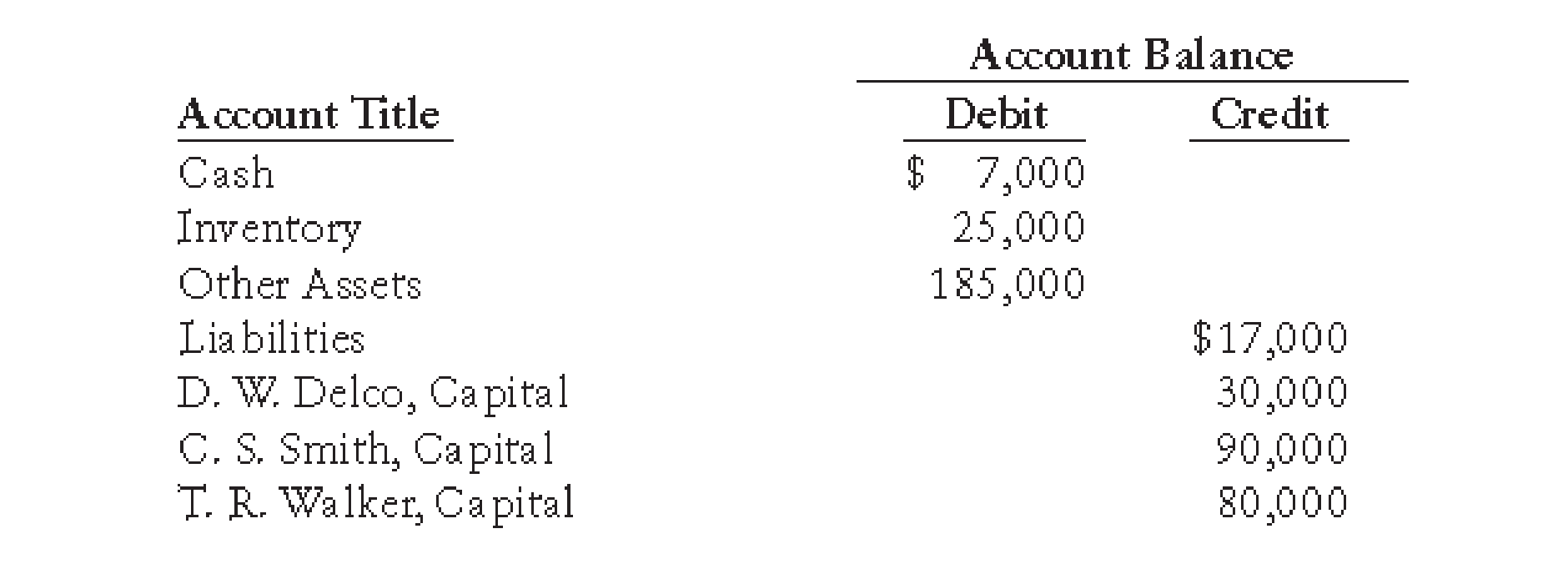

STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS After several years of operations, the

The noncash assets are sold for $165,000.

REQUIRED

1. Prepare a statement of partnership liquidation for the period April 1–15, 20--, showing the following:

(a) The sale of noncash assets on April 1

(b) The allocation of any gain or loss to the partners on April 1

(c) The payment of the liabilities on April 12

(d) The distribution of cash to the partners on April 15

2. Journalize these four transactions in a general journal.

Want to see the full answer?

Check out a sample textbook solution

Chapter 19 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS After several years of operations, the partnership of Nelson, Pope, and Williams is to be liquidated. After making closing entries on March 31, 20--, the following accounts remain open: REQUIRED 1. Prepare a statement of partnership liquidation for the period July 120, 20--, showing the following: (a) The sale of noncash assets on July 1 (b) The allocation of any gain or loss to the partners on July 1 (c) The payment of the liabilities on July 15 (d) The distribution of cash to the partners on July 20 2. Journalize these four transactions in a general journal.arrow_forwardENTRIES: PARTNERSHIP LIQUIDATION On liquidation of the partnership of J. Hui and K. Cline, as of November 1, 20--, inventory with a book value of 180,000 is sold for 230,000. Given that Hui and Cline share profits and losses equally, prepare the entries for the sale and the allocation of gain.arrow_forwardENTRIES FOR DISSOLUTION OF PARTNERSHIP Cummings and Stickel Construction Company, a partnership, is operating a general contracting business. Ownership of the company is divided among the partners, Katie Cummings, Julie Stickel, Roy Hewson, and Patricia Weber. Profits and losses are shared equally. The books are kept on the calendar-year basis. On August 10, after the business had been in operation for several years, Patricia Weber passed away. Mr. Weber wished to sell his wifes interest for 30,000. After the books were closed, the partners capital accounts had credit balances as follows: REQUIRED 1. Prepare the general journal entry required to enter the check issued to Mr. Weber in payment of his deceased wifes interest in the partnership. According to the partnership agreement, the difference between the amount paid to Mr. Weber and the book value of Patricia Webers capital account is allocated to the remaining partners based on their ending capital account balances. 2. Assume instead that Mr. Weber is paid 60,000 for the book value of Patricia Webers capital account. Prepare the necessary journal entry. 3. Assume instead that Julie Stickel (with the consent of the remaining partners) purchased Webers interest for 70,000 and gave Mr. Weber a personal check for that amount. Prepare the general journal entry for the partnership only.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College