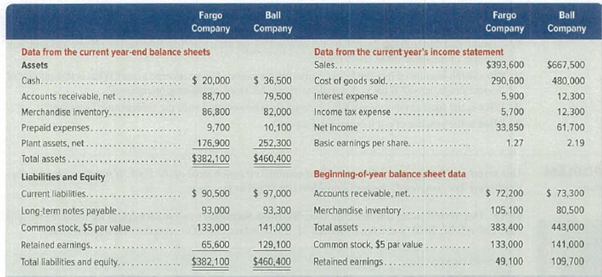

Summary information from the financial statements of two companies competing in the same industry follows.

Required

- 1. For both companies compute the (a)

current ratio , (b) acid-test ratio, (c)accounts receivable turnover, (d) inventory turnover, (e) days’ sales in inventory, and (f) days’ sales uncollected. Round to one decimal place. Identify the company you consider to be the better short-term credit risk and explain why. - 2. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on total assets, and (d) return on common stockholders’ equity. Assuming that each company paid cash dividends of $1.50 per share and each company’s stock can be purchased at $25 per share, compute their (e) price-earnings ratios and (f) dividend yields. Round to one decimal place; for part b, round to two decimals. Identify which company’s stock you would recommend as the better investment and explain why.

1(a)

Compute the current ratio of Company F and Company B.

Explanation of Solution

Current ratio: Current ratio is one of the liquidity ratios, which measures the capacity of the company to meet its short-term obligations using its current assets. Current ratio is calculated by using the formula:

Compute the current ratio of Company F and Company B:

| Ratios | Company F | Company B |

| Cash | $20,000 | $36,500 |

| Accounts receivables, net | $88,700 | $79,500 |

| Merchandise inventory | $86,800 | $82,000 |

| Prepaid expenses | $9,700 | $10,100 |

| Current assets (A) | $205,200 | $208,100 |

| Current liabilities (B) | $90,500 | $97,000 |

| Current ratio | 2.3:1 | 2.1:1 |

Table (1)

Therefore, the current ratio of Company F and Company B is 2.3 to 1 and 2.1 to 1 respectively.

1(b)

Compute the Acid-test ratio ratio of Company F and Company B.

Explanation of Solution

Acid-test ratio: It is a ratio used to determine a company’s ability to pay back its current liabilities by liquid assets that are current assets except inventory and prepaid expenses.

Compute the Acid-test ratio of Company F and Company B:

| Particulars | Company F | Company B |

| Cash | $20,000 | $36,500 |

| Accounts receivables, net | $77,100 | $70,500 |

| Current notes receivable (trade) | $11,600 | $9,000 |

| Quick assets (C) | $108,700 | $116,000 |

| Current liabilities (D) | $90,500 | $97,000 |

| Acid-test ratio | 1.2:1 | 1.2:1 |

Table (2)

Therefore, the Acid-test ratio of Company F and Company B is 1.2 to 1 and 1.2 to 1 respectively.

1(c)

Compute the accounts receivable turnover ratio of Company F and Company B.

Explanation of Solution

Accounts receivables turnover ratio: Receivables turnover ratio is mainly used to evaluate the collection process efficiency. It helps the company to know the number of times the accounts receivable is collected in a particular time period. This ratio is determined by dividing credit sales and average net receivables.

Compute the accounts receivable turnover ratio of Company F and Company B:

| Particulars | Company F | Company B |

| Beginning Accounts receivables, net (E) | $72,200 | $73,300 |

| Ending Accounts receivables, net (F) | $88,700 | $79,500 |

| Average accounts receivables | $80,450 | $76,400 |

| Net credit sales (H) | $393,600 | $667,500 |

| Accounts receivable turnover ratio | 4.9 times | 8.7 times |

Table (3)

Therefore, the accounts receivable turnover ratio of Company F and Company B is 4.9 to 1 and 8.7 to 1 respectively.

1(d)

Compute the Inventory turnover ratio of Company F and Company B.

Explanation of Solution

Inventory Turnover Ratio: This ratio is a financial metric used by a company to quantify the number of times inventory is used or sold during the accounting period. It is calculated by using the formula:

Compute the Inventory turnover ratio of Company F and Company B:

| Particulars | Company F | Company B |

| Ending inventory (I) | $86,800 | $82,000 |

| Beginning inventory (J) | $105,100 | $80,500 |

| Average inventory (K) | $95,950 | $81,250 |

| Cost of goods sold (L) | $290,600 | $480,000 |

| Inventory turnover ratio | 3.0 times | 5.9 times |

Table (4)

Therefore, the Inventory turnover ratio of Company F and Company B is 3.0 to 1 and 5.9 to 1 respectively.

1(e)

Compute the days’ sales in inventory of Company F and Company B.

Explanation of Solution

Days’ sales in inventory: Days’ in inventory is determined as the number of days a particular company takes to make sales of the inventory available with them.

Compute the days’ sales in inventory of Company F and Company B:

| Particulars | Company F | Company B |

| Ending inventory (M) | $86,800 | $82,000 |

| Cost of goods sold (N) | $290,600 | $480,000 |

| Days’ sales in inventory | 109.0 days | 62.4 days |

Table (5)

Therefore, the days’ sales in Inventory of Company F and Company B are 109 days and 62.4 days respectively.

1(f)

Compute the days’ sales uncollected of Company F and Company B.

Explanation of Solution

Days’ sales uncollected: This ratio is used to determine the number of days a particular company takes to collect accounts receivables.

Compute the days’ sales uncollected of Company F and Company B:

| Particulars | Company F | Company B |

| Ending Accounts receivables, net (F) | $88,700 | $79,500 |

| Net credit sales (O) | $393,600 | $667,500 |

| Days’ sales uncollected | 82.3 days | 43.5 days |

Table (6)

Therefore, the days’ sales uncollected of Company F and Company B are 82.3 days and 43.5 days respectively.

Identify the company with better short-term credit risk and explain the same.

Explanation of Solution

The current ratio of Company F is slightly better than the current ratio of Company B. The acid-test ratios of both the companies are same. The accounts turnover and the inventory turnover of Company B are better than the ratios of Company F. Hence, Company B is better in managing the short term credit risk.

2(a)

Compute the profit margin ratio of Company F and Company B.

Explanation of Solution

Profit margin: It is one of the profitability ratios. Profit margin ratio is used to measure the percentage of net income that is being generated per dollar of revenue or sales.

Given, net income and net sales of Company F are $33,850 and $393,600.

Compute the profit margin ratio of Company F:

Given, net income and net sales of Company B are $61,700 and $667,500.

Compute the profit margin ratio of Company B:

Therefore, the profit margin of Company F and Company B is 8.6% and 9.2% respectively.

2(b)

Compute the total asset turnover of Company F and Company B.

Explanation of Solution

Total asset turnover: Total asset turnover is a ratio that measures the productive capacity of the total assets to generate the sales revenue for the company. Thus, it shows the relationship between the net sales and the average total assets. Turnover of assets is calculated as follows:

Given, average total assets and net sales of Company F are $382,750 (1) and $393,600.

Compute the total assets turnover ratio of Company F:

Given, average total assets and net sales of Company B are $451,700 (1) and $667,500.

Compute the total assets turnover ratio of Company B:

Working note:

Compute the average total assets of Company F and Company B:

| Ratios and Formula | Company F | Company B |

|

Average total assets: |

…… (1)

Table (7)

Therefore, the total assets turnover of Company F and Company B is 1.03 times and 1.48 times respectively.

2(c)

Compute the return on total assets of Company F and Company B.

Explanation of Solution

Return on total assets: Return on total assets is the financial ratio that determines the amount of net income earned by the business with the use of total assets owned by it. It indicates the magnitude of the company’s earnings with relative to its total assets. Return on investment is calculated as follows:

Given, average total assets and net income of Company F are $382,750 (1) and $33,850.

Compute the return on total assets ratio of Company F:

Given, average total assets and net income of Company B are $451,700 (1) and $61,700.

Compute the return on total assets ratio of Company B:

Therefore, the total assets turnover of Company F and Company B is 8.8% and 13.7% respectively.

2(d)

Compute the return on common stockholders’ equity of Company F and Company B.

Explanation of Solution

Return on common stockholders’ equity ratio: It is a profitability ratio that measures the profit generating ability of the company from the invested money of the shareholders. The formula to calculate the return on equity is as follows:

Given, average Common stockholders’ equity and net income of Company F are $190,350 (2) and $33,850.

Compute the return on common stockholders’ equity of Company F:

Given, average Common stockholders’ equity and net income of Company B are $260,400 (2) and $61,700.

Compute the return on common stockholders’ equity of Company B:

Working note:

Compute the average Common stockholders’ equity of Company F and Company B:

| Ratios and Formula | Company F | Company B |

|

Average common stockholders’ equity: |

…… (2)

Table (8)

Therefore, the common stockholders’ equity of Company F and Company B is 17.8% and 23.7% respectively.

2(e)

Compute the price/earnings ratio of Company F and Company B.

Explanation of Solution

Price/Earnings Ratio: The price/earnings ratio shows the market value of the amount invested to earn $1 by a company. It is major tool used by investors for making decisions related to the investment in a company.

Given, market price per share of company F is $25 and earnings per share is $1.27.

Compute the price/earnings ratio of Company F:

Given, market price per share of company B is $25 and earnings per share is $2.19.

Compute the price/earnings ratio of Company B:

Therefore, the price/earnings ratio of Company F and Company B is 19.7 and 11.4 respectively.

2(f)

Compute the dividend yield ratio of Company F and Company B.

Explanation of Solution

Dividend yields: Dividend yield ratio indicates how much percentage of share prices a company pays out in the form of dividends price. The formula to calculate the dividend yield percentage is as follows:

Given, market price per share of company B is $25 and annual dividend per share is $1.50.

Compute the dividend yield ratio of Company F:

Given, market price per share of company B is $25 and annual dividend per share is $1.50.

Compute the dividend yield ratio of Company B:

Therefore, the dividend yield ratio of Company F and Company B is 6.0% and 6.0% respectively.

Identify the company, that its stock would be recommended as the better investment and explain the same.

Explanation of Solution

The price earnings ratio of Company F is slightly better than the price earnings ratio of Company B. The dividend yield ratios of both the companies are same. The profitability ratios of Company B are better than the ratios of Company F. Hence, Hence, Company B is a better investment option.

Want to see more full solutions like this?

Chapter 17 Solutions

Principles of Financial Accounting.

- Review the select information for Bean Superstore and Legumes Plus (industry competitors), and then complete the following. A. Compute the accounts receivable turnover ratios for each company for 2018 and 2019. B. Compute the number of days sales in receivables ratios for each company for 2018 and 2019. C. Determine which company is the better investment and why. Round answers to two decimal places.arrow_forwardReview the select information for Liquor Plaza and Beer Buddies (industry competitors) and complete the following. A. Compute the accounts receivable turnover ratios for each company for 2018 and 2019. B. Compute the number of days sales in receivables ratios for each company for 2018 and 2019. C. Determine which company is the better investment and why. Round answers to two decimal places.arrow_forwardGrammatico Company has just completed its third year of operations. The income statement is as follows: Selected information from the balance sheet is as follows: Required: Note: Round answers to two decimal places. 1. Compute the times-interest-earned ratio. 2. Compute the debt ratio. 3. CONCEPTUAL CONNECTION Assume that the lower quartile, median, and upper quartile values for debt and times-interest-earned ratios in Grammaticos industry are as follows: How does Grammatico compare with the industrial norms? Does it have too much debt?arrow_forward

- Measures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was 82.60 on December 31, 20Y2. Instructions Determine the following measures for 20Y2, rounding to one decimal place, including percentages, except for per-share amounts: 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days sales in receivables 6. Inventory turnover 7. Number of days sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders equity 14. Return on common stockholders equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yieldarrow_forwardUsing the following select financial statement information from Black Water Industries, compute the accounts receivable turnover ratios for 2018 and 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Black Water Industries?arrow_forwardMeasures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was 82.60 on December 31, 20Y2. Instructions Determine the following measures for 20Y2 (round to one decimal place, including percentages, except for per-share amounts): 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days sales in receivables 6. Inventory turnover 7. Number of days sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders equity 14. Return on common stockholders equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yieldarrow_forward

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: 1. Calculate the return on sales. (Note: Round the percent to two decimal places.) 2. CONCEPTUAL CONNECTION Briefly explain the meaning of the return on sales ratio, and comment on whether Juroes return on sales ratio appears appropriate.arrow_forwardThe following select financial statement information from Vortex Computing. Compute the accounts receivable turnover ratios and the number of days sales in receivables ratios for 2018 and 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Vortex Computing if industry average for accounts receivable turnover ratio is 4 times and days sales in receivables ratio is 85 days?arrow_forwardFINANCIAL RATIOS Based on the financial statements for Jackson Enterprises (income statement, statement of owners equity, and balance sheet) shown on pages 596597, prepare the following financial ratios. All sales are credit sales. The Accounts Receivable balance on January 1, 20--, was 21,600. 1. Working capital 2. Current ratio 3. Quick ratio 4. Return on owners equity 5. Accounts receivable turnover and average number of days required to collect receivables 6. Inventory turnover and average number of days required to sell inventoryarrow_forward

- Using the following select financial statement information from Mover Supply Depot, compute the accounts receivable turnover ratios for 2018 and 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Mover Supply Depot if the industry average is 4 times?arrow_forwardThe average liabilities, average stockholders' equity, and average total assets are as follows: 1. Determine the following ratios for both companies, rounding ratios and percentagesto one decimal place: a. Return on total assets b. Return on stockholders' equity c. Times interest earned d. Ratio of total liabilities to stockholders' equity 2. Based on the information in (1), analyze and compare the two companies'solvency and profitability. Comprehensive profitability and solvency analysis Marriott International, Inc., and Hyatt Hotels Corporation are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions): Balance sheet information is as follows:arrow_forwardFINANCIAL RATIOS Based on the financial statements, shown on pages 605606, for McDonald Carpeting Co. (income statement, statement of owners equity, and balance sheet), prepare the following financial ratios. All sales are credit sales. The balance of Accounts Receivable on January 1, 20--, was 6,800. 1. Working capital 2. Current ratio 3. Quick ratio 4. Return on owners equity 5. Accounts receivable turnover and the average number of days required to collect receivables 6. Inventory turnover and the average number of days required to sell inventoryarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning