INTERMEDIATE ACCT. W/CONNECT>CUSTOM<

9th Edition

ISBN: 9781307019636

Author: SPICELAND

Publisher: MCG/CREATE

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 18, Problem 18.1E

Comprehensive income

• LO18–2

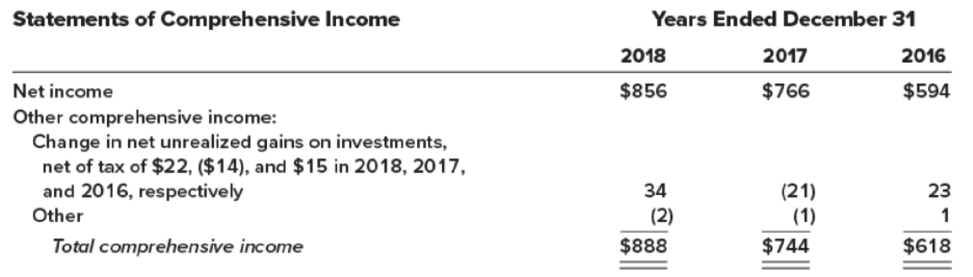

The following is from the 2018 annual report of Kaufman Chemicals, Inc.:

Kaufman reports accumulated other comprehensive income in its

| ($ in millions) | 2018 | 2017 |

| Shareholders’ equity: | ||

| Common stock | 355 | 355 |

| Additional paid-in capital | 8,567 | 8,567 |

| 6,544 | 5,988 | |

| Accumulated other comprehensive income | 107 | 75 |

| Total shareholders’ equity | $15,573 | $14,985 |

Required:

1. What is comprehensive income and how does it differ from net income?

2. How is comprehensive income reported in a balance sheet?

3. Why is Kaufman’s 2018 balance sheet amount different from the 2018 amount reported in the disclosure note? Explain.

4. From the information provided, determine how Kaufman calculated the $107 million accumulated other comprehensive income in 2018.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Problem 18-5 (Static) Shareholders' equity transactions; statement of shareholders' equity [LO18-6,18-

7,18-8]

Listed below are the transactions that affected the shareholders' equity of Branch-Rickle Corporation during the period 2021=2023. At

December 31, 2020, the corporation's accounts included:

57:28

Common stock, 105 million shares at $1 par

Paid-in capital-excess of par

Retained earnings

sin

thousands)

$105,000

630,000

970,000

at

nces

a. November 1, 2021, the board of directors declared a cash dividend of $0.80 per share on its common shares, payable to

shareholders of record November 15, to be paid December

b On March 1, 2022, the board of directors declared a property dividend consisting of corporate bonds of Warner Corporation that

Branch Rickie was holding as an investment. The bonds had a fair value of $1.6 million, but were purchased two years previously for

$1.3 million. Because they were intended to be held to maturity, the bonds had not been previously written up. The…

For years ended December 31

Equity Investee Financial Summary,

$ millions

2018

2017

2016

Net sales...

Gross margin

Net income..

Cummins' share of net income.

$7,352

$7,050

$5,654

1,373

1,422

1,182

647

680

499

$ 336

$ 308

$ 260

Royalty and interest income..

58

49

41

Total equity, royalty and interest from investees...

$ 394

$ 357

$ 301

Current assets

$3,401

1,449

$3,416

1,379

Noncurrent assets

Current liabilities..

Noncurrent liabilities..

Net assets...

(2,669)

(218)

(2,567)

(237)

$1,963

$1,991

Cummins' share of net assets

$1,144

$1,116

a. What assets and liabilities of unconsolidated affiliates are omitted from Cummins' balance sheet as a

result of the equity method of accounting for those investments?

b. Do the liabilities of the unconsolidated affiliates affect Cummins directly? Explain.

c. How does the equity method impact Cummins' ROE and its RNOA components (net operating asset

turnover and net operating profit margin)?

Problem 1 (Adapted)The shareholders’ equity of Yelan Company showed the following account balances on December 31, 2018:Share capital, P100 5,000,000Share Premium 1,000,000Retained earnings 2,000,000Revaluation surplus 800,000

Compute the book value per share on December 31, 2018.

Chapter 18 Solutions

INTERMEDIATE ACCT. W/CONNECT>CUSTOM<

Ch. 18 - Identify and briefly describe the two primary...Ch. 18 - Prob. 18.2QCh. 18 - Prob. 18.3QCh. 18 - Prob. 18.4QCh. 18 - Prob. 18.5QCh. 18 - Prob. 18.6QCh. 18 - Prob. 18.7QCh. 18 - What is meant by a shareholders preemptive right?Ch. 18 - Terminology varies in the way companies...Ch. 18 - Most preferred shares are cumulative. Explain what...

Ch. 18 - The par value of shares historically indicated the...Ch. 18 - Prob. 18.12QCh. 18 - How do we report components of comprehensive...Ch. 18 - The balance sheet reports the balances of...Ch. 18 - At times, companies issue their shares for...Ch. 18 - Prob. 18.16QCh. 18 - The costs of legal, promotional, and accounting...Ch. 18 - When a corporation acquires its own shares, those...Ch. 18 - Discuss the conceptual basis for accounting for a...Ch. 18 - The prescribed accounting treatment for stock...Ch. 18 - Brandon Components declares a 2-for-1 stock split....Ch. 18 - What is a reverse stock split? What would be the...Ch. 18 - Suppose you own 80 shares of Facebook common stock...Ch. 18 - Prob. 18.24QCh. 18 - Comprehensive income LO181 Schaeffer Corporation...Ch. 18 - Stock issued LO184 Penne Pharmaceuticals sold 8...Ch. 18 - Prob. 18.3BECh. 18 - Prob. 18.4BECh. 18 - Prob. 18.5BECh. 18 - Retirement of shares LO185 Agee Storage issued 35...Ch. 18 - Treasury stock LO185 The Jennings Group...Ch. 18 - Prob. 18.8BECh. 18 - Prob. 18.9BECh. 18 - Cash dividend LO188 Real World Financials...Ch. 18 - Effect of preferred stock on dividends LO187 The...Ch. 18 - Property dividend LO187 Adams Moving and Storage,...Ch. 18 - Stock dividend LO188 On June 13, the board of...Ch. 18 - Prob. 18.14BECh. 18 - Stock split LO188 Refer to the situation...Ch. 18 - Prob. 18.16BECh. 18 - Comprehensive income LO182 The following is from...Ch. 18 - Prob. 18.2ECh. 18 - Earnings or OCI? LO182 Indicate by letter whether...Ch. 18 - Stock issued for cash; Wright Medical Group LO184...Ch. 18 - Issuance of shares; noncash consideration LO184...Ch. 18 - Prob. 18.6ECh. 18 - Share issue costs; issuance LO184 ICOT Industries...Ch. 18 - Reporting preferred shares LO184, LO187 Ozark...Ch. 18 - Prob. 18.9ECh. 18 - Prob. 18.10ECh. 18 - Retirement of shares LO185 In 2018, Borland...Ch. 18 - Treasury stock LO185 In 2018, Western Transport...Ch. 18 - Treasury stock; weighted-average and FIFO cost ...Ch. 18 - Prob. 18.14ECh. 18 - Prob. 18.15ECh. 18 - Prob. 18.16ECh. 18 - Transact ions affecting retained earnings LO186,...Ch. 18 - Effect of cumulative, nonparticipating preferred...Ch. 18 - Stock dividend LO188 The shareholders equity of...Ch. 18 - Prob. 18.20ECh. 18 - Cash in lieu of fractional share rights LO188...Ch. 18 - Prob. 18.22ECh. 18 - Transact ions affecting retained earnings LO186...Ch. 18 - Profitability ratio LO181 Comparative balance...Ch. 18 - Prob. 18.25ECh. 18 - Various stock transactions; correction of journal...Ch. 18 - Share buybackcomparison of retirement and treasury...Ch. 18 - Reacquired sharescomparison of retired shares and...Ch. 18 - Prob. 18.4PCh. 18 - Shareholders equity transactions; statement of...Ch. 18 - Prob. 18.6PCh. 18 - Prob. 18.7PCh. 18 - Prob. 18.8PCh. 18 - Effect o f preferred stock characteristics on...Ch. 18 - Prob. 18.10PCh. 18 - Stock dividends received on investments;...Ch. 18 - Various shareholders equity topics; comprehensive ...Ch. 18 - Prob. 18.13PCh. 18 - Prob. 18.1BYPCh. 18 - Prob. 18.2BYPCh. 18 - Research Case 184 FASB codification; comprehensive...Ch. 18 - Judgment Case 185 Treasury stock; stock split;...Ch. 18 - Prob. 18.6BYPCh. 18 - Prob. 18.7BYPCh. 18 - Prob. 18.8BYPCh. 18 - Prob. 1CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 19-9 (Static) EPS from statement of retained earnings [LO19-4, 19-5, 19-6] Comparative Statements of Retained Earnings for Renn-Dever Corporation were reported as follows for the fiscal years ending December 31, 2019, 2020, and 2021. RENN-DEVER CORPORATION Statements of Retained Earnings For the Years Ended December 31 2021 2020 2019 Balance at beginning of year Net income (loss) $6,794, 292 3,308,700 $5,464,052 2,240,900 $5,624,552 (160,500) Deductions: Stock dividend (34,900 shares) Common shares retired, September 30 (110,000 shares) Common stock cash dividends 242,000 212,660 698,000 889,950 Balance at end of year $8,971,042 $6,794, 292 $5,464,052 At December 31, 2018, paid-in capital consisted of the following: $1,855,000 Common stock, 1,855,000 shares at $1 par Paid in capital-excess of par 7,420,000 No preferred stock or potential common shares were outstanding during any of the periods shown. Required: Compute Renn-Dever's earnings per share as it would have appeared in…arrow_forwardLogan Company's comparative Balance Sheet at December 31, 2021 reports the nts following (in millions): 2021 2020 Total Assets 85 60 Total Liabilities 55 45 During 2021, Logan Company earned net income in the amount of $14 million and issued $8 million of common stock. Calculate the amount of dividends that Logan Company-should report in its 2021 Statement of Stockholders' Equity? $5 million O $3 million $2 million $7 million None of the above.arrow_forwardConsolidated Statements of Changes in Shareholders' Equity ($ in thousands) Share Capital Contributed Surplus Retained Earnings AOCI(1) Total Balance at January 31, 2015 $ 167,460 $ 2,831 $ 140,527 $ 18,465 $ 329,283 Net earnings for the year — – 69,779 – 69,779 Other comprehensive income (Note 12) – – 4,583 11,953 16,536 Other comprehensive income of equity investee – – (15) – (15) Comprehensive income – – 74,347 11,953 86,300 Equity settled share-based payments – 124 – – 124 Dividends (Note 19) – – (58,210) – (58,210) Issuance of common shares (Note 15) 450 (335) – – 115 450 (211) (58,210) – (57,971) Balance at January 31, 2016 $167,910 $ 2,620 $156,664 $ 30,418 $357,612 Balance at January 31, 2014 $ 166,069 $ 3,528 $ 145,762 $ 7,081 $ 322,440 Net earnings for the year — – 62,883 – 62,883 Other comprehensive income (Note 12) – – (11,968) 11,384 (584) Other comprehensive income of equity investee – – 30 – 30 Comprehensive income – – 50,945 11,384…arrow_forward

- ome selected financial statement items belonging to MNO Company are given in the table below. According to this information, which of the following is Return on Assets (ROA) in 2021? Inventory 12,500 Total Assets in 2021 110,000 Current Liabilities 40,000 Total Assets in 2020 90,000 Net Profit 12,000 Shareholders' Equity 65,000 Select one: a. 0.18 b. 0.10 c. 0.13 d. 0.12arrow_forwardAnalysis and Interpretation of Liquidity and Solvency Balance sheets and income statements for 3M Company follow. 3M COMPANY Consolidated Statements of Income For Years Ended December 31 ($ millions) Net sales Operating expenses Cost of sales Selling, general and administrative expenses Research, development and related expenses Gain on sale of businesses Total operating expenses 16,682 16,055 7,602 6,626 1,821 1,870 (547) (586) 25,558 23,965 Operating income 7,207 7,692 Other expense, net* 207 144 Income before income taxes 7,000 7,548 Provision for income taxes 1,637 2,679 Net income including noncontrolling interest 5,363 4,869 Less: Net income attributable to noncontrolling interest 14 11 Net income attributable to 3M $5,349 $4,858 * Interest expense, gross is $350 million in 2018 and $322 million in 2017. Current assets 3M COMPANY Consolidated Balance Sheets At December 31 ($ millions) Cash and cash equivalents Marketable securities Accounts receivable Total inventories Prepaids…arrow_forwardRatio Analysis Consider the following information taken from the shareholders' equity section: (dollar amounts in thousands) 2018 2017 Preferred shares $ 1,000 $ 1,000 Common shares, 258,052,356 and 274,001,656 shares issued and outstanding in 2018 and 2017, respectively 3,343 3,310 Contributed surplus—common shares 766,382 596,239 Retained earnings 2,192,674 2,424,403 Accumulated other comprehensive (loss) income (206,662) 58,653 Total shareholders’ equity $2,756,737 $3,083,605 Additional Information (all numbers in thousands other than per share information): 2018 Weighted average common shares outstanding 260,000 Price per share at year-end $105.45 Net income $1,358,950 Preferred dividends $100,000 Common dividends $213,440 Common dividends per share $.82 Share repurchases $834,975 Required: 1. Calculate the following for 2018 (Note: Round answers to two decimal places): Shareholder Profitability:…arrow_forward

- ! Required information Great Adventures Problem AP10-1 [The following information applies to the questions displayed below.] Tony and Suzie have purchased land for a new camp. Now they need money to build the cabins, dining facility, a ropes course, and an outdoor swimming pool. Tony and Suzie first checked with Summit Bank to see if they could borrow an additional $1 million, but unfortunately the bank turned them down as too risky. Undeterred, they promoted their idea to close friends they had made through the outdoor clinics and TEAM events. They decided to go ahead and sell shares of stock in the company to raise the additional funds for the camp. Great Adventures has authorized $1 par value common stock. When the company began on July 1, 2021, Tony and Suzie each purchased 10,000 shares (20,000 shares total) of $1 par value common stock at $1 per share. The following transactions affect stockholders' equity during the remainder of 2022: November 5 Issue an additional 106,000…arrow_forwardRatio Analysis Consider the following information taken from the shareholders' equity section: (dollar amounts in thousands) 2018 2017 Preferred shares $ 1,000 $ 1,000 Common shares, 258,052,356 and 274,001,656 shares issued and outstanding in 2018 and 2017, respectively 3,343 3,310 Contributed surplus—common shares 766,382 596,239 Retained earnings 2,192,674 2,424,403 Accumulated other comprehensive (loss) income (206,662) 58,653 Total shareholders’ equity $2,756,737 $3,083,605 Additional Information (all numbers in thousands other than per share information): 2018 Weighted average common shares outstanding 260,000 Price per share at year-end $105.45 Net income $1,358,950 Preferred dividends $100,000 Common dividends $213,440 Common dividends per share $.82 Share repurchases $834,975 Required: 1. Calculate the following for 2018 (Note: Round answers to two decimal places): Shareholder Payout:…arrow_forwardSuppose selected comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of the end of the fiscal year (in millions). 2017 2016 Net sales $4,750 $5,401 Cost of goods sold 3,901 3,500 Net income 55 120 Accounts receivable 65 109 Inventory 1,250 1,350 Total assets 2,850 3,150 Total common stockholders' equity 961 1,111 Compute the following ratios for 2017. (Round asset turnover to 2 decimal places, e.g 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 2.5%)arrow_forward

- Delta Designs, Inc. Comparative Balance Sheet December 31, 2018 and 2017 2018 2017 Assets Total Current Assets $32,250 $66,600 Property, Plant, and Equipment, Net 180,750 168,720 Other Assets 37,000 60,680 Total Assets $250,000 $296,000 Liabilities Total Current Liabilities $30,500 $45,880 Long-term Debt 80,750 204,536 Total Liabilities 111,250 250,416 Stockholders' Equity Total Stockholders' Equity 138,750 45,584 Total Liabilities and Stockholders' Equity $250,000 $296,000 Perform a vertical analysis of DeltaDelta Designs' balance sheet for each year. (Round the percent of total amounts to one decimal place, X.X%.) Delta Designs, Inc. Balance Sheet December 31, 2018 and 2017 2018 Percent of Total…arrow_forward#21 The ABC Company began operations in January 2018 and reported the following results for each of its three years of operations: 2018 – 799,500 net loss 2019 – 123,000 net loss 2020 – 2,460,000 net income At December 31, 2020, ABC Company’s capital accounts were as follows: 8% cumulative preference share capital, 50,000 shares issued and outstanding – P 7,687,500 Ordinary share capital, 750,000 shares issued and outstanding – P 31,518,750 ABC Company has never paid a cash or bonus issue and there has been no change in its capital accounts since it began operations in 2018. What is the book value per ordinary share at December 31, 2020? Group of answer choices 41.62 42.85 41.70 42.03arrow_forward= Balance Sheet You are evaluating the balance sheet for Cypress Corporation. From the balance sheet you find the following balances: Cash and marketable securities = $540,000, Accounts receivable $740,000, Inventory = $440,000, Accrued wages and taxes = $44,000, Accounts payable= $140,000, and Notes payable $940,000. What is Cypress's net working capital? Multiple Choice о $596,000 $1,124,000 О $1,720,000 $2,844,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License