To determine: The Offer Price per share.

Introduction:

The term dividends allude to that portion of proceeds of an organization which is circulated by the organization among its investors. It is the remuneration of the investors for investments made by them in the shares of the organization. A dividend policy is an organization's way to deal with disseminating revenues back to its proprietors or investors. In the event that an organization is in a development stage, it might conclude that it won't pay profits, but instead re-contribute its

Answer to Problem 1MC

Solution: The Offer Price per share is $39.17.

Explanation of Solution

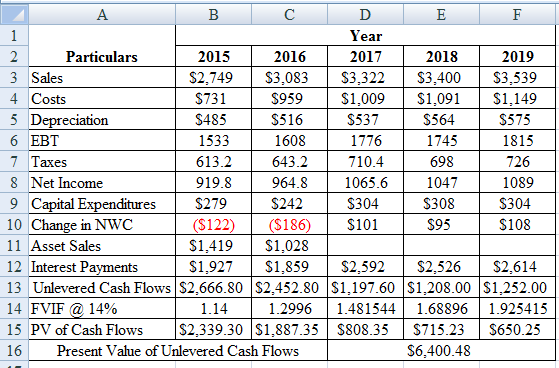

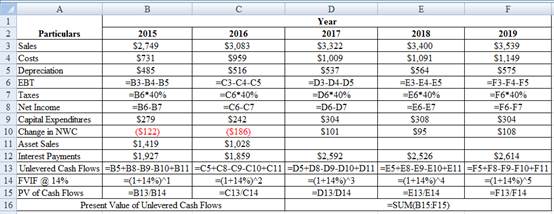

Determine the Present Value of Unlevered Cash Flows for the initial 5 years

Using a excel spreadsheet we calculate the present value of unlevered cash flows for the initial 5 years as,

Excel Spreadsheet:

Excel Workings:

Therefore the Present Value of Unlevered Cash Flows for the initial 5 years is $6,400.48

Determine the Unlevered Value of Cash Flow in Year 5

Therefore the Unlevered Value of Cash Flow in Year 5 is $12,341.14

Determine the Terminal Value at the end of Year 5

Therefore the Terminal Value at the end of Year 5 is $6,409.60

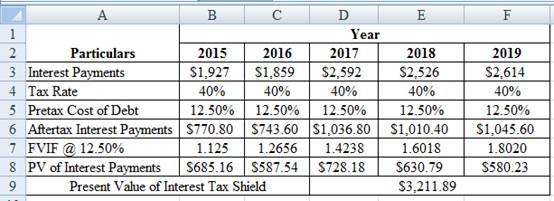

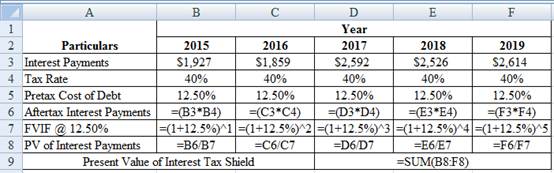

Determine the Present Value of Interest Tax Shield

Using a excel spreadsheet we calculate the present value of interest tax shield as,

Excel Spreadsheet:

Excel Workings:

Therefore the Present Value of Interest Tax Shield is $3,211.89

Determine the Levered

Therefore the Levered Cost of Equity using MM Proposition II with Corporate Taxes is 14.90%

Determine the WACC after Year 5

Therefore the WACC after Year 5 is 13.12%

Determine the Terminal Value of Levered Company after Year 5

Therefore the Terminal Value of Levered Company after Year 5 is $13,470.06

Determine the Interest Tax Shield after Year 5

Therefore the Interest Tax Shield after Year 5 is $1,128.92

Determine the Present Value of Interest Tax Shield after Year 5

Therefore the Present Value of Interest Tax Shield after Year 5 is $626.47

Determine the Value of Unlevered Cash Flows

Therefore the Value of Unlevered Cash Flows is $12,810.08

Determine the Value of Interest Tax Shield

Therefore the Value of Interest Tax Shield is $3,838.36

Determine the Offer Price per share

Therefore the Offer Price per share is $39.17,

Want to see more full solutions like this?

Chapter 18 Solutions

CORPORATE FIN.(LL)-W/ACCESS >CUSTOM<

- 1. Edmund Enterprises recently made a large investment to upgrade its technology. Although these improvements won’t have much effect on performance in the short run, they are expected to reduce future costs significantly. What effect will this investment have on Edmund Enterprises’ earnings per share this year? What effect might this investment have on the company’s intrinsic value and stock price? 2. Suppose you are a director of an energy company that has three divisions—natural gas, oil, and retail (gas stations). These divisions operate independently from one another, but all division managers report to the firm’s CEO. If you were on the compensation committee, as discussed in Question 1-12, and your committee was asked to set the compensation for the three division managers, would you use the same criteria as that used for the firm’s CEO? Explain your reasoningarrow_forwardWhy did HP split itself into two firms, a move that was rejected just three years earlier? Do you think the corporate strategy move of splitting the "old" HP into two companies will create shareholder value?arrow_forwardYour employer, a midsized human resources management company, is considering expansion intorelated fields, including the acquisition of Temp ForceCompany, an employment agency that supplies wordprocessor operators and computer programmersto businesses with temporarily heavy workloads.Your employer is also considering the purchase ofBiggerstaff & McDonald (B&M), a privately heldcompany owned by two friends, each with 5 millionshares of stock. B&M currently has free cash flow of$24 million, which is expected to grow at a constant rate of 5%. B&M’s financial statements reportshort-term investments of $100 million, debt of $200million, and preferred stock of $50 million. B&M’sweighted average cost of capital (WACC) is 11%.Answer the following questions: . (1) Write out a formula that can be used to valueany dividend-paying stock, regardless of itsdividend pattern.(2) What is a constant growth stock? How areconstant growth stocks valued?(3) What happens if a company has…arrow_forward

- Mini Case Your employer, a midsized human resources management company, is considering expansion into related fields, including the acquisition of Temp Force Company, an employment agency that supplies word processor operators and computer programmers to businesses with temporarily heavy workloads. Your employer is also considering the purchase of Biggerstaff & McDonald (B&M), a privately held company owned by two friends, each with 5 million shares of stock. B&M currently has free cash flow of $24 million, which is expected to grow at a constant rate of 5%. B&M’s financial statements report short-term investments of $100 million, debt of $200 million, and preferred stock of $50 million. B&M’s weighted average cost of capital (WACC) is 11%. Answer the following questions: Describe briefly the legal rights and privileges of common stockholders. What is free cash flow (FCF)? What is the weighted average cost of capital? What is the free cash flow valuation model? Use…arrow_forwardThe ink-jet printing division of Environmental Printing has grown tremendously in recent years. Assume the following transactions related to the ink-jet division occur during the year ended December 31, 2021. Environmental Printing is being sued for $9 million by Addamax. Plaintiff alleges that the defendants formed an unlawful joint venture and drove it out of business. The case is expected to go to trial later this year. The likelihood of payment is reasonably possible. Environmental Printing is the plaintiff in an $7 million lawsuit filed against a competitor in the high-end color-printer market. Environmental Printing expects to win the case and be awarded between $4.5 and $7 million. Environmental Printing recently became aware of a design flaw in one of its ink-jet printers. A product recall appears probable. Such an action would likely cost the company between $300,000 and $700,000. Record any amounts as a result of each of these contingencies. (If no entry is…arrow_forward

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning