INTER.ACC (LL)-W/CONNECT PKG

9th Edition

ISBN: 9781260636260

Author: SPICELAND

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 18.24E

Profitability ratio

• LO18–1

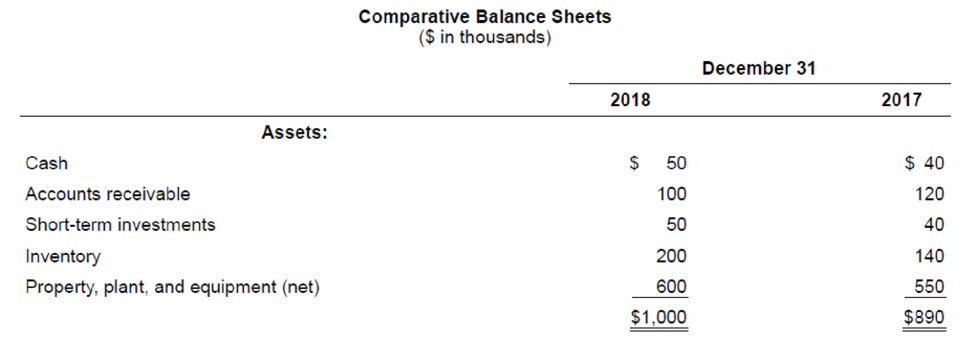

Comparative balance sheets for Softech Canvas Goods for 2018 and 2017 are shown below. Softech pays no dividends and instead reinvests all earnings for future growth.

Liabilities and Shareholders’ Equity:

| Current liabilities | $ 240 | $210 |

| Bonds payable | 160 | 160 |

| Paid-in capital | 400 | 400 |

| 200 | 120 | |

| $1,000 | $890 |

Required:

1. Determine the return on shareholders’ equity for 2018.

2. What does the ratio measure?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

4. Table 1 below presents some of the financial ratios of Company XYZ for 2019.

Table 1. Financial Ratios of Company XYZ, 2019

Value

2.6

12

2.7

16%

2%

20%

60%

Ratio

Total Asset Turnover Ratio

Fixed Asset Turnover Ratio

Current Ratio

Gross Profit Margin

Net Profit Margin

Long-term Debt Ratio

Total Debt Ratio

What is the company's Return on Equity (ROE) for 2019?

A. 6.5%

B. 13.0%

C. 9.6%

D. 3.12%

Net Protit marigin XTT X

Profitability and Asset Management Ratios You are thinking of investing in Tikki's Torches, Inc. You have only the following information on the firm at year-end 2018: net income = $680,000, total debt = $13.8 million, debt ratio = 43%. What is Tikki's ROE for 2018?

Multiple Choice

4.93%

11.47%

2.12%%

3.72%

The _________ is the internal rate of return a firm must earn on its investment in order to maintain the market value of its stock.

a.

gross profit margin

b.

IRR

c.

Cost of Capital

d.

net profit margin

A snapshot from Violet Flowers Ltd.'s financial information reveals the following for years 2018 and 2019:

Item

2018

2019

Long Term Debt

$4,600,000

$4,900,000

Interest expense

$600,500

$870,000

Dividends

$400,000

$590,000

Common Stock

$1,740,000

$1,815,000

Additional paid-in surplus

$4,200,000

$4,500,000

Violet Flowers' FCF for 2019 was:

a.

$300,000

b.

$515,000

c.

$785,000

d.

$270,000

Chapter 18 Solutions

INTER.ACC (LL)-W/CONNECT PKG

Ch. 18 - Identify and briefly describe the two primary...Ch. 18 - Prob. 18.2QCh. 18 - Prob. 18.3QCh. 18 - Prob. 18.4QCh. 18 - Prob. 18.5QCh. 18 - Prob. 18.6QCh. 18 - Prob. 18.7QCh. 18 - What is meant by a shareholders preemptive right?Ch. 18 - Terminology varies in the way companies...Ch. 18 - Most preferred shares are cumulative. Explain what...

Ch. 18 - The par value of shares historically indicated the...Ch. 18 - Prob. 18.12QCh. 18 - How do we report components of comprehensive...Ch. 18 - The balance sheet reports the balances of...Ch. 18 - At times, companies issue their shares for...Ch. 18 - Prob. 18.16QCh. 18 - The costs of legal, promotional, and accounting...Ch. 18 - When a corporation acquires its own shares, those...Ch. 18 - Discuss the conceptual basis for accounting for a...Ch. 18 - The prescribed accounting treatment for stock...Ch. 18 - Brandon Components declares a 2-for-1 stock split....Ch. 18 - What is a reverse stock split? What would be the...Ch. 18 - Suppose you own 80 shares of Facebook common stock...Ch. 18 - Prob. 18.24QCh. 18 - Comprehensive income LO181 Schaeffer Corporation...Ch. 18 - Stock issued LO184 Penne Pharmaceuticals sold 8...Ch. 18 - Prob. 18.3BECh. 18 - Prob. 18.4BECh. 18 - Prob. 18.5BECh. 18 - Retirement of shares LO185 Agee Storage issued 35...Ch. 18 - Treasury stock LO185 The Jennings Group...Ch. 18 - Prob. 18.8BECh. 18 - Prob. 18.9BECh. 18 - Cash dividend LO188 Real World Financials...Ch. 18 - Effect of preferred stock on dividends LO187 The...Ch. 18 - Property dividend LO187 Adams Moving and Storage,...Ch. 18 - Stock dividend LO188 On June 13, the board of...Ch. 18 - Prob. 18.14BECh. 18 - Stock split LO188 Refer to the situation...Ch. 18 - Prob. 18.16BECh. 18 - Comprehensive income LO182 The following is from...Ch. 18 - Prob. 18.2ECh. 18 - Earnings or OCI? LO182 Indicate by letter whether...Ch. 18 - Stock issued for cash; Wright Medical Group LO184...Ch. 18 - Issuance of shares; noncash consideration LO184...Ch. 18 - Prob. 18.6ECh. 18 - Share issue costs; issuance LO184 ICOT Industries...Ch. 18 - Reporting preferred shares LO184, LO187 Ozark...Ch. 18 - Prob. 18.9ECh. 18 - Prob. 18.10ECh. 18 - Retirement of shares LO185 In 2018, Borland...Ch. 18 - Treasury stock LO185 In 2018, Western Transport...Ch. 18 - Treasury stock; weighted-average and FIFO cost ...Ch. 18 - Prob. 18.14ECh. 18 - Prob. 18.15ECh. 18 - Prob. 18.16ECh. 18 - Transact ions affecting retained earnings LO186,...Ch. 18 - Effect of cumulative, nonparticipating preferred...Ch. 18 - Stock dividend LO188 The shareholders equity of...Ch. 18 - Prob. 18.20ECh. 18 - Cash in lieu of fractional share rights LO188...Ch. 18 - Prob. 18.22ECh. 18 - Transact ions affecting retained earnings LO186...Ch. 18 - Profitability ratio LO181 Comparative balance...Ch. 18 - Prob. 18.25ECh. 18 - Various stock transactions; correction of journal...Ch. 18 - Share buybackcomparison of retirement and treasury...Ch. 18 - Reacquired sharescomparison of retired shares and...Ch. 18 - Prob. 18.4PCh. 18 - Shareholders equity transactions; statement of...Ch. 18 - Prob. 18.6PCh. 18 - Prob. 18.7PCh. 18 - Prob. 18.8PCh. 18 - Effect o f preferred stock characteristics on...Ch. 18 - Prob. 18.10PCh. 18 - Stock dividends received on investments;...Ch. 18 - Various shareholders equity topics; comprehensive ...Ch. 18 - Prob. 18.13PCh. 18 - Prob. 18.1BYPCh. 18 - Prob. 18.2BYPCh. 18 - Research Case 184 FASB codification; comprehensive...Ch. 18 - Judgment Case 185 Treasury stock; stock split;...Ch. 18 - Prob. 18.6BYPCh. 18 - Prob. 18.7BYPCh. 18 - Prob. 18.8BYPCh. 18 - Prob. 1CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please calculate the following: 2017 2018 2019 2020 Net profit margin Gross profit margin Current ratio Quick ratio Debt ratio Interest coverage ratio Dividend yield Earnings per share 186.0 CPS 203.1CPS 217.4 CPS 263.1cps 2017 1-profit- 172.4 m 1-revenue- 5,628.0 m(billion) 2- gross profit- 1,230.5 m 2- revenue- 5,628.0 m 3- current assets- 1,170.7m 3- current liabilities- 885.8 m 4- current assets- 1,170.7 4- inventory- 859.9 m 4- current liabilities- 885.8 m 5- total debts- 1,598.8 5- total assets- 2,452.3 6- operating profit- 259.2 6- interest expense/ finance cost- 10.7m 7- annual dividends per share- 118.0 cents (46. cents per share) 7- current share price- $24.71 2018 1-profit- 233.2 m 1-revenue- 6,854.3 m(billion) 2- gross profit- 1,470.2 mil 2- revenue- 6,854.3 m 3- current assets- 1,210.5 m 3-…arrow_forwardThe following is data for 123 Corp: Book value, Dec 31 2016 Comprehensive income Dividends Required return 825 20% What is normal income for 2017? Round your answer to the nearest dollar (no decimal points) 2017 100 23 2018 150 32arrow_forwardProfitability Ratios Financial Ratios Return on Equity Return on Assets Gross Profit Margin Operating Profit Margin Net Profit Margin 2017 9.3% ww 57.21% 38.35% 2018 9.8% 5.0% 56.15% 36.77% | 2019 10.3% 5.2% 55.66% 34.89% 359.82% 359.90% 356.70% 2020 5.3% 2.6% 2021 6.7% 420% 3.4% 54.55% 53.82% 27.40% 28.72% 349.25% Observation/Interpretatio narrow_forward

- Profit Margin and Debt Ratio Assume you are given the following relationships for the Haslam Corporation: Sales/total assets 1.7 Return on assets (ROA) 2% Return on equity (ROE) 6% Calculate Haslam's profit margin. Do not round intermediate calculations. Round your answer to two decimal places. % Calculate Haslam's liabilities-to-assets ratio. Do not round intermediate calculations. Round your answer to two decimal places. % Suppose half of Haslam's liabilities are in the form of debt. Calculate the debt-to-assets ratio. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardPrevious Nex You are a financial Manager of Chevron Corp You need to assess the effectiveness of working capital management.of the company for 2018 using the following data What is th 2018 Payable turnover? 2017 Accoun Receivable 15 353 000 2018 Account Receivable 15,050 000 2017 Inventory = 5 585 000 2018 Inventory = 5 704.000 2017 Accounts Payable = 14 565.000 2018 Accounts Payable = 13 953 000 2017 Sales = 134 674 000 2018 Sales = 158 902.000 2017 Cost of Sales = 96 114.000 2018 Cost of Sales = 113 997 000 2017 Purchases = 95 114 000 2018 Purchases 123 435.000arrow_forwardcalculate the table below based on the income statement and balance sheet attached Ratio Anaylsis 2021 est 2020 2019 Industry Average Profitability Ratios Profit Margin on Sales (%) 8 Earning Power (%) 17.2 Return on Total Assets (%) 12 Return on Common Equity (%) 25 Market Value Ratios Price/Earnings Ratio Price/Earnings Ratio (times) 12.5 Price/Cash Flow Ratio (times) 6.8 Market /Book Value Ratio (times) 1.7arrow_forward

- Comparative balance sheets for Softech Canvas Goods for 2024 and 2023 are shown below. Softech pays no dividends and instead reinvests all earnings for future growth. Assets: Cash Comparative Balance Sheets ($ in thousands) Accounts receivable Short-term investments Inventory Property, plant, and equipment (net) Liabilities and Shareholders' Equity: Current liabilities Bonds payable Paid-in capital Retained earnings December 31 2024 2023 $ 50 $ 40 100 120 50 40 200 140 600 550 $ 1,000 $ 890 $ 240 $ 210 160 160 400 400 200 120 $ 1,000 $ 890 Required: 1. Determine the return on shareholders' equity for 2024. 2. What does the ratio measure? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the return on shareholders' equity for 2024. Note: Round your answer to 2 decimal places. Return on shareholders' equity %arrow_forwardRequirement 1. Compute these ratios: Working Capital Current Debt-to- Ratio Cash Ratio Debt Ratio Equity Ratio Round ratios to two 14.44 212400 7.73 decimal places or format as percentages or Accounts Days Sales currency as appropriate. Inventory Days Sales in Gross ProfitReceivable in Turnover Inventory Percentage Turnover Receivables 2019 Total Assets = Rate of Rate of Asset Return on Return on Turnover Stockholders' Earnings Total Assets Ratio Equity Per Share 2019 SHE = Price/ Earnings *Current Stock Price is Dividend $10.00 per share Ratio* Dividend Yield Payout Dividend per share= Requirement 2. Based on the ratios computed above, analyze the company's ability to pay its debts (both current and long term). Refer to at least 3 specific ratios in your analysis. Requirement 3: Based on the ratios computed above, analyze the company's management of inventory. Refer to at least 2 specific ratios in your analysis. Requirement 4: Based on the ratios computed above, analyze the company's…arrow_forwardBelow is the financial information from thế comparative statements of Pahd ana Company. (In Thousands) PAND CO. EMIC CO. 2019 2018 2019 2018 Sales Cost of Goods Sold Selling expenses Net Income Р 3,400 1,700 1,000 P 700 P 4,400 2,300 1,500 P 600 P 5,300 3,100 1.500 P 700 P 4,900 2,100 1.900 P 900 Accounts receivable Inventory Fixed Assets Total Assets P 3,600 1,000 2,300 P6,500 P 1,900 1,900 1.000 P 4,800 P 500 1,000 Р3,100 2,000 2.000 P 7,100arrow_forward

- rehensive Problem 2- St of Cash Flows and Ratios Algo C. Klein Inc. C. Klein Inc. Income Statement Comparative Balance Sheets December 31, 2018 and 2017 For years ended December 31, 2017 and 2018 2018 2017 Change 2018 2017 $469,000 $422,000 (303,000) (248,000) 166,000 174,000 Current assets: Sales (all on credit) Cost of goods sold Gross margin Cash $52.260 34,000 $37,900 $14,360 Accounts receivable (net) 28,000 6,000 Inventory Prepaid expenses 44,000 42,000 2100 2,000 -1,200 900 Depreciation expense Other operating 5631 36,000 51,000 Other current assets 1310 2000 -690 102,000 85,000 Totol current assets 132,470 112,000 20,470 expenses Total operating 138,000 136,000 expenses ok Operating income 28.000 38,000 Long-term Investments 75,000 52,000 23,000 Other income (expenses) Plant assets 302,000 253,000 49,000 nces Interest expense (4,700) (3,500) Less: accumulated (76,800) (51,000) 25,800 depreciation Gain on sale of 4,900 3,400 Total plant assets 225,200 202,000 23,200 investments…arrow_forwardProfit Margin and Debt Ratio Assume you are given the following relationships for the Haslam Corporation: Sales/total assets 1.5 Return on assets (ROA) 4% Return on equity (ROE) 7% Calculate Haslam's profit margin and liabilities-to-assets ratio. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: _______ % Liabilities-to-assets ratio: ______% Suppose half of its liabilities are in the form of debt. Calculate the debt-to-assets ratio. Do not round intermediate calculations. Round your answer to two decimal places. _______%arrow_forwardProblem #8. Profitability Ratios Gonzales is analyzing the earnings performance of the Bobadilla Transport Corporation. He has gathered the following data from Bobadilla's financial statements and from a report of the closing market prices of shares: Profit for 2019 Preference dividends declared during 2019 Ordinary dividends declared Dec. 31, 2019 Number of Bobadilla ordinary shares outstanding: P743,000 60,000 620,000 Jan. 1, 2019 Dec. 31, 2019 1,100,000 shs. 1,300,000 shs. Market price per ordinary share on Dec. 31, 2019 P15 Calculate the following ratios relating to the Bobadilla share: 1. Basic earnings per ordinary share 2. Price-earnings ratio 3. Dividend yield on ordinary sharearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License