Concept explainers

Remex (RMX) currently has no debt in its capital structure. The beta of its equity is 1.50. For each year into the indefinite future, Remex’s

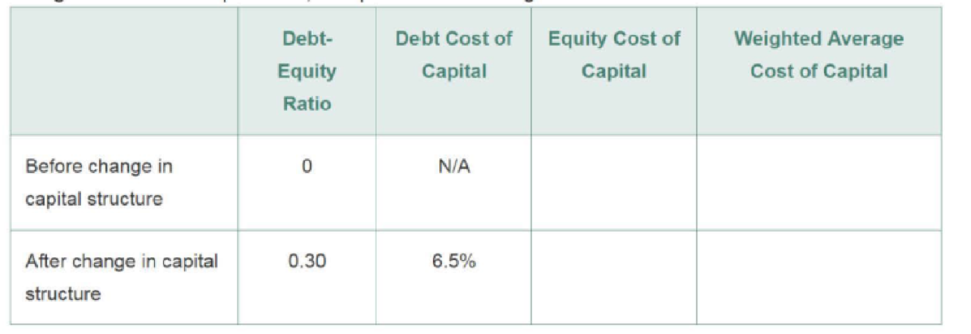

- a. Using the information provided, complete the following table:

- b. Using the information provided and your calculations in part a, determine the value of the tax shield acquired by Remex if it changes its capital structure in the way it is considering.

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

MyLab Finance with Pearson eText -- Access Card -- for Corporate Finance (Myfinancelab)

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning