a.

To show: The adjustments to be made in capital accounts of Ace Products in order to payout a stock dividend of 10%.

Introduction:

Stock Dividend:

When a company pays dividends to its shareholders not in cash but in the form of additional shares, such a dividend is termed as stock dividend. This form is generally paid out when company falls short of cash.

a.

Answer to Problem 18P

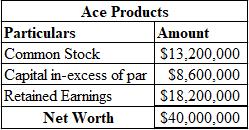

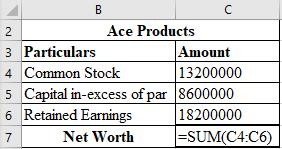

The adjustments that would be made to the capital account for payment of 10% stock dividend are as follows:

Explanation of Solution

The calculation used for making required adjustments to capital account is shown below:

Working Notes:

Calculation of Stock Dividend in numbers:

Calculation of additional capital in-excess of par:

Calculation of Capital in-excess of par:

Calculation of closing balance of

b.

To show: The adjustments to be made to the EPS as well as the stock price of Ace Products, assuming the P/E ratio to remain the same.

Introduction:

Earnings per share (EPS):

It is the profit earned by shareholders on each share. A higher EPS indicates higher value of the company because investors are ready to pay higher price for one share of the company.

Stock Price:

The highest price of one share of a company that an investor is willing to pay is termed as the stock’s price. It is current price used for the trading of such share.

b.

Answer to Problem 18P

The EPS of Ace Products after stock dividend is $1.82 and the price of its stocks is $18.20.

Explanation of Solution

Calculation of the EPS of Ace Products after stock dividends:

Calculation of the price of stock:

Working Note:

Calculation of Number of shares after stock dividend:

c.

To calculate: The number of shares a shareholder would have if he originally owns 70 shares.

Introduction:

Stockholder:

Also termed as a shareholder, the person who own shares or capital stock in a corporation is the stockholder. In other words, a shareholder is the one who partly owns a company, limited to the amount of his shares.

c.

Answer to Problem 18P

The number of shares that a shareholder originally holding 70 shares will after the declaration of stock dividend have 77 shares.

Explanation of Solution

Calculation of the number of shares of one of the shareholders after stock dividend:

d.

To calculate: The worth of the total investments of an investor before as well as after the stock dividend, the P/E ratio being constant.

Introduction:

Stock Dividend:

When a company pays dividends to its shareholders not in cash but in the form of additional shares, such a dividend is termed as stock dividend. This form is generally paid out when company falls short of cash.

d.

Answer to Problem 18P

The P/E ratio remaining constant, the worth of the total investments of an investor before the declaration of stock dividends is $1,400 and after the stock dividend is $1,401.

Explanation of Solution

Calculation of the value of an investors total investments before the declaration of stock dividends:

Calculation of the value of an investors total investments after the declaration of stock dividends:

Want to see more full solutions like this?

Chapter 18 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- Bayani Bakerys most recent FCF was 48 million; the FCF is expected to grow at a constant rate of 6%. The firms WACC is 12%, and it has 15 million shares of common stock outstanding. The firm has 30 million in short-term investments, which it plans to liquidate and distribute to common shareholders via a stock repurchase; the firm has no other nonoperating assets. It has 368 million in debt and 60 million in preferred stock. a. What is the value of operations? b. Immediately prior to the repurchase, what is the intrinsic value of equity? c. Immediately prior to the repurchase, what is the intrinsic stock price? d. How many shares will be repurchased? How many shares will remain after the repurchase? e. Immediately after the repurchase, what is the intrinsic value of equity? The intrinsic stock price?arrow_forwardBastion Corporation earned net income of $200,000 this year. The company began the year with 10,000 shares of common stock and issued 5,000 more on April 1. They issued $7,500 in preferred dividends for the year. What is the EPS for the year for Bastion?arrow_forwardEquity Inc. is currently an all-equity-financed firm. It has 10,000 shares outstanding that sell for $20 each. The firm has an operating income of $30,000 & pays no taxes. the firm contemplates a reconstructing that would issue $50,000 in 8% debt which will be used to repurchase stock. Show the value of the firm, EPS (earnings p. share?) and rate of return on the stock before and after reconstructing. What changed?arrow_forward

- Bonanza Billiard Games is an all-equity firm with 50 million shares outstanding, which are currently trading at $22 per share. Last month, Bonanza announced that it will change its capital structure by issuing $300 million in debt. The $200 million raised by this issue, plus another $200 million in cash that Bonanza already has, will be used to repurchase existing shares of stock. Assume that capital markets are perfect.• What is the market capitalization of the company before the transaction takes place?• What is the market capitalization of the company after the transaction takes place?arrow_forwardTrini Exports has a current market value of equity of $315,000. Currently, the firm has excess cash of $108,000, total assets of $424,000, net income of $113,000, and 3500 shares of stock outstanding. Trini Exports is going to use all of its excess cash to repurchase shares of stock. What will the stock price per share be after the stock repurchase is completed? (Show all workings)arrow_forwardTJ's has a market value equal to its book value. Currently, the firm has excess cash of $218,500, other assets of $897,309, and equity of $547,200. The firm has 40,000 shares of stock outstanding and net income of $59,800. Management has decided to spend 15 percent of the excess cash on a share repurchase program. How many shares of stock will be outstanding after the stock repurchase is completed?arrow_forward

- On January 20, Metropolitan Inc., sold 8 million shares of stock in an SEO. The market price of Metropolitan at the time was $40.25 per share. Of the 8 million shares sold, 5 million shares were primary shares being sold by the company, and the remaining 3 million shares were being sold by the venture capital investors. Assume the underwriter charges 5.1% of the gross proceeds as an underwriting fee. a. How much money did Metropolitan raise? b. How much money did the venture capitalists receive? c. If the stock price dropped 3.4% on the announcement of the SEO and the new shares were sold at that price, how much money would Metropolitan receive?arrow_forwardThe Longmire Company recently reported net profits after taxes of $34.3 million. It has 3.8 million shares of common stock outstanding and pays preferred dividends of $1.6 million per year. a. Compute the firm's earnings per share (EPS). b. Assuming that the stock currently trades at $57.46 per share, determine what the firm's dividend yield would be if it paid $2.96 per share to common stockholders. c. What would the firm's dividend payout ratio be if it paid $2.96 per share in dividends?arrow_forwardLILSO’s group's published annual report showed the following: -Operating profit for the year was EGP 4,000,000. -Interest Expense was EGP 700,000. -The group is subject to 20% taxes. -Number of common shares outstanding was 250,000. -The group has 100,000 Preferred stocks of EGP 15 par value. If you know that the group pays 11% dividends for each preferred stock, answer the following questions How much are the total earnings will be available for common stock holders? Calculate the Earnings per share (EPS) and the Dividends per share (DPS) if the board of directors decided to retain 70% of the year's earnings for further investment.arrow_forward

- A company has 1 million shares outstanding and earnings of $2 million. The company decides to use $10 million of unused cash to buy back shares on the open market. to buy back shares on the open market. The company's stock is trading at $50 per share. If the firm uses all of the $10 million of idle cash to buy back shares on the open market, the firm's shares trade at $50 per share. to buy back shares at market price, the company's earnings per share will be the highest share of the firm will be closest to : B. $2.30. C. $2.50. A. $2.00.arrow_forwardCullumber, Inc., a high-technology firm in Portland, raised a total of $60 million in an IPO. The company received $27 of the $30 per share offering price. The firm’s legal fees, SEC registration fees, and other out-of-pocket costs were $350,000. The firm’s stock price increased 17 percent on the first day of trading. What was the total cost to the firm of issuing the securities?arrow_forwardTucker’s National Distributing has a current market value of equityof $10,665. Currently, the firm has excess cash of $640, total assetsof $22,400, net income of $3,210, and 500 shares of stock outstanding.Tucker’s is going to use all of its excess cash to repurchase sharesof stock. What will the stock price per share be after the stockrepurchase is completed?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College