a)

To determine: The total dollar call premium required to call the old issue, whether it is tax deductible and the net after-tax cost of the call.

a)

Explanation of Solution

The overall premium is

b)

To determine: The dollar floatation cost and whether it is immediately tax deductible and post-tax flotation cost.

b)

Explanation of Solution

On the new issue the currency flotation rate is

c)

To determine: The amounts of old issue floatation cost and not been expensed and whether these deferred costs be expensed immediately if the old issue is refunded and the value of tax savings.

c)

Explanation of Solution

On the old issue the flotation costs were

d)

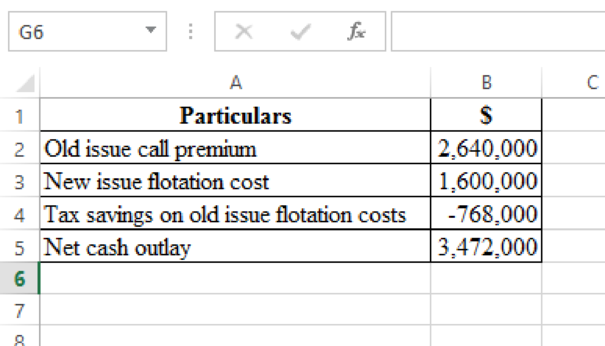

To determine: The net post-tax cash outlay needed to refund the old issue.

d)

Explanation of Solution

e)

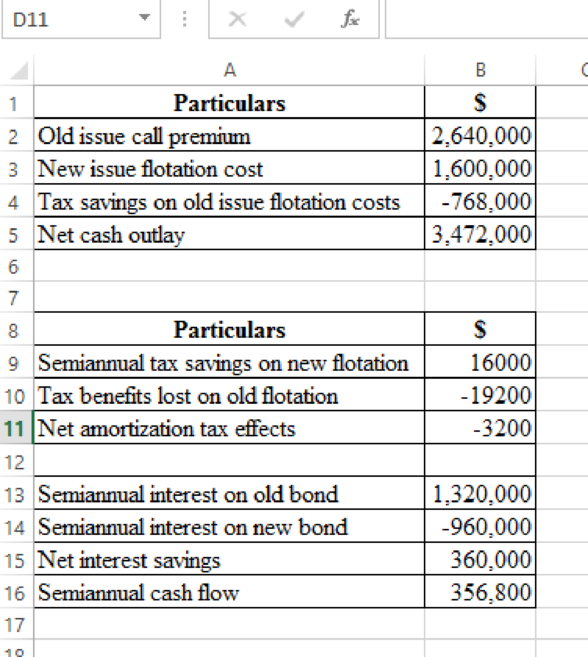

To determine: The semiannual tax savings that arises from amortizing the floatation cost and the foregone semiannual tax savings on the old-issue floatation cost.

e)

Explanation of Solution

The $1,600,000 cost of new issue flotation would be

f)

To determine: The semiannually post-tax interest savings that would result from the refunding.

f)

Explanation of Solution

The interest on the old issue is

g)

To determine: The sum of these two semiannual cash flows and appropriate discount rate to apply to these two semiannual cash flows and the present value.

g)

Explanation of Solution

The estimated amortization tax benefits over 20 years are about $3,200 per year, while the net interest costs over 20 years are about $360,000 per year. The net semi-annual cash balance, as shown below, is thus $356,800.

The cash flows are predicated on treaty obligations and therefore have about the same level of risk as to the debt of the company. In fact, the cash flows are already tax-net. Consequently, the suitable interest rate is the after-tax cost of debt to GST.(The citation of the cash to fund the net investment expenditure also affects the discount rate, but most companies use debt to finance that expenditure, and in this case, the discount rate should be the after-tax debt cost.)Finally, as we are valuing future flows, the correct debt cost is the cost of today, or the cost of the new issue, and not the debt cost that floated five years ago. The appropriate rate of discount is thus 0.6(8 percent) = 4.8 percent per annum, or 2.4 percent per semi-annual period.

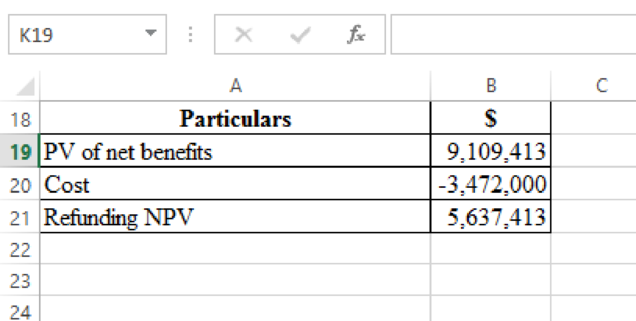

h)

To determine: The

h)

Explanation of Solution

The redemption of bonds would entail a net cash outlay of $3,472,000, but on a present-value basis it would yield $9,109,413 in net savings. The refunding NPV is thus $5,637,413:

The choice to repay instead of wait until later is much harder than finding the refunding NPV now. If interest rates were expected to fall, and therefore GST could issue debt below today's 8 percent rate in the future, then it might pay to wait. Interest rate motions, however, are very difficult to predict, if not impossible, and thus most

Want to see more full solutions like this?

Chapter 18 Solutions

Intermediate Financial Management (MindTap Course List)

- CHALLENGE PROBLEM The long-term liabilities section of Guyton Enterprises follows. The bonds outstanding on January 1, 20-1, have an annual coupon rate of 4% and had been issued several years ago at a price to yield 5% per year. The discount is amortized using the effective interest method. On December 31, 20-1, 900,000, 5% bonds were issued at a price to yield 6%. REQUIRED Compute the cash received from issuing the bonds on December 31, 20-1. (Hint: If you have not covered the effective interest method, assume that bond interest expense for 20-1 was 44,767.)arrow_forwardBond Valuation and Interest Rate Risk The Garraty Company has two bond issues outstanding. Both bonds pay 100 annual interest plus 1,000 at maturity. Bond L has a maturity of 15 years, and Bond S has a maturity of 1 year. a. What will be the value of each of these bonds when the going rate of interest is (1) 5%, (2) 8%, and (3) 12%? Assume that there is only one more interest payment to be made on Bond S. b. Why does the longer-term (15-year) bond fluctuate more when interest rates change than does the shorter-term bond (1 year)?arrow_forwardIssue Price The following terms relate to independent bond issues: 500 bonds; $1,000 face value; 8% stated rate; 5 years; annual interest payments 500 bonds; $1,000 face value; 8% stated rate; 5 years; semiannual interest payments 800 bonds; $1,000 face value; 8% stated rate; 10 years; semiannual interest payments 2,000 bonds; $500 face value; 12% stated rate; 15 years; semiannual interest payments Required Assuming the market rate of interest is 10%, calculate the selling price for each bond issue.arrow_forward

- Smashing Cantaloupes Inc. issued 5-year bonds with a par value of $35,000 and an 8% semiannual coupon (payable June 30 and December 31) on January 1, 2018, when the market rate of interest was 10%. Were the bonds issued at a discount or premium? Assuming the bonds sold at 92.288, what was the sales price of the bonds?arrow_forwardBond Yield and After-Tax Cost of Debt A companys 6% coupon rate, semiannual payment, 1,000 par value bond that matures in 30 years sells at a price of 515.16. The companys federal-plus-state tax rate is 40%. What is the firms after-tax component cost of debt for purposes of calculating the WACC? (Hint: Base your answer on the nominal rate.)arrow_forwardKrystian Inc. issued 10-year bonds with a face value of $100,000 and a stated rate of 4% when the market rate was 6%. Interest was paid semi-annually. Calculate and explain the timing of the cash flows the purchaser of the bonds (the investor) will receive throughout the bond term. Would an investor be willing to pay more or less than face value for this bond?arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning