell at full price sell at this price. How many books should Borders order? What is the expected profit? How many books does it expect to sell at a discount? What is the profit that the publisher makes given Borders’ actions? A plan under discussion is for the publisher to refund Borders $5 per book that does not sell during the two-month period. As before, Borders will discount them to $3 and sell any that remain.…arrow_forwardAlison's Accessories is a high volume worldwide fashion house with outlets in 65 countries. Sadly, space does not permit an exhaustive list but once the test is over, check out their website. Kalil, the supply chain manager is conducting her usual thorough analysis of her final four candidates for supplier and has developed the following tables of pertinent costs and other shipping metrics. Regardless of supplier, Alison's Accessories will operate 220 days per year and has forecast annual demand of 250,000 units. Kalil has obtained quotes for three different shipment sizes (Freight Costs table). All costs are in US Dollars. Table 1 Unit costs Supplier Price/Unit Carrying Cost A 123 22 B 125 19 C 126 18 D 100 40 Annual Freight Costs Supplier 15,000 units 25,000 units 50,000 units A 380,000 260,000 237,000 B 615,000 547,000 470,000 C 285,000 240,000 200,000 D 380,000 260,000 237,000 Other Costs Supplier Lead Time Annual Admin Costs A 30 250,000 B 15 275,000 C 7 225,000 D 90…arrow_forward1.Upstream supply chain members are A. retailers B. manufacturers C. end-use customers D. suppliers 2.The integrated group of business processes that form a supply chain are A. marketing, manufacturing and finance B. procurement, production and distribution C. manufacturing and service D. demand, value, and quality 3.The bullwhip effect occurs when A. slight to moderate demand variability becomes magnified as demand information is transmitted back upstream. B. slight to moderate demand variability becomes magnified as supply information is transmitted back upstream. C. slight to moderate demand variability becomes magnified as demand information is transmitted back downstream. D. slight to moderate demand variability becomes magnified as supply information is transmitted back downstream. 4.The key element in achieving supply chain integration is A. quality management B. ISO certification C. information technology D. EDI 5.A disadvantage of RFID technology that has hindered its…arrow_forward

- Outline what you would expect the price and income elasticity of demand of the following goods to be and why: 1-liter cartons of milk Beach holidays Pizzas delivered to the home A tube of Colgate toothpaste A tube of toothpaste Note: you are at liberty to suggest a value for elasticity in each case, however it is also acceptable to refer to the degree of elasticity which you think applies.arrow_forwardNorthcutt manufactures high-end racing bikes and is looking for a source of gear sprocket sets. Northcutt would need 1400 sets a month. Supplier A is a domestic firm, and Suppliers B and C are located overseas. Cost information for the suppliers is as follows: Supplier A- Price of $150 per set, plus packing cost of $3.00 per set. Total inland freight costs for all 1400 units would be $550 per month. Supplier B- Price of $74.00 per set, plus packing cost of $2.00 per set. International transportation costs would total $4000 per month, while total inland freight costs would be $850 per month. Supplier C- Price of $97 per set, plus packing cost of $4 per set. International transportation costs would total $4800 per month, while total inland freight costs would be $1200 per month. The total landed cost per month for Supplier B is __$arrow_forwardFaw Motors, Inc., was incorporated in Volkswagen on July 01, 2003. It has 4 plants across the China that design, manufacture, and market earth moving, construction, and materials handling equipment. It also manufactures engines for earthmoving vehicles and tractor-trailers. Faw Motors products are distributed worldwide. Net income last year totaled $350,000,000. Faw Motors has developed a "Transportation Quality" program in order to reduce shipping damages to its equipment and to ensure its just-in-time production and inventory system. The program consists of two parts. The first part ensures proper lifting and tie-down provisions by working with engineers in the design process. The second part focuses on internal practices to prepare the product for shipment. The chief transportation quality engineer has developed a carrier certification program for both inbound and outbound freight. The program establishes standards requiring the carrier to adhere to 100 percent performance. Use of…arrow_forward

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning