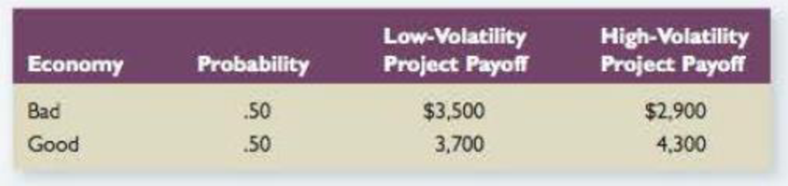

Agency Costs Fountain Corporation’s economists estimate that a good business environment and a bad business environment are equally likely for the coming year. The managers of the company must choose between two mutually exclusive projects. Assume that the project the company chooses will be the firm’s only activity and that the firm will close one year from today. The company is obligated to make a $3,500 payment to bondholders at the end of the year. The projects have the same systematic risk but different volatilities. Consider the following information pertaining to the two projects:

- a. What is the expected value of the company if the low-volatility project is undertaken? What if the high-volatility project is undertaken? Which of the two strategies maximizes the expected value of the firm?

- b. What is the expected value of the company’s equity if the low-volatility project is undertaken? What is it if the high-volatility project is undertaken?

- c. Which project would the company’s stockholders prefer’? Explain.

- d. Suppose bondholders arc fully aware that stockholders might choose to maximize equity value rather than total firm value and opt for the high-volatility project. To minimize this agency cost, the firm's bondholders decide to use a bond covenant to stipulate that the bondholders can demand a higher payment if the company chooses to take on the high-volatility project. What payment to bondholders would make stockholders indifferent between the two projects?

a)

To determine: The expected value of the firm if the low volatility project is undertaken.

Introduction:

Cost of equity: It is a return that a company pays to its equity investors. A company’s equity cost signifies the compensation the market demands in substitute for owning the possessions and bearing the ownership risks

Explanation of Solution

The expected value of every project is the total of the probability of each state of the economy times the value in that economy state.

As this is only project for the firm, the firm value will be similar as the project value.

Calculate the low-volatility project value:

The probability of bad is 0.50, project payoff value (low volatility) for bad is $3,500 and project payoff value (low volatility) for good is $3,700.

Therefore, the low volatility project value is $3,600.

Calculate the high-volatility project value:

The probability of good is 0.50, project payoff value (high volatility) for bad is $2,900 and project payoff value (high volatility) for good is $4,300.

Therefore, the high volatility project value is $3,600.

b)

To determine: The expected value of the company’s equity if low volatility and high volatility project is undertaken.

Explanation of Solution

Explanation:

The equity value is the residual value of the firm after the company pays off bondholders. If the low-volatility project is decided, the company’s equity will be worth of $0 if the economy is bad and $200 if the economy is good. As these two scenarios are evenly probable, the anticipated value of the company’s equity is as follows:

Calculate the expected value of equity with low volatility project:

Therefore, the expected value of equity with low volatility project value is $100.

Calculate the expected value of equity with high volatility project:

Therefore, the expected value of equity with high volatility project value is $400.

c)

To determine: Which project should the company’s stockholder prefer.

Explanation of Solution

Risk-neutral investors should prefer the strategy with the greater expected value. Hence, the firm’s stockholders should choose the high-volatility project, since it maximize the anticipated worth of the firm’s equity.

d)

To determine: The returns that bondholders would make stockholders indifferent among the two given projects.

Explanation of Solution

To make stockholders in-different among the lower-volatility project and the higher-volatility project, the bondholders will require increase their required debt-payment so that the anticipated equity worth if the high-volatility project is chosen is equal to the expected worth of equity if the lower-volatility project is chosen. As shown in part b, the expected value of equity when the lower-volatility project selected is $100.

If the high-volatility project is preferred, the value of the company will have around $2,900 if the economy is bad and $4,300 when the economy is good. When the economy is under bad, the whole $2,900 will go to the stockholders and bondholders will obtain nothing.

If the economy is under good, stockholders will obtain the dissimilarity among $4,300, the overall worth of the company, and the necessary debt payment. Assume, X as the debt payment that bondholders will need if the high-volatility project is preferred. For stockholders to be dissimilar among the two projects, the anticipated equity value if the high-volatility project is preferred must be equal to $100.

Determine the value of X:

Therefore, the debt payment value will be $4,100,

Want to see more full solutions like this?

Chapter 17 Solutions

CONNECT 1 SEMESTER ACCESS CARD FOR CORPORATE FINANCE

- Various Contingency Issues Skinner Company has the following contingencies: 1. Potential costs due to the discovery of a possible defect related to one of its products. These costs are probable and can be reasonably estimated. 2. A potential claim for damages to be received from a lawsuit filed this year against another company. It is probable that proceeds from the claim will be received by Skinner next year. 3. Potential costs due to a promotional campaign in which a cash refund is sent to customers when coupons are redeemed. Skinner estimated, based on past experience, that 70% of the coupons would be redeemed. Forty percent of the coupons were actually redeemed and the cash refunds sent this year. The remaining 30% of the coupons are expected to be redeemed next year. Required: 1. How should Skinner report the potential costs due to the discovery of a possible product defect? Explain why. 2. How should Skinner report this year the potential claim for damages that may be received next year? Explain why. 3. This year, how should Skinner account for the potential costs and obligations due to the promotional campaign?arrow_forwardRelaxing Collection Efforts The Boyd Corporation has annual credit sales of 1.6 million. Current expenses for the collection department are 35,000, bad-debt losses are 1.5%, and the days sales outstanding is 30 days. The firm is considering easing its collection efforts such that collection expenses will be reduced to 22,000 per year. The change is expected to increase bad-debt losses to 2.5% and to increase the days sales outstanding to 45 days. In addition, sales are expected to increase to 1,625,000 per year. Should the firm relax collection efforts if the opportunity cost of funds is 16%, the variable cost ratio is 75%, and taxes are 40%?arrow_forwardFountain Corporation’s economists estimate that a good business environment and a bad business environment are equally likely for the coming year. The managers of the company must choose between two mutually exclusive projects. Assume that the project the company chooses will be the firm’s only activity and that the firm will close one year from today. The company is obligated to make a $4,200 payment to bondholders at the end of the year. The projects have the same systematic risk but different volatilities. Consider the following information pertaining to the two projects: Economy Probability Low-Volatility Project Payoff High-Volatility Project Payoff Bad .50 $ 4,200 $ 3,400 Good .50 4,600 4,900 a. What is the expected value of the company if the low-volatility project is undertaken? What if the high-volatility project is undertaken? (Do not round intermediate calculations.) b. What is the expected value of the company’s equity if the low-volatility…arrow_forward

- Payback and NPV methods, no income taxes. (CMA, adapted) Andrews Construction is analyzing its capital expenditure proposals for the purchase of equipment in the coming year. The capital budget is limited to $5,000,000 for the year. Lori Bart, staff analyst at Andrews, is preparing an analysis of the three projects under consideration by Corey Andrews, the company’s owner. Required: Because the company’s cash is limited, Andrews thinks the payback method should be used to choose between the capital budgeting projects. What are the benefits and limitations of using the payback method to choose between projects? Calculate the payback period for each of the three projects. Ignore income taxes. Using the payback method, which projects should Andrews choose? Bart thinks that projects should be selected based on their NPVs. Assume all cash flows occur at the end of the year except for initial investment amounts. Calculate the NPV for each project. Ignore income taxes. Which projects,…arrow_forwardDifferential analysis involving opportunity costs On July 1, Coastal Distribution Company is considering leasing a building and buying the necessary equipment to operate a public warehouse. Alternative the company could use the funds to invest in $740,000 of 5% U.S Treasury bonds that mature in 14years the bonds could be purchased at face value. The following data have been assembled: Instructions 1. Prepare a differential analysis as of July 1 presenting the proposed operation of the warehouse for the 14yrs(Alternative 1) as compared with investing in U.S Treasury bonds 2.Based on the results disclosed by the differential analysis, should the proposal be accepted? 3. If the praposal is accepted, what is the total estimated operating income of the warehouse for the 14years?arrow_forwardGive typing answer with explanation and conclusion A company pursues a cost-cutting initiative that costs $21,000 to implement. Thereafter, however, the initiative reduces after-tax costs by $6,500 per year perpetually. The company relies on 64% debt financing at a 11.4% pretax interest rate. The company marginal tax rate is 31%. The company β is 1.41, short-term risk-free rate is 7.4%, and required risk premium for the market portfolio is 11.0%. Find the project’s net present value. -19,083 -23,090 -25,399 -27,939 -20,991arrow_forward

- Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store’s product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store manager believes that the economic surge will subside; therefore, she will release the additional investment in working capital. The store manager’s pay raises are largely determined by her store’s return on investment (ROI), which has exceeded 22% each of the last three years. Required: 1. Assuming the company’s discount rate is 16%, calculate the net present value of the store manager’s investment opportunity. 2. Calculate the annual margin, turnover, and return on investment (ROI) provided by the store manager’s investment…arrow_forwardA new product will cost $750,000 to design, test prototypes, and set up for production. Net revenue the first year is projected to be $225,000. Marketing is unsure whether future year revenues will (a) increase by $25,000 per year as the product’s advantages become more widely known or (b) decrease by 10% per year due to competition. A third pattern of increasing by $25,000 for one year and then decreasing by 10% per year has been suggested as being more realistic. The firm evaluates projects with a 12% interest rate, and it believes that this product will have a 5-year life. Calculate the present worth and rate of return for each scenario.arrow_forwardMarginal cost-benefit analysis and the goal of the firm Ken Allen, capital budgeting analyst for Bally Gears, Inc., has been asked to evaluate a proposal. The manager of the automotive division believes that replacing the robotics used on the heavy truck gear line will produce total benefits of $584,000 (in today's dollars) over the next 5 years. The existing robotics would produce benefits of $398,000 (also in today's dollars) over that same time period. An initial cash investment of $233,600 would be required to install the new equipment. The manager estimates that the existing robotics can be sold for $62,000. Show how Ken will apply marginal cost-benefit analysis techniques to determine the following: a. The marginal (added) benefits of the proposed new robotics is.......? b. The marginal (added) cost of the proposed new robotics is...........? c. The net benefit of the proposed new robotics is........? d. Ken Allen should recommend the company............? (Select the…arrow_forward

- Khan Ltd is an importer of novelty products. The directors are considering whether to introduce a new product, expected to have a very short economic life. Two alternative methods of promoting the new product are available, details of which are as follows: Alternative 1 would involve heavy initial advertising and the employment of a large number of agents. The directors expect that an immediate cash outflow of £100,000 would be required (the cost of advertising) which would produce a net cash inflow in year one of £70,000 and £63,000 in year two. Alternative 2 would involve a lower outlay on advertising (£50,000, payable immediately), and no use of agents. It would produce net cash inflows of zero after one year and £42,000 at the end of each of the subsequent two years. Mr Court, a director of Khan Ltd, comments, “I generally favour the payback method for choosing between investment alternatives such as these. However, I am worried that the advertising expenditure under the second…arrow_forwardeEgg is considering the purchase of a new distributed network computer system to help handle its warehouse inventories. The system costs $50,000 to purchase and install and $32,000 to operate each year. The system is estimated to be useful for 4 years. Management expects the new system to reduce the cost of managing inventories by $58,000 per year. The firm’s cost of capital (discount rate) is 11%. a.The firm is not yet profitable and therefore pays no income taxes. b.The firm is in the 26% income tax bracket and uses straight-line (SLN) depreciation with no salvage value. Assume MACRS rules do not apply. c. The firm is in the 26% income tax bracket and uses double-declining-balance (DDB) depreciation with no salvage value. Given a four-year life, the DDB depreciation rate is 50% (i.e., 2 × 25%). In year four, record depreciation expense as the net book value (NBV) of the asset at the start of the year. 1. What is the internal rate of return (IRR) of the proposed investment for…arrow_forwardCompanies invest in expansion projects with the expectation of increasing the earnings of its business. Consider the case of McFann Co.: McFann Co. is considering an investment that will have the following sales, variable costs, and fixed operating costs: Year 1 Year 2 Year 3 Year 4 Unit sales 3,000 3,250 3,300 3,400 Sales price $17.25 $17.33 $17.45 $18.24 Variable cost per unit $8.88 $8.92 $9.03 $9.06 Fixed operating costs $12,500 $13,000 $13,220 $13,250 This project will require an investment of $25,000 in new equipment. Under the new tax law, the equipment is eligible for 100% bonus deprecation at t = 0, so it will be fully depreciated at the time of purchase. The equipment will have no salvage value at the end of the project’s four-year life. McFann pays a constant tax rate of 25%, and it has a weighted average cost of capital (WACC) of 11%. Determine what the project’s net present value (NPV) would be under the new tax law. Determine what…arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning