Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 1P

Profit or Loss on New Stock Issue

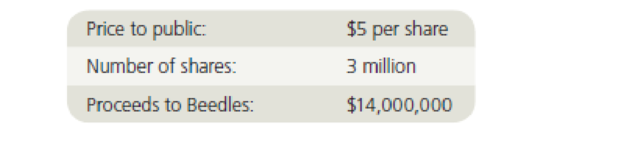

Security Brokers Inc. specializes in underwriting new issues by small firms. On a recent offering of Beedles Inc., the terms were as follows:

The out-of-pocket expenses incurred by Security Brokers in the design and distribution of the issue were $300,000. What profit or loss would Security Brokers incur if the issue were sold to the public at the following average price?

- a. $5 per share

- b. $6 per share

- c. $4 per share

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Security Brokers Inc. specializes in underwriting new issues by small firms. On a recent offering of Beedles Inc., the terms were as follows: Price to public: $5 per share Number of shares: 3 million Proceeds to Beedles: $14,000,000 The out-of-pocket expenses incurred by Security Brokers in the design and distribution of the issue were $360, 000. What profit or loss would Security Brokers incur if the issue were sold to the public at the following average price? Round your answers to the nearest dollar. Loss should be indicated by a minus sign. $5 per share? $ $6.75 per share? $ $4 per share? $

A firm desires to sell stock to the public. The underwriter charges $0.4 million in fees and offers to buy six million shares from the firm at a price of $30 per share. In addition, registration and audit fees total $120,000, and marketing and miscellaneous fees add up to another $65,000. The underwriter expects to earn gross proceeds per share of $36.

a) What is the issuing firm's out-of-pocket dollar transaction cost to issue the stock?

b) Immediately after the stock was issued, the stock price rose to $38. What is the issuing firm's opportunity cost?

c) What is the total issuance cost, including opportunity costs, as a percentage of the total funds available to the issuing firm?

David's Watersports Firm is considering a public offering of common stock. Its investment banker has informed the company that the retail price will be $16.85 per share for 550,000 shares. The company will receive $15.40 per share and will incur $180,000 in registration, accounting, and printing fees.

A. What is the spread on this issue in percentage terms? What are the total expenses of the issue as a percentage of total value (at retail)?

B. If the firm wanted to net $15.99 million from this issue, how many shares must be sold?

Chapter 18 Solutions

Intermediate Financial Management (MindTap Course List)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Stock Price after Recapitalization Lee Manufacturings value of operations is equal to 900 million after a recapitalization. (The firm had no debt before the recap.) Lee raised 300 million in new debt and used this to buy back stock. Lee had no short-term investments before or after the recap. After the recap, wd = 1/3. The firm had 30 million shares before the recap. What is P (the stock price after the recap)?arrow_forwardSuppose IWT has decided to distribute $50 million, which it presently is holding in liquid short-term investments. IWT’s value of operations is estimated to be about $1,937.5 million; it has $387.5 million in debt and zero preferred stock. As mentioned previously, IWT has 100 million shares of stock outstanding. Assume that IWT has not yet made the distribution. What is IWT’s intrinsic value of equity? What is its intrinsic stock price per share? Now suppose that IWT has just made the $50 million distribution in the form of dividends. What is IWT’s intrinsic value of equity? What is its intrinsic stock price per share? Suppose instead that IWT has just made the $50 million distribution in the form of a stock repurchase. Now what is IWT’s intrinsic value of equity? How many shares did IWT repurchase? How many shares remained outstanding after the repurchase? What is its intrinsic stock price per share after the repurchase?arrow_forwardThe Castle Company recently reported net profits after taxes of $15.8 million. It has 2.5 million shares of common stock outstanding and pays preferred dividends of $1 million a year. The company’s stock currently trades at $60 per share. Compute the stock’s earnings per share (EPS). What is the stock’s P/E ratio? Determine what the stock’s dividend yield would be if it paid $1.75 per share to common stockholders.arrow_forward

- A firm goes public. The firm receives $36.50 for each of the 7.25 million shares sold. The initial offering price was $38.75 per share, and the stock rose to $42.65 per share is the first few minutes of trading. The firm paid $2,285,000 in direct legal and other costs and $988,000 in indirect cost. What was the total for underpricing of this offer?arrow_forwardA broker that brings new issues of small firms to the public market. Its most recent deal for Deer Park, Inc., had the following characteristics: Number of shares: 1,400,000 Proceeds to Deer Park: $13,900,000 Price to public: $15 per share The legal fees were $153,000, printing costs were $56,500, and all the other expenses were $70,000. What is the profit or loss for the broker? Profit / (Loss) $enter the profit or loss in dollarsarrow_forwardeBookProfit or Loss on New Stock Issue Beedles Inc. needed to raise $14 million in an IPO and chose Security Brokers Inc. to underwrite the offering. The agreement stated that Security Brokers would sell 3 million shares to the public and provide $14 million in net proceeds to Beedles. The out-of-pocket expenses incurred by Security Brokers in the design and distribution of the issue were $240,000. What profit or loss would Security Brokers incur if the issue were sold to the public at the following average price? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answers to the nearest dollar. Loss should be indicated by a minus sign. $5.25 per share? $ $5.75 per share? $ $4.25 per share? $arrow_forward

- A firm goes public. The firm receives $35 for each of the 7.75 million shares sold. The initial offering price was $37 per share, and the stock rose to $38.25 per share is the first few minutes of trading. The firm paid $2,085,000 in direct legal and other costs and $833,000 in indirect cost. What were the underwrites spread of this offer?arrow_forwardMoonscape has just completed an initial public offering. The firm sold 3 million shares at an offer price of $12 per share. The underwriting spread was $0.30 a share. The price of the stock closed at $18.00 per share at the end of the first day of trading. The firm incurred $300,000 in legal, administrative, and other costs. What were flotation costs as a fraction of funds raised? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Cost as percent of funds raised?arrow_forwardSuppose a Sam's company in CA, completes an $95 million IPO priced to the public at $50 per share. The firm receives $47 per share, and the out-of-pocket expenses are $480,000. The stock’s closing price at the end of the first day is $59. What is the total cost to the firm of issuing the securities? $_______arrow_forward

- Gamma Industries has net income of $300,000, and it has 1,875,000 shares of common stock outstanding. The company's stock currently trades at $42 a share. Gamma is considering a plan in which it will use available cash to repurchase 10% of its shares in the open market at the current $42 stock price. The repurchase is expected to have no effect on net income or the company's P/E ratio. What will be its stock price following the stock repurchase? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardNeed my work checked The common stock of Permanent Assurance Corporation currently trades at $40.00 per share, which is approximates its intrinsic value. The company has announced plans to maintain its dividend next year at $1.20 per share. Your research indicates that historically, the firm's dividend payout ratio has averaged 50% while its return on equity averaged 9.0%. The book value of the shares is $25.00 and research shows there is relatively low variation in the firm's operations. You believe the firm's payout ratio and ROE should continue at their historic levels in the future over the long term. Enter your answers on the spreadsheet. Calculate the dividend yield of the firm's shares based on the announced dividend and rounded to 2 decimals: Dividend Yield:3.25% Estimate the long-term dividend yield based on the firm’s financial and operational performance based on the absolute approach and round to 2 decimals. Long-term dividend yield:3.25%…arrow_forwardA company has 20,858,702 shares outstanding. In an IPO, the firm issued 3,000,000 new shares. The initial price was ¢18.00 per share with investment bankers retaining ¢1.26 as fees. The final first-day closing price was ¢23.50 i. What were the total proceeds from this offering? What part was retained by the firm? What part by the investment bankers? What percent of the offering is this? ii. What was the market value of the firm following its first day as a publicly-held company?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Securities Markets and Transactions Pt1; Author: Larry Byerly;https://www.youtube.com/watch?v=v0ClVlaxWFY;License: Standard Youtube License