To determine: The after-tax cash flow to the shareholders if invested in T-Bills, after-tax cash flow to the shareholders if invested in

Introduction: The term dividends allude to that portion of proceeds of an organization which is circulated by the organization among its investors. It is the remuneration of the investors for investments made by them in the shares of the organization.

Answer to Problem 19QP

The after-tax cash flow to the shareholders if invested in T-Bills is $4,053,154.23, after-tax cash flow to the shareholders if invested in preferred stock is $4,361,828.43, the future value of T-Bills is $4,067,483.35 and the future value of preferred stock investment is $4,234,702.69.

Explanation of Solution

Option 1: If the company invest money currently

Determine the after-tax yield of corporate investment in T-bills

Therefore the after-tax yield of corporate investment in T-bills is 1.95%

Determine the future value of investment of corporate investment in T-bills

Therefore the future value of investment of corporate investment in T-bills is $4,768,416.74

Determine the after-tax cash flow to the shareholders if invested in T-Bills

Therefore the after-tax cash flow to the shareholders if invested in T-Bills is $4,053,154.23

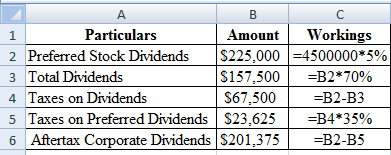

Determine the after-tax corporate dividends if invested in preferred stock

Using a excel spreadsheet we calculate the after-tax coporate dividends as,

Excel Spreadsheet:

Therefore the after-tax corporate dividends if invested in preferred stock is $201,375

Determine the after-tax yield of corporate investment in preferred stock

Therefore the after-tax yield of corporate investment in preferred stock is 4.48%

Determine the future value of investment of corporate investment in preferred stock

Therefore the future value of investment of corporate investment in preferred stock is $5,131,562.86

Determine the after-tax cash flow to the shareholders if invested in preferred stock

Therefore the after-tax cash flow to the shareholders if invested in preferred stock is $4,361,828.43

Option 2: If the company pay dividend currently

Determine the after-tax payments to shareholders

Therefore the after-tax payments to shareholders is $3,825,000

Determine the after-tax individual dividend yield on T-Bills

Therefore the after-tax individual dividend yield on T-Bills is 2.07%

Determine the future value if individual invest in T-Bill

Therefore the future value if individual invest in T-Bill is $4,067,483.35

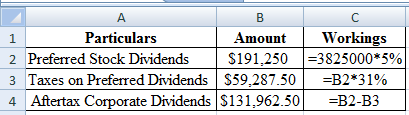

Determine the after-tax corporate dividends if individual invest in preferred stock

Using a excel spreadsheet we calculate the after-tax coporate dividends as,

Excel Spreadsheet:

Therefore the after-tax corporate dividends if individual in invest preferred stock is $131,962.50

Determine the after-tax yield preferred dividend yield

Therefore the after-tax yield preferred dividend yield is 3.45%

Determine the future value if individual invest in preferred stock

Therefore the future value if individual invest in T-Bill is $4,234,702.69

Want to see more full solutions like this?

Chapter 19 Solutions

CORPORATE FINANCE (LL)-W/ACCESS

- Value of Operations Kendra Enterprises has never paid a dividend. Free cash flow is projected to be $80,000 and $100,000 for the next 2 years, respectively; after the second year, FCF is expected to grow at a constant rate of 8%. The company’s weighted average cost of capital is 12%. What is the terminal, or horizon, value of operations? (Hint: Find the value of all free cash flows beyond Year 2 discounted back to Year 2.) Calculate the value of Kendra’s operations.arrow_forwardCarter Swimming Pools has $16 million in net operating profit after taxes (NOPAT) in the current year. Carter has $12 million in total net operating assets in the current year and had $10 million in the previous year. What is its free cash flow?arrow_forwardHasting Corporation is interested in acquiring Vandell Corporation. Vandell has 1 million shares outstanding and a target capital structure consisting of 30% debt; its beta is 1.4 (given its target capital structure). Vandell has $10.82 million in debt that trades at par and pays an 8% interest rate. Vandell’s free cash flow (FCFJ is $2 million per year and is expected to grow at a constant rate of 5% a year. Vandell pays a 40% combined federal and state tax rate. The risk-free rate of interest is 5%, and the market risk premium is 6%. Hasting’s First step is to estimate the current intrinsic value of Vandell. What are Vandell’s cost of equity and weighted average cost of capital? What is Vandell’s intrinsic value of operations? [Hint: Use the free cash flow corporate valuation model from Chapter 8.) What is the current intrinsic value of Vandell’s stock?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning